IoT Device Management Market Size, Share & Trends Analysis Report By Component (Solution, Services), By Deployment Mode, By Enterprise Size, By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-335-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

IoT Device Management Market Trends

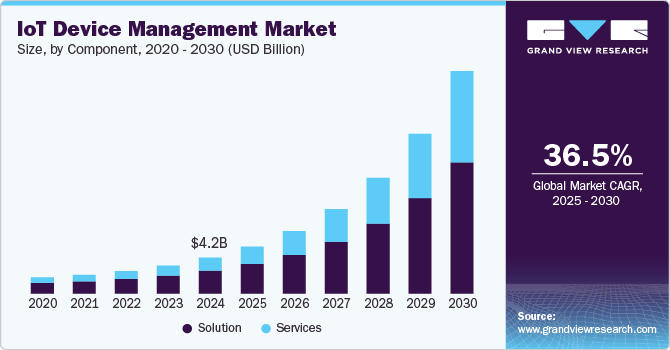

The global IoT device management market size was estimated at USD 4.20 billion in 2024 and is anticipated to grow at a CAGR of 36.5% from 2025 to 2030. The strong emphasis on digitalization and the subsequent proliferation of connected devices are expected to drive the market growth over the forecast period. The implementation of IoT technology enhances the performance of connected devices by assisting in various tasks, such as deployment, monitoring, managing, updating, and controlling, driving the adoption of IoT device management solutions in multiple industries, including transportation & logistics, healthcare, retail, utilities, and manufacturing.

The growing focus of enterprises on controlling linked devices and improving operational efficiencies across industry verticals is expected to boost the demand for IoT device management solutions. Major players are launching new products and services to stay competitive in the market. Major players in the IoT industry are undertaking various initiatives aimed at standardizing protocols of data flow, such as the formation of the Open Mobile Alliance (OMA), which enhances interoperability among IoT devices from different manufacturers also contributed to the growth of the IoT device management market.

The widespread adoption of communication and networking technologies, as well as the demand for real-time analytics, connected assets, and machine security, has favored the demand for device management software. Device management software supports functions such as control and maintenance, software upgrades, monitoring and diagnostics of linked devices, as well as authentication and provisioning according to predefined security and operational policies. Moreover, the upgradation of industrial technologies, such as Blockchain, IoT, and machine learning, and the need for effective management of connected devices prompted market players to focus on the development of security solutions, real-time data analytics, and data management solutions.

In June 2022, Amazon Web Services (AWS) introduced IoT Device Management, a fully managed cloud service that can enable users to remotely organize, monitor, register, and manage IoT devices at scale. It integrates with AWS IoT Core to manage devices in the cloud and AWS IoT Device Defender to monitor and audit the security posture of IoT infrastructure. In addition, the device management software helps monitor equipment’s metadata and set policy changes with service alerts to stay informed about device configuration or unusual behaviors.

Component Insights

The solution segment accounted for the largest revenue share of over 63.0% in 2024. The aggressive adoption of IoT devices across various industries, such as smart cities, healthcare, manufacturing, and transportation, necessitates robust management solutions to oversee the performance, security, and lifecycle of these devices. The increasing need to make data-driven decisions to enhance productivity and boost the profitability of business operations further drives the adoption of IoT device management solutions.

The services segment is expected to grow at a CAGR of 39.3% over the forecast period. The segment includes a wide range of offerings such as consulting, integration, managed services, and support. These services are vital for helping businesses implement IoT solutions efficiently, manage large-scale device networks, and handle real-time data processing.

Solution Insights

The remote monitoring segment accounted for the largest revenue share of over 22.0% in 2024. Industries are adopting IoT devices for remote equipment monitoring and predictive maintenance to minimize downtime and enhance operational efficiency. The growing adoption of IoT technology for industrial applications drives the demand for effective device management solutions to ensure reliable performance and seamless integration across various industrial processes.

The security solutions segment is expected to grow at a significant CAGR over the forecast period. As IoT ecosystems expand, cyberattacks targeting connected devices are rising, pushing organizations to invest in advanced security solutions to safeguard their networks and data.

Service Insights

The professional segment accounted for the largest revenue share of over 63.0% in 2024. Implementing and managing IoT solutions can be complex, involving numerous devices, systems, and data streams. Professional services, including consulting, integration, and support, are essential for ensuring successful deployments and addressing device interoperability and system integration challenges.

The managed segment is expected to grow at a significant CAGR over the forecast period. The shift toward digital transformation, with more companies relying on IoT for real-time data collection and analysis, supports the growth of this segment as businesses seek to optimize device performance and data flow across their operations.

Deployment Mode Insights

The private cloud segment accounted for the largest revenue share of over 53.0% in 2024. Scalability and integration with existing IT infrastructure fuel the adoption of private cloud in IoT device management. As IoT networks grow, private cloud solutions provide the ability to scale resources efficiently while maintaining a secure, isolated environment. Additionally, private clouds can seamlessly integrate with on-premises systems, enabling businesses to manage their IoT devices across a hybrid architecture, thus enhancing operational efficiency and reducing management complexity.

The public cloud segment is expected to grow at a significant CAGR over the forecast period. The growing emphasis on data security and compliance is pushing organizations to adopt cloud-based IoT management solutions that offer robust security features and compliance with regulatory standards. Public cloud providers often invest heavily in security measures, providing businesses with confidence in their data management.

Enterprise Size Insights

The large enterprise segment accounted for the largest revenue share of over 67.0% in 2024. Large enterprises implement extensive IoT networks across multiple locations, necessitating advanced device management solutions to effectively monitor, control, and update numerous connected devices. The complexity and scale of these deployments demand sophisticated management tools that can handle diverse operational requirements, ensure device security, and optimize performance. Hence, large enterprises typically opt for robust IoT device management platforms to maintain operational efficiency

The SMEs segment is expected to grow at a significant CAGR over the forecast period due to the increasing affordability and accessibility of IoT technologies. Advances in cloud computing and network infrastructure have lowered the barriers to entry for SMEs, allowing them to deploy IoT solutions without substantial capital investment. Moreover, the proliferation of as-a-service models, such as Software as a Service (SaaS) for IoT device management, enables SMEs to access sophisticated tools and platforms on a subscription basis, further driving adoption.

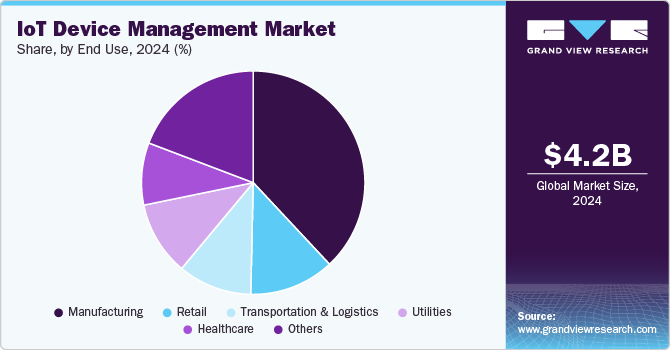

End Use Insights

The manufacturing segment accounted for the largest revenue share of 38.0% in 2024. The shift toward Industry 4.0 is accelerating the adoption of IoT technology in manufacturing, leading to the development of smart factories driven by enhanced automation solutions and data-driven processes. IoT device management solutions are essential in this transition, ensuring the seamless operation, monitoring, and control of connected devices across the production floor. These management tools enable manufacturers to optimize performance, enhance efficiency, and maintain continuous, data-driven operations in modern manufacturing environments.

The healthcare segment is expected to grow at a significant CAGR over the forecast period due to the increasing adoption of connected medical devices. These devices, including wearables, remote monitoring systems, and smart diagnostic tools, enable healthcare providers to collect real-time data about patients' health. This data-driven approach facilitates timely interventions and personalized care, leading to improved patient outcomes.

Regional Insights

The IoT device management market in North America held a share of over 31.0% in 2024, driven by the increasing adoption of IoT-enabled consumer devices, including smart home systems, wearables, and connected appliances, necessitating effective IoT device management to enhance user experiences by ensuring seamless device functionality, secure connectivity, and easy integration. As more consumers embrace connected devices, managing these ecosystems becomes essential to maintain performance and deliver a smooth, reliable user experience.

U.S. IoT Device Management Trends

The IoT device management market in the U.S. is expected to grow significantly at a CAGR of 34.9% from 2024 to 2030. Advancements in technologies such as artificial intelligence (AI) and machine learning (ML) are propelling the market growth. These technologies enhance device management capabilities by enabling predictive maintenance, anomaly detection, and automation. Organizations can leverage AI and ML to proactively address issues before they escalate, improving device reliability and reducing operational downtime.

Europe IoT Device Management Trends

The IoT device management market in Europe is growing with a significant CAGR from 2025 to 2030. Increasing emphasis on sustainability and energy efficiency is also propelling the growth of the market in Europe. Governments and businesses are prioritizing initiatives that reduce carbon footprints and optimize resource usage. IoT device management solutions facilitate real-time monitoring and analytics, enabling organizations to track energy consumption, manage assets efficiently, and implement predictive maintenance.

The UK IoT device management market is expected to grow rapidly in the coming years. The growing demand for smart home and consumer IoT devices in the UK is a major driver of the market for IoT device management. In smart homes, technologies such as smart thermostats, lighting systems, and security cameras are becoming increasingly popular due to their convenience and energy efficiency. These devices require robust management solutions to ensure seamless operation, security, and integration.

The IoT device management market in Germany held a substantial market share in 2024. The increasing adoption of Industry 4.0 and smart manufacturing in Germany drives the demand for IoT device management solutions. Industry 4.0 emphasizes the integration of IoT technologies into industrial processes to enhance automation, optimize production, and implement predictive maintenance.

Asia Pacific IoT Device Management Trends

Asia Pacific is growing significantly at a CAGR of 38.2% from 2025 to 2030, driven by the proliferation of connected devices, a high population density, and the continued rollout of high-speed data networks. As governments across Asia Pacific continue to promote Industry 4.0 principles and encourage smart manufacturing, the adoption of smart devices across various manufacturing units is gaining traction, thereby opening immense opportunities for the growth of the regional market over the forecast period.

The Japan IoT device management market is expected to grow rapidly in the coming years. Japan's aging population significantly boosts the demand for healthcare and remote monitoring solutions. With a growing elderly population, the need for IoT devices that support health monitoring and elderly care, such as wearable health trackers and remote patient management systems, is also increasing.

The IoT device management market in China held a substantial market share in 2024. The Chinese government's “Made in China 2025” initiative plays a crucial role in driving the adoption of IoT solutions to enhance manufacturing and industrial automation. The initiative focuses on modernizing China’s manufacturing sector by promoting advanced technologies, including IoT, to improve production efficiency, reduce costs, and enhance global competitiveness.

Key IoT Device Management Company Insights

Some of the key companies in the IoT device management market include Bosch Software Technologies; Smith Micro Software, Inc.; International Business Machines Corp.; Microsoft; and Oracle and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

In February 2024, Oracle Corp. introduced the new Oracle Enterprise Communications Platform, transforming industry communication by integrating IoT, messaging, and video. Built on Oracle Cloud Infrastructure, the platform enabled real-time communication and data sharing across devices and systems, enhancing operational efficiency and decision-making. The platform was also designed to streamline processes, improve customer experiences, and drive digital transformation by enabling secure, scalable, and flexible communication.

-

In March 2023, Aeris Communication, Inc. completed the acquisition of Ericsson's IoT Accelerator (IoT-A) and Connected Vehicle Cloud (CVC) businesses. The acquisition was aimed to enhance the company’s IoT and connected vehicle capabilities, expand its service offerings, and strengthen its position in the IoT market with advanced connectivity solutions and technologies.

Key IoT Device Management Companies:

The following are the leading companies in the IoT device management market. These companies collectively hold the largest market share and dictate industry trends.

- Advantech Co., Ltd.

- Aeris Communication, Inc.

- Bosch Global Software Technologies

- Cumulocity GmbH

- International Business Machines Corporation (IBM)

- Microsoft Corp.

- Oracle Corp.

- PTC Inc.

- Smith Micro Software, Inc.

IoT Device Management Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 5.48 billion |

|

Revenue forecast in 2030 |

USD 25.93 billion |

|

Growth rate |

CAGR of 36.5% from 2025 to 2030 |

|

Actual data |

2018 - 2023 |

|

Base year for estimation |

2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report component |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, solution, service, deployment mode, enterprise size, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa |

|

Key companies profiled |

Advantech Co., Ltd.; Aeris Communication, Inc.; Bosch Global Software Technologies; Cumulocity GmbH; International Business Machines Corporation (IBM); Microsoft Corp.; Oracle Corp.; PTC Inc.; Smith Micro Software, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global IoT Device Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the IoT device management market report based on component, solution, service, deployment mode, enterprise size, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solution

-

Services

-

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Real-Time Streaming Analytics

-

Security Solutions

-

Data Management

-

Remote Monitoring

-

Network Bandwidth Management

-

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Professional

-

Managed

-

-

Deployment Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Public cloud

-

Private cloud

-

Hybrid cloud

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small and Medium-sized Enterprises (SMEs)

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Retail

-

Healthcare

-

Transportation & Logistics

-

Utilities

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global IoT device management market size was estimated at USD 4.20 billion in 2024 and is expected to reach USD 5.48 billion in 2025.

b. The global IoT device management market is expected to grow at a compound annual growth rate of 36.5% from 2025 to 2030 to reach USD 25.93 billion by 2030.

b. The IoT device management market in North America held a share of over 31.0% in 2024, driven by the increasing adoption of IoT-enabled consumer devices, including smart home systems, wearables, and connected appliances, necessitating effective IoT device management to enhance user experiences by ensuring seamless device functionality, secure connectivity, and easy integration.

b. Some key players operating in the IoT device management market include Advantech Co., Ltd., Aeris Communication, Inc., Bosch Global Software Technologies, Cumulocity GmbH, International Business Machines Corporation (IBM), Microsoft Corp., Oracle Corp., PTC Inc., and Smith Micro Software, Inc.

b. Key factors that are driving the strong emphasis on digitalization and the subsequent proliferation of connected devices. The implementation of IoT technology enhances the performance of connected devices by assisting in various tasks, such as deployment, monitoring, managing, updating, and controlling, driving the adoption of IoT device management solutions in various industries.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."