IoT Platform Market Size, Share & Trends Analysis Report By Component (Platform, Services), By Deployment (Private Cloud, Public Cloud), By Organization Size, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-479-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

IoT Platform Market Size & Trends

The global IoT platform market size was estimated at USD 11.10 billion in 2023 and is projected to grow at a CAGR of 12.7% from 2024 to 2030. The increasing integration of IoT technology in various industries, such as manufacturing, healthcare, and agriculture, is driving the demand for robust IoT platforms. In addition, the growing need for automation and remote monitoring is further accelerating the adoption of IoT platforms, which is expected to further fuel the market growth in the coming years.

Governments and private enterprises worldwide are investing significantly in the development of smart cities and smart homes, which is further boosting the demand for IoT platforms. These platforms serve as the backbone for connecting various devices and systems, enabling seamless communication and control. The deployment of IoT platforms in smart cities and smart home projects supports applications such as traffic management, energy optimization, and public safety, further driving the market demand.

The convergence of cloud computing and edge computing is significantly propelling market growth. Cloud-based IoT platforms offer scalability, flexibility, and cost-effectiveness, allowing businesses to manage large volumes of IoT data efficiently and edge computing enables real-time data processing closer to the source, reducing latency and enhancing security. The combination of these technologies is paving the way for innovative IoT applications in areas such as autonomous vehicles, industrial automation, and healthcare, thereby driving market growth.

Furthermore, the rising concerns over data security and privacy are accelerating the adoption of IoT platforms. Regulatory frameworks such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) are compelling organizations to adopt secure IoT platforms that comply with data protection standards. This has led to the development of advanced security features within IoT platforms, such as encryption, multi-factor authentication, and secure firmware updates, thereby boosting market expansion.

Moreover, the integration of artificial intelligence (AI) and machine learning (ML) into IoT platforms is revolutionizing the market by enabling advanced analytics, predictive maintenance, and intelligent automation. AI-powered IoT platforms can analyze massive amounts of data generated by connected devices to uncover insights and optimize operations. This trend is expected to continue as businesses seek to leverage AI and ML to gain a competitive edge through IoT-enabled innovations.

Component Insights

The platform segment accounted for the largest market share of over 65% in 2023, owing to its role as the foundational layer enabling connectivity, data management, and analytics for IoT solutions. IoT platforms act as the backbone for integrating diverse devices and systems, providing a unified interface for managing and analyzing IoT data. As businesses increasingly adopt IoT technologies for various applications, the demand for robust and scalable platforms has surged, driving the segment’s growth.

The services segment is expected to witness the fastest CAGR of over 14% from 2024 to 2030. This growth is fueled by the growing need for consulting, implementation, and support services related to IoT deployments. As businesses increasingly integrate IoT solutions, they require expert guidance for seamless deployment, integration with existing systems, and ongoing maintenance to ensure optimal performance. The complexity of IoT ecosystems, coupled with the rapid evolution of technologies, is further driving the demand for specialized services to help organizations navigate challenges and maximize their IoT investments, thereby driving the segment’s growth.

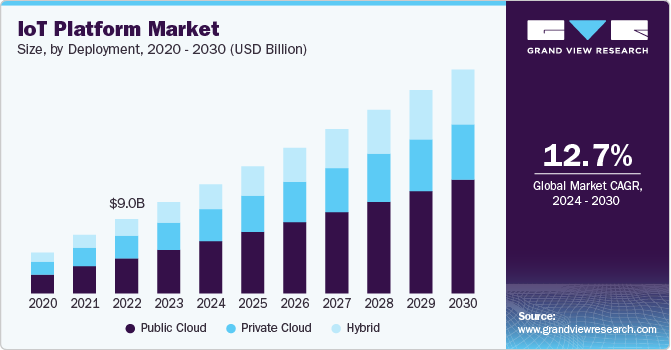

Deployment Insights

The public cloud segment accounted for the largest market share in 2023, owing to its scalability, cost-effectiveness, and flexibility, which are critical for managing the massive data volumes generated by IoT devices. Public cloud platforms offer advanced analytics, machine learning capabilities, and pay-as-you-go pricing models, making them attractive to organizations looking to deploy IoT solutions without significant upfront infrastructure investments. The availability of robust security features and compliance certifications also contributes to the widespread adoption of public cloud platforms, enabling businesses to leverage IoT data effectively while minimizing operational costs.

The hybrid segment is expected to witness the fastest CAGR from 2024 to 2030 as organizations seek to balance the benefits of public and private clouds in their IoT strategies. Hybrid cloud platforms offer the flexibility to manage sensitive data on private clouds while utilizing public cloud resources for broader scalability and advanced analytics. This approach addresses concerns related to data sovereignty, security, and latency, making it ideal for industries with stringent regulatory requirements. As IoT adoption expands across sectors with varying data needs, the hybrid model provides a versatile solution, driving its rapid growth.

Application Insights

The smart manufacturing segment in the market accounted for the largest share in 2023. This growth can be attributed to the widespread adoption of IoT technologies to enhance production efficiency, reduce downtime, and improve quality control. Manufacturers are increasingly integrating IoT solutions, such as connected machinery, predictive maintenance, and real-time monitoring, to optimize operations and gain a competitive edge. The ability to collect and analyze data from various sources in real time enables better decision-making and resource management, thereby driving segment growth.

The smart transportation segment is anticipated to record the fastest growth from 2024 to 2030, driven by the rising demand for connected vehicles, smart traffic management, and logistics optimization. IoT platforms enable real-time tracking, fleet management, and predictive maintenance in transportation, improving safety, efficiency, and sustainability. With increasing urbanization and the need for efficient mobility solutions, smart transportation is becoming a critical area for IoT applications. Governments and private enterprises are investing heavily in smart city initiatives, further accelerating the adoption of IoT platforms in this segment.

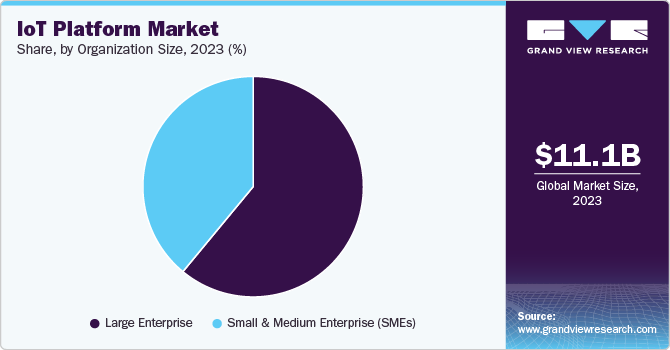

Organization Size Insights

The large enterprises segment in the market accounted for the largest share in 2023. This growth can be attributed to large enterprises' resources and scale to invest in comprehensive IoT solutions, integrating them into their digital transformation initiatives. This adoption is driven by the need for real-time monitoring, predictive maintenance, and automation in sectors such as manufacturing, logistics, and energy.

The small & medium enterprises segment is anticipated to record the fastest growth from 2024 to 2030, as these businesses increasingly recognize the value of IoT in enhancing operational efficiency, reducing costs, and driving innovation. Cloud-based IoT platforms, which offer lower entry costs and scalable solutions, are particularly attractive to SMEs. The democratization of IoT technologies and the availability of user-friendly platforms have enabled smaller businesses to implement IoT solutions tailored to their specific needs, fostering innovation and competitiveness and thereby driving segment growth.

Regional Insights

The IoT platform market in North America accounted for the largest revenue share of 36% in 2023, driven by rapid technological advancements, the increasing adoption of cloud-based solutions, and the growing need for enhanced connectivity and data analytics. Major industries such as manufacturing, healthcare, and smart cities are investing heavily in IoT solutions to improve operational efficiency and customer experience. In addition, government initiatives promoting smart infrastructure and the expansion of 5G networks are propelling the market forward in the region. The presence of leading technology firms and a strong focus on innovation further enhance the region's competitive landscape.

U.S. IoT Platform Market Trends

The IoT platform market in the U.S. accounted for a revenue share of over 84% in 2023. In the U.S., the emphasis on cybersecurity to protect IoT devices is shaping market trends, leading to enhanced investments in secure platforms. Furthermore, collaborations between startups and established firms are fostering innovation and the development of specialized IoT solutions tailored to specific industry needs.

Europe IoT Platform Market Trends

The IoT platform market in Europe is projected to grow at a CAGR of over 11% from 2024 to 2030, driven by stringent regulatory frameworks and a strong emphasis on sustainability. The European Union's initiatives aimed at reducing carbon emissions and enhancing energy efficiency are driving the adoption of IoT technologies across various sectors, including transportation, manufacturing, and energy. The region is witnessing increased investment in smart city projects and connected infrastructure, enhancing urban living standards.

Asia-Pacific IoT Platform Market Trends

The IoT platform market in the Asia Pacific region is expected to grow at a significant CAGR of 15.7% from 2024 to 2030. Countries in the region are leading in IoT adoption, driven by government initiatives supporting digital transformation and smart city development. The region is witnessing significant investments in industrial IoT to optimize manufacturing processes and supply chains.

Key IoT Platform Company Insights

Some of the key players operating in the market include Microsoft Corporation and Amazon Web Services, Inc., among others.

-

Microsoft Corporation is an American multinational technology company known for its software products, including the Windows operating system and the Microsoft Corporation 365 suite of productivity applications. The company has significantly expanded its portfolio to include cloud computing services through Azure, gaming with Xbox consoles, and various hardware devices such as Surface tablets.

-

Amazon Web Services, Inc. is a subsidiary of Amazon.com, Inc., providing on-demand cloud computing platforms and APIs to individuals, companies, and governments on a metered pay-as-you-go basis. The company offers a wide range of services, including computing power, storage options, and networking capabilities. With data centers located globally, its innovative services, such as Amazon EC2 (Elastic Compute Cloud) and Amazon S3 (Simple Storage Service), have revolutionized how businesses operate by enabling scalable and flexible IT solutions.

Oracle Corporation and PTC Inc. are some of the emerging market participants in the market.

-

Oracle Corporation is a global player in database software and technology, cloud-engineered systems, and enterprise software products. The company has evolved significantly, particularly with its focus on cloud computing and IoT solutions. The company offers a comprehensive suite of applications and services designed to help organizations manage their business processes efficiently.

-

PTC Inc. is an American technology company specializing in software solutions for product development, including computer-aided design (CAD), product lifecycle management (PLM), and the Internet of Things (IoT). The company's IoT platform, ThingWorx, enables organizations to build and deploy IoT applications that enhance operational efficiency and drive innovation. PTC Inc. focuses on integrating augmented reality (AR) with IoT data to improve user experiences and operational insights.

Key IoT Platform Companies:

The following are the leading companies in the IoT platform market. These companies collectively hold the largest market share and dictate industry trends.

- Microsoft Corporation

- Amazon Web Services, Inc.

- Google LLC

- Siemens AG

- IBM Corporation

- Cisco Systems, Inc.

- Oracle Corporation

- PTC Inc.

- SAP SE

- Intel Corporation

Recent Developments

-

In August 2024, Oracle Corporation announced the integration of AT&T's IoT connectivity and network APIs into its Enterprise Communications Platform (ECP), enhancing real-time communication capabilities for its industry cloud applications. This collaboration aims to simplify the management of IoT devices and connectivity, allowing businesses to benefit from high-performance, reliable communications across various sectors, including public safety, where it supports critical services like dispatch command centers.

-

In January 2024, Microsoft Corporation signed a 10-year strategic partnership with Vodafone to bring generative AI, digital services, and cloud solutions to over 300 billion businesses and consumers across Europe and Africa. This partnership highlights the growing importance of IoT platforms in enabling digital transformation and delivering innovative services to businesses and consumers.

-

In January 2023, Siemens AG introduced advanced AI capabilities for its IoT solutions aimed at enhancing building management and efficiency. These innovations focus on integrating cognitive environmental sensors with intelligent workplace applications, enabling businesses to improve occupant well-being, operational efficiencies, and sustainability efforts.

IoT Platform Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 13.24 billion |

|

Revenue forecast in 2030 |

USD 27.15 billion |

|

Growth Rate |

CAGR of 12.7% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report Component |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, organization size, application, regional |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, Australia, Japan, India, South Korea, Brazil, South Africa, Saudi Arabia, U.A.E. |

|

Key companies profiled |

Microsoft Corporation; Amazon Web Services, Inc.; Google LLC; Siemens AG; IBM Corporation; Cisco Systems, Inc.; Oracle Corporation; PTC Inc.; SAP SE; Intel Corporation. |

|

Customization scope |

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global IoT Platform Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global IoT platform market report based on component, deployment, organization size, application, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Platform

-

Device Management

-

Connectivity Management

-

Application Enablement

-

Others

-

-

Services

-

Professional Services

-

Training & Consulting

-

Integration & Deployment

-

Support & Maintenance

-

-

Managed Services

-

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Private Cloud

-

Public Cloud

-

Hybrid

-

-

Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small & Medium Enterprises

-

Large Enterprises

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Smart Manufacturing

-

Building & Home Automation

-

Smart Grid and Utilities

-

Connected Healthcare

-

Smart Retail

-

Smart Transportation

-

Telecommunications

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Australia

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global IoT platform market size was estimated at USD 11.10 billion in 2023 and is expected to reach USD 13.24 billion in 2024.

b. The global IoT platform market is expected to grow at a compound annual growth rate of 12.7% from 2024 to 2030 to reach USD 27.15 billion by 2030.

b. North America dominated the robotic platform market with a share of 36% in 2023. The North America IoT platform market is driven by rapid technological advancements, rising adoption of cloud-based solutions, and an increasing demand for improved connectivity and data analytics.

b. Some key players operating in the IoT platform market include Microsoft Corporation, Amazon Web Services, Inc., Siemens AG, Cisco Systems, Inc., Oracle Corporation, PTC Inc., and Intel Corporation

b. Key factors that are driving the market growth include the growing need for automation and remote monitoring and increasing integration of IoT technology in various industries, such as manufacturing, healthcare, and agriculture, among others

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."