IoT Chip Market Size, Share & Trends Analysis Report By Product (Connectivity Integrated Circuits, Logic Devices), By End Use (Consumer Electronics, Wearable Devices), By Region (North America, Europe), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-408-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

IoT Chip Market Size & Trends

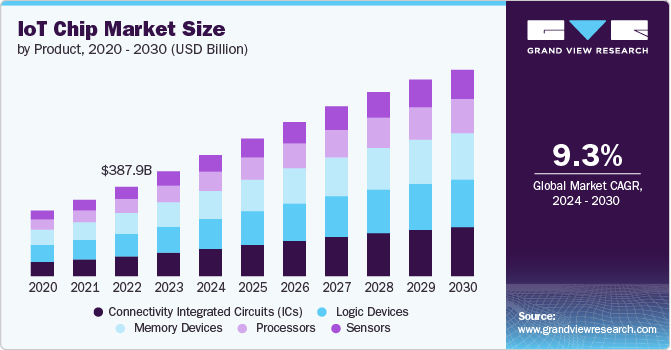

The global IoT chip market size was estimated at USD 454.82 billion in 2023 and is expected to grow at a CAGR of 9.3% from 2024 to 2030. The market is driven by the increasing demand for connected devices, rapid urbanization, and the need for efficient and cost-effective solutions. The proliferation of smart homes, cities, and industries has led to a surge in demand for IoT-enabled devices, which requires advanced processing capabilities, memory, and connectivity. Additionally, the need for real-time data analysis and processing is propelling the adoption of IoT chips with advanced capabilities such as artificial intelligence (AI), machine learning (ML), and edge computing.

The increasing adoption of smart home devices, wearable technology, and industrial IoT applications necessitates the development and deployment of efficient and versatile IoT chips. These chips are fundamental to enabling the connectivity, processing power, and energy efficiency required for IoT devices to function effectively. As more devices become interconnected, the demand for advanced IoT chips are expected to continue to rise in the coming years.

The increasing demand for IoT-enabled devices across various industries such as industrial automation, healthcare, transportation, and consumer electronics is driving the growth of the market. The growing need for automation, remote monitoring, and predictive maintenance in industries has led to a surge in demand for IoT-enabled devices that can process large amounts of data and provide real-time insights. Additionally, the growing adoption of smart home devices such as smart speakers, thermostats, and security cameras is also contributing to the growth of the Market.

Furthermore, the incorporation of AI into IoT chips is reshaping the semiconductor industry by driving demand for more powerful and efficient IoT chipsets. Semiconductor companies are focusing on developing AI-specific architectures, such as embedded GPUs, accelerators, and neuromorphic computing solutions, to meet the growing requirements of AI-enabled IoT devices. This trend is expected to present significant growth opportunities for the market.

Companies operating in the market are implementing various strategies to gain a competitive edge in the market. Some companies are focusing on partnerships and collaborations with other players in the ecosystem to expand their product offerings and reach new markets. For instance, in April 2024, Qualcomm Technologies, Inc. acquired Foundries.io, a UK-based provider of open-source embedded software and cloud-native platforms for IoT and edge computing applications. The acquisition is part of Qualcomm's strategy to expand its IoT product portfolio and strengthen its open-source expertise to accelerate the commercialization of its Qualcomm Linux offerings. Such strategies by market players are expected to fuel market growth in the coming years.

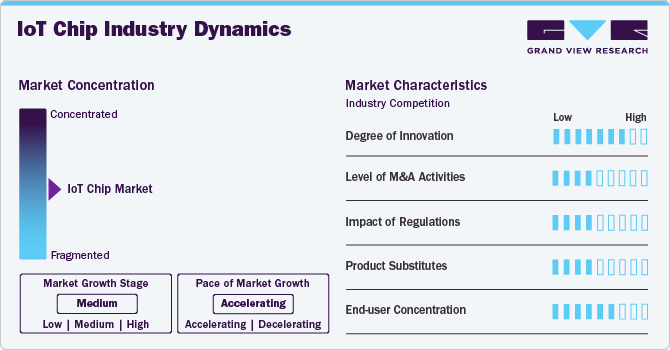

Market Concentration & Characteristics

The IoT chip market is characterized by a high degree of innovation. This growth can be attributed to various factors, including the increased adoption of AI and machine learning capabilities to enable edge computing and real-time decision-making, advancements in connectivity technologies such as Wi-Fi 6, Bluetooth 5.2, and 5G to enable faster and more reliable connections, growing focus on energy efficiency and power management techniques to extend battery life in IoT devices, the integration of more robust security features such as hardware-based cryptography to protect IoT devices from cyber threats, and the emergence of new applications in the automotive and industrial IoT sectors, are driving innovation in IoT chips to power advanced technologies.

The level of mergers & acquisition activities in the market is expected to be moderate. Companies operating in this sector are focusing on expanding their product portfolios, acquiring new technologies, or consolidate their market positions. These strategic moves are expected to significantly impact the competitive landscape of the industry by reshaping market share and influencing pricing dynamics.

The impact of regulations on the market is expected to be moderate. Regulations related to data security, privacy, and interoperability are essential for companies operating in this market. Regulatory changes can impact product development cycles, manufacturing processes, and overall business strategies within the industry. This has led to moderate impact of regulations in the market.

The level of product substitutes in the market is moderate. While there are alternative substitutes for IoT chips, the unique requirements of many IoT applications, such as ultra-low power consumption for battery-operated devices and the need for real-time, on-device processing, ensure that specialized IoT chips remain crucial in many applications, thereby leading to moderate level of product substitutes.

The end user concentration in the market is moderate to high. End users in sectors such as wearable devices, building automation, industrial applications, automotive & transportation, and others are increasingly relying on IoT chips to enable connectivity, enhance efficiency, and improve operations.

Product Type Insights

The connectivity integrated circuits (ICs) segment accounted for the largest market share of 25% in 2023. This is attributed to the fundamental role of connectivity in IoT applications. As the IoT ecosystem continues to expand, the need for seamless, reliable, and energy-efficient communication between devices is paramount. Connectivity ICs provide the essential hardware for various wireless communication protocols, enabling devices to connect and exchange data effectively, whether through Wi-Fi, Bluetooth, cellular networks, or other wireless technologies.

The sensors segment is anticipated to record the fastest growth from 2024 to 2030. This surge can be attributed to several factors. Firstly, the increasing adoption of IoT devices across various industries such as healthcare, automotive, manufacturing, and smart homes is driving the demand for sensors embedded in these devices. Sensors play a crucial role in collecting real-time data, enabling better decision-making processes and enhancing operational efficiency. Moreover, advancements in sensor technologies, including miniaturization, improved accuracy, and lower power consumption, are further fueling their integration into IoT devices. Additionally, the growing focus on enhancing connectivity and communication capabilities in IoT systems is boosting the demand for sensors that can facilitate seamless data transmission and interaction between devices.

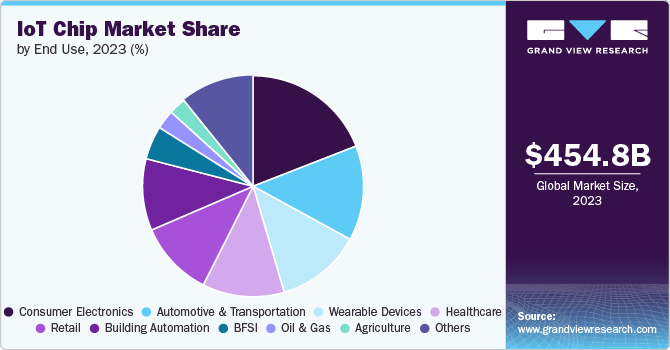

End Use Insights

The consumer electronics segment accounted for the largest market share in 2023, owing to the widespread integration of IoT technology in smart devices. IoT functionalities have become integral to various consumer electronics, including smartphones, smart speakers, smart home appliances, wearables, and among others. These devices leverage IoT chips to enable features like remote control, data tracking, and interoperability, enhancing user convenience and experience. The growing demand for smart, interconnected consumer electronics, coupled with an increasingly tech-savvy consumer base, has driven the adoption of IoT chips over the forecast period.

The aerospace and defense segment is anticipated to record the fastest growth from 2024 to 2030. The aerospace and defense industry is increasingly adopting IoT devices for various applications, such as monitoring aircraft engine performance, tracking military assets, and enhancing soldier safety. These devices rely on specialized IoT chips for data processing, analysis, and communication. The growing demand for these devices will drive the market for IoT chips in the aerospace and defense sector. Furthermore, the advancements in IoT chip technology are also contributing to the growth of the market.

Regional Insights

The North America region accounted for the highest revenue share of nearly 36% in 2023. The market is driven by increasing demand for connected devices in sectors such as consumer electronics, healthcare, industrial automation, and smart cities. The region’s strong focus on innovation and technological advancements is further propelling the market growth.Companies in North America, including key players such as Intel Corporation and Texas Instruments, are at the forefront of developing cutting-edge IoT chip technologies. These advancements include more efficient processors, enhanced connectivity solutions, improved sensors, and innovative memory devices tailored for diverse IoT applications.

U.S. IoT Chip Market Trends

The market in U.S. is projected to grow at a CAGR of over 5% from 2024 to 2030. Various sectors in U.S. are rapidly integrating IoT chips into their operations to enhance efficiency, productivity, and connectivity. Industries such as healthcare are leveraging IoT chips for remote patient monitoring and data analytics, while smart home devices powered by IoT chips are gaining popularity among consumers, thereby driving the market growth in U.S.

Europe IoT Chip Market Trends

The market in Europe is anticipated to grow at a CAGR of over 7% from 2024 to 2030. The increasing adoption of IoT technologies across industries, the demand for connected devices, and the push towards Industry 4.0 initiatives is driving the market growth in Europe.

The U.K. IoT chip market is witnessing a growing focus on developing advanced sensor technologies for military aircraft, drones, and commercial planes, which is driving the market growth.

The IoT chip market in Germany is expected to grow at a significant CAGR from 2024 to 2030. The smart home and building automation market in Germany is growing rapidly, driven by the increasing need for energy efficiency, security, and convenience, further boosting the market growth.

The France IoT chip market is witnessing rapid demand from the healthcare sector. The healthcare industry in France is exploring the potential of IoT technologies to improve patient care, remote monitoring, and medical device connectivity, thereby driving market growth.

Asia-Pacific IoT Chip Market Trends

The market in the Asia-Pacific region is expected to grow at a CAGR of over 12% from 2024 to 2030. The Asia-Pacific region is experiencing a surge in continuous advancements in processor technology. IoT chip manufacturers are developing more powerful and energy-efficient processors tailored for IoT applications. This trend is enhancing the performance and capabilities of IoT devices across various industries in the region.

The China IoT chip market is witnessing a surge in product demand across industries such as consumer electronics, automotive, and industrial sectors. Chinese companies are actively investing in research and development of IoT chip technologies, leading to the emergence of local players in the market.

The IoT chip market in Japan is witnessing rapid technological advancements. Japanese companies are known for their cutting-edge technology and precision engineering. The focus on miniaturization and energy efficiency in IoT chip design aligns with Japan’s reputation for high-quality electronic components, which is driving the demand for advanced IoT chips in Japan.

The India IoT chip market is expected to grow at a significant CAGR from 2024 to 2030. The market in India is fueled by a burgeoning tech ecosystem and increasing digitalization efforts. The country’s vibrant startup culture is contributing to innovation in IoT chip technologies, with a focus on cost-effective solutions tailored to local needs.

Middle East and Africa IoT Chip Market Trends

The market in the Middle East and Africa is expected to grow at the fastest CAGR of over 13% from 2024 to 2030. The adoption of Industrial IoT (IIoT) solutions in sectors such as manufacturing and utilities is driving the need for specialized IoT chips designed for industrial applications. These chips support functions such as predictive maintenance, asset tracking, and real-time monitoring. This trend is driving the market growth in the region.

The Saudi Arabia IoT chip market is anticipated to grow at a significant CAGR from 2024 to 2030. The development of smart cities in Saudi Arabia, such as NEOM and Riyadh Smart City, requires advanced IoT infrastructure supported by IoT chip. These chips enable smart city applications such as traffic management, energy efficiency, and public safety, which is further boosting the market growth.

Key IoT Chip Company Insights

Some of the key players operating in the market include Qualcomm Technologies, Inc., Intel Corporation, among others.

-

Qualcomm Technologies, Inc., a subsidiary of Qualcomm Incorporated, is an American multinational semiconductor and telecommunications company known for its advancements in wireless technology. The company specializes in designing and manufacturing semiconductors for mobile devices and IoT solutions. The company is renowned for its snapdragon processors and leadership in 5G technology. The company has a significant global presence, driving innovation in connectivity solutions across consumer electronics and industrial sectors.

-

Intel Corporation is known for its powerful microprocessors and a broad range of computing solutions. The company provides a wide range of products from personal computers, data centers, and IoT applications. With a strong focus on innovation, the company is at the forefront of technologies such as artificial intelligence, autonomous driving, and quantum computing, playing a crucial role in advancing the global computing infrastructure.

MediaTek, Inc., Samsung Electronics Co.Ltd, Microchip Technology, Inc. are some of the emerging market participants in the market.

-

MediaTek, Inc. provides system-on-chip solutions for wireless communications, high-definition television, and DVD and Blu-ray. They are known for their innovative chip designs that cater to a wide range of devices, including smartphones, tablets, smart TVs, and IoT devices. The company has been actively expanding its presence in the market by offering cost-effective and energy-efficient solutions.

-

Samsung Electronics Co., Ltd. is known for its consumer electronics, mobile devices, semiconductors, and other technology-related products. The company has been focusing on developing advanced semiconductor technologies to power various IoT applications.

Key IoT Chip Companies:

The following are the leading companies in the IoT chip market. These companies collectively hold the largest market share and dictate industry trends.

- Qualcomm Technologies Inc.

- Intel Corporation

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- NXP Semiconductors N.V.

- Samsung Electronics Co. Ltd.

- Analog Devices Inc.

- MediaTek Inc.

- Microchip Technology Inc.

- Infineon Technologies AG

Recent Developments

-

In April 2024, Qualcomm Technologies Inc. launched a new ultra-low power Wi-Fi IoT chip designed to compete with Bluetooth technology. This new chip aims to address the power efficiency and connectivity challenges faced by IoT devices, offering improved battery life and enhanced performance for a wide range of connected devices.

-

In April 2023, Qualcomm Technologies Inc. introduced a series of IoT chips, including the QCS8550 and QCM8550, which are higher-powered and designed for applications such as drones and cloud gaming.

-

In May 2023, Intel Corporation unveiled a new product called Agilex 7 featuring the R-Tile chipset. This innovation introduces the first FPGA with CXL and PCIe 5.0 capabilities, making it the only FPGA with built-in IP support for these interfaces.

IoT Chip Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 525.21 billion |

|

Revenue forecast in 2030 |

USD 895.05 billion |

|

Growth Rate |

CAGR of 9.3% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report Deployment |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, U.K., Germany, France, China, Australia, Japan, India, South Korea, Brazil, South Africa, Saudi Arabia, U.A.E. |

|

Key companies profiled |

Qualcomm Technologies Inc.; Intel Corporation; STMicroelectronics N.V.; Texas Instruments Incorporated; NXP Semiconductors N.V.; Samsung Electronics Co. Ltd.; Analog Devices Inc.; MediaTek Inc.; Microchip Technology Inc.; Infineon Technologies AG |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global IoT Chip Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global IoT chip market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Connectivity Integrated Circuits (ICs)

-

Logic Devices

-

Memory Devices

-

Processors

-

Sensors

-

Temperature Sensors

-

Motion Sensors

-

Light Sensors

-

Others

-

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Consumer Electronics

-

Wearable Devices

-

Automotive & Transportation

-

BFSI

-

Healthcare

-

Retail

-

Building Automation

-

Oil & Gas

-

Agriculture

-

Aerospace & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Australia

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global IoT chip market size was estimated at USD 454.82 million in 2023 and is expected to reach USD 525.21 million in 2024.

b. The global IoT chip market is expected to grow at a compound annual growth rate of 9.3% from 2024 to 2030 to reach USD 895.05 million by 2030.

b. The IoT chip market in North America accounted for a significant revenue share of over 36% in 2023, driven by increasing demand for connected devices in sectors such as consumer electronics, healthcare, industrial automation, and smart cities. The region’s strong focus on innovation and technological advancements is further propelling the market growth

b. Some key players operating in the IoT chip market include Qualcomm Technologies Inc., Intel Corporation, STMicroelectronics N.V., Texas Instruments Incorporated, NXP Semiconductors N.V., Samsung Electronics Co. Ltd., Analog Devices Inc., MediaTek Inc., Microchip Technology Inc., Infineon Technologies AG

b. Key factors that are driving IoT chip market growth include the increasing demand for connected devices, rapid urbanization, and the need for efficient and cost-effective solutions.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."