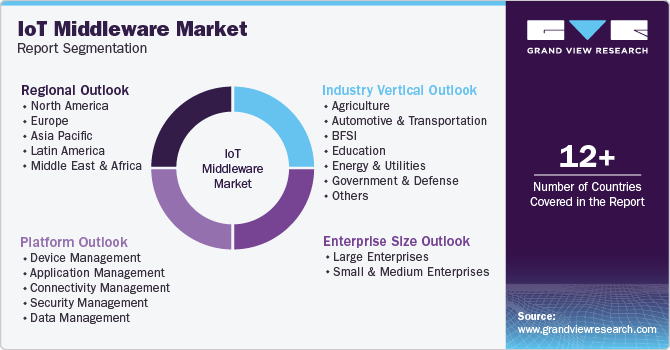

IoT Middleware Market Size, Share & Trends Analysis Report By Platform, By Enterprise Size (Large Enterprises, Small & Medium Enterprises), By Industry Vertical, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-444-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

IoT Middleware Market Size & Trends

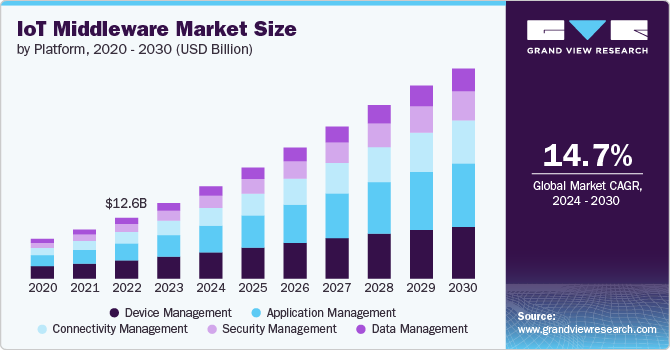

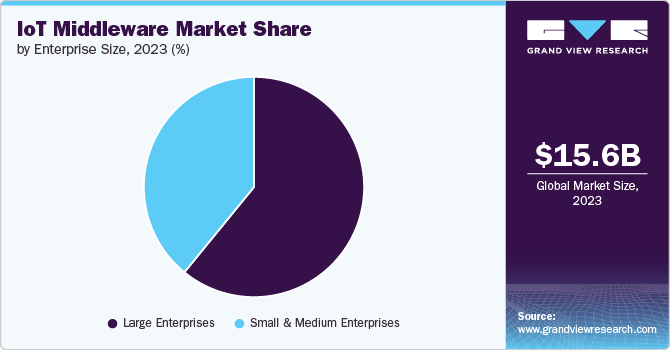

The global IoT middleware market size was estimated at USD 15.64 billion in 2023 and is expected to grow at a CAGR of 14.7% from 2024 to 2030.The market is driven by the increasing adoption of IoT across various industries, including manufacturing, healthcare, and smart cities. The primary factors driving the market include the growing demand for cloud-based middleware solutions, which offer scalability and flexibility, and the increasing focus on security features within middleware to address concerns around data privacy and cyber threats. In addition, the push towards standardization in IoT technologies is leading to the development of more interoperable middleware platforms, further accelerating market expansion.

The convergence of Information Technology (IT) and Operational Technology (OT) is a key factor driving the growth of the internet of things (IoT) middleware market. As industries embrace digital transformation, there is an increasing need to link traditional operational systems with modern IT infrastructures. This integration allows organizations to harness data analytics, machine learning, and artificial intelligence to improve operational efficiency and reduce costs. IoT middleware is essential in bridging this gap by enabling seamless communication between diverse systems, thereby enhancing collaboration and data sharing across different parts of the organization.

In addition, the rapid adoption of cloud computing technologies is significantly influencing the growth of the IoT middleware market. Cloud platforms offer scalable resources that can accommodate the vast amounts of data generated by connected devices without requiring extensive on-premises infrastructure. This shift towards cloud-based solutions allows organizations to deploy IoT applications more efficiently while reducing capital expenditures associated with hardware investments. In addition, cloud-based IoT middleware solutions provide enhanced flexibility and accessibility, enabling businesses to manage their operations remotely and respond quickly to changing market demands. This trend is expected to further fuel the market growth in coming years.

Furthermore, advancements in high-speed network technologies such as 5G are driving the adoption of IoT middleware solutions. The increased bandwidth and reduced latency offered by these technologies enable real-time data transmission between devices, which is critical for applications requiring immediate responses, such as autonomous vehicles or smart manufacturing systems. As organizations seek to harness the full potential of IoT applications that rely on real-time connectivity, the demand for sophisticated middleware solutions capable of managing these interactions is expected to continue to rise in coming years.

Moreover, there is a heightened focus on implementing robust security measures within IoT middleware solutions to protect sensitive data and ensure secure communications between devices. This trend drives innovation in security features within middleware platforms as well as emphasizes the importance of compliance with regulatory standards governing data protection.

Platform Insights

The device management segment accounted for the largest market share of over 29% in 2023. This growth can be attributed to several key drivers including the increasing proliferation of connected devices necessitates robust management solutions to ensure seamless operation and security. In addition, regulatory compliance and data privacy concerns drive businesses to adopt comprehensive device management systems that can provide real-time insights and facilitate remote management capabilities.

The connectivity management segment is expected to witness a highest CAGR of over 15% from 2024 to 2030, driven by the increasing demand for reliable and scalable connectivity solutions that support a diverse range of IoT applications. Furthermore, advancements in network technologies such as 5G are expected to enhance connectivity options significantly, enabling faster data transmission and lower latency for IoT devices. The rising trend of edge computing also contributes to this segmental growth by requiring efficient connectivity management solutions that can handle data processing closer to where it is generated.

Industry Vertical Insights

The manufacturing segment accounted for the largest market share in 2023, driven by the industry's accelerated adoption of Industry 4.0 initiatives. Manufacturers are increasingly integrating IoT solutions to enhance automation, optimize production processes, and improve overall operational efficiency. IoT middleware plays a critical role in connecting and managing a wide array of sensors, machines, and devices on the factory floor, enabling real-time data collection and analysis. This allows manufacturers to implement predictive maintenance, reduce downtime, and achieve greater precision in quality control, all of which contribute to significant cost savings and productivity gains, thereby fueling the growth of the market in this sector.

The healthcare segment is anticipated to record the fastest growth from 2024 to 2030, owing to the increasing demand for remote patient monitoring, telemedicine, and enhanced education management systems. The rise in chronic diseases and an aging population necessitate innovative solutions that can improve patient outcomes while reducing costs. IoT devices enable real-time data collection and analysis, allowing education providers to monitor patients’ health remotely, leading to timely interventions and personalized care.

Enterprise Size Insights

The large enterprises segment registered the largest revenue share in 2023. This growth can be attributed to their extensive adoption of IoT technologies to enhance operational efficiency and data management. Large enterprises typically have more resources to invest in advanced technologies, allowing them to implement comprehensive IoT solutions that integrate various devices and systems across their operations. This integration facilitates real-time data analytics, improved decision-making processes, and enhanced customer experiences. Furthermore, large enterprises often require robust security measures and compliance with regulatory standards, which IoT middleware can provide through its centralized management capabilities.

The small and medium enterprises segment is expected to grow at a highest CAGR from 2024 to 2030, owing to the increasing awareness of the benefits of IoT solutions among SMEs, such as cost reduction, improved operational efficiency, and enhanced customer engagement. As technology becomes more accessible and affordable, SMEs are increasingly adopting IoT middleware solutions that enable them to leverage data-driven insights without requiring extensive IT infrastructure or expertise. In addition, government initiatives aimed at promoting digital transformation among SMEs are likely to further stimulate this growth.

Regional Insights

The North America region accounted for the highest revenue share of 36% in 2023. North America is home to several leading technology companies that are heavily investing in IoT solutions, which has led to the development of sophisticated middleware platforms that facilitate seamless connectivity and data management across devices. In addition, the increasing adoption of cloud-based services and edge computing is driving the demand for middleware solutions that can efficiently process and analyze data in real-time.

U.S. IoT Middleware Market Trends

The IoT middleware market in U.S. is projected to grow at a CAGR of over 11% from 2024 to 2030. The U.S. IoT middleware market is experiencing robust growth driven by the increasing adoption of advanced technologies such as cloud computing and artificial intelligence, which enhance data management and analytics capabilities. The demand for centralized monitoring solutions across various sectors, including education, manufacturing, and finance, is propelling the need for effective middleware that can facilitate seamless communication between diverse IoT devices.

Europe IoT Middleware Market Trends

The IoT middleware market in Europe is anticipated to grow at a CAGR of over 13% from 2024 to 2030. This growth is driven by Europe’s strong focus on sustainability and compliance with stringent regulations regarding data protection. European countries are increasingly leveraging IoT technologies to enhance operational efficiency across sectors like energy management, transportation, and manufacturing. The emphasis on creating interoperable systems has led to collaborations between tech companies and industry stakeholders to develop standardized middleware solutions that can integrate various devices seamlessly.

Asia Pacific IoT Middleware Market Trends

The IoT middleware market in the Asia Pacific region is expected to grow at the fastest CAGR of over 17% from 2024 to 2030. Asia Pacific is experiencing rapid urbanization, increased internet penetration, and a burgeoning manufacturing sector. Countries in the region are at the forefront of adopting IoT technologies across various industries such as Education, automotive, and agriculture. The rise of smart cities initiatives in major urban centers is propelling investments in middleware solutions that enable interoperability among diverse devices and systems.

Key IoT Middleware Company Insights

Some of the key players operating in the IoT middleware market include Microsoft Corporation and Amazon Web Services, Inc. among others.

-

Microsoft Corporation is a multinational technology company and provides various software solutions. Its Azure IoT platform provides a comprehensive suite of services that facilitate the development, deployment, and management of IoT applications. Microsoft leverages its extensive cloud infrastructure to offer robust IoT middleware solutions that enable seamless connectivity, data processing, and analytics for various industries.

-

Amazon Web Services, Inc., a subsidiary of Amazon.com Inc, offers a range of services designed to connect devices, collect data, and enable real-time analytics. The company emphasizes ease of use, scalability, and flexibility, allowing businesses to quickly deploy IoT solutions tailored to their specific needs. With a strong emphasis on machine learning and artificial intelligence, AWS empowers organizations to derive actionable insights from IoT data, enhancing operational efficiency and decision-making capabilities. The extensive global infrastructure of AWS. further supports its position as a leading provider of IoT middleware solutions.

Hitachi, Ltd. and SAP SE are some of the emerging market participants in the IoT middleware market.

-

Hitachi Ltd. is a global technology company and offers Hitachi Global Data Integration, a comprehensive IoT service that enables customers to collect, store, and utilize IoT data worldwide. Hitachi's IoT middleware solutions provide features such as easy device connectivity, data gathering and visualization, and solutions for social issues. The service integrates IoT platforms from various network operators and helps customers quickly create new IoT-based services.

-

SAP SE is a multinational software corporation that offers SAP IoT, a comprehensive platform that enables businesses to connect devices, collect data, and derive insights from IoT systems. SAP IoT provides features like device connectivity, data management, analytics, and integration with SAP's broader enterprise software ecosystem. The platform supports various IoT protocols, edge computing capabilities, and machine learning to help customers optimize operations, enhance decision-making, and create new business models.

Key IoT Middleware Companies:

The following are the leading companies in the IoT middleware market. These companies collectively hold the largest market share and dictate industry trends.

- Microsoft Corporation

- Amazon Web Services, Inc.

- Google LLC

- Cisco Systems, Inc.

- Hitachi, Ltd.

- Oracle Corporation

- SAP SE

- PTC Inc.

- Bosch Global Software Technologies Pvt Ltd.

- Software AG

Recent Developments

-

In May 2024, Hitachi, Ltd. and Google LLC announced a multi-year partnership to accelerate enterprise innovation and productivity with generative AI. The partnership aims to accelerate enterprise innovation with generative AI suggests potential advancements in IoT middleware solutions that could leverage these technologies to enhance efficiency and productivity for businesses.

-

In April 2024, Microsoft Corporation and Cloud Software Group announced an eight-year strategic partnership to bring joint cloud solutions and generative AI to more than 100 million people. The partnership is expected to drive innovation in the Internet of Things (IoT) middleware market, as the integration of cloud and AI technologies will enhance the capabilities of IoT applications, enabling more efficient data management and analysis across various sectors.

-

In September 2023, InterVision Systems LLC announced a multi-year strategic collaboration agreement with Amazon Web Services, Inc. to enhance cloud adoption and modernization for its public sector and commercial clients. This partnership aims to leverage InterVision's extensive AWS competencies to deliver innovative cloud solutions, including data modernization and managed cloud services, ultimately driving agility and cost savings for customers.

IoT Middleware Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 19.12 billion |

|

Revenue forecast in 2030 |

USD 43.55 billion |

|

Growth rate |

CAGR of 14.7% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report component |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Platform, enterprise size, industry vertical, regional |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE |

|

Key companies profiled |

Microsoft Corporation; Amazon Web Services, Inc.; Google LLC; Cisco Systems, Inc.; Hitachi, Ltd.; Oracle Corporation; SAP SE; PTC Inc.; Bosch Global Software Technologies Private Limited; Software AG |

|

Customization scope |

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global IoT Middleware Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global IoT middleware market report based on platform, enterprise size, industry vertical and region:

-

Platform Outlook (Revenue, USD Billion, 2018 - 2030)

-

Device Management

-

Application Management

-

Connectivity Management

-

Security Management

-

Data Management

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small And Medium Enterprises

-

-

Industry Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

Agriculture

-

Automotive & Transportation

-

BFSI

-

Education

-

Energy & Utilities

-

Government & Defense

-

Healthcare

-

IT & Telecom

-

Manufacturing

-

Retail & Consumer Goods

-

Tourism & Hospitality

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Australia

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global IoT middleware market size was estimated at USD 15.64 billion in 2023 and is expected to reach USD 19.12 billion in 2024.

b. The global IoT middleware market is expected to grow at a compound annual growth rate of 14.7% from 2024 to 2030 to reach USD 43.55 billion by 2030.

b. North America accounted for a market revenue share of 36% in 2023, driven by the increasing adoption of cloud-based services and edge computing

b. Some key players operating in the IoT middleware market include Microsoft Corporation, Amazon Web Services, Inc., Google LLC, Cisco Systems, Inc., Hitachi, Ltd., Oracle Corporation, SAP SE, PTC Inc., Bosch Global Software Technologies Private Limited, Software AG

b. The key factors driving the IoT middleware market include the increasing adoption of IoT across various industries, the growing demand for cloud-based middleware solutions and the increasing focus on security features within middleware to address concerns around data privacy and cyber threats.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."