IoT In Utilities Market Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Deployment (On-premise, Cloud), By Connectivity, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-474-1

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

IoT In Utilities Market Size & Trends

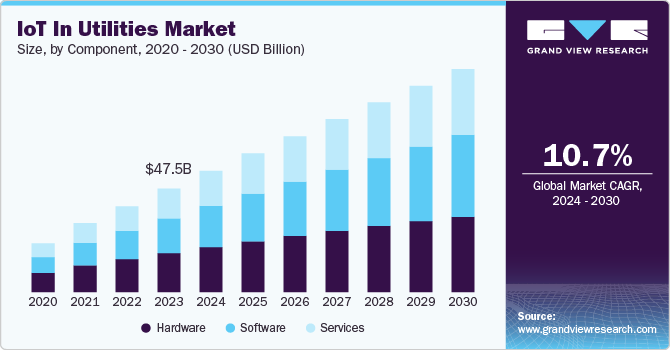

The global IoT in utilities market size was estimated at USD 47.53 billion in 2023 and is expected to grow at a CAGR of 10.7% from 2024 to 2030. The market is witnessing significant growth due to the increasing adoption of smart technologies in the energy, water, and gas sectors. Utilities are embracing IoT to modernize infrastructure, improve efficiency, and enhance customer service by integrating sensors, smart meters, and connected devices across their networks. These technologies enable real-time monitoring, predictive maintenance, and automated control of utility systems, leading to reduced operational costs, lower energy consumption, and improved reliability. These factors are expected to drive the market growth in the coming years.

The market growth is further driven by the establishment of environmental standards by government bodies and regulatory authorities. These standards mandate the adoption of energy-efficient technologies, which in turn stimulates the demand for IoT solutions to monitor and optimize energy consumption. Additionally, environmental regulations aimed at reducing pollution and waste are encouraging utilities to implement IoT-enabled systems for real-time monitoring and control of operations. By creating regulatory frameworks that promote sustainability and environmental protection, government standards are fostering a favorable environment for the market growth.

In addition, the growing demand for smart cities and home automation is also driving the IoT in utilities market growth. Consumers expect more personalized and efficient services, such as real-time energy usage tracking and automatic billing, which IoT-enabled utilities can provide. The increasing penetration of 5G networks and advanced data analytics further enhances the capabilities of IoT systems, enabling utilities to process large volumes of data for better decision-making and improved service delivery.

As utilities strive to address challenges like aging infrastructure, climate change, and rising demand for clean energy, the market for IoT in utilities is set for continued growth, playing a crucial role in the digital transformation of the industry. Several governments are investing in grid modernization initiatives. For instance, in August 2024, the U.S. Department of Energy announced a USD 2.2 billion investment in the development of grid infrastructure across 18 states to protect against extreme weather events, catalyze additional grid capacity, and lower costs for communities to manage load stemming from manufacturing and data centers. Such factors are expected to propel market growth over the upcoming years.

Component Insights

The hardware segment captured the largest revenue share of over 37% in 2023 owing to advancements in sensor technology, microprocessors, and wireless communication protocols that support the development of smaller, more efficient, and cost-effective IoT devices. The increasing focus on energy efficiency and sustainability is driving the demand for smart devices that can optimize resource consumption and reduce operational costs. Moreover, the growing adoption of IoT platforms and cloud-based solutions is providing the necessary infrastructure to support the deployment and management of IoT hardware devices, further contributing to the segment’s growth.

The software segment is expected to record the fastest CAGR of nearly 12% from 2024 to 2030. As IoT networks expand and become more interconnected, there is a growing need for advanced software platforms to manage, analyze, and optimize data from these devices. These software solutions enable utilities to improve operational efficiency, enhance customer service, and gain valuable insights into energy consumption patterns. The integration of artificial intelligence and machine learning capabilities within IoT software platforms is further creating significant growth opportunities for the market, as it enables utilities to automate tasks and optimize resource allocation.

Deployment Insights

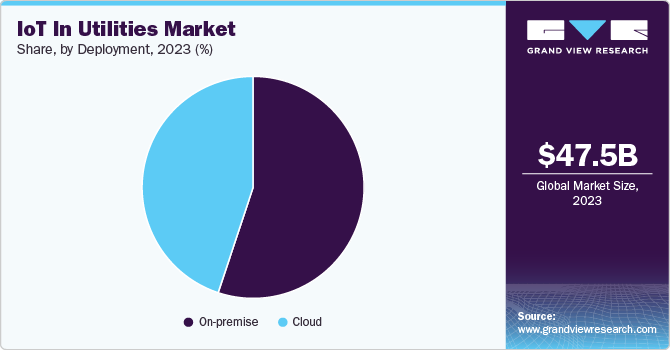

The on-premise segment held the largest revenue share in 2023. Organizations in industries such as manufacturing, energy, and transportation are increasingly deploying IoT solutions to optimize operations, improve efficiency, and reduce costs. On-premise deployments offer greater control over data security, privacy, and compliance, making them attractive to organizations with stringent data management requirements. In addition, this deployment mode provides lower latency and reduced reliance on external network connectivity, making it suitable for applications that require real-time data processing and control. These factors underline the dominance of on-premise segment in the market.

The cloud segment is poised for a significant CAGR from 2024 to 2030. Cloud-based IoT solutions offer cost-effective deployment and management, as well as enhanced security and reliability, which is driving their demand and favoring segmental growth. Moreover, cloud platforms offer scalable and flexible storage and processing capabilities required to manage the large volume of data generated by IoT devices. Furthermore, the integration of cloud-based analytics and machine learning tools enables utilities to extract valuable insights from IoT data, optimizing operations and improving efficiency. These factors, combined with the growing adoption of IoT technologies in the utilities sector, are contributing to the market expansion.

Connectivity Insights

The Wi-Fi segment accounted for the largest revenue share in 2023 owing to high demand for this technology driven by its widespread availability, affordability, and ease of deployment. Wi-Fi technology provides reliable and robust connectivity for a variety of IoT devices, enabling seamless data transmission and remote monitoring. In addition, the growing adoption of Wi-Fi mesh networks is providing broader coverage and improved performance, making it an attractive option for IoT applications in both indoor and outdoor environments. The high usability and versatility of this technology is expected to create lucrative growth opportunities for the segment over the coming years.

The Z-Wave segment is expected to record a notable CAGR from 2024 to 2030 owing to reliability, low power consumption, and long-range capabilities of this technology. It is well-suited for home automation and smart utility applications, allowing for seamless integration of various devices and systems. The increasing focus on energy efficiency and sustainability, coupled with the growing adoption of smart home solutions, is driving the demand for Z-Wave-enabled devices and platforms. Moreover, the availability of affordable Z-Wave modules and the growing ecosystem of compatible devices are further driving the segmental growth.

Application Insights

The smart grid segment accounted for the largest revenue share in 2023 owing to several factors. The increasing focus on energy efficiency and sustainability has driven the adoption of smart grid technologies to optimize power distribution and reduce energy consumption. Furthermore, the integration of renewable energy sources into the grid has created a need for advanced grid management solutions. Furthermore, the growing demand for real-time monitoring and control of energy systems, coupled with the advancements in IoT and communication technologies, has fueled the growth of smart grid application segment.

The energy management segment is expected to record the fastest CAGR from 2024 to 2030. The increasing need for efficient energy consumption, cost savings, and sustainability initiatives have urged utilities and industries to invest in energy management solutions based on IoT technology. It enables real-time monitoring and automation of energy systems, optimizing consumption, and reducing waste. Moreover, IoT solutions also help manage energy grids, track power usage, and integrate renewable energy sources effectively, which is driving their demand in this segment. The rise in smart grids, coupled with growing government regulations for energy efficiency and carbon reduction, further drives demand for IoT in energy management, creating significant growth prospects for the segment.

Regional Insights

The IoT in utilities market in North America accounted for the largest revenue share of around 36% in 2023. The increasing focus on energy efficiency and sustainability has driven the adoption of smart grid technologies and IoT solutions for utilities. Moreover, advancements in sensor technology, data analytics, and cloud computing have enabled utilities to collect and analyse vast amounts of data to optimize operations and improve efficiency. With rising concerns over climate change and regulatory mandates, IoT-driven technologies are gaining wide prominence across utilities in the region. Additionally, increasing government investment in IoT-enabled utilities to enhance grid reliability and resilience is expected to enhance the market outlook over the coming years.

U.S. IoT In Utilities Market Trends

IoT in utilities market in the U.S. is expected to record significant growth at a CAGR 7% from 2024 to 2030, owing to increasing adoption of IoT solutions to optimize resource management, enhance grid reliability, and enable real-time monitoring of energy consumption in the country. These technologies allow for predictive maintenance, improved asset management, and more efficient distribution of electricity, water, and gas. Moreover, rise in renewable energy integration, along with government initiatives promoting smart infrastructure and sustainability, are further accelerating the market growth.

Asia Pacific IoT In Utilities Market Trends

The IoT in utilities market in Asia Pacific is expected to record a promising CAGR of 13% from 2024 to 2030. Factors such as increasing adoption of smart grid technologies, need for efficient energy management, and emphasis on sustainability, are driving the market growth. The increasing government investments in grid infrastructure, including smart meters, sensors, and automated systems, to improve energy distribution and minimize waste is creating ample growth opportunities for the market. Rapid urbanization, rising energy demand, and the integration of renewable energy sources have further accelerated the adoption of IoT solutions in utilities. These factors, combined with smart city initiatives and energy conservation, are driving the expansion of the Asia Pacific market.

Europe IoT In Utilities Market Trends

IoT in utilities market in Europe accounted for a notable revenue share of over 24% in 2023, owing to increasing focus on smart energy management, sustainability, and infrastructure modernization across regional countries. As European countries are prioritizing renewable energy integration, smart grids, and energy efficiency, IoT-enabled technologies are witnessing heightened demand for real-time monitoring, automation, and optimization. IoT devices and sensors help utility providers enhance operational efficiency, reduce energy waste, and offer predictive maintenance, thereby minimizing downtime and costs. Moreover, growing inclination toward carbon neutrality and stringent EU regulations on emissions and energy consumption are driving the adoption of IoT solutions, thereby contributing to the regional market growth.

Key IoT In Utilities Market Company Insights

Some of the key players operating in IoT in utilities market are IBM Corporation; Cisco Systems Inc.; Microsoft Corporation; ABB Ltd.; and SAP SE.

-

IBM Corporation operates across diverse industry verticals including cloud computing, AI, software, and hardware. The company offers solutions in the areas like data analytics, cybersecurity, and quantum computing, impacting sectors such as finance, healthcare, and manufacturing.

-

Microsoft Corporation is a U.S.-based multinational company, that develops and manufactures consumer electronic products and computer hardware & software systems. It is one of the prominent computer operating system providers worldwide. The company specializes in various application areas such as business software, design tools, developer tools, entertainment products, hardware, windows operating system, windows applications, smartphones, and cloud computing.

-

Cisco Systems Inc. operates in the networking and communications equipment industry, offering solutions for networking, security, cloud, and collaboration. It also caters to diverse industry verticals such as telecommunication, IT, healthcare, finance, and more.

-

SAP SE is a software solutions provider helping businesses effectively manage their operations. With the introduction of its original SAP R/2 and SAP R/3 software, SAP SE has established the global standard for enterprise resource planning (ERP) software. It offers various solutions for ERP, financial management, supply chain management, CRM, send management, human capital management, etc.

-

ABB’s operating business segments include electrification products, robotics and motion, industrial automation, and power grids. The industrial automation division of the company provides products, services, and systems to enhance business processes.

Key IoT In Utilities Companies:

The following are the leading companies in the IoT in utilities market. These companies collectively hold the largest market share and dictate industry trends.

- Cisco Systems, Inc.

- IBM Corporation

- General Electric Company

- Siemens AG

- Microsoft Corporation

- Huawei Technologies

- SAP SE

- Honeywell International Inc.

- Schneider Electric

- ABB Ltd

- Toshiba Corporation

- Mitsubishi Electric Group

- Verizon

Recent Developments

-

In June 2024, Siemens AG launched Solido Simulation Suite software, an integrated range of Fast SPICE, AI-powered SPICE, and mixed-signal simulators designed to help customers expedite design and verification tasks for their advanced analog, custom, and mixed-signal IC designs. This new solution facilitates numerous applications through the System-on-a-Chip (SoC) and best-in-class circuit verification capabilities.

-

In April 2024, Cisco Systems, Inc. acquired Isovalent, Inc. an open-source cloud native networking and security solution provider. As a part of this deal, the latter’s advanced technologies will support the Cisco Security Cloud vision, a cloud-delivered, AI-driven, integrated security platform designed to cater to businesses of any size, providing high-end protection against threats related to multi-cloud.

-

In April 2024, ABB Ltd, along with Capgemini Services SAS, Microsoft Corporation, Rockwell Automation Inc., Schneider Electric, and Siemens AG, collaborated on a new initiative named Margo to deliver interoperability for Industrial IoT ecosystems, while addressing key obstacles to digital transformation. Through this initiative, the companies intend to unlock interoperability at the edge, a crucial industrial IoT ecosystems layer where plant data is transformed into AI-powered insights to deliver sustainability and efficiency.

-

In December 2023, General Electric Company and MYTILINEOS Energy & Metals received a USD 11.33 billion contract from National Grid Electricity Transmission and SP Transmission, for the first high-capacity east coast subsea link of U.K. The GE Vernova - MYTILINEOS consortium has been selected for supplying and constructing two high-voltage direct current converter stations for Eastern Green Link

IoT In Utilities Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 55.65 billion |

|

Revenue forecast in 2030 |

USD 102.36 billion |

|

Growth rate |

CAGR of 10.7% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, connectivity, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Cisco Systems, Inc; IBM Corporation; General Electric Company; Siemens AG; Microsoft Corporation; Huawei TechnologiesCo. Ltd; SAP SE; Honeywell International Inc.; Schneider Electric; ABB Ltd; Oracle Corporation; Hitachi, Ltd.; Toshiba Corporation; Mitsubishi Electric Group; Verizon |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global IoT In Utilities Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global IoT in utilities market report based on component, deployment, connectivity, application, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

Consulting

-

Integration and Deployment

-

Support and Maintenance

-

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Connectivity Outlook (Revenue, USD Billion, 2018 - 2030)

-

Zigbee

-

Wi-Fi

-

Bluetooth

-

Z-Wave

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Smart Meters

-

Smart Grid

-

Energy Management Systems

-

Water Management

-

Waste Management

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global IoT in utilities market size was estimated at USD 47.53 billion in 2023 and is expected to reach USD 55.65 billion in 2024.

b. The global IoT in utilities market is expected to grow at a compound annual growth rate of 10.7% from 2024 to 2030 to reach USD 102.36 billion by 2030.

b. The North America region dominated the industry with the highest revenue share of over 36% in 2023. The increasing focus on energy efficiency and sustainability has driven the adoption of smart grid technologies and IoT solutions for utilities.

b. The key players in the IoT in utilities market include Cisco Systems, Inc; IBM Corporation; General Electric Company; Siemens AG; Microsoft Corporation; Huawei Technologies Co. Ltd; SAP SE; Honeywell International Inc.; Schneider Electric; ABB Ltd; Oracle Corporation; Hitachi, Ltd.; Toshiba Corporation; Mitsubishi Electric Group; and Verizon.

b. Key factors that are driving the market growth include the advancements in sensor technology, data analytics, and cloud computing that enable utilities to collect and analyze vast amounts of data to optimize operations and improve efficiency. With rising concerns over climate change and regulatory mandates, IoT-driven technologies are gaining wide prominence across utilities globally.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."