IoT Sensors Market Size, Share & Trends Analysis Report By Type (Temperature Sensors, Motion Sensors, Light Sensors), By End Use (Consumer Electronics, Wearable Devices, Automotive & Transportation, Healthcare), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-386-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

IoT Sensors Market Size & Trends

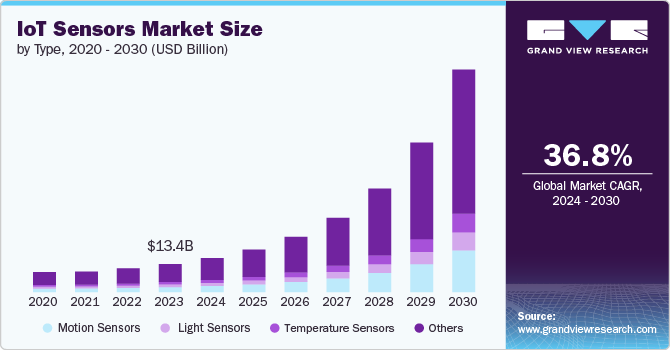

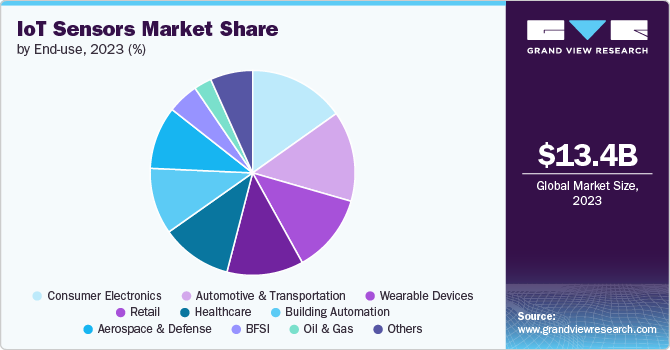

The global IoT sensors market size was estimated at USD 13.36 billion in 2023 and is expected to grow at a CAGR of 36.8% from 2024 to 2030. The market growth is attributed to the growing inclination for connected devices across several industry verticals, such as automotive, retail, healthcare, aerospace, defense, building automation, manufacturing, etc. Moreover, the growing significance of real-time data to optimize processes and workflows, identify errors, improve response times, and make data-driven strategies is creating lucrative opportunities for IoT sensors market.

Rapid urbanization across different parts of the world and simultaneous development of smart cities and proliferation of smart homes is positively influencing the IoT sensors market outlook. The popularity of smart homes and buildings is driving demand for sensors that collect data on temperature, humidity, lighting, and occupancy. This data facilitates remote monitoring, automated control, and improved energy efficiency. Besides, increasing demand for connected cars that are powered by IoT sensors for navigation, safety features, and autonomous driving technologies is also creating significant growth avenues for the market.

In addition, factors such as growing fitness consciousness, rising disposable incomes, and increasing consumer demand for smart gadgets are creating significant growth avenues for IoT sensors market. Increasing demand for smartwatches, fitness trackers, and health monitors is stimulating the demand for high-end sensors. Some smartwatches now feature blood oxygen sensors or electrocardiogram (ECG) sensors for advanced health monitoring. These gadgets essentially rely on IoT sensors which further fuels the product demand, accelerating the market expansion.

The growth of IoT sensors market is being further driven by the increasing focus of market players on innovation and technological advancements to develop cutting-edge sensor solutions that can effectively cater to the evolving consumer needs. For instance, in May 2024, Sensirion AG launched SLD3x, a miniature liquid flow sensor platform for drug delivery in subcutaneous processes. This solution has been designed to ensure precise dosing and improved patient care during various subcutaneous therapies. Such developments are expected to boost the market growth in coming years

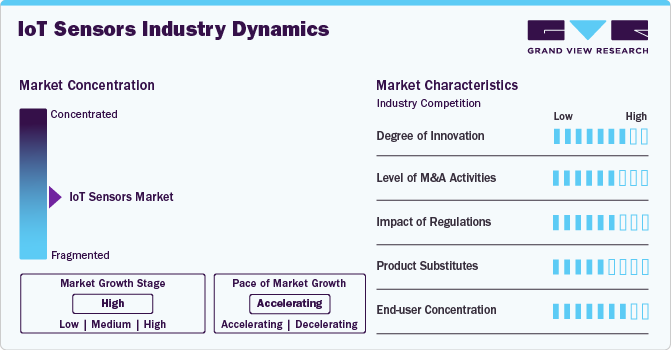

Market Concentration & Characteristics

The IoT sensors market is characterized by a high degree of innovation, driven by the advancements in technology, catering to a wide range of industries including automotive, consumer goods, healthcare, retail, aerospace, etc. Furthermore, the adoption of Industry 4.0 principles is driving the adoption of smart sensors for predictive maintenance, improving operational efficiency and reducing downtime in industrial settings, which is further driving innovation in the market.

The level of mergers & acquisitions in the market is expected to be moderate. Companies operating in this sector are engaging in M&A activities to acquire new technologies, expand their product portfolio, and gain a competitive edge in the industry. However, with the increasing number of smaller players entering the market with new smart sensor technologies and solutions, the level of M&A activities is moderate.

The impact of regulations on the market is expected to be moderate. Regulations play a significant role in shaping the IoT sensors market by setting standards for quality, performance, safety, and data privacy. Compliance with regulatory requirements is essential for manufacturers to ensure that their products meet industry standards and address concerns related to data security and privacy.

The competition from product substitutes in the market is expected to be low due to the availability of several conventional tracking solutions. However, the growing significance of real-time tracking and growing reliance on data generated from the IoT sensors lowers the threat of product substitutes.

The end-user concentration in the IoT sensors market is high as IoT sensors are being increasingly adopted across various industries such as automotive, aerospace & defense, consumer electronics, building automation, oil & gas, etc., due to their versatility and efficiency in data collection and analysis.

Type Insights

The motion sensors segment is expected to record the fastest CAGR of nearly 38.0% from 2024 to 2030. The segment growth is ascribed to the increasing demand for these sensors among businesses and industrial facilities for perimeter security, deterring unauthorized entry, and preventing theft. They are also used in access control systems, granting entry only to authorized personnel. Additionally, increasing demand in retail stores to track customer traffic patterns and analyze dwell time in specific areas to optimize store layout and enhance customer experience is further driving the market growth.

The light sensors segment accounted for the revenue share of more than 9.0% in 2023. The rising trend of smart homes buildings equipped with light sensors that enable features such as automatic lighting control, daylight harvesting, and occupancy detection. These features enhance convenience, energy efficiency, and security within living and working spaces. Besides, rising consumer demand for wearables like smartwatches and fitness trackers that are integrated with light sensors to automatically adjust display brightness or track sleep patterns based on ambient light conditions is further enhancing the market outlook.

End Use Insights

The consumer electronics segment accounted for significant revenue share in 2023 owing to high increasing popularity of smart gadgets, such as smartphones, smartwatches, and fitness trackers equipped with various sensors (motion, heart rate, GPS). Moreover, increasing adoption of smart home devices including smart thermostats, security systems, and connected appliances rely on smart sensors for their function. This increased demand for smart home products is fueling the segmental growth.

The automotive & transportation segment is expected to record the highest CAGR from 2024 to 2030 owing to increasing demand for vehicles equipped with multitude of sensors such as radar, LiDAR, and cameras to enable ADAS features including automatic emergency braking, adaptive cruise control, and lane departure warning. In addition, IoT sensors are integrated into telematics systems that track vehicle performance, fuel consumption, and maintenance needs. This data can be used by fleet operators to optimize routes, reduce fuel costs, and schedule preventive maintenance, which is driving the demand for IoT sensors and contributing to segmental growth.

Regional Insights

The IoT sensors market in North America accounted for largest revenue share of over 40% in 2023 as the region boasts a well-developed digital infrastructure with high-speed internet connectivity and extensive deployment of IoT networks. Moreover, the strong presence of several major IoT sensor manufacturers and technology companies that are engaged in the development of innovative sensor technologies is creating ample growth opportunities for the regional market.

U.S. IoT Sensors Market Trends

The U.S. IoT sensors market is estimated to witness a significant growth rate of more than 32.0% from 2024 to 2030 on account of the thriving technology sector in the country coupled with supportive government initiatives promoting the adoption of Industry 4.0.

Asia Pacific IoT Sensors Market Trends

The IoT sensors market in Asia Pacific is expected to record its highest growth rate of over 40% from 2024 to 2030. The ongoing expansion of manufacturing sector in countries like China, India, and South Korea, which creates a high demand for IoT sensors used in machine monitoring, industrial automation, and predictive maintenance. Moreover, the rapid expansion of internet connectivity and mobile phone usage creates a strong foundation for IoT adoption, which is further enhancing the overall market outlook.

India IoT sensors market is estimated to record a notable growth rate from 2024 to 2030 as the country offers significant potential for the adoption of IoT technologies in sectors like agriculture, healthcare, manufacturing, etc.

The IoT sensors market in China accounted for a significant revenue share in 2023 owing to high consumer demand for smart gadgets, proliferation of connected automobiles, and expansion of manufacturing sector in the country.

Japan IoT sensors market is expected to witness a notable CAGR from 2024 to 2030 owing to increasing focus of regional players to develop innovative sensors for diverse applications that can cater to various industry verticals.

Europe IoT Sensors Market Trends

The IoT sensors market in Europe accounted for a notable revenue share of in 2023 and is expected to witness a notable growth over the coming years. This growth is attributed to the growing significance of real-time data collected by IoT sensors among businesses. Moreover, Stricter environmental regulations in Europe are driving the demand for IoT sensors that can monitor air quality, energy consumption, and waste management, thereby creating significant growth opportunities for the market.

The UK IoT sensors market is expected to witness a significant growth over the coming years with owing to heightened demand for smart sensors in industrial automation, automotive applications, and healthcare sectors in the country.

The IoT sensors market in Germany is estimated to record a notable CAGR from 2024 to 2030 owing to the presence of mature automotive industry in the country with leading automakers increasingly adopting IoT technologies in their vehicles to offer enhanced high-end features.

Middle East and Africa (MEA) IoT Sensors Market Trends

The MEA IoT sensors market is estimated to record a considerable CAGR from 2024 to 2030. governments are heavily invested in developing smart cities, which rely heavily on sensor networks for data collection and infrastructure management. This includes traffic monitoring, waste management, and environmental monitoring. Moreover, businesses across various sectors are recognizing the potential of IoT sensors to optimize operations, reduce waste, and improve productivity, which is expected to drive the market growth over the coming years.

The IoT sensors market in Saudi Arabia accounted for a notable revenue share in 2023 owing to increasing government investment into the development of smart cities and growing consumer inclination for smart building solutions.

Key IoT Sensors Company Insights

Some players operating in the market include Honeywell International, Inc., Siemens AG, and Robert Bosch GmbH among others.

-

Honeywell International, Inc. is a multinational conglomerate that operates in various industries, including aerospace, building technologies, performance materials, and safety and productivity solutions. The company is known for its innovative technologies and solutions that cater to a wide range of applications, from industrial automation to smart home devices and offers a diverse portfolio of sensor products that are used in industrial automation, HVAC systems, transportation, and more.

-

Siemens AG is a German multinational conglomerate that operates in various sectors such as energy, healthcare, industry, and infrastructure. The company offers a comprehensive range of sensor solutions that are integrated into its automation systems and IoT platforms. These sensors are designed to provide accurate data collection for monitoring and controlling various processes across industries like manufacturing, energy management, and smart buildings.

-

Robert Bosch GmbH is a German technology and services provider. The company operates through four major business segments: industrial technology, consumer goods, mobility solutions, and the energy & building technology segment. It offers smart home solutions that enable homeowners to control and monitor various appliances and systems, including heating, lighting, and security, through a single platform.

NXP Semiconductors N.V., Analog Devices, Inc., Omron Corporation are some emerging market participants.

-

NXP Semiconductors N.V. operates in industry verticals such as automotive and industrial, IoT, mobile, and communication infrastructure. It delivers advanced semiconductor solutions that enable secure connections and enhance efficiency in various applications, contributing to the advancements of connected ecosystems worldwide.

-

Analog Devices, Inc. is a global semiconductor company specializing in the design and manufacturing of analog, mixed-signal, and digital signal processing integrated circuits. The company’s offerings cater to various applications such as Internet of Things (IoT), autonomous vehicles, industrial automation, and healthcare. The company’s smart sensor products include accelerometers, gyroscopes, temperature sensors, pressure sensors, and environmental sensors.

-

Omron Corporation specializes in industrial automation and healthcare products. The company offers a wide range of sensors designed for applications such as factory automation, energy management, healthcare monitoring, and automotive systems. The company’s smart sensor solutions are integrated with high-end technologies such as artificial intelligence (AI), machine learning algorithms, and internet connectivity to enable real-time data collection and analysis for effective decision-making.

Key IoT Sensors Companies:

The following are the leading companies in the IoT sensors market. These companies collectively hold the largest market share and dictate industry trends.

- Texas Instruments

- TE Connectivity Corporation

- STMicroelectronics International N.V.

- NXP Semiconductor N.V.

- Honeywell International Inc.

- Siemens AG

- General Electric

- OMRON Corporation

- Murata Manufacturing Co., Ltd.

- Analog Devices, Inc.

- Robert Bosch GmbH

- Infineon Technologies AG

- Sensirion AG

Recent Developments

-

In July 2024, STMicroelectronics International N.V. launched VL53L4ED single-zone Time-of-Flight sensor with operating temperature range extended to -40°C to 105°C. Designed for harsh industrial environments, this new sensor offers enhanced proximity detection and ranging in high ambient light conditions in as various applications, including smart-factory equipment, industrial tools, robot guidance systems, security systems, and outdoor lighting controls.

-

In May 2024, Murata Manufacturing Co., Ltd. signed a licensing agreement with renowned automobile tire manufacturer Michelin. As a part of this deal, the company will provide advanced RFID (Radio Frequency Identification) tire tags for the latter’s automotive tires for improved tire management, security, traceability, and sustainability.

-

In April 2024, TE Connectivity announced expansion of its IoT wireless pressure sensor range with the addition of69xxN wireless pressure sensor and 65xxN wireless pressure sensor. The latest addition aims at catering to the rising demand for miniaturized, digital, low power, and wireless sensors that can operate in challenging environments.

IoT Sensors Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 16.20 billion |

|

Revenue forecast in 2030 |

USD 106.01 billion |

|

Growth rate |

CAGR of 36.8% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Texas Instruments; TE Connectivity Corporation; STMicroelectronics International N.V.; NXP Semiconductor N.V.; Infineon Technologies AG; Honeywell International Inc.; Siemens AG; General Electric; OMRON Corporation; Murata Manufacturing Co., Ltd.; Analog Devices, Inc.; Robert Bosch GmbH; Sensirion AG |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global IoT Sensors Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global IoT sensors market report based on type, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Temperature Sensors

-

Motion Sensors

-

Light Sensors

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumer Electronics

-

Wearable Devices

-

Automotive & Transportation

-

BFSI

-

Healthcare

-

Retail

-

Building Automation

-

Oil & Gas

-

Agriculture

-

Aerospace & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global IoT sensors market size was estimated at USD 13.36 billion in 2023 and is expected to reach USD 16.20 billion in 2024.

b. The global IoT sensors market is expected to grow at a compound annual growth rate of 36.8% from 2024 to 2030 to reach USD 106.01 billion by 2030.

b. The North America region dominated the industry with a revenue share of 35.7% in 2023. This can be attributed to the well-developed digital infrastructure in the region with high-speed internet connectivity and extensive deployment of IoT networks.

b. Some key players operating in IoT sensors market include Texas Instruments, TE Connectivity Corporation, STMicroelectronics International N.V., NXP Semiconductor N.V., Honeywell International Inc., Siemens AG, General Electric, OMRON Corporation, Murata Manufacturing Co., Ltd., Analog Devices, Inc., Robert Bosch GmbH, Infineon Technologies AG, and Sensirion AG

b. Key factors that are driving IoT sensors market growth include the increased demand for growing inclination for connected devices across several industry verticals, rising significance of real-time data to optimize processes and workflows, and rapid urbanization and growing popularity of smart homes across the globe.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."