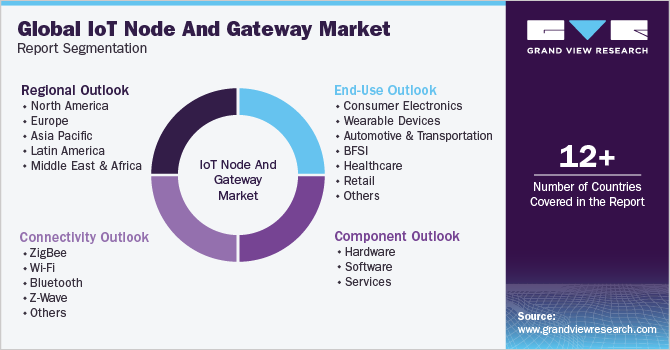

IoT Node And Gateway Market Size, Share & Trends Analysis Report By Component, By Connectivity (ZigBee, Wi-Fi, Bluetooth, Z-Wave), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-130-0

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

The global IoT node and gateway market size was estimated at USD 419.62 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 13.1% from 2023 to 2030. The primary factors driving the growth include the proliferation of Internet of Things (IoT) applications in healthcare, manufacturing, agriculture, and smart cities. The need for efficient data collection, real-time monitoring, and seamless connectivity is driving the adoption of these technologies. Additionally, advancements in wireless communication technologies like 5G and AI are bolstering the capabilities of the market, enabling faster and more reliable data transfer. In June 2023, IBM Corporation announced the acquisition of Agyla SAS. The acquisition will extend IBM’s portfolio of hybrid multi-cloud services and further advance the company’s hybrid cloud and AI strategy in the region.

Moreover, the market landscape is evolving with the emergence of Low-Power Wide-Area Network (LPWAN) technologies like LoRa and Sigfox, which offer extended connectivity range and lower power consumption. Across sectors from agriculture to logistics, internet of things (IoT) nodes and gateways are revolutionizing operations. Nodes with sensors gather real-time data, while gateways ensure this data reaches its destination securely and efficiently. As industries strive for efficiency and automation, the demand for these technologies is expected to rise. Recent developments include the integration of AI and machine learning into IoT nodes, allowing for more intelligent data processing at the edge. This reduces latency and enhances the decision-making capabilities of the devices.

Industries are harnessing node and gateway technology to enhance operations. Agriculture benefits from soil moisture data, manufacturing optimizes production lines, and smart cities improve infrastructure management; with 5G connectivity gaining traction, node & gateway are becoming even more instrumental in supporting high-speed, low-latency data transfer. Rapid expansion characterizes the market driven by the widespread adoption of IoT solutions. It encompasses sensors and actuators and captures real-world data, while gateways enable efficient data transfer to the central system.

Various advancements are being made in the market as the industry reshapes the landscape of connected devices and data communication. Advancements in microelectronics have led to smaller, more power-efficient IoT nodes. This enables seamless integration into various devices and environments while extended battery life reduces maintenance needs. IoT nodes now possess enhanced processing capabilities, enabling data preprocessing at the edge. This reduces latency and conserves bandwidth as only relevant information is sent to the cloud for further analysis. Integrating 5G technology offers higher data speeds and reduced latency, significantly benefiting IoT node and gateway. It enables real-time communication, which is crucial for applications like autonomous vehicles and remote healthcare. The market is advantageous due to the increasing integration of IoT in various sectors.

Component Insights

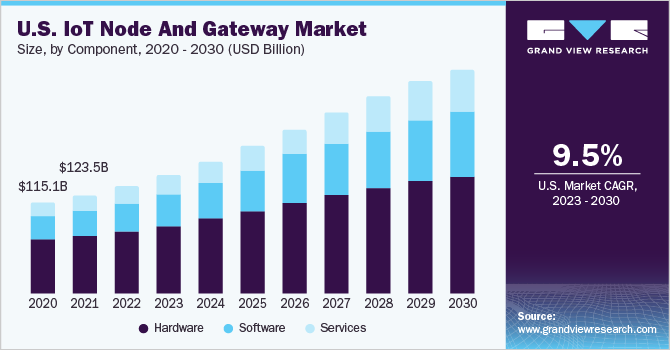

The hardware segment captured the highest revenue share of around 58% in 2022. The IoT market has been experiencing remarkable growth driven in large part by advancements in hardware components for both Internet of things node and gateway. These components are the building blocks of IoT devices, enabling them to collect, process, and transmit data efficiently and reliably. The most notable trend in IoT hardware components is miniaturization. Manufacturers are continually striving to reduce the size of sensors, processors, and other components while maintaining or even improving their performance. In May 2022, Advantech Co. Ltd. launched UNO-2271G V2. The next generation UNO-2271G V2 edge IoT gateway features a modular design and can be easily integrated with an optional second stack I/O extension module to support diverse operations.

The services segment is expected to witness the highest CAGR of around 15% by 2030. IoT landscape, node, and gateway serve as the backbone, connecting various devices and systems to the cloud or other data processing infrastructure. Sensors, on the other hand, are the important hardware component of node and gateway, providing real-time information about the physical world. In March 2022, Intel Corporation acquired Granulate Cloud Solutions Ltd., an Israel-based developer of real-time continuous optimization software. The acquisition of Granulate will help cloud and data center customers maximize computer workload performance and reduce infrastructure and cloud costs.

End-use Insights

The consumer electronics segment captured the highest revenue share of around 19% in 2022. The market is particularly booming and expected to grow exponentially in the coming years. The rise in popularity of IoT technology is driven by the convenience and efficiency it offers to users. It allows users to connect and control multiple devices from a single point, making their lives easier and more efficient. For instance, people can control their home appliances, lighting, and security systems from their smartphones or other connected devices. Moreover, the trend towards smart homes and smart cities is driving the demand in the market. With smart homes, people can monitor and control their homes remotely, ensuring safety and energy efficiency.

The aerospace and defense segment is expected to witness a CAGR of 13.9% from 2023 to 2030. In the aerospace and defense industry, it has been used to monitor aircraft performance, track the movement of military assets, and improve logistics and supply chain management. This technology has provided valuable insights into equipment maintenance and usage, as well as enabling better decision-making in real-time, thereby, the growth of the market in the aerospace and defense industry is expected to continue in the coming years. For instance, in April 2022, Intel Corporation announced the signing of a memorandum with Lockheed Martin to harness innovative 5G software and hardware solutions to enable faster and more decisive actions for the U.S. Department of Defense.

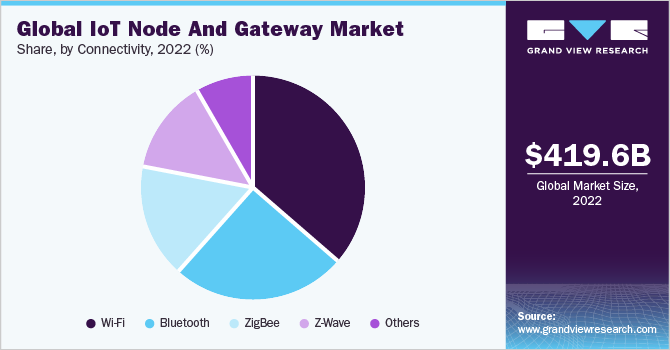

Connectivity Insights

The Wi-Fi segment captured the highest market share of over 36 % in 2022. Wi-Fi networks are ubiquitous in homes, offices, and public spaces, making them easily accessible for IoT devices. Easily availability has led to increased adoption, as IoT nodes can seamlessly connect to existing infrastructure. Wi-Fi offers high data transfer speeds, making it suitable for applications that require real-time data transmission, such as video surveillance, industrial automation, and smart home devices. This high throughput is crucial for the success of IoT applications. For instance, in June 2023, Cisco Systems Inc. partnered with AT&T Inc. to enhance connectivity and advance the calling landscape for hybrid workforces. This partnership allows users the flexibility to take calls across multiple devices while traveling for work, running errands, and more.

The Z-wave segment is expected to witness the highest CAGR of 13.4% from 2023 to 2030. Z-Wave is a wireless communication protocol that was developed with the specific goal of facilitating interoperability among various smart devices. It operates on the sub-GHz frequency band, providing superior range and penetration through walls and floors compared to its Wi-Fi and Bluetooth counterparts. In May 2023, Laird Connectivity launched the RM126x series of LoRaWAN modules. The RM126x module series comes as two variants with the RM1262 based on the SX1262 chipset and the RM1261 based on the SX1261 chipset.

Regional Insights

North America dominated the Internet of Things (IoT) node and gateway market in 2022 with a revenue share of over 36.0%. The region has been at the forefront of technological innovation, with a robust ecosystem of tech companies, startups, and research institutions. This environment has fostered the development of cutting-edge IoT solutions, making it an ideal market for adoption. The region has been quick to embrace emerging technologies such as 5G, edge computing, and AI, which are essential for IoT deployments.

The Middle East and Africa region is expected to grow at the fastest CAGR of 17.3% over the forecast period. The regional growth can be attributed to the growing focus on digital transformation and economic diversification. Several Middle Eastern countries, such as the UAE have ambitious visions for smart cities and smart infrastructure, making extensive use of IoT technology. Investments in areas like energy management, transportation, and healthcare have led to the widespread deployment of IoT node and gateway, contributing to high adoption rates.

Key Companies & Market Share Insights

The key players often include technology innovators, solution providers, and research institutions. The hardware and software provide the foundation. Still, software connectivity and security capabilities are critical determinants of value. IoT platform provides core connectivity, device management, data analytics, and integration capabilities. For instance, In May 2023, Cisco Systems Inc. announced a partnership with the United States Golf Association with this partnership the two organizations leverage Cisco’s industry-leading solutions, innovation, and expertise to strengthen the USGA’s technological infrastructure at their championships and foster innovation and inclusion in the sport of golf. Some prominent players in the global IoT node and gateway market include:

-

Cisco Systems Inc.

-

Sierra Wireless

-

Intel Corporation

-

IBM Corporation

-

Huawei Technologies Co. Ltd.

-

Dell Technologies Inc.

-

Advantech Co. Ltd.

-

NXP Semiconductors N.V.

-

Eurotech

-

Particle Industries Inc.

-

Helium

-

Laird Connectivity

-

Robert Bosch GmbH

-

STMicroelectronics N.V.

-

Texas Instruments Incorporation

IoT Node And Gateway Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 478.11 billion |

|

Revenue forecast in 2030 |

USD 1.13 trillion |

|

Growth rate |

CAGR of 13.1% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, connectivity, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Mexico; UAE; South Africa |

|

Key companies profiled |

Cisco Systems Inc.; Sierra Wireless; Intel Corporation; IBM Corporation; Huawei Technologies Co. Ltd.; Dell Technologies Inc.; Advantech Co. Ltd.; NXP Semiconductors N.V.; Eurotech; Particle Industries Inc.; Helium; Laird Connectivity; Robert Bosch GmbH; STMicroelectronics N.V.; Texas Instruments Incorporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global IoT Node And Gateway Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and analyzes the latest industry trends and opportunities in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the IoT node and gateway market report based on component, connectivity, end-use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Connectivity Integrated Circuited (ICs)

-

Logic Devices

-

Memory Devices

-

Processors

-

Sensors

-

Temperature Sensors

-

Motion Sensors

-

Light Sensors

-

Others

-

-

-

Software

-

Services

-

-

Connectivity Outlook (Revenue, USD Billion, 2018 - 2030)

-

ZigBee

-

Wi-Fi

-

Bluetooth

-

Z-Wave

-

Others

-

-

End-Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Consumer Electronics

-

Wearable Devices

-

Automotive & Transportation

-

BFSI

-

Healthcare

-

Retail

-

Building Automation

-

Oil & Gas

-

Agriculture

-

Aerospace & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global internet of things node and gateway market size was estimated at USD 419.62 billion in 2022 and is expected to reach USD 478.11 billion in 2023.

b. The global IoT node and gateway market is expected to witness a compound annual growth rate of 13.1% from 2023 to 2030 to reach USD 1.13 trillion by 2030.

b. The hardware segment accounted for the largest market share of over 58% in 2022. The growth is attributed to the pivotal role played by hardware components in enabling the seamless connectivity and functionality of IoT ecosystems, reflecting the substantial demand for sensors, processors, ICs and other essential hardware elements crucial for IoT node and gateway deployments.

b. Some key players operating in the Internet of things node and gateway market include Cisco Systems Inc., Sierra Wireless, Intel Corporation, IBM Corporation, Huawei Technologies Co. Ltd., Dell Technologies Inc., Advantech Co. Ltd., NXP Semiconductors N.V., Eurotech, Particle Industries Inc., Helium, Laird Connectivity, Robert Bosch GmbH, STMicroelectronics N.V., Texas Instruments Incorporation.

b. The Internet of Things (IoT) node and gateway market is expected to grow substantially due to several key factors, including the advent of 5G technology, the increasing utilization of wireless smart sensors and networks, a burgeoning market for connected devices, and the rising demand for data centers driven by the growing adoption of cloud platforms.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."