IP Camera Market Size, Share & Trends Analysis Report By Component (Hardware, Services), By Product Type (Pan Tilt Zoom, Infrared), By Connection Type (Consolidated, Distributed), By Application (Commercial, Residential), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-006-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

IP Camera Market Size & Trends

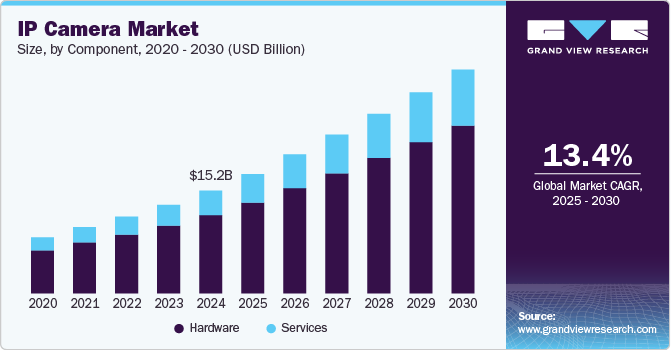

The global IP camera market size was estimated at USD 15.21 billion in 2024 and is projected to grow at a CAGR of 13.4% from 2025 to 2030. The IP Camera Industry is experiencing rapid growth due to the increasing adoption of AI-powered cameras for advanced surveillance. These cameras leverage deep learning and computer vision to enhance security features such as facial recognition, behavior analysis, and real-time alerts. Businesses and governments are investing in AI-driven IP cameras to improve monitoring efficiency and threat detection. Smart cities and smart home ecosystems are also fueling the demand for AI-integrated surveillance solutions. AI-enabled IP cameras reduce false alarms and optimize video analytics, making them a preferred choice over traditional CCTV systems. As AI technology advances, the market is expected to witness further innovations, driving continued adoption across multiple sectors.

The increasing demand for cloud-based surveillance solutions is driving the shift in the IP camera industry towards scalable and remote-access systems. Cloud storage removes the necessity for extensive on-premises infrastructure, leading to cost reduction and greater accessibility for businesses of all sizes. Organizations are adopting cloud-based IP cameras for their superior cybersecurity measures, seamless software updates, and efficient data backup. The rapid adoption of Video Surveillance as a Service (VSaaS) is further accelerating market expansion. Cloud integration allows real-time monitoring from any location, significantly enhancing security operations for enterprises and households. As 5G networks and edge computing advance, the adoption of cloud-based IP cameras is expected to grow rapidly.

The rising demand for high-resolution cameras in the IP camera industry is fueled by the need for clearer and more detailed video footage. Businesses, law enforcement agencies, and smart city projects increasingly rely on high-definition (HD) and ultra-high-definition (UHD) cameras for enhanced security. The deployment of 4K and 8K resolution IP cameras improves image clarity, facilitating accurate facial and license plate recognition. With decreasing storage and bandwidth costs, the adoption of high-resolution cameras is becoming more viable. The integration of advanced compression technologies such as H.265 ensures efficient data transmission without overwhelming network infrastructure. As security professionals prioritize high-quality surveillance footage, this trend is expected to strengthen further.

The growing adoption of wireless and IoT-enabled surveillance solutions is transforming the IP Camera Industry by enabling flexible deployment and enhanced connectivity. Wireless IP cameras remove the complexities associated with traditional wired setups, making them ideal for residential, commercial, and industrial applications. The integration of IoT allows these cameras to communicate seamlessly with other smart devices, improving security automation and interoperability. Businesses and homeowners favor wireless IP cameras due to their simple installation and remote access via mobile applications. The expansion of smart city projects and home automation ecosystems is further boosting demand for these advanced surveillance solutions. With the ongoing rollout of 5G technology, wireless IP cameras will become even more efficient and widely utilized.

The widespread deployment of smart city projects and infrastructure developments is fueling the adoption of IP cameras in the IP Camera Industry. Governments are making substantial investments in intelligent surveillance systems to enhance public safety, optimize traffic management, and improve urban security. AI-powered IP cameras equipped with real-time analytics can detect anomalies, track crowd movements, and facilitate rapid emergency responses. The increasing use of automated traffic enforcement and public surveillance is driving the demand for connected cameras. Integration with IoT and edge computing ensures efficient real-time data processing, reducing latency in security decision-making. As urbanization accelerates, IP cameras will play a vital role in shaping the future of smart city security.

The rising security concerns in both residential and commercial sectors are increasing the demand for IP surveillance solutions within the IP Camera Industry. Homeowners and businesses are turning to advanced IP cameras to prevent theft, vandalism, and unauthorized access. AI-enabled IP cameras, integrated with smart home security systems, offer remote monitoring and automation features. Retail stores, warehouses, and office spaces are deploying IP cameras to enhance loss prevention strategies and improve employee safety. The affordability and accessibility of cloud-based IP cameras have made security surveillance more viable for small businesses and households. As security threats evolve, the demand for robust IP camera solutions will continue to grow.

The continuous technological advancements in camera features and performance are driving innovation in the IP Camera Industry. Manufacturers are integrating advanced functionalities such as night vision, thermal imaging, and wide dynamic range (WDR) to enhance video quality under diverse conditions. Enhanced low-light sensors enable better surveillance in dim environments, ensuring around-the-clock monitoring. AI-powered motion detection and smart alert systems are minimizing false alarms and improving threat identification. The adoption of 5G and Wi-Fi 6 is enhancing data transmission speeds, ensuring seamless connectivity for IP surveillance networks. As research and development efforts progress, the industry is expected to witness further improvements, making IP cameras more sophisticated and efficient.

Component Insights

The hardware segment accounted for the largest market share of over 76% in 2024, driven by advancements in imaging technology, AI-powered processors, and edge computing capabilities. High-resolution sensors, improved infrared (IR) illumination, and advanced compression technologies like H.265 enhance video quality and storage efficiency. The integration of AI chips within IP cameras enables real-time analytics, facial recognition, and smart motion detection, reducing the need for centralized processing. With increasing concerns over cybersecurity, manufacturers are focusing on hardware-based encryption and secure boot mechanisms to protect video data from cyber threats. As demand for intelligent and high-performance surveillance solutions rises, innovations in IP camera hardware will continue to shape the future of the market..

The service segment is expected to witness the fastest CAGR of over 14% from 2025 to 2030, driven by the increasing demand for cloud-based video surveillance, remote monitoring, and managed security services. Subscription-based models for video analytics, storage, and maintenance are gaining traction as businesses and homeowners seek cost-effective security solutions. AI-powered services, such as real-time threat detection, facial recognition, and anomaly detection, are enhancing the value proposition of IP camera ecosystems. Cybersecurity concerns are also fueling demand for secure video transmission, encrypted cloud storage, and regular firmware updates as part of managed services. As organizations prioritize scalable and intelligent surveillance solutions, the services segment will continue to expand, with a focus on AI-driven automation and end-to-end security management.

Product Type Insights

The infrared segment accounted for the largest market share in 2024, growing rapidly due to the increasing demand for enhanced low-light and night-vision surveillance solutions. Infrared (IR) IP cameras are widely adopted in critical infrastructure, perimeter security, and residential surveillance, providing clear imaging in complete darkness. The integration of AI-powered thermal analytics and smart motion detection is enhancing threat identification and reducing false alarms. Industries such as transportation, defense, and smart cities are leveraging infrared IP cameras for 24/7 monitoring in low-visibility environments. As advancements in thermal imaging and AI-driven analytics continue, the demand for high-performance infrared IP cameras is expected to surge across various security applications.

The pan-tilt-zoom (PTZ) segment is expected to witness the fastest CAGR from 2025 to 2030, due to the growing need for dynamic and flexible surveillance solutions. PTZ cameras offer 360-degree coverage, optical zoom, and real-time tracking, making them ideal for large-scale monitoring in commercial, industrial, and public security applications. AI-powered automation and motion detection are enhancing PTZ cameras' ability to follow moving objects and reduce blind spots. The increasing adoption of cloud-based video management systems (VMS) is further improving remote control and real-time monitoring capabilities. As smart surveillance and AI-driven analytics evolve, the demand for PTZ IP cameras is expected to grow, particularly in city surveillance, retail, and critical infrastructure protection.

Connection Type Insights

The consolidated segment accounted for the largest market share in 2024, driven by large-scale enterprises, government agencies, and critical infrastructure facilities requiring integrated and high-performance surveillance solutions. Organizations in this segment prioritize AI-powered analytics, centralized video management systems (VMS), and scalable cloud-based security infrastructure for seamless monitoring across multiple locations. Advanced technologies like facial recognition, behavior analysis, and real-time threat detection are increasingly being integrated into consolidated security networks to enhance situational awareness. Cybersecurity concerns are also a major focus, leading to increased investment in encrypted video transmission and secure data storage solutions. As regulatory compliance and security standards become more stringent, the demand for enterprise-grade, AI-enhanced IP camera systems in consolidated environments is expected to grow significantly.

The distributed segment is expected to witness the highest CAGR from 2025 to 2030. The distributed segment is expanding as businesses and organizations with multiple locations seek scalable and interconnected surveillance solutions. Retail chains, logistics hubs, and franchise businesses are adopting cloud-based and AI-driven IP cameras to ensure seamless remote monitoring and real-time threat detection across dispersed sites. The integration of edge computing and decentralized video processing reduces bandwidth consumption while enhancing automation and analytics capabilities. Cybersecurity and data privacy remain key concerns, driving investments in encrypted video transmission and AI-powered anomaly detection. As demand for flexible, multi-location surveillance solutions grows, the adoption of intelligent, cloud-integrated IP camera systems in the distributed segment is expected to rise rapidly.

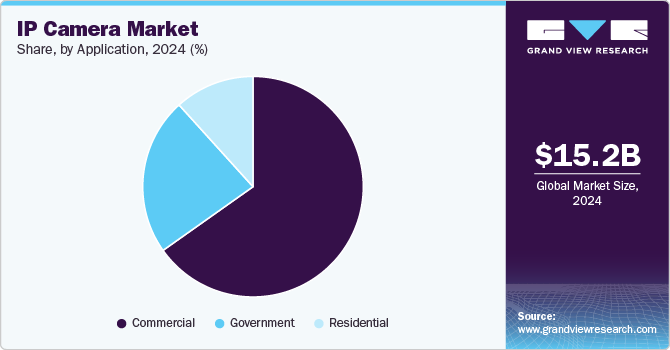

Application Insights

The commercial segment accounted for the largest market share in 2024. The IP camera market in the commercial segment is experiencing rapid growth, driven by the increasing adoption of AI-powered video analytics and cloud-based surveillance solutions. Businesses across retail, banking, hospitality, and corporate sectors are leveraging high-resolution IP cameras with advanced features like facial recognition, motion detection, and real-time alerts to enhance security and operational efficiency.

The shift toward edge computing and IoT integration is enabling commercial enterprises to deploy intelligent surveillance systems with reduced latency and enhanced automation. Additionally, growing concerns over cybersecurity threats are pushing companies to invest in encrypted video transmission and secure cloud storage solutions. As smart building initiatives and regulatory compliance requirements expand, the demand for scalable and AI-driven IP camera solutions is expected to rise significantly.

The residential segment is expected to register as the fastest CAGR from 2025 to 2030. The segment is witnessing strong growth due to rising concerns over home security and the increasing adoption of smart home technologies. Homeowners are increasingly investing in AI-powered IP cameras with features such as facial recognition, two-way audio, and motion-triggered alerts for enhanced safety and convenience. The shift toward cloud-based storage and mobile app integration allows users to remotely monitor their homes in real-time, driving demand for smart surveillance solutions. Additionally, the affordability of high-resolution cameras and the expansion of subscription-based security services are making advanced surveillance accessible to a wider consumer base. As smart home ecosystems continue to evolve, the residential IP camera market is expected to expand further, with a focus on AI-driven automation and privacy-focused security solutions.

Regional Insights

North America IP camera market dominated the global market with a significant share of 24% in 2024. The North American security surveillance market is experiencing strong growth due to the increasing adoption of AI-driven video analytics and cloud-based security solutions. Rising concerns over public safety, cybersecurity, and critical infrastructure protection are driving demand for intelligent surveillance systems. Government regulations and investments in smart city initiatives further fuel market expansion.

U.S. IP Camera Market Trends

The IP camera market in the U.S. is expected to grow at a CAGR of over 15% from 2025 to 2030. The U.S. leads in surveillance technology adoption, with a high demand for AI-powered security solutions in commercial, government, and retail sectors. Cloud-based video management systems (VMS) and edge analytics are becoming standard as businesses seek scalable security solutions. The increasing use of facial recognition technology is also driving debates over privacy regulations and ethical AI deployment.

Europe IP Camera Market Trends

Europe IP camera is expected to grow at a CAGR of over 11% from 2025 to 2030. Europe’s security market is shaped by stringent data privacy laws, such as GDPR, influencing the adoption of AI and facial recognition in surveillance. Smart city projects and growing concerns over terrorism and organized crime are fueling investments in advanced security infrastructure. Demand for IP cameras and cloud-based security solutions is rising across both public and private sectors.

The U.K. is a key player in the European security market, with a strong focus on public surveillance and counter-terrorism measures. The widespread use of CCTV systems, coupled with AI-powered analytics, is driving the development of intelligent monitoring solutions. The rise in retail theft and cybersecurity threats is further boosting investments in integrated security systems.

Germany’s surveillance market is driven by its emphasis on industrial security, critical infrastructure protection, and stringent privacy laws. The country is seeing increased adoption of AI-driven security solutions in the manufacturing and logistics sectors. As smart cities and IoT-based security gain traction, Germany remains a leader in advanced video analytics and cybersecurity measures.

Asia Pacific IP Camera Market Trends

Asia-Pacific is expected to grow at a significant CAGR of over 14% in 2024. The Asia-Pacific region is witnessing rapid growth in the surveillance market due to urbanization, rising security concerns, and government initiatives for smart cities. AI-powered surveillance, edge computing, and cloud-based security solutions are gaining traction across commercial and public sectors. China and India are leading the region’s adoption of advanced surveillance technologies.

China dominates the global surveillance market with massive investments in AI-powered security, facial recognition, and smart city infrastructure. The government’s push for public surveillance and smart policing has resulted in the widespread adoption of high-resolution IP cameras and real-time analytics. Chinese companies, such as Hikvision and Dahua, continue to lead in innovation and global market expansion.

India’s security market is growing due to increasing urbanization, rising crime rates, and government initiatives such as Smart Cities Mission. The demand for AI-powered surveillance, cloud-based security solutions, and automated monitoring is rising across industries. The commercial sector, including retail and banking, is driving investments in video analytics and access control systems.

Middle East & Africa IP Camera Market Trends

The MEA region is witnessing rising demand for advanced security solutions due to geopolitical tensions, infrastructure development, and smart city initiatives. Countries like the UAE and Saudi Arabia are leading in AI-driven surveillance adoption for critical infrastructure and commercial security. The African market is expanding with increasing investments in public safety and retail surveillance solutions.

Key IP Camera Company Insights

Some key players operating in the market are Honeywell International Inc., and Bosch Security Systems, among others.

-

Bosch Security Systems is a well-established player known for its high-performance video surveillance, intrusion detection, and fire safety solutions. The company integrates AI-based analytics into its cameras, enabling real-time threat detection and automated security responses. Bosch continues to lead in the premium security market by focusing on sustainability and cybersecurity in surveillance technology.

-

Honeywell International Inc is a mature player in the security industry, offering end-to-end security solutions, including IP surveillance, access control, and building automation. The company emphasizes AI-driven threat detection and IoT integration to enhance security efficiency. With a strong focus on enterprise and industrial security, Honeywell continues to innovate in the smart security ecosystem.

Vivotek Inc. and Stealth Monitoring are some emerging market participants in the IP camera market.

-

Stealth Monitoring is gaining traction in the security market with its AI-driven remote video surveillance solutions. The company focuses on proactive threat detection, helping businesses reduce security risks through real-time monitoring. As demand for intelligent surveillance grows, Stealth Monitoring continues to expand its presence in commercial and industrial sectors.

-

Vivotek Inc. is an emerging player in the global security market, focusing on IP surveillance cameras and integrated security solutions. The company leverages AI and deep learning to improve object detection, facial recognition, and low-light imaging. As the demand for intelligent surveillance solutions increases, Vivotek is expanding its market reach through strategic partnerships and new technology innovations.

Key IP Camera Companies:

The following are the leading companies in the IP camera market. These companies collectively hold the largest market share and dictate industry trends.

- Hangzhou Hikvision Digital Technology Co. Ltd.

- Bosch Security Systems GmbH

- Honeywell International Inc.

- Johnson Controls

- Panasonic Corporation

- Samsung Electronics Co. Ltd.

- Sony Corporation

- Schneider Electric SE

- Avigilon Corporation

- Arecont Vision Costar LLC.

- Vivotek Inc.

- Stealth Monitoring.

Recent Developments

-

In March 2025, Genetec partnered with Axis Communications and Convergint to present integrated security solutions at The Security Event 2025. This collaboration shows a unified approach to advanced security technologies, combining expertise in video surveillance, access control, and system integration. The initiative highlights the companies’ commitment to innovation in the security sector.

-

In March 2025, Konica Minolta announced the sale of all shares and loans receivable by its subsidiary, MOBOTIX AG, to Certina Software Investments AG. MOBOTIX, known for its decentralized processing IP camera systems, will transition to new ownership as part of this deal. The divestiture aligns with Konica Minolta’s strategic restructuring efforts.

-

In February 2025, Alarm.com acquired a majority stake in CHeKT, a Louisiana-based cloud platform specializing in remote video monitoring. This acquisition strengthens Alarm.com’s proactive video surveillance capabilities, offering improved security solutions for businesses and consumers. The move aligns with Alarm.com’s strategy to expand its presence in the intelligent monitoring industry.

-

In February 2025, Hikvision introduced its latest Pro Series Network Cameras featuring ColorVu 3.0 technology, significantly improving low-light imaging performance. This advancement enhances visibility in dark environments, making the cameras ideal for round-the-clock surveillance. The new technology aims to set a higher standard for security imaging solutions.

IP Camera Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 17.67 billion |

|

Revenue forecast in 2030 |

USD 31.11 billion |

|

Growth rate |

CAGR of 13.4% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion/million, volume in thousand units, and CAGR from 2025 to 2030 |

|

Report Product |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, product type, connection type, application, region |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Mexico |

|

Key companies profiled |

Hangzhou Hikvision Digital Technology Co. Ltd.; Bosch Security Systems GmbH; Honeywell International Inc.; Johnson Controls; Panasonic Corporation; Samsung Electronics Co. Ltd.; Sony Corporation; Schneider Electric SE; Avigilon Corporation; Arecont Vision Costar LLC.; Vivotek Inc.; Stealth Monitoring. |

|

Customization scope |

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet you exact research needs. Explore purchase options |

Global IP Camera Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global IP camera market report based on component, product type, connection type, application, and region:

-

Component Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Services

-

-

Product Type Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Fixed

-

Pan-Tilt-Zoom (PTZ)

-

Infrared

-

-

Connection Type Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Consolidated

-

Distributed

-

-

Application Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

BFSI

-

Education

-

Healthcare

-

Industrial

-

Real Estate

-

Retail

-

Transportation & Logistics

-

-

Government

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. Key factors that are driving the IP camera market growth include rising demand for security surveillance due to the increasing number of home burglaries and squatting; residential security, thus becoming the top priority of homeowners.

b. The global IP camera market size was estimated at USD 15.21 billion in 2024 and is expected to reach USD 17.67 billion in 2025.

b. The global IP camera market is expected to grow at a compound annual growth rate of 13.4% from 2025 to 2030 to reach USD 31.11 billion by 2030.

b. Infrared camera in the product type dominated the IP camera market with a share of over 44% in 2024. This is attributable to the increased demand for infrared solutions in industrial sectors such as military & defense, government facilities, and BFSI.

b. Some key players operating in the IP camera market include 3DEYE Inc., Arecont Vision Costar LLC., Bosch Security Systems GmbH, D-Link Corporation, Honeywell International Inc., and Panasonic Corporation among others.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."