IoT Devices Market Size, Share & Trends Analysis Report By Component (Sensors, Actuators, Processors, Edge Devices), By End Use, By Connectivity, By Region (North America, Europe, APAC, Latin America, MEA), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-512-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

IoT Devices Market Size & Trends

The global IoT devices market size was estimated at USD 70.28 billion in 2024 and is expected to grow at a CAGR of 16.8% from 2025 to 2030. This expansion is largely fueled by the convergence of technological advancements and growing innovations such as 5G connectivity, edge computing, and the increasing demand for real-time data analytics. These technologies are enhancing operational efficiencies across various sectors, including healthcare and manufacturing, and enabling the development of smarter products and services that cater to a more connected lifestyle, which is expected to present lucrative opportunities for the internet of things (IoT) devices industry in the coming years.

The increased adoption of smart devices is reshaping everyday life, with wearables, smart appliances, and home automation systems creating interconnected ecosystems that enhance convenience and efficiency. In industries, IoT devices are enabling real-time data collection and analytics, optimizing operations, and reducing costs. The rise of smart cities is another major driver, as governments and businesses invest in technologies for traffic management, energy distribution, and environmental monitoring to improve urban living standards.

The expansion of Industrial IoT (IIoT) is a significant trend, particularly in manufacturing. IoT devices are being employed to optimize production processes, reduce resource consumption, and enable predictive maintenance. These advancements are transforming factories into smart facilities capable of data-driven decision-making. Additionally, the automotive sector is leveraging IoT for connected vehicles, enabling features such as real-time monitoring, electric vehicle charging integration, and advanced payment mechanisms.

The push for sustainability and energy efficiency is further propelling the IoT devices industry. Sensor-based solutions are being widely adopted to monitor and manage energy consumption across homes, businesses, and public infrastructure. These technologies not only help reduce costs but also align with global environmental goals by promoting resource optimization and reducing carbon footprints.

Moreover, technological advancements such as 5G connectivity, edge computing, and the integration of AI and machine learning are revolutionizing the IoT devices industry. 5G networks provide faster data transmission with low latency, enabling seamless communication between devices. Edge computing enhances real-time data processing at the device level, while AI and machine learning enable predictive analytics and automation across industries. This trend is expected to drive the IoT devices industry’s expansion in the coming years.

Component Insights

The sensors segment recorded the largest revenue share of over 32% in 2024. This growth is driven by the rising demand for connected and wearable devices, particularly in industries such as healthcare and consumer electronics. This demand is further fueled by advancements in technology, such as improved wireless connectivity and the increasing adoption of smart home systems, which enhance operational efficiency and user experience.

The edge devices segment is projected to register the fastest CAGR of over 17% from 2025 to 2030. This growth is largely driven by advancements in edge computing and 5G technology, which facilitate faster data processing and real-time analytics. The growing need for reduced latency and improved data management in various applications, including industrial automation and smart cities, is also propelling this segment growth.

End Use Insights

The industrial IoT (IIoT) segment recorded the largest revenue share in 2024. This growth is primarily driven by the increasing focus on Industry 4.0 technologies that enhance productivity and efficiency in manufacturing processes. This transformation is facilitated by the integration of IoT solutions that enable real-time monitoring, predictive maintenance, and data analytics, ultimately reducing operational costs and downtime. Additionally, the rising investments in smart factories and automation technologies reflect a shift towards more connected and efficient production systems, further propelling segmental growth.

The agriculture segment is projected to register the fastest CAGR from 2025 to 2030, primarily driven by the growing need for precision farming techniques that utilize IoT devices for monitoring crop health, soil conditions, and weather patterns. The adoption of smart agriculture technologies is enhancing yield efficiency and resource management, addressing challenges such as labor shortages and climate variability. Moreover, government initiatives promoting sustainable farming practices and technological advancements in sensor and drone technologies are significantly contributing to the rapid growth of this segment.

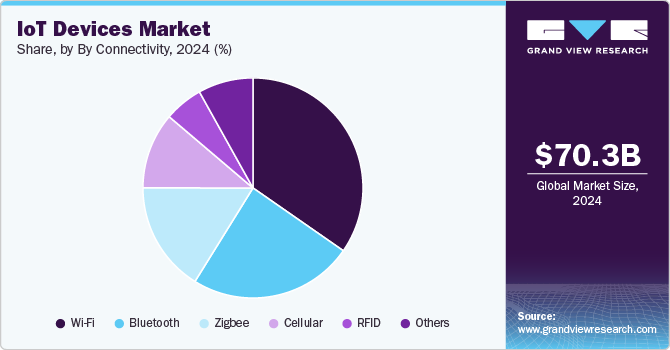

Connectivity Insights

The Wi-Fi segment recorded the largest revenue share in 2024. This growth is primarily driven by the increasing demand for high-speed internet and the proliferation of connected devices. As IoT adoption accelerates, efficient and reliable Wi-Fi modules have become essential for ensuring seamless connectivity and data exchange among a growing number of IoT devices. The advancements in Wi-Fi technology, particularly with the rollout of Wi-Fi-6 and the introduction of Wi-Fi-7, enhance communication efficiency, making it a preferred choice for various applications, including smart homes and industrial settings, thereby propelling the segmental growth.

The cellular segment is projected to register the fastest CAGR from 2025 to 2030, primarily driven by the expanding coverage and capabilities of cellular networks, particularly with the advent of 5G technology. This advancement allows for improved data transmission speeds and lower latency, which are critical for applications requiring real-time data processing and communication. The growing need for mobile connectivity in sectors such as automotive, healthcare, and smart cities is also propelling this segment forward, as it supports a wide range of IoT applications that demand robust and reliable network infrastructure.

Regional Insights

North America dominated IoT devices market with a share of over 34% in 2024. This expansion is largely driven by the increasing penetration of smart devices, heightened consumer electronics demand, and the rollout of 5G technologies, which facilitate faster and more reliable connectivity. The region's advanced telecom infrastructure is expected to further support this growth.

U.S. IoT Devices Market Trends

The U.S. IoT devices industry held a dominant position in 2024. This growth is primarily driven by an increasing adoption of automation technologies across various industries, enhancing operational efficiency and reducing costs. The integration of advanced analytics and smart sensors facilitates real-time data collection and decision-making, which is crucial for predictive maintenance and supply chain optimization.

Europe IoT Devices Market Trends

The European IoT devices industry is expected to grow at a CAGR of over 15% from 2025 to 2030. This growth is driven by significant investments in smart city initiatives and industrial automation. The region is witnessing a surge in the adoption of IoT technologies across sectors like healthcare, manufacturing, and transportation, fueled by government support and regulatory frameworks promoting digital transformation. The integration of AI with IoT is also enhancing operational efficiencies and creating new business models. As European countries focus on sustainability and energy efficiency, the demand for connected devices is expected to rise significantly in the coming years.

The IoT devices market in UK is expected to grow at a significant CAGR in the coming years, primarily fueled by the growing demand for smart home technologies and consumer IoT devices. The popularity of smart thermostats, lighting systems, and security cameras is driving the need for effective IoT device management solutions to ensure seamless operation and integration. Additionally, government initiatives aimed at promoting digital transformation and sustainability are further propelling market growth, making the UK a key player in the European IoT landscape.

The Germany IoT devices market landscape is characterized by its strong focus on industrial automation and smart manufacturing. The country's robust industrial base is increasingly adopting IoT solutions to enhance operational efficiency and productivity. Furthermore, Germany's commitment to sustainability and energy efficiency is driving the development of connected devices that optimize resource usage while meeting regulatory standards, positioning it as a critical hub for IoT innovation.

Asia Pacific IoT Devices Market Trends

The Asia-Pacific IoT devices industry is expected to grow at the fastest CAGR of over 20% from 2025 to 2030, driven by rapid urbanization and increasing smartphone penetration. Countries like China and India are leading this growth, driven by their large populations and expanding middle class. The rise in demand for smart home devices and industrial IoT applications is further accelerated by government initiatives aimed at fostering technological innovation and infrastructure development. Additionally, the proliferation of 5G networks in APAC is set to enhance connectivity for IoT applications, thereby propelling market growth.

Japan IoT devices market remains at the forefront, characterized by technological advancements and a strong emphasis on automation across various sectors, including manufacturing and healthcare. The integration of AI and machine learning with IoT applications is enhancing data analytics capabilities, enabling real-time monitoring and predictive maintenance. Additionally, Japan's aging population is driving demand for smart healthcare solutions that leverage IoT technologies to improve patient care and streamline operations within healthcare facilities.

The IoT devices market in China is experiencing rapid expansion owing to its rapid urbanization and large-scale adoption of smart technologies. The Chinese government’s support for digital transformation initiatives and investments in 5G infrastructure is accelerating the deployment of IoT solutions across various industries. With an increasing focus on smart city projects and industrial IoT applications, China is poised to lead in connected device proliferation, driving innovation and economic growth in the region.

Key IoT Devices Company Insights

Some of the key players operating in the market include Cisco Systems, Inc.; Honeywell International, Inc., and Qualcomm Technologies, Inc.

-

Cisco Systems, Inc. is a technology company specializing in networking hardware, software, and telecommunications equipment. The company is also known for its innovative enterprise networking, security, and IoT solutions. The company caters to diverse industries and industry verticals, including cities and communities, manufacturing, smart buildings, education, mining, financial services, mining, oil & gas, healthcare, transportation, and retail, among others.

-

Honeywell International Inc. is a multinational conglomerate engaged in the development of technologies and solutions for building automation, energy and sustainability, industrial automation, and aerospace applications. The company is known for its innovative and diversified technology-based products and services. The company caters to diverse industries and industry verticals, including aerospace, commercial buildings, energy, healthcare, IT/hi-tech, life sciences, and manufacturing, among others.

Some of the emerging market players in the IoT devices market include Sierra Wireless and Silicon Laboratories, Inc.

-

Sierra Wireless, a subsidiary of Semtech Corporation, is a provider of IoT connectivity solutions, specializing in cellular modules, rugged routers, and comprehensive global connectivity services. With nearly 30 years of experience, Semtech simplifies the IoT landscape by providing a robust portfolio that includes advanced 4G LTE and 5G technologies, enabling secure and reliable connections for various applications across industries such as utilities, healthcare, and logistics.

-

Silicon Laboratories, Inc.is a global player in wireless connectivity for the Internet of Things (IoT), offering an integrated hardware and software platform, intuitive development tools, and unmatched ecosystem support. With nearly two decades of expertise, the company focuses on high-performance, low-power solutions with advanced security and multi-protocol support, enabling the development of innovative industrial, commercial, and home applications.

Key IoT Devices Companies:

The following are the leading companies in the IoT devices market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Group

- Cisco Systems, Inc.

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- Intel Corporation

- NXP Semiconductors NV

- PTC Inc.

- Qualcomm Technologies, Inc.

- Robert Bosch GmbH

- Samsung Electronics Co., Ltd.

- Siemens AG

- Sierra Wireless

- Silicon Laboratories, Inc.

- STMicroelectronics NV

- Texas Instruments Incorporated

Recent Developments

-

In January 2025, At CES 2025, Samsung Electronics Co.Ltd unveiled its innovative "Home AI" technology aimed at hyper-personalization within smart homes. This suite of AI solutions enhances user experiences by integrating with SmartThings to provide tailored services for various household needs. The incorporation of the Samsung Knox Matrix security system addresses critical concerns about device security in the IoT ecosystem, promoting consumer confidence in adopting smart technologies.

-

In January 2025, Honeywell International, Inc. in partnership with Verizon launched a groundbreaking bundled solution designed to streamline the retail lifecycle, encompassing procurement through customer operations. This collaboration combines Honeywell's hardware, software, and services with Verizon's high-speed 5G connectivity, providing businesses with a simplified procurement process and a single point of contact for all technology needs.

-

In January 2025, Qualcomm Technologies, Inc. announced a collaboration with Toshiba to develop scalable AI-powered IoT solutions for the retail sector. This partnership aims to integrate edge computing with cloud services, allowing real-time processing of data from intelligent cameras and other retail devices.

IoT Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 83.33 billion |

|

Revenue forecast in 2030 |

USD 181.17 billion |

|

Growth rate |

CAGR of 16.8% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, end use, connectivity, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE |

|

Key companies profiled |

ABB Group; Cisco Systems, Inc.; Honeywell International Inc.; Huawei Technologies Co., Ltd.; Intel Corporation; NXP Semiconductors NV; PTC Inc.; Qualcomm Technologies, Inc.; Robert Bosch GmbH; Samsung Electronics Co., Ltd.; Siemens AG; Sierra Wireless; Silicon Laboratories, Inc.; STMicroelectronics NV; Texas Instruments Incorporated. |

|

Customization scope |

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global IoT Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global IoT devices market report based on component, end use, connectivity, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Smart Home

-

Sensors

-

Actuators

-

Processors

-

Edge Devices

-

Others

-

-

Industrial IoT (IIoT)

-

Sensors

-

Actuators

-

Processors

-

Edge Devices

-

Others

-

-

Healthcare

-

Sensors

-

Actuators

-

Processors

-

Edge Devices

-

Others

-

-

Automotive and Transportation

-

Sensors

-

Actuators

-

Processors

-

Edge Devices

-

Others

-

-

Retail

-

Sensors

-

Actuators

-

Processors

-

Edge Devices

-

Others

-

-

Agriculture

-

Sensors

-

Actuators

-

Processors

-

Edge Devices

-

Others

-

-

Energy and Utilities

-

Sensors

-

Actuators

-

Processors

-

Edge Devices

-

Others

-

-

Smart Cities

-

Sensors

-

Actuators

-

Processors

-

Edge Devices

-

Others

-

-

Wearables

-

Sensors

-

Actuators

-

Processors

-

Edge Devices

-

Others

-

-

Consumer Electronics

-

Sensors

-

Actuators

-

Processors

-

Edge Devices

-

Others

-

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Smart Home IoT Devices

-

Smart Thermostats

-

Energy Meters

-

Smart Locks

-

Surveillance Cameras

-

Smart Speakers

-

Connected Appliances

-

Others

-

-

Industrial IoT (IIoT)

-

Programmable Logic Controllers (PLCs)

-

Asset Trackers

-

RFID Systems

-

Connected Cameras

-

Others

-

-

Healthcare

-

Wearable Health Monitors

-

Remote Diagnostic Tools

-

Connected Imaging Devices

-

Smart Insulin Pens

-

Smart Ventilators

-

Others

-

-

Automotive and Transportation

-

Onboard Diagnostic (OBD) Devices

-

Telematics Systems

-

GPS Trackers

-

Asset Trackers

-

Connected Cameras

-

Others

-

-

Retail

-

Digital Kiosks

-

Electronic Price Tags

-

RFID Systems

-

Connected Barcode Scanners

-

Surveillance Cameras

-

Access Control Devices

-

Others

-

-

Agriculture

-

Weather Stations

-

Irrigation Controllers

-

Wearable Animal Trackers

-

Feeding Monitors

-

Connected Cameras

-

Others

-

-

Energy and Utilities

-

Connected Meters

-

Load Control Switches

-

Grid Sensors

-

Leak Detection Sensors

-

Flow Meters

-

Pressure Monitoring Devices

-

Others

-

-

Smart Cities

-

Smart Streetlights

-

Connected Parking Meters

-

Waste Management Sensors

-

Air Quality Monitors

-

EV Charging Stations

-

Traffic Monitoring Systems

-

Connected Cameras

-

Others

-

-

Wearables

-

Smartwatches

-

Fitness Bands

-

Wearable AR/VR Devices

-

Others

-

-

Consumer Electronics

-

Smart TVs

-

Gaming Consoles

-

Streaming Devices

-

Smart Routers

-

Smart Glasses

-

Others

-

-

Others

-

-

Connectivity Outlook (Revenue, USD Billion, 2018 - 2030)

-

Smart Home IoT Devices

-

Wi-Fi

-

Bluetooth

-

Zigbee

-

Cellular (5G,4G,3G)

-

RFID

-

Others

-

-

Industrial IoT (IIoT)

-

Wi-Fi

-

Bluetooth

-

Zigbee

-

Cellular (5G,4G,3G)

-

RFID

-

Others

-

-

Healthcare

-

Wi-Fi

-

Bluetooth

-

Zigbee

-

Cellular (5G,4G,3G)

-

RFID

-

Others

-

-

Automotive and Transportation

-

Wi-Fi

-

Bluetooth

-

Zigbee

-

Cellular (5G,4G,3G)

-

RFID

-

Others

-

-

Retail

-

Wi-Fi

-

Bluetooth

-

Zigbee

-

Cellular (5G,4G,3G)

-

RFID

-

Others

-

-

Agriculture

-

Wi-Fi

-

Bluetooth

-

Zigbee

-

Cellular (5G,4G,3G)

-

RFID

-

Others

-

-

Energy and Utilities

-

Wi-Fi

-

Bluetooth

-

Zigbee

-

Cellular (5G,4G,3G)

-

RFID

-

Others

-

-

Smart Cities

-

Wi-Fi

-

Bluetooth

-

Zigbee

-

Cellular (5G,4G,3G)

-

RFID

-

Others

-

-

Wearables

-

Wi-Fi

-

Bluetooth

-

Zigbee

-

Cellular (5G,4G,3G)

-

RFID

-

Others

-

-

Consumer Electronics

-

Wi-Fi

-

Bluetooth

-

Zigbee

-

Cellular (5G,4G,3G)

-

RFID

-

Others

-

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global IoT devices market was estimated at USD 70.28 billion in 2024 and is expected to reach USD 83.33 billion in 2025.

b. The global IoT devices market is expected to grow at a compound annual growth rate of 16.8% from 2025 to 2030 to reach USD 181.17 billion by 2030.

b. North America dominated the IoT devices market with a share of over 34% in 2024, driven by the increasing penetration of smart devices, heightened consumer electronics demand, and the rollout of 5G technologies, which facilitate faster and more reliable connectivity.

b. Some key players operating in the IoT devices market include ABB Group, Cisco Systems, Inc., Honeywell International Inc., Huawei Technologies Co., Ltd., Intel Corporation, NXP Semiconductors NV, PTC Inc., Qualcomm Technologies, Inc., Robert Bosch GmbH, Samsung Electronics Co., Ltd., Siemens AG, Sierra Wireless, Silicon Laboratories, Inc., STMicroelectronics NV, and Texas Instruments Incorporated

b. The key factors IoT devices market include the convergence of technological advancements and growing innovations such as 5G connectivity, edge computing, and the increasing demand for real-time data analytics.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."