- Home

- »

- Next Generation Technologies

- »

-

IoT In Construction Market Size And Share Report, 2030GVR Report cover

![IoT In Construction Market Size, Share & Trends Report]()

IoT In Construction Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Application (Asset Monitoring, Fleet Management), By End-use (Commercial, Residential), By Region (North America, Europe), And Segment Forecasts

- Report ID: GVR-4-68040-402-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

IoT In Construction Market Summary

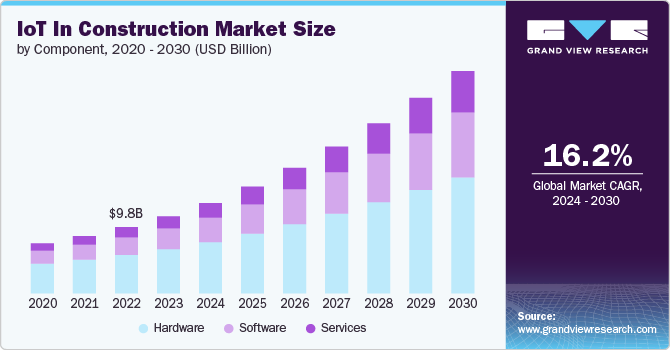

The global IoT in construction market size was estimated at USD 11.46 billion in 2023 and is expected to reach USD 33.04 billion by 2030, and is projected to grow at a CAGR of 16.2% from 2024 to 2030. The increasing demand for enhanced operational efficiency and productivity on construction sites is driving market growth.

Key Market Trends & Insights

- North America region accounted for the highest revenue share of 36% in 2023.

- The market in the U.S. is projected to grow at a CAGR of 13% from 2024 to 2030.

- By component, the hardware segment accounted for the largest market share of over 57% in 2023.

- By application, the asset monitoring segment registered the largest revenue share in 2023.

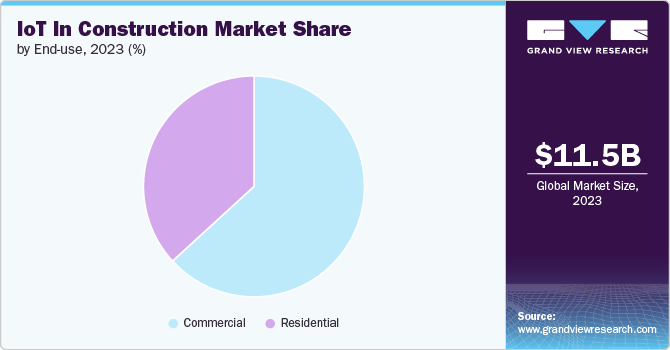

- By end use, the commercial segment in the market registered the largest share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 11.46 Billion

- 2030 Projected Market Size: USD 33.04 Billion

- CAGR (2024-2030): 16.2%

- North America: Largest market in 2023

- Middle East and Africa: Fastest growing market

IoT technologies facilitate real-time monitoring and management of equipment, materials, and workforce, leading to reduced downtime and optimized resource utilization. Additionally, the growing emphasis on worker safety and regulatory compliance is propelling the adoption of IoT solutions that provide real-time alerts and predictive maintenance capabilities, which is expected to fuel market growth in the coming years.The proliferation of IoT devices in construction has led to the generation of vast amounts of data. This data can be analyzed to gain insights into various aspects of construction projects, such as project timelines, resource utilization, and cost management. Advanced analytics and machine learning algorithms can predict potential issues and provide actionable recommendations, enabling construction managers to make informed decisions. This trend of data-driven decision-making enhances project planning, reduces risks, and improves overall project outcomes and is propelling the adoption of IoT technologies in construction, making the market more dynamic and competitive.

In addition, the rise of smart cities and sustainable construction practices is contributing to the market's growth, as IoT technologies play a crucial role in achieving energy efficiency and environmental sustainability in construction projects. Smart cities rely on interconnected systems and infrastructure that IoT devices enable, providing real-time data and analytics to optimize urban planning, traffic management, and public services. In the realm of sustainable construction, IoT technologies facilitate the monitoring and management of energy consumption, water usage, and waste production.

Furthermore, IoT technology is revolutionizing safety standards in construction by providing real-time data and insights into potential hazards. Wearable devices equipped with IoT sensors can monitor workers' health and alert supervisors to any unsafe conditions or practices. Additionally, IoT-enabled drones and cameras can survey construction sites, identifying safety risks and ensuring compliance with safety regulations. By proactively addressing safety concerns, construction firms can reduce accidents and enhance worker well-being, contributing to a safer work environment.

Moreover, the construction industry is witnessing a shift toward smart buildings and infrastructure driven by IoT technology. Smart buildings use IoT sensors to optimize energy usage, monitor environmental conditions, and manage building systems such as heating, ventilation, and air conditioning (HVAC). These systems can automatically adjust settings based on real-time data, improving energy efficiency and reducing operational costs. Furthermore, IoT-enabled infrastructure projects, such as smart roads and bridges, enhance public safety and optimize traffic flow through real-time monitoring and data analysis.

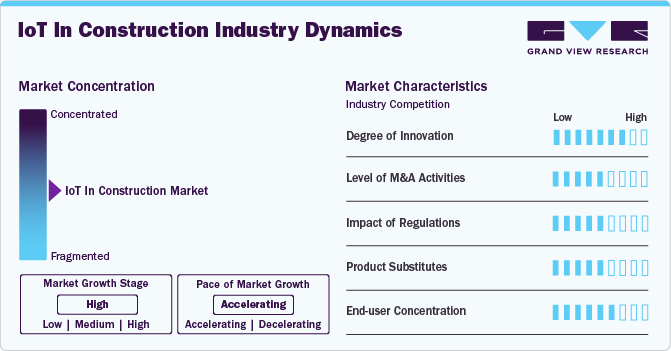

Market Concentration & Characteristics

The IoT in construction market is characterized by a high degree of innovation, driven by the advancements in technology and the increasing need for efficiency and safety on construction sites. Innovations such as smart sensors, wearable devices, and advanced data analytics are transforming traditional construction practices. Companies are leveraging IoT to enhance project management, improve resource allocation, and monitor equipment health in real time. The integration of artificial intelligence (AI) with IoT solutions is further propelling innovation by enabling predictive maintenance and optimizing workflows.

The level of mergers & acquisition activities in the market is expected to be moderate. Major players are acquiring startups that specialize in IoT solutions to enhance their product offerings or gain access to new markets. This trend is fueled by the recognition that integrating IoT technologies can provide competitive advantages through improved operational efficiencies and enhanced customer experiences.

The impact of regulations on the market is expected to be moderate. Governments worldwide are increasingly focusing on safety standards, data privacy, and environmental regulations that impact how IoT technologies are deployed on construction sites. Compliance with these regulations can drive innovation as companies develop solutions that not only meet legal requirements but also enhance sustainability efforts.

The competition from product substitutes in the market is expected to be moderate. Traditional construction management software and manual processes, can serve as substitutes for IoT solutions. The extent of competition from these substitutes is influenced by factors such as price, functionality, and user experience. When substitutes are readily available and offer comparable or superior benefits, they can limit the pricing power of IoT firms and compel them to innovate continuously.

The end-user concentration in the market is moderate to high. End users include construction companies, project owners and developers, facility managers, government and municipalities, and subcontractors. Construction companies utilize IoT for real-time monitoring and predictive maintenance to enhance efficiency and productivity. Project owners and developers adopt IoT to gain better control over project progress and financial metrics, ensuring timely and budget-compliant project delivery. Facility managers leverage IoT for smart building management, optimizing energy usage and system reliability. Governments and municipalities employ IoT for monitoring and maintaining public infrastructure, improving safety and urban planning.

Component Insights

The hardware segment accounted for the largest market share of over 57% in 2023. This growth can be attributed to the comprehensive nature of IoT in construction solutions that integrate various security measures into a single package. These solutions encompass a wide range of features, including device authentication, data encryption, intrusion detection, and threat intelligence, which collectively enhance the overall security posture of IoT ecosystems. Moreover, the growing adoption of IoT across diverse industries, from healthcare to manufacturing, has amplified the demand for versatile and scalable security solutions, thereby driving the segmental growth.

The services segment is expected to witness the fastest CAGR of 19% from 2024 to 2030, driven by the growing need for specialized services that facilitate the deployment, integration, and maintenance of IoT solutions in the construction industry. These services encompass a range of offerings, including consulting, system integration, training, and support, which are essential for ensuring the successful implementation and operation of IoT systems. Furthermore, the rising demand for customized IoT solutions and the need for continuous optimization and updates to keep pace with technological advancements are expected to contribute to the rapid growth of the services segment in the market.

Application Insights

The asset monitoring segment registered the largest revenue share in 2023. This growth can be attributed to its critical role in enhancing the efficiency and productivity of construction operations. IoT-based asset monitoring solutions enable real-time tracking and management of construction equipment, vehicles, and materials, ensuring optimal utilization and reducing downtime. The high demand for robust asset monitoring systems is driven by the need to maximize resource utilization, minimize delays, and ensure timely project completion, driving segmental growth.

The predictive maintenance segment is expected to grow at the fastest CAGR from 2024 to 2030, fueled by the increasing adoption of IoT technologies to minimize unplanned downtime and extend the lifespan of construction equipment and machinery. Predictive maintenance solutions use IoT sensors and advanced analytics to monitor the condition of assets in real-time, identifying potential issues before they result in costly breakdowns. This proactive approach to maintenance helps reduce repair costs, avoiding project delays and improving overall equipment efficiency. As construction companies become more aware of the long-term benefits of predictive maintenance, including reduced operational costs and enhanced productivity, the demand for these solutions is expected to surge in the coming years.

End-use Insights

The commercial segment in the market registered the largest share in 2023. This growth can be attributed to the growing adoption of IoT technologies in commercial construction projects, such as office buildings, shopping centers, and industrial facilities, driven by the need for improved efficiency, cost savings, and enhanced building management. Additionally, the commercial sector often has higher budgets and greater capacity to invest in advanced technologies, further driving segmental growth.

The residential segment is anticipated to record the fastest growth from 2024 to 2030, owing to the increasing consumer demand for smart home technologies and the growing trend of home automation. IoT-enabled devices such as smart thermostats, lighting systems, security cameras, and home assistants are becoming more affordable and accessible, driving widespread adoption in residential construction. Additionally, the push towards energy-efficient and sustainable living is encouraging homeowners and builders to integrate IoT solutions to monitor and manage energy usage, water consumption, and home security.

Regional Insights

The North America region accounted for the highest revenue share of 36% in 2023. The market is driven by advanced technology adoption, stringent safety and environmental regulations, and significant infrastructure investments. The region witnesses a strong focus on smart building initiatives, the adoption of digital twins for real-time simulation and monitoring, and the growth of prefabrication and modular construction methods facilitated by IoT solutions, all contributing to enhanced efficiency and productivity in construction projects.

U.S. IoT In Construction Market Trends

The market in the U.S. is projected to grow at a CAGR of 13% from 2024 to 2030. The market is witnessing a significant shift towards increased automation and data-driven decision-making, driven by the adoption of advanced technologies such as Building Information Modeling (BIM) and real-time monitoring systems. This trend is characterized by the integration of IoT devices that enhance operational efficiency, improve safety protocols, and facilitate remote management of construction sites.

Europe IoT In Construction Market Trends

The market in Europe is anticipated to grow at a CAGR of over 14% from 2024 to 2030. This growth is driven by the strong emphasis on sustainability, government support for smart city projects, and the need to upgrade aging infrastructure. Trends include the development of energy-efficient buildings with IoT-enabled systems for optimized energy usage, the integration of IoT for improved construction site safety and management, and the growing adoption of smart infrastructure solutions to enhance urban planning and public safety.

The U.K. IoT in construction market is anticipated to grow at the significant CAGR from 2024 to 2030. The U.K. government’s initiatives to digitize the construction sector are fostering innovation, encouraging collaboration among stakeholders, and facilitating the development of smart buildings equipped with IoT capabilities, further driving the market growth.

The IoT in construction market in Germany is expected to grow at a considerable CAGR from 2024 to 2030. In Germany, the construction sector is witnessing a significant transformation driven by Industry 4.0 principles, which emphasize automation and data exchange in manufacturing technologies. Furthermore, German construction firms are leveraging advanced analytics to improve decision-making processes and reduce costs associated with delays or equipment failures. This trend is expected to further fuel the market expansion in Germany.

The France IoT in construction market is projected to grow significantly from 2024 to 2030. French construction companies are increasingly utilizing connected devices for site monitoring, asset tracking, and energy management systems that contribute to greener building practices. Furthermore, the emphasis on smart city developments has further accelerated investments in IoT technologies that facilitate urban planning and infrastructure management.

Asia-Pacific IoT In Construction Market Trends

The market in the Asia Pacific region is expected to grow at the significant CAGR of over 19% from 2024 to 2030. The Asia-Pacific region is experiencing rapid urbanization, significant infrastructure development, and increasing government initiatives for smart city projects driving the market. Furthermore, the widespread adoption of IoT for real-time monitoring and management of construction activities, the use of IoT-enabled machinery for predictive maintenance, and the implementation of smart building technologies to improve resource efficiency and reduce operational costs is enhancing the market growth in the region.

The China IoT in construction market is expected to grow considerably from 2024 to 2030. The Chinese government’s significant investments in infrastructure projects such as the Belt and Road Initiative promote the adoption of IoT technologies to enhance efficiency and sustainability

The IoT in construction market in Japan is projected to witness a considerable growth rate from 2024 to 2030. The market is driven by the need to address labor shortages, the emphasis on disaster resilience, and the government's push for smart infrastructure development. Japan’s aging population has led to labor shortages in the construction sector, promoting the adoption of IoT and automation to maintain productivity.

The India IoT in construction market is estimated to record a significant growth rate from 2024 to 2030. The market is driven by rapid urbanization, government initiatives, and the need for efficient infrastructure development to support economic growth. The government’s focus on building 100 smart cities and improving urban infrastructure propels the adoption of IoT technologies.

Middle East and Africa IoT In Construction Market Trends

The market in the Middle East and Africa is expected to grow at the fastest CAGR of over 20% from 2024 to 2030, driven by large-scale infrastructure projects, government investments in smart city initiatives, and the need to improve construction site safety and efficiency. Furthermore, the integration of IoT for enhanced project management and real-time data analytics, the adoption of smart building technologies for energy management and sustainability, and the use of IoT-enabled solutions to address challenges in remote and harsh environments, improving overall project outcomes is accelerating the market growth.

The Saudi Arabia IoT in construction market is accounted for a considerable revenue share in 2023. The use of digital twins for real-time project monitoring and optimization, the growth of prefabrication and modular construction methods enabled by IoT for improved precision and reduced build times are the key drivers boosting the market growth in Saudi Arabia.

Key IoT In Construction Company Insights

Some of the key players operating in the market include Microsoft Corporation, Amazon Web Services, Inc., and Cisco Systems, Inc. Inc. among others.

-

Microsoft Corporation is a multinational technology company actively engaging in the construction IoT market through its comprehensive Azure IoT suite of services. Azure IoT Hub enables secure and reliable communication between IoT devices and the cloud, while Azure IoT Edge allows running analytics and custom logic on devices at the edge to reduce costs and latency. Azure Digital Twins enables the creation of digital models of construction sites and buildings to optimize operations and experiences, while Azure IoT Central provides a fully managed IoT SaaS solution for easily connecting, monitoring, and managing IoT assets at scale.

-

Amazon Web Services (Amazon Web Services, Inc.), a subsidiary of Amazon.com Inc, offers an extensive suite of cloud-based products that cater to various business needs including computing power (via Amazon EC2), storage solutions (Amazon S3), databases (Amazon RDS), machine learning (Amazon SageMaker), and more. Amazon Web Services, Inc. IoT Core is a managed cloud service that enables connected devices to securely interact with cloud applications and other devices, while Amazon Web Services, Inc. IoT Greengrass allows devices to run local compute, messaging, data caching, sync, and ML inference capabilities at the edge. Amazon Web Services, Inc. IoT Analytics makes it easy to run sophisticated analytics on massive amounts of IoT data to gain insights, and Amazon Web Services, Inc. IoT SiteWise collects, organizes, and analyzes data from construction equipment to monitor operations and optimize performance.

Intel Corporation, Software AG are some of the emerging market participants in the market.

-

Intel Corporation is a leading semiconductor manufacturer and technology company recognized globally for its innovative products and solutions. The company offers hardware-based security technologies designed to protect connected devices and systems from cyber threats. Intel's IoT solutions focus on enhancing operational efficiency and enabling real-time data analytics, which are crucial for construction projects that require precise monitoring and management of resources. The company's hardware and software offerings support the integration of IoT devices, facilitating better communication and data flow between construction equipment and management systems.

-

Software AG is a German multinational software corporation actively engaging in the market through its Cumulocity IoT platform, which enables companies to connect, manage, and analyze data from various devices efficiently. The platform's low-code, self-service capabilities allow construction firms to quickly develop tailored IoT applications that enhance operational efficiency and decision-making. By partnering with organizations like BSA, Software AG is expanding its reach in providing IoT-based building management solutions, helping construction companies leverage real-time data for improved safety, resource management, and overall project performance.

Key IoT In Construction Companies:

The following are the leading companies in the iot in construction market. These companies collectively hold the largest market share and dictate industry trends.

- Microsoft Corporation

- Amazon Web Services, Inc.

- Siemens

- Cisco Systems, Inc.

- Intel Corporation

- Qualcomm Incorporated

- Huawei Technologies Co.Ltd

- PTC Inc.

- Bosch Global Software Technologies Private Limited

- Software AG

Recent Developments

-

In April 2024, at Hannover Messe 2024, Microsoft Corporation highlighted its industrial transformation strategy with the launch of two key accelerators: an adaptive cloud approach and Azure IoT Operations, which is currently in preview. These innovations aim to enhance collaboration between IT and operational technology (OT) by leveraging open standards and creating a unified data foundation.

-

In October 2023, Microsoft Corporation opened a new smart building complex that showcases its Azure Digital Twins service, which enables the digital modeling of physical spaces and real-time tracking of people and devices. This initiative is part of Microsoft Corporation's ongoing efforts to enhance its smart building technology, utilizing IoT sensors to manage and optimize operations across its facilities.

-

In October 2023, Amazon Web Services, Inc. announced new features for Amazon Web Services, Inc. IoT Twin Maker that enhance the digital twin entity modeling experience. These improvements include support for multiple data sources, simplified data mapping, and the ability to create and manage entities more efficiently. By streamlining the process of creating and managing digital twins, these updates make it easier for construction companies to leverage IoT data to optimize building operations, reduce costs, and improve occupant experiences.

IoT In Construction Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 13.43 billion

Revenue forecast in 2030

USD 33.04 billion

Growth Rate

CAGR of 16.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report Component

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, application,end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; U.A.E.

Key companies profiled

Microsoft Corporation; Amazon Web Services, Inc.; Siemens; Cisco Systems, Inc.; Intel Corporation; Qualcomm Incorporated; Huawei Technologies Co. Ltd; PTC Inc.; Bosch Global Software Technologies Private Limited; Software AG

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global IoT In Construction Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global IoT in construction market report based on component, application, end-use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Asset Monitoring

-

Fleet Management

-

Predictive Maintenance

-

Remote Operations

-

Safety

-

Wearables

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Commercial

-

Residential

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Australia

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global IoT in construction market size was estimated at USD 11.46 billion in 2023 and is expected to reach USD 13.43 billion in 2024.

b. The global IoT in construction market is expected to grow at a compound annual growth rate of 16.2% from 2024 to 2030 to reach USD 33.04 billion by 2030.

b. The IoT in construction market in North America accounted for a significant revenue share of over 36% in 2023. The market is driven by advanced technology adoption, stringent safety and environmental regulations, and significant infrastructure investments.

b. Some key players operating in the IoT in construction market include Microsoft Corporation, Amazon Web Services, Inc., Siemens, Cisco Systems, Inc., Intel Corporation, Qualcomm Incorporated, Huawei Technologies Co.Ltd, PTC Inc., Bosch Global Software Technologies Private Limited, Software AG

b. Key factors that are driving IoT in construction market growth include the increasing demand for enhanced operational efficiency and productivity on construction sites, the rise of smart cities and sustainable construction practices and the shift towards smart buildings and infrastructure, driven by IoT technology

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.