- Home

- »

- Renewable Energy

- »

-

Ion Exchange Membrane Market Size, Industry Report, 2030GVR Report cover

![Ion Exchange Membrane Market Size, Share & Trends Report]()

Ion Exchange Membrane Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Inorganic Membrane, Hydrocarbon Membrane), By Application (Water Treatment, Electrodialysis), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-518-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ion Exchange Membrane Market Summary

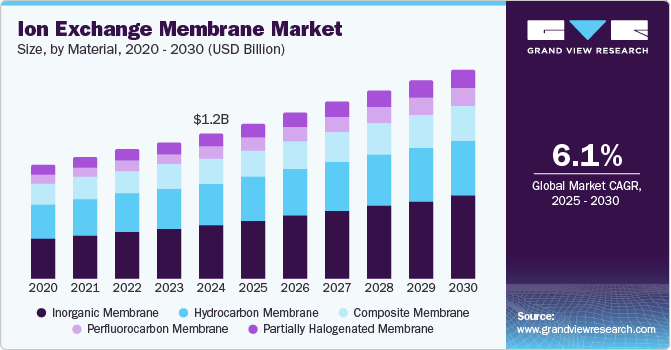

The global ion exchange membrane market size was estimated at USD 1.16 billion in 2024 and is anticipated to reach USD 1.67 billion by 2030, growing at a CAGR of 6.1% from 2025 to 2030. The increasing demand for water treatment solutions and advancements in renewable energy technologies proliferate the market.

Key Market Trends & Insights

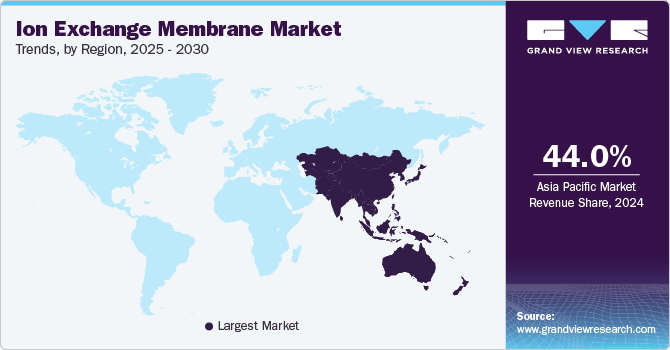

- Asia Pacific is the dominant region with a revenue share of over 44.0% in 2024.

- Based on material, the inorganic membrane segment dominated with a market share of 37.1% in 2024.

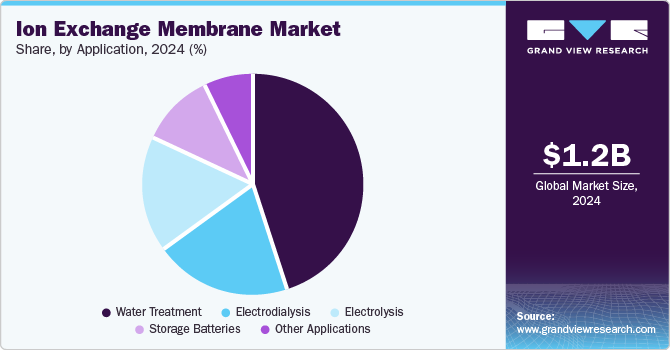

- Based on application, the water treatment segment dominated with a market share of 44.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.16 Billion

- 2030 Projected Market Size: USD 1.67 Billion

- CAGR (2025-2030): 6.1%

- Asia Pacific: Largest market in 2024

These membranes are widely used for water desalination, purification, and industrial processes, especially where water scarcity is a concern. As populations grow and water demand rises globally, especially in arid regions, the need for efficient water purification methods has spiked. IEMs, due to their ability to separate ions and contaminants, play a crucial role in desalination processes, driving demand for these advanced filtration systems.

The global shift toward clean energy has accelerated investments in green technologies like fuel cells and electrolysers, where IEMs are integral components. These applications improve the energy efficiency of processes and help reduce carbon emissions, aligning with global sustainability goals. As countries invest in hydrogen as a clean fuel alternative, the demand for ion exchange membranes in energy applications is poised to expand.

Innovations in membrane material science have led to the development of more durable and efficient membranes, enhancing the performance of ion exchange processes. The introduction of advanced materials, such as high-performance polymers, has resulted in membranes that offer greater chemical resistance, improved ion selectivity, and longer operational lifespans. These improvements make IEMs increasingly attractive for various industrial applications, including wastewater treatment, mining, and food processing, thus driving market expansion across diverse sectors.

The increasing industrialization in emerging economies is another critical factor propelling the growth of the ion exchange membrane industry. As industries such as chemicals, pharmaceuticals, and food processing expand in regions such as Asia-Pacific, Latin America, and Africa, the demand for advanced filtration technologies rises. IEMs are essential in ensuring the purity and quality of water used in these industries, and their ability to separate ions efficiently and contaminants is indispensable. This growing industrial base in developing countries strongly drives IEM adoption. As industrialization spreads, the market is expected to witness growth.

Drivers, Opportunities & Restraints

The growing demand for water treatment solutions worldwide drives the ion exchange membrane industry growth. As water scarcity becomes a critical global issue, the need for advanced water filtration systems, such as those using ion exchange membranes, has increased. These membranes effectively remove contaminants like salts, metals, and organic compounds, making them essential in water desalination and wastewater treatment. Additionally, the rise in industrial applications such as food and beverage processing, pharmaceuticals, and chemical manufacturing further accelerates the market growth. These industries are increasingly adopting ion exchange membranes to enhance purification processes, improve product quality, and meet stringent regulatory standards.

The growth of the renewable energy sector, particularly in the production of hydrogen via water electrolysis, presents a substantial opportunity. Ion exchange membranes are vital in electrolysis, and their development could foster a cleaner energy transition. As sustainability efforts rise across industries, the demand for environmentally friendly, energy-efficient ion exchange membranes is expected to increase.

High initial installation and maintenance costs are significant barriers for small and medium-sized enterprises. These membranes require periodic regeneration and cleaning, adding to the operational expenses. Additionally, membrane fouling, which occurs due to the accumulation of contaminants, can reduce their lifespan and efficiency, further increasing maintenance costs.

Material Insights

The inorganic membranes, typically made from metal oxides, ceramics, or glass, are increasingly recognized for their superior stability, high resistance to chemical degradation, and long-lasting performance. As industries face growing pressure to address environmental concerns and optimize energy usage, inorganic membranes emerge as a pivotal solution due to their enhanced durability and resistance in harsh operational environments.

Perfluorocarbon membrane is anticipated to register the fastest CAGR over the forecast period. Perfluorocarbon membranes, made from polymers like polytetrafluoroethylene (PTFE), are recognized for their high chemical stability, low surface energy, and excellent resistance to fouling. These characteristics make them especially valuable in applications requiring extreme durability and chemical compatibility, such as chemical processing, water treatment, and industrial separations. Their ability to operate under harsh conditions is a driving force behind their increasing adoption.

Application Insights

With populations growing rapidly, urbanization expanding, and industrialization accelerating, the need for efficient water purification and treatment technologies has never been more critical. Ion exchange membranes are pivotal in modern water treatment systems, especially in desalination processes, wastewater treatment, and water softening applications. Their ability to selectively filter out impurities, such as salts, heavy metals, and organic compounds, positions them as key components in addressing the global water crisis.

Storage batteries is anticipated to register the fastest CAGR over the forecast period. As the global shift towards cleaner energy sources accelerates, the need for efficient and reliable energy storage systems has become more pressing. Ion exchange membranes play a crucial role in the functioning of advanced battery technologies, such as flow and solid-state batteries, by facilitating the movement of ions between electrodes, ensuring efficient energy storage and release. This is especially important in long-term energy storage applications, such as large-scale renewable energy systems and backup power solutions.

Regional Insights

Asia Pacific is anticipated to register the fastest CAGR over the forecast period. As countries in Asia Pacific, particularly India and China, face severe water scarcity issues, there is an urgent need for advanced water purification technologies. Ion exchange membranes are essential in reverse osmosis, electrodialysis, and water desalination, critical for providing clean and safe drinking water. The growing concern over water pollution and the necessity to address contamination in industrial and domestic water supplies have spurred investments in water treatment infrastructure, further propelling market demand.

North America Ion Exchange Membrane Market Trends

North America, particularly the U.S. and Canada, has seen a surge in industrialization and urbanization over the past decades, increasing demand for clean water. This growth has created a need for more efficient water treatment technologies, including ion exchange membranes, which are crucial for reverse osmosis, desalination, and wastewater treatment. The continued challenge of water contamination and the necessity to provide clean water to urban and rural areas have further spurred investments in water treatment solutions, thus driving the market for ion exchange membranes.

U.S. Ion Exchange Membrane Market Trends

In the U.S., the Environmental Protection Agency (EPA) and other governmental bodies have set rigorous water quality standards that compel industries to adopt advanced treatment technologies, including ion exchange membranes. These regulations promote cleaner technologies for water recycling and wastewater treatment, encouraging industries to invest in membrane-based systems for better compliance with environmental standards.

Europe Ion Exchange Membrane Market Trends

Europe ion exchange membrane industry held a significant revenue share in 2024. The European Union (EU) has implemented stringent environmental regulations, particularly water management and pollution control. For instance, the EU’s Water Framework Directive and other local laws enforce strict water quality standards that drive industries to adopt more advanced water treatment technologies, including ion exchange membranes. These regulations compel industries to focus on reducing their environmental footprint, boosting the adoption of ion exchange membranes in processes that support water purification, waste management, and resource conservation.

Central & South America Ion Exchange Membrane Market Trends

Central & South America ion exchange membrane industry is anticipated to grow significantly over the forecast period. Countries in the region, particularly Brazil, invest heavily in renewable energy sources like wind, solar, and hydroelectric power. As part of the energy transition, there is also an increasing interest in hydrogen fuel cells and other electrochemical energy storage systems, which rely on ion exchange membranes for efficient operation.

Middle East & Africa Ion Exchange Membrane Market Trends

Middle East & Africa is anticipated to register the fastest CAGR over the forecast period. Water scarcity is critical in many MEA countries, particularly in the Middle East, where arid climates and limited freshwater resources pose significant challenges. As a result, nations such as Saudi Arabia, the UAE, and Kuwait are heavily investing in desalination plants to provide clean drinking water. Ion exchange membranes play a vital role in these desalination processes, especially in reverse osmosis (RO) systems, where they help remove salts and contaminants. With water scarcity becoming more severe and the demand for clean water rising, the adoption of ion exchange membranes for water treatment is expected to continue driving the market in the region.

Key Ion Exchange Membrane Company Insights

Some of the key players operating in the market include 3M and AGC ENGINEERING Co. Ltd.

-

3M is a diversified technology and manufacturing corporation known for its innovative products and solutions across various industries. 3M operates in segments such as safety and industrial, transportation and electronics, health care, and consumer goods. 3M provides advanced ion exchange membranes, critical components used in various applications, including water treatment, energy storage, and fuel cells.

-

AGC Engineering Co. Ltd. is a prominent manufacturer based in Japan. It specializes in developing and producing advanced materials, particularly ion-exchange membranes. AGC Engineering’s primary offering in ion-exchange membranes is the FORBLUE SELEMION series, which includes cation-exchange and anion-exchange membranes made from hydrocarbon-based materials.

Key Ion Exchange Membrane Companies:

The following are the leading companies in the ion exchange membrane market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- AGC ENGINEERING Co. Ltd

- Dioxide Materials

- DuPont de Nemours, Inc.

- Evergreen Technologies Pvt Ltd

- Fujifilm Manufacturing Europe BV

- SUEZ

- Hyflux Ltd.

- ION EXCHANGE

- LANXESS

- Liaoning Yichen Membrane Technology Co. Ltd

- Merck KGaA

- Membranes International Inc.

- ResinTech

- Saltworks Technologies Inc.

Ion Exchange Membrane Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.24 billion

Revenue forecast in 2030

USD 1.67 billion

Growth rate

CAGR of 6.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Spain; UK; France; Italy; Russia; China; India; Japan; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

3M; AGC ENGINEERING Co. Ltd; Dioxide Materials; DuPont de Nemours, Inc.; Evergreen Technologies Pvt Ltd; Fujifilm Manufacturing Europe BV; SUEZ; Hyflux Ltd.; ION EXCHANGE; LANXESS; Liaoning Yichen Membrane Technology Co. Ltd; Merck KGaA; Membranes International Inc.; ResinTech; Saltworks Technologies Inc.; Prysmian Group; Nexans; Fujikura; Southwire; Sumitomo Corporation; Belden; KEI Industries; Cords Cable Industries; Amphenol; Finolex Cables; Encore Wire Corp

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ion Exchange Membrane Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ion exchange membrane market report based on material, application, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Inorganic Membrane

-

Hydrocarbon Membrane

-

Composite Membrane

-

Partially Halogenated Membrane

-

Perfluorocarbon Membrane

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Water Treatment

-

Electrodialysis

-

Electrolysis

-

Storage Batteries

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global ion exchange membrane market size was estimated at USD 1.16 billion in 2024 and is expected to reach USD 1.24 billion in 2025.

b. The global ion exchange membrane market is expected to grow at a compound annual growth rate of 6.1% from 2024 to 2030 to reach USD 1.67 billion by 2030.

b. Based on Material, Inorganic membrane held the largest market revenue share of over 37.0% in 2024. The inorganic membranes, typically made from metal oxides, ceramics, or glass, are increasingly recognized for their superior stability, high resistance to chemical degradation, and long-lasting performance.

b. Some of the key vendors of the global ion exchange membrane market are 3M, AGC ENGINEERING Co. Ltd., and others, among others.

b. The increasing demand for water treatment solutions and advancements in renewable energy technologies proliferate the market. These membranes are widely used for water desalination, purification, and industrial processes, especially where water scarcity is a concern.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.