- Home

- »

- Advanced Interior Materials

- »

-

Iodine Market Size, Share, Growth & Trends Report, 2030GVR Report cover

![Iodine Market Size, Share & Trends Report]()

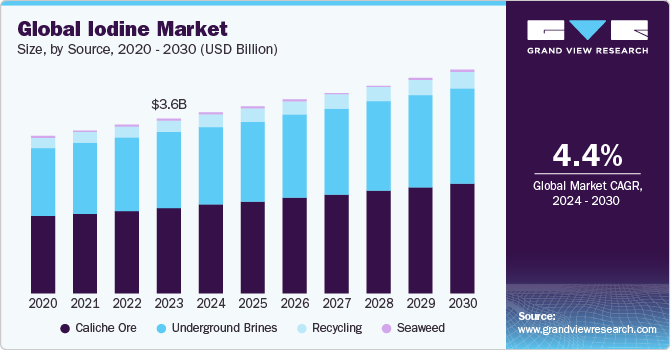

Iodine Market (2024 - 2030) Size, Share & Trends Analysis Report By Source (Caliche Ore, Underground Brines, Recycling, Seaweed), By End-use (Pharmaceuticals, Animal Feed, Medical Imaging, Chemicals), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-151-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Iodine Market Summary

The global iodine market size was estimated at USD 3.58 billion in 2023 and is projected to reach USD 4.88 billion by 2030, growing at a CAGR of 4.4% from 2024 to 2030. Growth in the pharmaceutical industry and increased requirements for fortified animal feed have contributed to iodine demand.

Key Market Trends & Insights

- The iodine market of Europe accounted for the largest revenue share of over 36% in 2023.

- The iodine market in the U.S. accounted for about 73.0% of the region's demand in 2023.

- By source, the caliche ore segment dominated the market with the highest revenue share of over 48.0% in 2023.

- By end-use, the medical imaging segment accounted for the highest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3.58 Billion

- 2030 Projected Market Size: USD 4.88 Billion

- CAGR (2024-2030): 4.4%

- Europe: Largest market in 2023

Iodine is an important trace element that must be obtained from food or nutritional supplements. It is required by the body to produce thyroxine and triiodothyronine, the thyroid hormone. This hormone assists in the formation of essential proteins and enzymes that aid in regulating metabolic activity. Iodine-based levothyroxine drugs are manufactured with iodine being the primary constituent. Hence, the product demand has been high in the country. Without adequacy of the product, the thyroid hormones do not function properly, and lead to an under-active or overactive thyroid gland. This causes medical conditions, such as hypothyroidism and hyperthyroidism, that have various negative side effects in the body.

The increasing demand for non-interventional investigative medical equipment such as X-rays and Computed Tomography (CT) is also a key driver. For medical imaging studies, such as CT scans, angiograms, myelograms, and arthrograms, iodine-containing contrast media are widely used to make hollow structures in the body.

Expansions by end-use segments in the value chain is anticipated to increase the demand for iodine over the forecast period. For instance, in May 2023, Omron Healthcare announced its plans to invest in a medical equipment plant in Tamil Nadu, India for a value of INR 1.28 billion (~USD 15.7 million).

Iodine Price Trends

Iodine prices observed another surge in 2023, after registering a substantial growth in 2022. As per the USGS, iodine prices rose by 40% in 2022 and by 33% in 2023, on a y-o-y basis. Iodine producers accredit healthcare companies for the price surge. For instance, in September 2023, London-based Iofina PLC announced a growth of 27% in its revenue H1 2023, on a y-o-y basis. The growth can be attributed to high iodine prices and growing demand in countries with advanced healthcare systems.

Market Concentration & Characteristics

Industry growth stage is medium, and the pace of market growth is accelerating. Domestic players compete with companies at a global level based on product quality and customer reach. Moderate levels of innovation characterize the market. The industry has been focusing its efforts on improvising the production process, to achieve cost-effectiveness with minimal wastage. The market is also characterized by low levels of merger and acquisition (M&A) activity owing to the high degree of competitive rivalry amongst key players and its consolidated nature.

The market is also subject to low levels of regulatory scrutiny. However, end-users such as medical devices and pharmaceuticals are subjected to high regulatory scrutiny for specifications of devices and chemical composition of various drugs. The number of substitutes for iodine is limited. For instance, in the pharmaceutical industry, iodine is preferred as an antiseptic owing to its non-toxic nature and widespread availability, as compared to other chemicals such as picloxydine, tobramycin, polyhexanide, and chlorhexidine.

End user concentration is a significant factor in the market, since iodine is a common agent used across industries such as medical imaging, chemicals, pharmaceuticals, and animal feeds. This concentration further has an influence on market dynamics and trends.

Source Insights

The caliche ore segment dominated the market with the highest revenue share of over 48.0% in 2023. This trend is anticipated to continue over the forecast period. This is available in abundance in Chile, where large volumes of iodine are extracted and processed for commercial use. Sociedad Quimica y Minera de Chile SA and Albemarle are key mining companies that process caliche ore in CSA and North America, respectively.

Caliche ore is widely available, especially in arid regions, easily extracted, and cost-effective. It is also known as calcrete, duricrust, or hardpan. It is a shallow layer of soil or sediment in which particles are cemented together by minerals, such as calcium carbonate, that have precipitated in interstitial spaces.

Underground brines accounted for the second highest share in 2023. The main reserves of brines are in Chile, Japan, USA, CIS, and Indonesia, and are mainly associated with natural gas and oil deposits found in these regions. It is the most widely used technique for iodine production, however, volumes associated with caliche ore extraction are the highest in the world.

End-use Insights

Based on end-use, the medical imaging segment accounted for the highest revenue share in 2023. This constituted the x-ray contrast media or medical imaging devices that are used in diagnostics such as x-ray, angiography and CT scans. Iodinated contrast media contain iodine atoms for imaging modalities. It is a preferred contrasting agent since its k-shell binding energy is similar to the average energy of X-rays used in radiography.

Chemicals that include iodophors, biocides, and fluorochemicals accounted for a combined revenue share of about 21.0% in 2023. Iodophors are a preparation of iodine and an organic molecule, such as a polymer, from which the latter gets gradually released. It is widely used in the dairy industry and in breweries as a disinfectant.

Biocides are chemicals that destroy or render inactive, any harmful microorganism. They are widely used in the food & beverage industry. Iodine is also used in the synthesis of fluorochemicals, which are chemical compounds that contain fluorine. The increasing usage of these chemicals in various end use industries is anticipated to boost growth during the forecast period.

Regional Insights

North America accounted for a revenue share of about 24.0% in 2023. It is anticipated to be driven by the increasing demand for medical imaging devices.

U.S. Iodine Market Trends

The iodine market in the U.S. accounted for about 73.0% of the region's demand in 2023. Rising demand in the U.S. for iodine has been attributed to increased usage of thyroxine medicines to correct thyroid deficiencies.

Europe Iodine Market Trends

The iodine market of Europe accounted for the largest revenue share of over 36% in 2023, owing to the growth in the medical imaging devices and pharmaceutical industries.

Germany iodine market witnessed the highest CAGR in Europe in 2023. Rising usage of medical imaging devices and production of animal feeds is anticipated to boost demand in the country.

Asia Pacific Iodine Market Trends

APAC accounted for the second largest revenue share of about 32% in 2023. Increased emphasis on the domestic pharmaceutical industry and agriculture is anticipated to drive demand.

China iodine market accounted for the highest revenue share in APAC in 2023. The increased government emphasis on key growth industries to offset the economic downturn arising out of the Evergrande debt is likely to boost demand.

The iodine market of India is anticipated to be driven by the Make In India policy, with manufacturing of medical imaging devices and chemicals gaining momentum. Further, the production of animal feeds is also expected to drive growth.

Central & South America Iodine Market Trends

The growth in the usage of X-ray contrast media in medical imaging and animal feeds are anticipated to boost the iodine market in the region.

Brazil iodine market witnessed the highest revenue CAGR in the region during 2023. Increasing manufacturing of chemicals and animal feeds is anticipated to contribute to growth.

Middle East & Africa Iodine Market Trends

The region is investing in boosting its economy and divesting from an oil-based economy. Governments are focusing their efforts on building various key industries such as chemicals and pharmaceuticals.

KSA iodine market accounted for the highest revenue share in 2023. The market is in a growth stage, while the country develops its petrochemical and pharmaceutical industries, as part of its Vision 2030 objective.

Key Iodine Company Insights

The landscape is very competitive and concentrated as well. Key players have been devising strategies such as expanding market share, investing in R&D, and undertaking mergers & acquisitions.

Market players compete against product quality, reliability in terms of supply and customer service, and diversity in product portfolio. Furthermore, key end users are investing in expanding their capacity, which offers exciting opportunities for the iodine market. For instance, in December 2023, India-based Piramal Pharma announced its plans to invest around INR 1,000 crore (~USD 120.0 million) for its brownfield expansion plans that would increase medicine production across all its business verticals.

Some of the key players operating in the market include Iochem Corporation, Itochu Chemical Frontier Corporation and Cosayach

-

Iochem Corporation is a U.S.-based producer of medical grade iodine. It produces prilled, flaked, resublimed, and recycled iodine that is used in various medical applications such as angiogram contrast dyes and antiseptics for the dairy industry.

-

Itochu Chemical Frontier Corporation is a Japan-based manufacturer of chemical products including solvents, acrylics, urethanes, agricultural, chemical and feed additives.

-

Cosayach is a Chile-based producer of iodine by the blow-out technique from caliche ore. It also produces nitrates and iosalts.

NIPPOH CHEMICALS CO., LTD and Iofina are some emerging market participants.

-

NIPPOH CHEMICALS CO., LTD is a Japan-based manufacturer of fine chemicals that produces iodine, bromine, chlorine, aromatic amino, and cyano compounds. It produces iodine through the blowing-out process. In addition, it engages in the recovery of iodine from industrial waste.

-

Iofina is a UK-based vertically integrated producer of specialty chemical derivatives including iodine and non-iodine products. It extracts iodine from brine solutions produced in oil and gas fields.

Key Iodine Companies:

The following are the leading companies in the iodine market. These companies collectively hold the largest market share and dictate industry trends.

- ACF Minera SA

- Cosayach

- Glide Chem Private Limited

- GODO SHIGEN Co. Ltd

- Iochem Corporation

- Iofina

- ISE Chemicals Corporation

- Itochu Chemical Frontier Corporation

- Kanto Natural Gas Development Co. Ltd

- NIPPOH CHEMICALS CO., LTD

Recent Developments

-

In October 2023, Iofina announced its plans to construct its 10th new iodine extraction plant in a new location in Oklahoma.

-

In June 2023, Iofina commissioned its 6th iodine extraction plant in Oklahoma that uses its proprietary production technology. It ramped up production in the following weeks. The company benefitted from the high iodine prices prevailing throughout the year and hence increased its profitability in 2023.

-

In May 2023, Germany-based REMONDIS SE & Co. KG commissioned a new plant for the recovery of iodine from flue gas produced from the incineration of hazardous waste to promote its sustainability goals for the circular economy.

Iodine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.75 billion

Revenue forecast in 2030

USD 4.88 billion

Growth Rate

CAGR of 4.4% from 2024 to 2030

Base year

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

May 2024

Quantitative units

Revenue in USD million/billion; Volume in tons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, company profiles, and trends

Segments covered

Source, end-use, and region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Central & South America

Country Scope

U.S.; Germany; France; Italy; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

ACF Minera SA; Cosayach; Glide Chem Private Limited; GODO SHIGEN Co. Ltd; Iochem Corporation; Iofina; ISE Chemicals Corporation; Itochu Chemical Frontier Corporation; Kanto Natural Gas Development Co. Ltd; NIPPOH CHEMICALS CO. LTD

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Iodine Market Report Segmentation

This report forecasts revenue and volume growth at the country and regional level and provides an analysis of the latest industry trends and opportunities in source and end-use segments from 2018 to 2030. For this study, Grand View Research has segmented the global iodine market report based on source, end-use, and region:

-

Source Outlook (Volume, Tons; Revenue, USD Billion, 2018 - 2030)

-

Caliche Ore

-

Underground Brines

-

Recycling

-

Seaweed

-

-

End-use Outlook (Volume, Tons; Revenue, USD Billion, 2018 - 2030)

-

Pharmaceuticals

-

Animal Feed

-

Medical Imaging

-

Chemicals

-

Others

-

-

Region Outlook (Volume, Tons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global iodine market was estimated at USD 3.58 billion in 2023 and is expected to reach USD 3.75 billion in 2024.

b. The global iodine market is anticipated to grow at a compound annual growth rate of 4.4% from 2024 to 2030 to reach USD 4.88 billion by 2030.

b. Based on source, caliche ore held the largest revenue share of over 48.0% in 2023 owing to its cost effectiveness and established production process.

b. Some of the key players are ACF Minera SA, Cosayach, Glide Chem Private Limited, GODO SHIGEN Co. Ltd, Iochem Corporation, Iofina, ISE Chemicals Corporation, Itochu Chemical Frontier Corporation, Kanto Natural Gas Development Co. Ltd, NIPPOH CHEMICALS CO. LTD, among others.

b. The growing demand for thyroid hormones, requirement for fortified animal feed, and increasing usage of medical imaging devices are anticipated to drive the iodine market over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.