- Home

- »

- Next Generation Technologies

- »

-

IoT Insurance Market Size, Share & Trends Report, 2030GVR Report cover

![IoT Insurance Market Size, Share & Trends Report]()

IoT Insurance Market (2024 - 2030) Size, Share & Trends Analysis Report By Component, By Insurance Type (Life & Health Insurance, Property & Casualty Insurance), By End-use Industry (Automotive & Transportation, Healthcare), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-245-7

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

IoT Insurance Market Summary

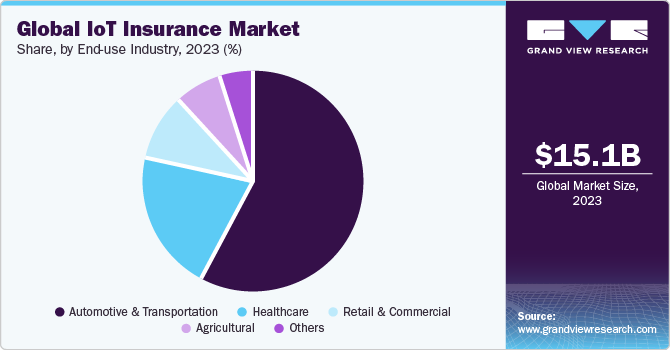

The global IoT insurance market size was estimated at USD 15.09 billion in 2023 and is projected to reach USD 91.75 billion by 2030, growing at a CAGR of 29.7% from 2024 to 2030. The IoT insurance industry is anticipated to develop owing to the insurance sector's development of innovative insurance models and the growing use of Internet of Things (IoT) to lower risk- and premium-related expenses.

Key Market Trends & Insights

- North America dominated the global IoT insurance market with the largest revenue share of 36.9% in 2023.

- By component, the solution segment led the market with the largest revenue share of 67.2% in 2023.

- By end use, the automotive and transportation segment accounted for the largest market revenue share in 2023.

- By insurance type, the property & casualty insurance segment is expected to witness at the fastest CAGR during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 15.09 billion

- 2030 Projected Market Size: USD 91.75 billion

- CAGR (2024-2030): 29.7%

- North America: Largest market in 2023

The advancement of technologies such as sensors, machine learning, big data, and data analytics further augments the expansion of the market. IoT utilities are anticipated to gain pace during the projection period, with smart grids envisioned to take over the whole energy business.

The growing use of cutting-edge technologies in the insurance sector, including artificial intelligence and machine learning, would offer lucrative potential for expanding the global IoT insurance market. In addition, there is a growing need for cloud platforms and other value-added services and the increased use of IoT in established and developing economies. The global IoT insurance industry is growing due to insurance businesses investing more in IoT technology to improve operational efficiency.

Insurance companies can target industries such as manufacturing, healthcare, and agriculture, where IoT devices are widely used, and provide customized insurance solutions as IoT usage spreads throughout these sectors and geographical areas. Insurance companies can provide customized coverage and rates based on individual data and behavior with the help of IoT technology.

The traditional insurance industry is undergoing an unparalleled change owing to IoT. Insurance businesses employ IoT technology to gather vast volumes of data from linked devices, such as telematics and telemedicine, and to help them derive meaningful insights from that data. Most of the largest insurance companies, including State Farm Group, Allianz SE, and UnitedHealth Group, have begun investing in IoT technology to enhance operating procedures.

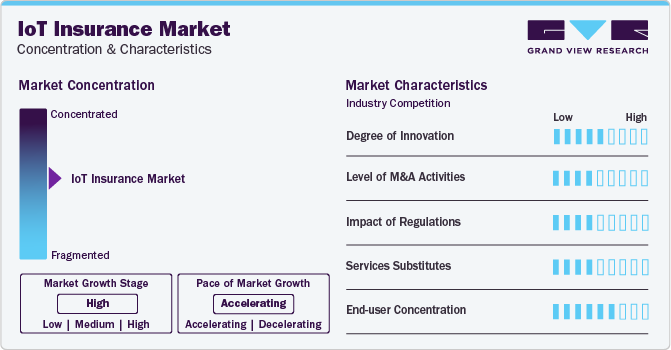

Market Concentration & Characteristics

The market growth stage is high, and the pace is accelerating. The rapid technological advancements drive innovation and continuous improvement in IoT insurance solutions. Emerging technologies such as artificial intelligence, machine learning, blockchain, and cloud computing are increasingly integrated into IoT Insurance platforms, enabling enhanced automation, analytics-driven insights, and real-time monitoring capabilities.

The market is significantly consolidated, featuring several global and regional players. The market players are investing in research & development (R&D) to develop advanced solutions and gain a competitive edge. Moreover, they are entering into partnerships and mergers & acquisitions as the market is characterized by innovation, disruption, and rapid change.

End-use Industry Insights

The automotive and transportation segment led the market with the largest revenue share in 2023. Fleet management is streamlined by the widespread usage of IoT insurance services in the automobile and transportation industries. Car electronics track cargo conditions, driver conduct, and routes. It is advantageous for businesses and insurers as it can precisely analyze risk, increase productivity, and guarantee cargo integrity. IoT insurance is centered around telematics and has several applications in the car industry. These devices track driver behavior and provide location, speed, and brake information. Employing this information, insurers can lower rates for conscientious drivers, promote safe driving, and tailor policies.

The healthcare segment is expected to witness the fastest CAGR during the forecast period. Healthcare dramatically benefits from using IoT-enabled wearables and medical equipment. These gadgets monitor health behaviors and vital signs, enabling insurers to provide customized insurance. Consumers who lead healthier lifestyles benefit from lower premiums and improved general health.

Component Insights

The solution segment led the market with the largest revenue share of 67.2% in 2023 and is expected to retain its dominance over the forecast period. The technology and software that facilitate data gathering, analysis, and usage are central to the exponential rise of IoT insurance solutions. Software programs, IoT devices, and data analytics platforms are some solutions. Insurance companies collect real-time data from wearables, sensors, and telematics devices using IoT technologies. Claims processing, insurance customization, and risk assessment are all aided by this data. With the help of IoT technology, insurers can provide creative, data-driven insurance products and improve client experiences by offering proactive risk management and individualized coverage.

The services segment is anticipated to witness the fastest CAGR during the forecast period. The technology components are enhanced by IoT insurance services, which offer knowledge, assistance, and guidance. Data analysis, risk assessment, policy formulation, and client assistance are all included in these services. Insurance firms frequently collaborate with IoT service providers to fully utilize IoT technologies. The value of IoT in insurance is further increased by service providers' assistance in resolving data security and compliance issues.

Insurance type Insights

The life & health insurance segment held the largest revenue share in 2023. IoT technology encourages proactive health monitoring, which enhances life and health insurance. Wearables and connected health devices gather real-time data on policyholders' vital signs, fitness levels, and health habits. With this data, insurers can provide individualized policies that give benefits and discounts for leading healthier lives. IoT-enabled remote patient monitoring and telemedicine also lower costs and increase access to healthcare. IoT-enabled life and health insurance improves general well-being and gives policyholders financial stability.

The property & casualty insurance segment is expected to witness the fastest CAGR during the forecast period. IoT technology is mainly concerned with claims processing and risk reduction. Smart sensors and devices monitor safety, security, and environmental factors in homes, cars, and commercial buildings. By using this information, insurers may proactively identify and reduce risks, reducing mishaps and losses. IoT data also speeds up the claim's procedure in the case of a claim, as insurers have real-time information about the incident. IoT-enhanced property and casualty insurance lowers risks, minimizes losses, and raises client satisfaction.

Regional Insights

The North America IoT insurance market accounted for a dominant revenue share of 36.9% in 2023, owing to increased awareness and quicker uptake of IoT in the region. Numerous businesses, including State Farm, Progressive, and Liberty Mutual, are utilizing the IoT technology available in the area to improve the effectiveness of their risk assessments.

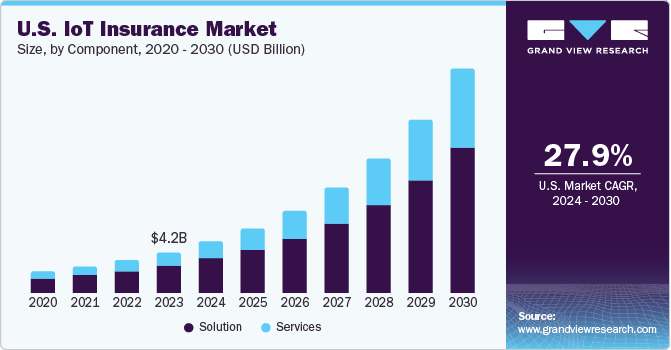

U.S. IoT Insurance Market Trends

The IoT insurance market in the U.S. is expected to grow at a significant CAGR of 27.9% over the forecast period. Implementation of IoT technology by insurance companies is a significant contributor. The area gains from an established insurance market and cutting-edge IoT technology. In this country, insurers use IoT devices for telematics-based property monitoring and auto insurance. Innovation in the Internet of Things insurance industry is driven by customer demand for customized coverage and risk mitigation. For instance, in November 2023, John Hancock was one of the first American insurance companies to harness the potential of wearable technology. Through a partnership with Vitality, the company gave away Fitbits to its customers and tracked their health, which reduced the likelihood that they would file a claim.

Europe IoT Insurance Market Trends

Europe can be identified as a lucrative region. The IoT insurance industry in Europe is broad and well-established in nations including the UK, Germany, and France. Adoption of IoT varies per country, although it is becoming more popular. Particularly in Germany, telematics-based motor insurance is quite common. European insurers are also investigating IoT solutions for health and home insurance. A patchwork of regulations characterizes the European market and encourages competition and innovation.

The IoT insurance market in UK is expected to grow over the forecast period owing to the growing popularity of IoT devices in British homes. The UK is witnessing a spike in the adoption of smart homes. The IoT insurance industry is predicted to grow and is part of a broader global trend. Technological developments, increased IoT penetration, and the demand for more precise risk assessment and individualized insurance solutions drive the industry.

The France IoT insurance market is expected to grow over the forecast period. Insurers provide customized plans in the French IoT insurance market that are tailored to the particular requirements of companies and individuals utilizing IoT technology. These policies include gadget malfunction, data privacy, cybersecurity, and third-party responsibility. The market is anticipated to expand as numerous enterprises embrace IoT technology and realize how critical it is to safeguard their assets and reduce risks.

The IoT insurance market in Germany is expected to grow over the forecast period. German insurers use AI technologies to enhance their underwriting and risk assessment procedures. AI can assist insurers in more effectively identifying possible hazards and providing more individualized insurance solutions by analyzing vast volumes of data. For instance, in July 2021, Munich Re subsidiary ERGO created a customized insurance solution and risk assessment tool for small and medium-sized businesses (SMEs) based on artificial intelligence (AI).

Asia Pacific IoT Insurance Market Trends

The Asia Pacific IoT insurance market is anticipated to witness significant growth in the forthcoming years. The sharply rising investments in artificial intelligence technologies can be attributed to this growth. China, Japan, and India are at the forefront of the rapidly expanding IoT insurance industry in Asia Pacific. The demand for IoT-based insurance solutions is driven by the growing middle class, rising rates of urbanization, and rising vehicle ownership. IoT has been embraced by Chinese insurers, in particular, for a range of insurance products. Japan is a leader in IoT adoption for health insurance and senior care.

The IoT insurance market in China is expected to grow over the forecast period. China's insurance companies are collaborating with IoT service providers to deliver integrated solutions, including connectivity, IoT devices, and insurance protection. In response to these shifts, insurance companies are providing tailored solutions, emphasizing data protection and privacy, incorporating AI, concentrating on cybersecurity, and working with IoT service providers.

The Japan IoT insurance market is expected to grow over the forecast period. As Japan continues to embrace digitalization and IoT technologies, the country's IoT insurance landscape is changing quickly. Insurance companies are responding to these developments by providing tailored solutions, emphasizing data security and privacy, incorporating AI, working with IoT service providers, and concentrating on cybersecurity. For instance, in February 2021, Tokio Marine & Nichido Fire Insurance provided a data protection insurance policy that pays for court costs and losses resulting from data breaches and privacy violations in the IoT technology.

Middle East & Africa IoT Insurance Market Trends

The IoT insurance market in Middle East & Africa is expected to grow over the forecast period. Risk assessment and cost-cutting measures are becoming increasingly crucial as telematics-enabled auto insurance grows. Moreover, precise risk assessment is essential in these nations owing to the high accident rates and difficulties with road safety. By identifying and rewarding safer drivers, telematics data assists insurers in promoting road safety.

Key IoT Insurance Company Insights

Some of the key players operating in the market include Oracle Corporation; SAP SE; IBM Corporation; & Microsoft Corporation.

-

Oracle Corporation is a multinational computer technology company that provides products and services to address enterprise information technology environments worldwide. Oracle IoT provides simplified ensuring data that can quickly be incorporated into digital strategy and develop cutting-edge services with lower risk. An effective IoT strategy relies on integration with current systems and procedures. Oracle IoT facilitates this seamless and effective integration. Oracle IoT makes secure and dependable bidirectional connectivity between IoT devices and the cloud possible. The gadgets can connect directly or indirectly to the cloud via a gateway. Oracle IoT gives every device a distinct digital identity to build trust connections between devices and applications.

-

SAP SE is a multinational software corporation providing enterprise software and services to businesses of various sizes and industries. SAP offers a Master IoT Insurance solution that enables organizations to manage high-quality, unified master data across various domains and sources. SAP operates in Europe, the Middle East, Africa, the Americas, and Asia Pacific, serving clients in consumer products, oil, gas, energy, financial services, aerospace and defense, transportation, and logistics.

Synechron, Inc. and Concirrus are some of the other market participants.

-

Synechron, Inc. is a company that offers information technology consulting services meant to support corporate development. Cloud computing, business intelligence, digital strategy development, blockchain and artificial intelligence innovation, business process management, application programming interface development, and other related services are among the company's offerings that help the financial services sector expand and maximize profits.

-

Concirrus is the inventor of an artificial intelligence-powered marine insurance platform that provides insurers with behavioral insights. The company's platform integrates machine learning, advanced analytics, and active risk management to tackle the problems encountered by the commercial insurance industries for automobiles and marine insurance. Clients can actively control their risks, improving their commercial success.

Key IoT Insurance Companies:

The following are the leading companies in the IoT insurance market. These companies collectively hold the largest market share and dictate industry trends.

- Oracle Corporation

- SAP SE

- IBM Corporation

- Microsoft Corporation

- Intel Corporation

- Telit Communications PLC

- Capgemini SE.

- Cognizant

- Cisco Systems Inc.

- Accenture PLC

- Verisk Analytics Inc.

- Wipro Limited

- Google LLC

- Synechron, Inc.

- Concirrus

Recent Developments

-

In October 2023, Accenture plc announced the acquisition of the Hamburg, Germany-based insurance operations provider, ON Service GROUP. Accenture is currently better positioned to manage the whole supply chain and help clients leverage digital services to boost their operational effectiveness, flexibility, and potential for expansion.

-

In November 2022, IBM Corporation announced a partnership with Bulgaria and Ablera to develop ABACUS, an AI-driven pricing and rating system designed for insurance firms. Through this agreement, ABACUS is likely to be able to operate at a speed and accuracy never before possible, eliminating the need for tedious, prone-to-error manual labor and opening up the use of advanced applied mathematics tools to a more extensive range of users.

-

In August 2022, Telit, an international leader in the Internet of Things (IoT), announced the purchase of group assets from Mobilogix. This acquisition provides extensive equipment design resources and expertise focusing on original equipment manufacturing, regulatory approvals, operating certificates, and optimizing the migration of electronic manufacturing services.

IoT Insurance Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 19.25 billion

Revenue forecast in 2030

USD 91.75 billion

Growth rate

CAGR of 29.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, insurance type, end-use industry, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; UAE; Saudi Arabia; South Africa

Key companies profiled

Oracle Corporation; SAP SE; IBM Corporation; Microsoft Corporation; Intel Corporation; Telit Communications PLC; Capgemini SE; Cognizant; Cisco Systems Inc; Accenture PLC; Verisk Analytics Inc; Wipro Limited; Google LLC; Synechron, Inc; Concirrus

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

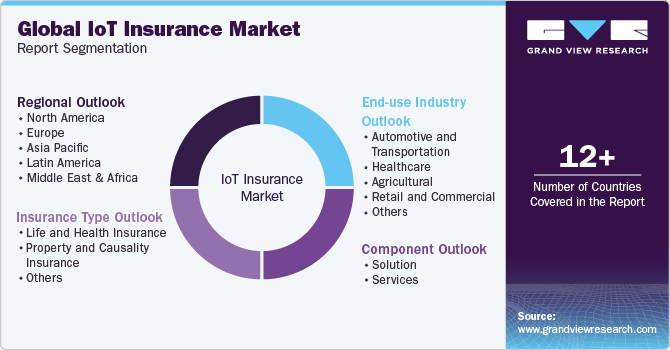

Global IoT Insurance Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest vertical trends in each of the sub-segments from 2017 to 2030. For this report, Grand View Research has segmented the global IoT Insurance market research report based on component, insurance type, end-use industry, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Services

-

-

Insurance Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Life and Health Insurance

-

Property and Causality Insurance

-

Others

-

-

End-use Industry Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive and Transportation

-

Healthcare

-

Agricultural

-

Retail and Commercial

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global IoT insurance market size was estimated at USD 15.09 billion in 2023 and is expected to reach USD 19.25 billion by 2024

b. The global IoT insurance market is expected to grow at a compound annual growth rate of 29.7% from 2024 to 2030 to reach USD 91.75 billion by 2030

b. The solution segment led the market with the largest revenue share of 67.2% in 2023 and is expected to retain its dominance over the forecast period. The technology and software that facilitate data gathering, analysis, and usage are central to the exponential rise of IoT insurance solutions.

b. Some key players operating in the IoT insurance market include Oracle Corporation; SAP SE; IBM Corporation; Microsoft Corporation; Intel Corporation; Telit Communications PLC; Capgemini SE; Cognizant; Cisco Systems Inc; Accenture PLC; Verisk Analytics Inc; Wipro Limited; Google LLC; Synechron, Inc; and Concirrus

b. The IoT insurance industry is anticipated to develop owing to the insurance sector's development of innovative insurance models and the growing use of IoT to lower risk- and premium-related expenses.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.