- Home

- »

- Electronic Security

- »

-

IR Camera Market Size, Share And Growth Report, 2030GVR Report cover

![IR Camera Market Size, Share & Trends Report]()

IR Camera Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Cooled, Uncooled), By Material (Germanium, Silicon, Sapphire, Others), By Type, By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-318-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

IR Camera Market Summary

The global IR camera market size was estimated at USD 7,791.7 million in 2023 and is projected to reach USD 11,978.3 million by 2030, growing at a CAGR of 6.5% from 2024 to 2030. As concerns about safety and security continue to rise, businesses, government agencies, and homeowners are investing in infrared camera (IR) cameras to enhance their monitoring capabilities.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- In terms of segment, cooled accounted for a revenue of USD 7,791.7 million in 2023.

- Cooled is the most lucrative technology segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 7,791.7 Million

- 2030 Projected Market Size: USD 11,978.3 Million

- CAGR (2024-2030): 6.5%

- Asia Pacific: Largest market in 2023

These cameras provide high-quality imaging in low-light or nighttime conditions, making them indispensable for security applications.

IR cameras with thermal imaging sensors are used in various applications, including industrial maintenance, building inspections, firefighting, and medical diagnostics. Their ability to detect and visualize heat signatures makes them invaluable for identifying potential issues in machinery, electrical systems, and buildings, driving their adoption across different sectors.

Manufacturers are continually improving IR cameras' performance, resolution, and affordability, making them more accessible to a broader market. As a result, automotive, aerospace, and consumer electronics industries are integrating IR cameras into their products for applications such as driver assistance systems, night vision, and facial recognition, further propelling the market growth.

Furthermore, IR cameras are essential for preventive maintenance initiatives. These cameras can assist in identifying potential failures before they happen by detecting unusual heat patterns in electrical systems, mechanical equipment, and rotating machinery. This proactive approach helps repair or replace items on time, reducing downtime and avoiding expensive breakdowns. Therefore, companies can cut costs and enhance their overall operational efficiency.

Technology Insights

Uncooled IR cameras dominated the market and accounted for a market revenue share of 64.1% in 2023. Uncooled IR cameras utilize microbolometer sensors that do not require cryogenic cooling, unlike traditional cooled IR cameras. These sensors have continuously improved sensitivity, resolution, and cost-effectiveness, making uncooled IR cameras more accessible and practical for a broader range of applications. As these sensors become more efficient and reliable, they enable the development of high-performance IR cameras that cater to diverse industrial, commercial, and consumer need

Cooled IR cameras are expected to register the fastest CAGR of 7.6% during the forecast period. Cooled IR cameras rely on sophisticated cooling mechanisms to reduce the temperature of the infrared detectors, significantly enhancing their sensitivity and image quality. They are essential for advanced military operations, including target acquisition, surveillance, and reconnaissance. Their superior sensitivity and resolution make them necessary tools for identifying distant objects, detecting hidden threats, and providing critical situational awareness in complex and demanding environments.

Material Insights

Germanium accounted for the largest market revenue share in 2023. Germanium, a key material for IR camera lenses and optical components, has become essential due to its excellent transmission capabilities in the infrared spectrum. Its high refractive index and low absorption rates in the mid-wave infrared (MWIR) and long-wave infrared (LWIR) regions make it ideal for producing high-quality thermal images.

Sapphire is expected to register the fastest CAGR during the forecast period. Sapphire is known for its superior hardness, high thermal conductivity, and excellent infrared light transmission, particularly in the short-wave infrared (SWIR) spectrum. The proliferation of sapphire-based IR camera components can be attributed to the material's broad transmission range in the infrared spectrum. Sapphire lenses and windows offer exceptional infrared light transmission, enabling high-quality imaging and accurate thermal measurements.

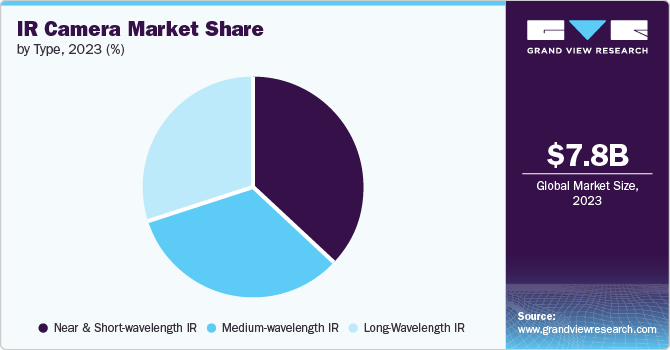

Type Insights

Near and short-wavelength IR type accounted for the largest market revenue share in 2023. Near and SWIR cameras are essential for various applications, including quality control, material sorting, and machine vision. Their ability to capture detailed images of objects based on their heat signatures and reflectance properties makes them invaluable in the manufacturing, agriculture, and electronics industries. As businesses seek more precise and efficient methods for inspecting products and monitoring processes, the demand for advanced Near and SWIR imaging solutions continues to rise.

Long-wavelength IR type is expected to register the fastest CAGR during the forecast period. LWIR cameras are particularly valued for detecting heat signatures in total darkness and through obscurants like smoke, fog, and dust. This makes them essential for military and civilian security operations, including border surveillance, perimeter security, and public safety monitoring.

Application Insights

The commercial segment dominated the market in 2023. Businesses and organizations are increasingly investing in sophisticated security systems to protect assets, ensure the safety of employees, and secure property from potential threats. IR cameras, known for providing precise and detailed images in low-light and complete darkness, are essential for effective surveillance and monitoring. As commercial properties, retail environments, and office buildings require enhanced security measures, the demand for IR cameras with high-resolution capabilities and advanced features continues to rise, fueling the expansion of the market.

The industrial sector is projected to grow at the fastest CAGR over the forecast period. IR cameras detect heat anomalies that indicate potential equipment failures, such as electrical faults, mechanical wear, and overheating components. By enabling early detection of problems before they lead to significant breakdowns or costly repairs, IR cameras help industries reduce maintenance costs, minimize downtime, and extend the lifespan of their equipment. As companies strive to optimize their operations and maintain high productivity levels, the demand for advanced IR camera technologies for preventive maintenance continues to grow.

Regional Insights

The North America IR camera market held a substantial market revenue share in 2023. The region’s advanced technology infrastructure and strict security regulations enhance the demand for IR cameras. Furthermore, continuous improvements in IR camera technology and increasing investments in research and development are still driving market growth in North America.

U.S. IR Camera Market Trends

The U.S. IR camera market dominated the North America market in 2023. The Department of Defense and other federal agencies are major consumers of IR camera technology for surveillance, reconnaissance, and target acquisition applications. The U.S. military requires high-performance thermal imaging systems capable of operating in challenging environments and providing clear, detailed images for tactical operations.

Europe IR Camera Market Trends

The Europe IR camera market was identified as a lucrative region in 2023. The European Union has implemented various regulations and initiatives to reduce energy consumption and promote green technologies. IR cameras are essential for energy audits, allowing businesses and property managers to identify heat losses, evaluate insulation performance, and optimize HVAC systems. IR cameras support the EU's sustainability goals by offering detailed thermal imaging that helps pinpoint inefficiencies and ensure compliance with energy regulations.

Germany IR camera market held a substantial market share in 2023. In Germany’s highly developed industrial sector, IR cameras are employed for a wide range of applications, including preventive maintenance, quality control, and process optimization. For example, in manufacturing facilities, IR cameras monitor machinery for signs of overheating, detect faults in electrical systems, and ensure product quality.

Asia Pacific IR Camera Market Trends

The Asia Pacific IR camera market accounted for the largest market revenue share of 27.8% in 2023. Technological advancements are significantly fueling the growth of the IR camera market in the Asia-Pacific region. Innovations in infrared imaging technologies, such as the development of high-definition thermal sensors and advanced image processing algorithms, have enhanced the performance of IR cameras. These advancements enable IR cameras to deliver clearer, more detailed images and provide features such as improved thermal sensitivity and extended range.

India IR camera market is expected to grow rapidly in the coming years. With urban areas expanding rapidly and population densities increasing, there is a pressing need for effective security measures. IR cameras offer advantages such as capturing clear images in low-light conditions, which are essential for monitoring public spaces, protecting infrastructure, and ensuring safety at high-profile events. Both government and private sectors are investing in IR camera systems to enhance surveillance capabilities, thereby driving market growth.

Key IR Camera Company Insights

Some of the key companies in the IR camera market include Teledyne FLIR LLC, SPI Corp., OPGAL Optronic Industries Ltd., and Raytheon Company. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Teledyne FLIR LLC provides portable cameras for tasks in the field, such as inspections and search & rescue, surveillance cameras for protecting boundaries, and cameras for industrial automation duties like quality control. They also provide airborne and gimbaled camera systems for aerial surveys and maritime security, night vision solutions for low-light visibility, and tailored camera solutions for specific client requirements.

-

SPI Corp offers diverse thermal imaging systems, including long-range multi/dual-sensor FLIR PTZ thermal imaging cameras, thermal scopes, and tactical lasers. The company provides solutions for law enforcement, border patrol, homeland security, and surveillance, including handheld thermal imaging cameras, scopes, and long-range PTZ infrared camera systems.

Key IR Camera Companies:

The following are the leading companies in the IR Camera market. These companies collectively hold the largest market share and dictate industry trends.

- Teledyne FLIR LLC

- SPI Corp.

- OPGAL Optronic Industries Ltd.

- Raytheon Company

- Seek Thermal Inc.

- Fluke Corporation

- Leonardo DRS

- Axis Communication AB

- Xenics nv

- L3Harris Technologies Inc.

Recent Developments

-

In November 2023, Sierra-Olympia introduced "The Ventus Compact MK2," a state-of-the-art infrared camera. This advanced device is tailored for compact integration in applications with limited space, such as airborne, handheld, and other low-SWaP scenarios. The launch of this innovative technology is set to transform the utilization of infrared imaging across diverse industries.

IR Camera Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.20 billion

Revenue forecast in 2030

USD 11.98 billion

Growth Rate

CAGR of 6.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, Material, Type, Application, Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, South Arabia, UAE, South Africa

Key companies profiled

Teledyne FLIR LLC, SPI Corp., OPGAL Optronic Industries Ltd., Raytheon Company, Seek Thermal Inc., Fluke Corporation, Leonardo DRS, Axis Communication AB, Xenics nv, L3Harris Technologies Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global IR Camera Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global IR camera market report based on technology, material, type, application, and region

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cooled

-

Uncooled

-

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Germanium

-

Silicon

-

Sapphire

-

Others

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Near and Short-wavelength IR

-

Medium-wavelength IR

-

Long-Wavelength IR

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Military & Defense

-

Automotive

-

Industrial

-

Commercial

-

Residential

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.