- Home

- »

- Consumer F&B

- »

-

Irish Butter Market Size, Share And Growth Report, 2030GVR Report cover

![Irish Butter Market Size, Share & Trends Report]()

Irish Butter Market (2025 - 2030) Size, Share & Trends Analysis Report By Flavor (Unflavored, Salted), By Distribution Channel (Off-trade, On-trade), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-428-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Irish Butter Market Size & Trends

The global Irish butter market size was estimated at USD 924.8 million in 2024 and is expected to grow at a CAGR of 5.6% from 2025 to 2030. The market for Irish butter has gained significant attention in recent years due to its rich heritage, premium quality, and strong association with natural and grass-fed dairy practices. Irish butter, is often celebrated for its creamy texture and rich flavor, largely attributed to the lush, green pastures where Irish cows graze. The market's growth is also supported by the increasing global demand for natural and high-quality food products, positioning Irish butter as a premium offering in both domestic and international markets.

The rising consumer preference for natural and organic products has led to increased demand for butter made from grass-fed cows, which is a hallmark of Irish dairy farming. Moreover, the growing trend of home baking and cooking, fueled by the COVID-19 pandemic, has boosted the consumption of butter, further propelling market growth. Besides, the Irish butter industry also benefits from the country's strong dairy tradition and favorable climate, which allows for year-round grazing and contributes to the high quality of the product.

Consumers are increasingly seeking products that are not only high in quality but also produced in an environmentally responsible manner. This has led to a rise in demand for butter that is certified organic or produced with minimal environmental impact. Moreover, there is a trend towards premiumization, with consumers willing to pay more for butter that is perceived as a luxury item, often due to its artisanal production methods or unique flavor profile. The global appeal of Irish butter, particularly in markets like the U.S. and Europe, continues to grow as consumers become more health-conscious and seek out authentic, high-quality dairy products.

Emerging trends in the market for Irish butter reflect broader shifts in consumer behavior and preferences. There is a growing interest in functional foods, with consumers increasingly seeking products that offer health benefits beyond basic nutrition. Irish butter, with its high content of vitamins A, D, and E, as well as beneficial fatty acids, is well-positioned to capitalize on this trend. Moreover, the rise of plant-based diets has led some producers to explore innovative product lines, such as dairy-free butter alternatives made with Irish-grown ingredients. While these alternatives are still niche, they represent a potential area for future growth as the market adapts to evolving consumer demands.

Flavor Insights

The unflavored Irish butter market accounted for a revenue share of 66.4% in 2023. The unflavored Irish butter serves as an exquisite base for cooking and baking, enhancing the flavor of dishes without overpowering them. Moreover, chefs and home cooks alike value the ability of unflavored butter to complement an array of recipes, from savory to sweet, thereby making it a multifunctional ingredient in daily culinary practices. As consumers invest more in their culinary experiences, the perception of unflavored Irish butter as a high-quality, essential pantry item is cemented, reinforcing its demand in the market.

The salted Irish butter market is expected to grow at a CAGR of 5.7% from 2024 to 2030. This anticipated growth is driven by the continued popularity of salted butter, which remains a staple in many households due to its rich taste and versatility in cooking and baking. The market's expansion is further supported by the global trend toward natural and minimally processed foods, as salted Irish butter is often prized for its simple, high-quality ingredients. As consumers increasingly seek out premium dairy products, the demand for salted Irish butter is likely to rise, bolstered by its strong association with traditional Irish dairy farming and the distinct flavor profile that sets it apart in the global market.

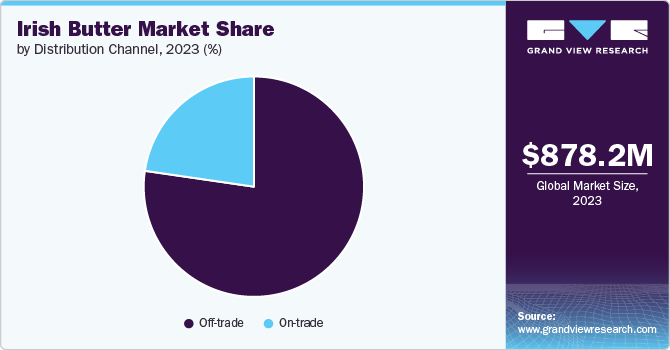

Distribution Channel Insights

Sales of Irish butter through off-trade distribution accounted for a revenue share of 77.3% in 2023. This dominance is largely attributed to the widespread availability of Irish butter in supermarkets, grocery stores, and other retail outlets, making it easily accessible to a broad consumer base. The convenience of purchasing butter through these channels, combined with effective in-store promotions and brand visibility, has significantly contributed to the strong sales performance. Moreover, the increasing trend of consumers opting for premium and artisanal food products during regular shopping trips has further bolstered off-trade sales, reinforcing the importance of this distribution channel in driving the market's overall growth.

Sales of Irish butter through on-trade distribution channels are expected to grow at a CAGR of 6.5% from 2024 to 2030. This growth is expected to be driven by the increasing demand for high-quality, premium butter in the food service sector, including restaurants, hotels, and cafes, where Irish butter is prized for its rich flavor and superior quality. As the hospitality industry continues to recover and expand, particularly in regions where Irish butter is synonymous with gourmet dining, the on-trade segment is likely to see heightened demand. Additionally, the trend of incorporating artisanal and natural ingredients into menu offerings is expected to further propel the sales of Irish butter through these channels, contributing to its sustained market growth over the coming years.

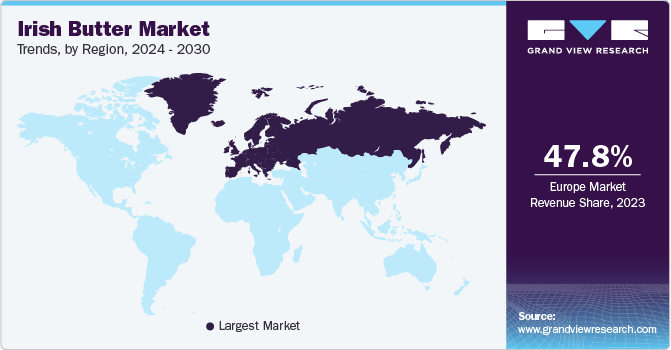

Regional Insights

The Irish butter market in North America captured a revenue share of over 28.5% in 2023, reflecting the region's growing appreciation for international and artisanal butter. North American consumers have increasingly gravitated towards Irish butter, attracted by its rich, creamy texture and the natural, grass-fed origins that distinguish it from other butters. The success of well-established brands like Kerrygold, which have effectively marketed the authenticity and quality of Irish butter, has played a key role in this market penetration. The growing preference for natural, high-quality ingredients among health-conscious consumers, along with the popularity of cooking and baking at home, has further driven the demand, solidifying North America as a crucial market for Irish butter.

U.S. Irish Butter Market Trends

The U.S. market for Irish butter has seen several noteworthy trends in recent years, reflecting shifting consumer preferences and the growing appeal of premium, authentic food products. One prominent trend is the increasing demand for natural and organic dairy products, driven by a broader movement toward health-conscious eating. Irish butter, often made from grass-fed cows and minimally processed, aligns well with this trend, leading to its growing popularity among U.S. consumers. Another trend is the rise of gourmet and artisanal food culture in the U.S., where consumers are willing to pay a premium for high-quality, unique flavors. Irish butter, with its rich taste and creamy texture, has become a favored choice for those looking to enhance their cooking and baking experiences.

Europe Irish Butter Market Trends

The European market for Irish butter has been shaped by several key trends that highlight the region's deep appreciation for high-quality dairy products and its alignment with broader food and sustainability movements. One of the most significant trends is the rising demand for organic and natural foods across Europe, driven by increasing consumer awareness of health and wellness. Irish butter, renowned for being produced from grass-fed cows and free from artificial additives, fits seamlessly into this trend, bolstering its popularity in the region.

Another prominent trend in the European market is the growing emphasis on sustainability and ethical sourcing. European consumers are increasingly concerned about the environmental impact of their food choices, and Irish butter, with its strong ties to traditional, sustainable farming practices, has gained favor as a result. The focus on reducing carbon footprints and supporting environmentally responsible products has further elevated Irish butter's status in the European market, particularly in countries with stringent environmental standards.

Asia Pacific Irish Butter Market Trends

The Irish butter market in the Asia Pacific region is expected to witness a CAGR of 6.6% from 2024 to 2030, driven by several key factors unique to this region. One of the primary drivers is the growing middle class and increasing disposable incomes in key countries such as China and India. As consumers in these emerging markets gain more purchasing power, there is a rising demand for premium and imported food products, including Irish butter, which is perceived as a high-quality and luxury item.

Another factor contributing to the market's growth is the expanding foodservice sector, which is increasingly incorporating international and gourmet ingredients to cater to evolving consumer tastes. As the food and beverage industry in the Asia Pacific region continues to upscale and diversify, Irish butter is gaining popularity in upscale restaurants, cafes, and hotels, where it is valued for its rich flavor and superior quality.

Key Irish Butter Company Insights

The competitive landscape of the Irish butter market is characterized by several key dynamics that influence market strategies and growth opportunities. The market is predominantly shaped by established players who leverage their strong brand recognition and commitment to high-quality production. These companies typically emphasize premium quality, natural ingredients, and traditional production methods to differentiate themselves in a competitive field.

A significant aspect of the competitive landscape is the focus on product innovation and differentiation. Many brands are expanding their product portfolios to include flavored varieties and specialty blends, catering to the evolving preferences of consumers who seek unique taste experiences. This trend is driven by a desire for variety and a growing interest in gourmet and artisanal products, which allows companies to target niche markets and capture a broader consumer base.

Key Irish Butter Companies:

The following are the leading companies in the irish butter market. These companies collectively hold the largest market share and dictate industry trends.

- Kerrygold

- Dansko Foods

- Abernethy Butter

- Lakeland Dairies

- Tirlán Limited

- Champion Traditional Creamery

- North Cork Creameries Ltd.

- Glenstal Foods

- Associated British Foods (ABF)

- Avonmore

Recent Developments

-

In May 2024, Kerrygold launched a new range of butter sticks namely salted and garlic & herb Irish butter to serve the growing demand for these products.

-

In March 2024, Ór-Real Irish Butter is expanding its product range as sales growth continues. The award-winning Irish butter brand is made in Kanturk Co. Cork by North Cork Creameries using the traditional method of slow churning.

Irish Butter Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 971.0 million

Revenue forecast in 2030

USD 1,275.1 million

Growth rate

CAGR of 5.6% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Flavor, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; South Africa

Key companies profiled

Kerrygold; Dansko Foods; Abernethy Butter; Lakeland Dairies; Tirlán Limited; Champion Traditional Creamery; North Cork Creameries Ltd.; Glenstal Foods; Associated British Foods (ABF); Avonmore

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Irish Butter Market Report Segmentation

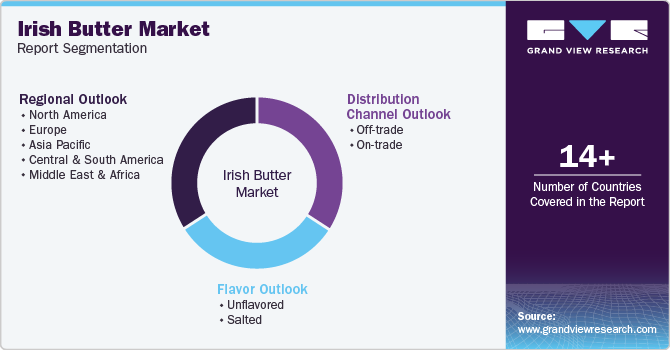

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global Irish butter market report based on flavor, distribution channel, and region:

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Unflavored

-

Salted

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Off-trade

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Online

-

Others

-

-

On-trade

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global Irish butter market size was estimated at USD 878.2 million in 2023 and is expected to reach USD 924.8 million in 2024.

b. The global Irish butter market is expected to grow at a compounded growth rate of 5.5% from 2024 to 2030, reaching USD 1,275.1 million by 2030.

b. The Irish butter market in Europe captured a revenue share of 47.8% in 2023. European consumers are increasingly concerned about the environmental impact of their food choices. Irish butter, with its strong ties to traditional, sustainable farming practices, has gained favor as a result.

b. Some key players operating in the market include Kerrygold, Dansko Foods, Abernethy Butter, Lakeland Dairies, Tirlán Limited, Champion Traditional Creamery, North Cork Creameries Ltd., Glenstal Foods, Associated British Foods (ABF), and Avonmore.

b. The rising consumer preference for natural and organic products has led to increased demand for butter made from grass-fed cows, which is a hallmark of Irish dairy farming.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.