Iron Ore Market Size, Share & Trends Analysis Report By Type (Fines, Pellets, Lumps), By End-use (Steel Industry), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-445-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Iron Ore Market Size & Trends

“2030 iron ore market value to reach USD 301.86 billion”

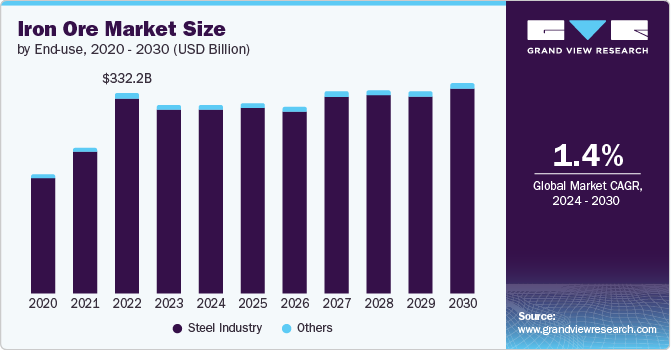

The global iron ore market size was estimated at USD 289.72 billion in 2023 and is expected to grow at a CAGR of 1.4% from 2024 to 2030. The consumption of iron ore worldwide is anticipated to be driven by the global demand for construction steel. The requirement for non-residential and commercial construction and affordable housing units in emerging countries is anticipated to drive the consumption of construction steel in the coming years, thereby surging the demand for iron ore.

As per World Population Prospects, published by the United Nations, the global population is projected to reach 8.6 billion by 2030. This, in turn, is expected to fuel the demand for new houses, thereby indirectly contributing to the global demand for iron ore as it is used for manufacturing steel.

Drivers, Opportunities, and Restraints

The stabilization of the U.S. Federal Rates resulted in the easing of inflation across the U.S. toward the end of 2023. This paved the way for increased spending in the manufacturing and consumer markets. Moreover, the devaluation of the two large currencies of the world, including the Euro and the Yuan, against the U.S. dollar surged the purchasing parity and subsequently improved construction spending.

Rising construction expenditure worldwide is one of the major drivers for the growth of the global iron ore market. According to the U.S. Census Bureau, construction spending in the U.S. rose by 7% in 2023 compared with that of 2022 and was 10% higher in April 2024 than in April 2023. The surge in this spending in the country can be attributed to the rise in demand for single-family housing and a decline in mortgage rates.

Consumer prices in the U.S. were increasing by 33.2% y-o-y in February 2024 with the core CPI rising 3.8%, amid high oil prices and housing costs. The U.S. Federal Reserve maintained interest rates at a range of 5.25% to 5.5% up to June 2024. As per the latest developments, it appears unlikely that the Federal Reserve will impose an interest rate cut during the third quarter of 2024. This indicates stable economic growth and a revival in manufacturing activities, thereby creating growth opportunities for the iron ore market.

The construction industry of China is the largest consumer of steel in the world. As such purchase contracts for iron ore are centered around its prices in China. The prevailing fluctuations in the price of iron ore are indicative of the subdued steel demand from the construction industry in China. The low iron ore prices are expected to reduce the costs of raw materials used for steel production. Hence, the profitability of producers in the global steel industry is anticipated to be high over the next few years. This is expected to have a cascading effect on iron ore supply and prices and can restrain the profitability of iron ore producers.

Iron Ore Price Trends

In the first quarter of 2024, iron ore prices fell by almost a third due to investor concerns owing to the continued signs of weakened demand from China. The average price declined below USD 100/ton and exhibited a moderate recovery in April 2024. With authorities in the country making efforts to revive its real estate market, the Steel Association of China has been focusing on improving capacity utilization levels to cater to future demand.

The anticipated recovery of the economy of China was expected to improve pricing levels by mid-2024. However, economic reforms in the country appear to have been delayed. This consequently postponed the implementation of new construction projects in China, thereby deferring steel procurement in the country. As a result, the recovery of iron ore prices was not above USD 100/ton by midyear as previously forecast by global investment analysts. Prices of iron ore are anticipated to indicate a mild recovery toward the end of 2024. The execution of the global construction projects and the recovery of the USD currency recovery viz-a-viz the Chinese Yuan are expected to end the year 2024 with an average pricing level of about USD 117/ton.

Market Concentration & Characteristics

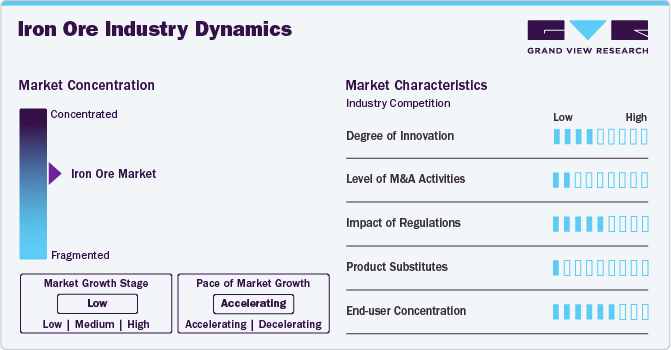

The global iron ore market is at a lower stage of the industry growth, indicating an accelerated pace of growth. Iron ore deposits are located all over the world, with Australia, Brazil, the U.S., and Canada being its largest producers. The global iron ore market is fairly consolidated owing to the high capital costs and regulatory approvals that are required. As such, the market is characterized by large-scale producers of iron ore that cater to its global demand.

The degree of innovations is moderate in the market and is characterized by upgrading technologies for mining and processing (beneficiation) iron ore. Presently, companies worldwide are focused on sustainable mining activities with efforts being made by them to ensure that their production processes achieve a low-carbon footprint and incur minimal costs. The level of M&A activities in the market remained low in 2023.

The iron ore mining activities endure a high regulatory impact as players carrying out these activities are governed by stringent laws to obtain mining licenses and environmental clearance, as well as have minimal socio-economic impact. Compliance with these regulations often requires significant investments in advanced technologies and sustainable mining practices, thereby leading to surged operational costs. The substitutes for iron ore are limited as it is a key raw material for producing steel. It is mainly found processed into pellets, lumps, and fines. The concentration of end users is also high in the market as iron ore is used in the construction and cement manufacturing industries, as well as in foundries and refractories. It is also used for manufacturing chemicals, ferroalloys, and glass.

Type Insights

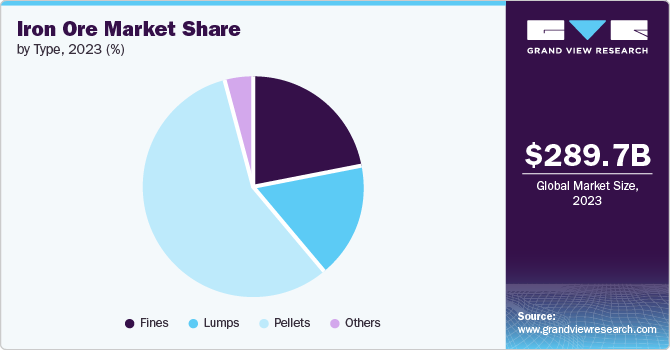

“The pellets segment held the largest revenue share of over 57% of the market in 2023.”

Pellets are ground iron ore fines converted to spherical-shaped balls. They have good physical properties for both, bulk and mechanical transportation over long distances. These balls also have excellent metallurgical properties that are better than raw iron ore. The pellets segment of the iron ore market is anticipated to grow at the highest CAGR of 2.0% over the forecast period. Pellets are used as raw materials for iron manufacturing, as a substitute for sinter and lumps.

Pellets are most preferred owing to their desirable shape, size, strength, and excellently designed metallurgical properties. Their usage in blast furnaces can increase the productivity of iron plants without the requirement for additional capital investments. They enhance the productivity of the iron-making units without any further capital investments.

End-use Insights

“Steel making is anticipated to register the highest revenue CAGR of 1.8% over the forecast period.”

Iron ore in the form of fines, lumps, pellets, and sinters is used for manufacturing steel. Primary steelmaking involves the usage of pig iron, which is smelted from iron ore in either the basic oxygen furnace (BOF) or electric arc furnace (BAF). Both these methods produce high-quality steel, which is further developed into different shapes.

Steel is further used in various end use industries. Of these, the construction and automotive industries account for the largest revenue shares of the overall global steel consumed. Infrastructure development and construction activities extensively require high volumes of steel to enhance the aesthetic appeal and corrosion resistance of structures.

Rising investments in the production of green steel and the adoption of sustainable construction practices are anticipated to provide growth opportunities for the steel segment and subsequently for the iron ore market in the coming years. For instance, the U.S. Department of Energy has announced an investment of USD 6 billion in 33 projects in over 20 states to decarbonize energy-intensive industries in the country. These projects are expected to be funded by the Bipartisan Infrastructure Law and Inflation Reduction Act.

Other end uses of iron ore include its usage in foundries, cement manufacturing, coal washeries, ferroalloys, chemical plants, glass manufacturing, and refractories. These accounted for about 2.5% of the revenue share of the global iron ore market.

Regional Insights

The growth of the iron ore market in North America is anticipated to be driven by investments in non-residential construction activities and government investments in infrastructure development projects. Countries in the region, especially the U.S. and Mexico are focusing on accelerating their economic growth by investing in infrastructure development projects and supporting their manufacturing industry. This, in turn, is expected to surge the demand for steel, thereby leading to a rise in the consumption of iron ore in the coming years.

U.S. Iron Ore Market Trends

The U.S. is the third-largest steel producer in the world. The demand for steel in the country is driven by its construction industry. This, in turn, contributes to the demand for iron ore, which is used for manufacturing steel. As per the U.S. Census Bureau, the total construction spending in the country during the first three months of 2024 amounted to USD 461.00 billion, thereby witnessing an increase of 10.6% y-o-y.

Asia Pacific Iron Ore Market Trends

“China held a revenue share of over 71% of the iron ore market in Asia Pacific.”

Asia Pacific witnessed the highest demand for iron ore in 2023 owing to the large production volume of crude steel in China, India, and Japan. This steel produced is used in residential and commercial construction activities, as well as in the automotive & transportation, energy, and electronics industries. The construction industry in the region has witnessed significant growth over the past few years owing to ongoing industrial development, coupled with its robust economies. This, in turn, has led to a rise in the consumption of steel, thereby contributing to the demand for iron ore that is used as a raw material to manufacture steel.

The demand for iron ore diminished in China in 2023 due to a slowdown in its domestic market. This downturn was primarily influenced by the weakening of the real estate sector in the country that began in the fourth quarter of 2021 due to the debt crisis faced by real estate developers in China. However, the market indicated a moderate revival in 2023, thereby encouraging iron ore producers to bank on stable prices.

Europe Iron Ore Market Trends

The growth of the iron ore market in Europe has been impacted by the Russia-Ukraine war, which has resulted in increased energy costs, a shortage of skilled labor, and a rise in commodity prices. Hence, it is challenging to carry out energy-intensive manufacturing processes such as that of iron ore in a high-cost environment in the region. This has mostly impacted steel production in Europe with several producers having halted their manufacturing activities and awaiting market normalcy to resume their production.

In 2023, Germany accounted for a revenue share of over 14% of the iron ore market in Europe. The growth of the market in the country is moderate as a result of geopolitical issues in Europe and a rise in input costs. However, the demand is anticipated to improve for use in sustainable energy production, consumer packaging, electric vehicles, and green construction in the coming years. Additionally, the country is the largest exporter of semi-finished and finished steel in Europe.

Central & South America Iron Ore Market Trends

The iron ore market in Central & South America is projected to witness growth due to the flourishing construction industry in the region. For instance, in March 2024, Hilton announced its accelerated expansion in the Caribbean and Latin America with record room growth in 2023 and a robust pipeline of nearly 110 hotels. Hilton plans to open more than 15 hotels across the Caribbean and Latin America in 2024.

Middle East & Africa Iron Ore Market Trends

The iron ore market in the Middle East & Africa is anticipated to grow at a moderate pace over the forecast period due to investments in infrastructure development projects. For instance, the Government of Egypt is focusing on infrastructure development, while attracting foreign investors to reduce its fiscal deficit. The Ras El Hekma project undertaken by Abu Dhabi Developmental Holding Company (ADQ) for a total investment of USD 35 billion is anticipated to further mobilize infrastructure development projects in the country. Such projects are expected to sustain iron ore manufacturing in the Middle East & Africa during the forecast period.

Key Iron Ore Company Insights

Some key players operating in the market are Vale, BHP, and ArcelorMittal.

-

Brazil-based Vale was incorporated in 1942. It is the largest producer of iron ore in the world. The company has mining assets in Brazil, China, and Oman. The ore extracted by it in Carajas, Brazil has an iron content of 67% that is one of the highest in the world. Vale produces iron ore pellets and briquettes.

-

Australia-based BHP was founded in 1966. Its operations include integrated iron ore mines and rail & port operations in Pilbara, Western Australia. The company produces lumps, sinters, fines, and pellets.

-

Luxembourg-based ArcelorMittal was incorporated in 2006, as a result of the merger of Arcelor with India-based Mittal Steel. Its seaborne iron ore mines are located in Quebec (Canada), as well as in Liberia. The company produces iron ore lumps, fines, concentrate pellets, and sinter feed.

Key Iron Ore Companies:

The following are the leading companies in the iron ore market. These companies collectively hold the largest market share and dictate industry trends.

- Anglo American

- Ansteel Group Corporation Limited

- ArcelorMittal

- BHP

- Cleveland-Cliffs Inc.

- EVRAZ plc

- Fortescue Metals Group Ltd

- HBIS Group

- LKAB

- Metalloinvest MC LLC

- Rio Tinto

- Vale

Recent Developments

-

In April 2024, Australia-based Strike Resources Limited, an iron ore company, completed its negotiations to sell its Pilbara Paulsens East Iron Ore Project to Australia-based Miracle Iron Holdings for ~USD 13.4 million (A$ 20.5 million).

Iron Ore Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 278.44 billion |

|

Revenue forecast in 2030 |

USD 301.86 billion |

|

Growth rate |

CAGR of 1.4% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018–2022 |

|

Forecast period |

2024–2030 |

|

Quantitative units |

Volume in million tons, revenue in USD million, and CAGR from 2024 to 2030 |

|

Report coverage |

Volume forecasts, revenue forecasts, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South Africa; Middle East; Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; France; Turkey; Russia; China; India; Japan; Brazil |

|

Key companies profiled |

Anglo American; Ansteel Group Corporation Limited; ArcelorMittal; BHP; Cleveland-Cliffs Inc.; EVRAZ plc; Fortescue Metals Group Ltd; HBIS Group; LKAB; Metalloinvest MC LLC; Rio Tinto; Vale |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts' working days) with purchase; addition or alteration based on country, regional, and segmentation scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research requirements. Explore purchase options |

Global Iron Ore Market Report Segmentation

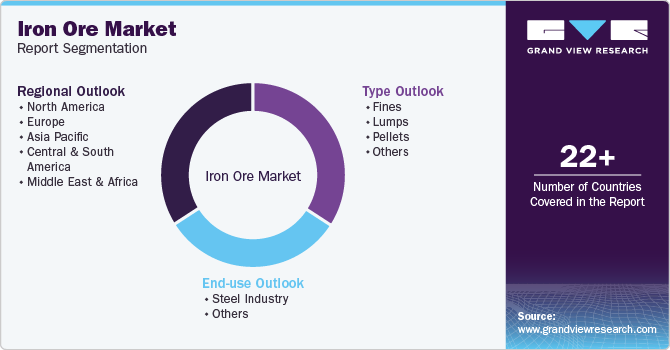

This report forecasts revenue and volume growth of the market at the global, regional, and country levels and provides an analysis of the latest trends in each of the market subsegments from 2018 to 2030. For this study, Grand View Research has segmented the global iron ore market report based on type, end-use, and region:

-

Type Outlook (Volume, Million Tons; Revenue, USD Million; 2018 - 2030)

-

Fines

-

Lumps

-

Pellets

-

Others

-

-

End-use Outlook (Volume, Million Tons; Revenue, USD Million; 2018 - 2030)

-

Steel Industry

-

Others

-

-

Regional Outlook (Volume, Million Tons; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Turkey

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global iron ore market size was valued at USD 289.72 billion in 2023 and is expected to reach USD 278.44 billion by 2024.

b. The global iron ore market is expected to grow at a compound annual growth rate of 1.4% from 2024 to 2030 to reach USD 301.86 billion by 2030.

b. Based on type, the pellets segment dominated the market with a revenue share of over 57.0% in 2023.

b. Some key players in the global iron ore market are Anglo American, Ansteel Group Corporation Limited, ArcelorMittal, BHP, Cleveland-Cliffs Inc., EVRAZ plc, Fortescue Metals Group Ltd, HBIS Group, LKAB, Metalloinvest MC LLC, Rio Tinto, and Vale.

b. The key drivers for the growth of the global iron ore market are the increased number of non-residential construction projects in developed countries and the construction of low-cost, affordable housing units in emerging economies.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."