IoT In Banking And Financial Services Market Size, Share & Trends Analysis Report By Component (Hardware, Software), By Deployment (On-premise, Cloud), By Solution, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-409-0

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

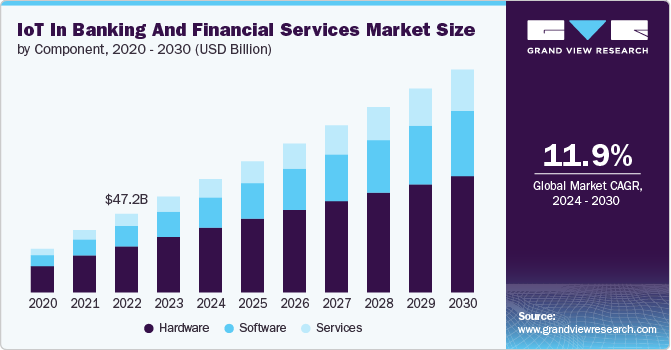

The global IoT in banking and financial services market size was estimated at USD 57.55 billion in 2023 and is expected to grow at a CAGR of 11.9% from 2024 to 2030. The rise of IoT technology is increasingly shaping the growth of banks and financial services by revolutionizing customer interactions. IoT devices provide real-time insights into customer behaviors and preferences, leading to highly personalized and seamless service experiences. For instance, IoT-enabled wearables notify customers about unusual transactions or upcoming bill payments, transforming traditional service models. This trend towards more tailored interactions boosts customer satisfaction and drives market expansion in IoT for banking and financial services.

Moreover, IoT technology helps financial institutions update operations and reduce costs through automation and real-time monitoring. IoT sensors can track asset conditions, manage energy usage, and optimize branch operations. Automated processes, such as smart ATMs and connected security systems, reduce the need for manual intervention and enhance service reliability. In addition, IoT-driven data analytics provides insights into process improvements and resource allocation. These efficiency gains translate into cost savings and higher profitability for banks and financial services providers, driving market growth.

The IoT offers advanced security solutions that protect financial institutions and their customers from cyber threats and fraud. IoT devices, such as connected cameras and biometric sensors, enhance physical security at bank branches and ATMs. Moreover, IoT-enabled systems can monitor transactions and detect unusual patterns in real time, triggering immediate alerts for potential fraud. Integrating IoT with artificial intelligence (AI) further enhances predictive analytics and risk assessment. Improved security measures build customer trust and safeguard financial assets, driving market growth.

Moreover, the increase in IoT devices generates vast amounts of data, which can be analyzed to gain valuable business insights. Financial institutions can use IoT data to understand market trends, customer behavior, and operational performance. Advanced analytics tools process this data to provide actionable insights for strategic decision-making. For instance, banks can identify profitable customer segments, optimize product offerings, and predict market shifts. Data-driven strategies enable financial institutions to stay competitive and responsive to market demands, fueling market growth.

Furthermore, IoT enables the development of innovative financial products and services that cater to evolving customer needs. For instance, usage-based insurance, powered by IoT sensors in vehicles, offers personalized premiums based on driving behavior. IoT-enabled devices can also facilitate new payment methods, such as contactless and wearable payments, enhancing customer convenience. In addition, IoT supports the creation of smart contracts and blockchain-based financial solutions, streamlining transactions and reducing intermediaries. These innovations attract tech-savvy customers and open new revenue streams for financial institutions, contributing to the market's growth.

Market Concentration & Characteristics

The degree of innovation in the market is high. The degree of innovation within the IoT in banking and financial services significantly influences the market's growth and capabilities. Advanced technologies and innovative approaches enable more accurate tracking and analysis of objects in space, leading to enhanced safety and operational efficiency for space missions.

Regulations have a high impact and play a critical role in shaping the market, as they establish essential guidelines and standards for space activities. Stricter regulations can drive the demand for more sophisticated situational awareness solutions to comply with safety and operational standards, fostering innovation and growth in the sector.

The level of mergers & acquisitions in the market is high. The market is also being influenced by the rising number of mergers and acquisitions, which help companies increase market share, expand the customer base, and strengthen product portfolios.

The impact of product substitutes is low to moderate. Introducing product substitutes in the market plays a significant role in catalyzing innovation and driving competitive pricing strategies. Substitutes push existing companies to enhance their technological offerings and broaden the market by providing cost-effective alternatives, impacting market dynamics and growth prospects.

End user concentration is high in the market. Theincreasing concentration of end users in the market significantly enhances collaboration and data-sharing efforts critical to monitoring and understanding space environments. This consolidation facilitates a more unified approach towards mitigating collisions, tracking debris, and ensuring the sustainable use of outer space, ultimately leading to improved safety and operational efficiencies for all space-faring entities.

Component Insights

The hardware protection segment dominated in 2023 with a market share of around 58% due to increasing demand for connected devices, such as ATMs, smart cards, and biometric systems. These devices enhance security, enable seamless transactions, and improve customer experience, driving their adoption. In addition, sensor technologies and edge computing advancements contribute to expanding the segment’s growth.

The services segment is expected to record the highest CAGR of 14.6% from 2024 to 2030. The growth is attributed to the increasing demand for managed and professional services, which assist in implementing, maintaining, and optimizing IoT solutions. Financial institutions leverage these services to enhance customer experiences, improve operational efficiency, and ensure regulatory compliance. As the adoption of IoT technologies expands, this segment is expected to see continued growth, driven by the need for expertise in managing complex IoT ecosystems.

Deployment Insights

The on-premise segment held the highest revenue share in 2023, driven by concerns over data security, compliance with stringent regulatory requirements, and the need for customized solutions tailored to specific organizational needs. Furthermore, the on-premise deployments offer banks greater flexibility in integrating IoT technologies with legacy systems, which is critical for ensuring seamless operations.

The cloud segment is estimated to register the highest growth rate from 2024 to 2030, driven by the need for scalable and flexible infrastructure that supports real-time data processing and analytics. Financial institutions increasingly adopt cloud solutions to enhance operational efficiency, reduce costs, and improve customer experience. This shift is further accelerated by advancements in cloud security, making it a preferred choice for handling sensitive financial data. The trend is expected to continue as banks and financial services seek to innovate and streamline their operations.

Solution Insights

The customer experience management segment held the highest revenue share in 2023 due to the increasing need for personalized customer interactions and real-time engagement. Banks and financial institutions leverage IoT technologies to enhance customer satisfaction, streamline services, and build stronger client relationships. This growth is further driven by advancements in data analytics and AI, which enable more effective and targeted customer experience strategies. As a result, customer experience management solutions are becoming a critical component in the digital transformation efforts within the financial sector, propelling the segment's growth forward.

The security segment is estimated to register a significant growth rate from 2024 to 2030, driven by the increasing need to protect sensitive financial data and prevent cyber threats. As IoT adoption in banking expands, the demand for advanced security solutions, including encryption, authentication, and real-time threat detection, is rising. Regulatory requirements and the heightened awareness of cyber risks in financial institutions further fuel this growth. Overall, the segment is expected to play a critical role in ensuring the safety and reliability of IoT deployments in the financial sector.

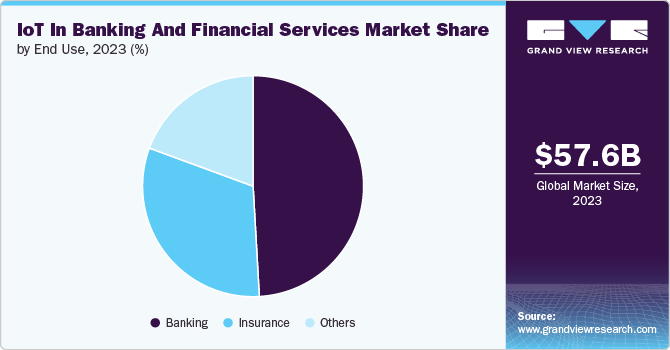

End-use Insights

The banking segment held the highest revenue share in 2023, driven by the increasing adoption of IoT solutions for enhancing security, streamlining operations, and improving customer experiences. Banks leverage IoT technologies to optimize branch management, automate processes, and offer personalized services. In addition, integrating IoT with AI and big data analytics enables banks to monitor transactions better and mitigate risks, further fueling the segment's expansion.

The insurance segment is estimated to register the highest growth rate from 2024 to 2030 due to the increasing adoption of IoT technologies for risk assessment, fraud detection, and personalized customer experiences. IoT-driven data analytics enables insurers to offer more tailored policies and streamline claims processes, enhancing efficiency and customer satisfaction. This segment's growth is also fueled by the rise of telematics in auto insurance and smart home devices, which provide real-time data to optimize coverage and pricing.

Regional Insights

The IoT in banking and financial services market in North America accounted for the highest revenue share of 36.47% in 2023. The persistent deployment of advanced technology infrastructure and a robust regulatory framework in North America are key driving forces behind the market growth. The region's emphasis on innovation and security in financial transactions further accelerates the adoption of IoT solutions.

U.S. IoT In Banking And Financial Services Market Trends

The IoT in banking and financial services market in the U.S. is anticipated to grow at a CAGR of 9.1% from 2024 to 2030. In the U.S., the drive towards enhanced security and personalized customer experiences in financial services significantly boosts IoT adoption, paving the way for innovative banking solutions.

Asia Pacific IoT In Banking And Financial Services Market Trends

The IoT in banking and financial services market in Asia Pacific is anticipated to grow at the highest CAGR of 14.9% from 2024 to 2030. Asia Pacific's rapid urbanization, digitalization, and significant investments in smart city projects are major growth drivers for the IoT in financial and banking services market. The increasing mobile and internet penetration in this region also significantly propels the demand for innovative financial solutions powered by IoT.

India IoT in banking and financial services market is estimated to record a significant growth rate from 2024 to 2030. The rapid digitization of banking services and a growing emphasis on financial inclusion and mobile banking propel IoT integration to achieve unparalleled efficiency and reach.

The IoT in banking and financial services market in China is expected to grow considerably from 2024 to 2030. China's IoT growth in financial services is largely fueled by the government's push for a smarter, tech-driven economy, and the integration of IoT with mobile payments and fintech innovations has become a key growth driver.

Japan IoT in the banking and financial services market is projected to grow considerably from 2024 to 2030. In Japan, the focus on precision and reliability in banking operations and the country's technological prowess are propelling the adoption of IoT solutions, which aim to enhance customer service and operational efficiency.

Europe IoT In Banking And Financial Services Market Trends

The IoT in banking and financial services market in Europe accounted for a notable revenue share in 2023. Europe's strong focus on data protection and privacy, reinforced by regulations like GDPR, lays a solid foundation for secure IoT adoption in the financial and banking services market. The continent's advanced technological infrastructure and push for digital banking solutions also foster a conducive environment for IoT growth.

The UK IoT in the banking and financial services market is projected to grow considerably from 2024 to 2030. The UK is witnessing a surge in IoT adoption in financial services, driven by the need to comply with stringent regulatory standards and the desire to provide consumers with advanced, secure banking experiences.

The IoT in banking and financial services market in Germany is expected to record significant growth from 2024 to 2030. Germany's growth in this market is powered by the country's strong focus on security and privacy and the integration of IoT technologies to streamline banking operations and improve customer service.

Middle East and Africa (MEA) IoT In Banking And Financial Services Market Trends

The IoT in banking and financial services market in MEA is anticipated to grow at a significant CAGR of 14.2% from 2024 to 2030. In MEA, the growing demand for financial inclusion and mobile banking, especially in developing areas, drives the adoption of IoT in banking and financial services. The region's strategic investments in digital transformation initiatives and the growing fintech sector are further catalyzing the market growth.

Saudia Arabia IoT in the banking and financial services market accounted for a considerable revenue share in 2023. The country's vision for a digital-first economy and the rise in digital banking initiatives are key drivers, with IoT in financial services fostering innovation in customer experience and operational efficiency.

Key IoT In Banking And Financial Services Company Insights

Some of the key players operating in the market are IBM Corporation, Microsoft Corporation, and SAP SE.

- IBM Corporation has evolved into a multinational technology and consulting company. Known for its significant contributions to computing, IBM plays a pivotal role in developing hardware, software, and cloud-based services.

- Microsoft Corporation is a global technology company renowned for its Windows operating systems, Office productivity suite, and, more recently, cloud computing services through Azure. It specializes in the development, manufacturing, licensing, support, and sales of computer software, consumer electronics, and personal computers and services.

Software AG and Vodafone Group Plc, among others, are some of the emerging market participants.

- Software AG, founded in Germany, specializes in enterprise software for business process improvement. Its product portfolio includes solutions for integration, IoT, process management, analytics, and database management, among others.

- Vodafone Group is a British multinational telecommunications company. As one of the world's leading telecom operators, it provides a range of services, including voice, messaging, data, and fixed communications. Vodafone has mobile operations in numerous countries, partner networks in additional countries, and fixed broadband operations in select markets, serving millions of customers globally.

Key IoT In Banking And Financial Services Companies:

The following are the leading companies in the iot in banking and financial services market. These companies collectively hold the largest market share and dictate industry trends.

- IBM Corporation

- Microsoft Corporation

- SAP SE

- Oracle Corporation

- Cisco Systems, Inc.

- Capgemini SE

- Accenture PLC

- Software AG

- HCLTech Ltd.

- Vodafone Group

Recent Developments

-

In September 2023, HCLTech Ltd. and ANZ, one of the four major banks in Australia and the most significant banking group in New Zealand and the Pacific, extended their partnership through a new initiative aimed at revolutionizing ANZ’s digital experience for employees in 33 countries. HCLTech Ltd. utilized cutting-edge technologies such as extended reality, generative AI, and IoT-enabled workspaces to facilitate immersive, sustainable, and inclusive environments for enterprises.

-

In August 2022, Accenture PLC acquired The Stable, a specialized agency dedicated to assisting consumer brands in developing and managing their digital commerce platforms. Moreover, The Stable helps brands optimize their brand presence and sales outcomes across major retailers in North America. This acquisition highlights Accenture PLC's ongoing commitment to investing in commerce solutions to facilitate client growth and ensure their ongoing relevancy in the market.

-

In May 2022, HCL Technologies UK Limited, a fully owned subsidiary of HCLTech Ltd., completed the acquisition of Confinale AG, a digital banking and wealth management consultancy firm based in Switzerland and an Avaloq Premium Implementation Partner. With this acquisition, HCLTech Ltd. expanded its global wealth management presence, focusing on Avaloq consulting, implementation, and management skills.

IoT In Banking And Financial Services Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 68.15 billion |

|

Revenue forecast in 2030 |

USD 134.01 billion |

|

Growth rate |

CAGR of 11.9% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, solution, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

IBM Corporation; Microsoft Corporation; SAP SE; Oracle Corporation; Cisco Systems, Inc.; Capgemini SE; Accenture PLC; Software AG; HCLTech Ltd.; Vodafone Group. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global IoT In Banking And Financial Services Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global IoT in banking and financial services market report based on component, deployment, solution, end-use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Security

-

Customer Experience Management

-

Monitoring

-

Data Management

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Banking

-

Insurance

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global IoT in banking and financial services market size was estimated at USD 57.55 billion in 2023 and is expected to reach USD 68.15 billion in 2024.

b. The global IoT in banking and financial services market is expected to grow at a compound annual growth rate of 11.9% from 2024 to 2030 to reach USD 134.01 billion by 2030.

b. The North America region accounted for the largest share of over 36% in the IoT in banking and financial services market in 2023 and is expected to continue its dominance in the coming years.

b. Some key players operating in the IoT in banking and financial services market include IBM Corporation, Microsoft Corporation, SAP SE, Oracle Corporation, Cisco Systems, Inc., Capgemini SE, Accenture PLC, Software AG, HCLTech Ltd., Vodafone Group.

b. Key factors that are driving the IoT in banking and financial services market growth include the delivery of personalized and seamless customer experiences. Through the use of IoT devices, these institutions can acquire real-time insights into customer behaviors and preferences, enabling more customized service offerings.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."