IO-Link Market Size, Share & Trends Analysis Report By Technology (IO-Link Wired, IO-Link Wireless), By Component (IO-Link Masters, IO-Link Devices), By End-use, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-396-9

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

IO-Link Market Size & Trends

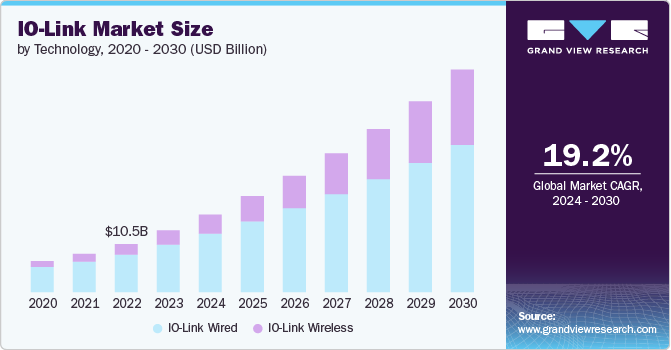

The global IO-Link market size was estimated at USD 13.51 billion in 2023 and is expected to grow at a CAGR of 19.2% from 2024 to 2030. The market is experiencing a surge in adoption within industrial automation owing to the growing demand for increased communication between sensors and actuators. This technology allows for seamless data exchange, improving the efficiency and reliability of industrial processes. The trend towards smart factories and Industry 4.0 is driving the demand for IO-Link systems, as they enable real-time data monitoring and predictive maintenance, reducing downtime and operational costs.

The integration of IO-Link technology into IIoT applications is a significant trend driving the market. IO-Link’s ability to facilitate two-way communication between devices and control systems is crucial for implementing advanced IIoT solutions. This technology supports the collection and analysis of data from various sensors, enhancing decision-making processes and operational efficiency. As industries increasingly adopt IIoT to streamline operations, the demand for IO-Link is expected to grow.

The automotive sector is a key driver of the market, with manufacturers leveraging this technology to enhance production line automation. IO-Link systems help in monitoring and controlling various manufacturing processes, ensuring higher precision and quality. The trend towards electric and autonomous vehicles is further boosting the demand for advanced automation solutions, including IO-Link, to maintain competitive production standards and meet stringent quality requirements.

Recent advancements in IO-Link wireless technology are opening new opportunities for the market. Wireless IO-Link systems eliminate the need for complex wiring, reducing installation costs and enhancing flexibility in industrial setups. This trend is particularly beneficial in applications where cabling is impractical or costly, such as rotating machinery or mobile equipment. The development of robust and reliable wireless IO-Link solutions is expected to drive market growth significantly.

Moreover, the food and beverage industry are increasingly adopting IO-Link technology to improve production efficiency and ensure compliance with stringent safety standards. IO-Link systems enable precise control and monitoring of processing equipment, ensuring product quality and consistency. The trend towards automation in this industry, driven by the need for high hygiene standards and traceability, is expected to fuel the growth of the market.

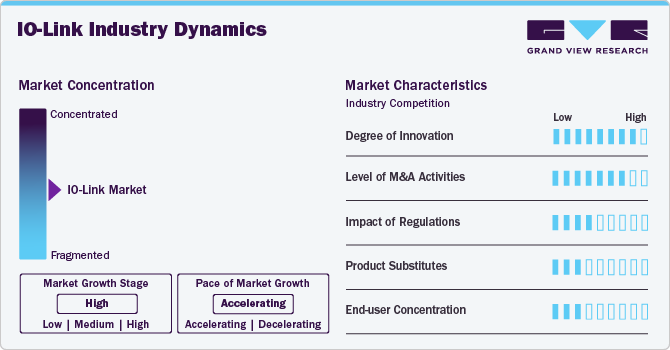

Market Concentration & Characteristics

The degree of innovation in the market is high due to continuous advancements in communication technology and integration capabilities. IO-Link is a cutting-edge, standardized communication protocol that enhances data exchange between sensors, actuators, and control systems, making it integral to the development of smart factories and Industry 4.0. The ongoing innovations in wireless IO-Link technology, increased compatibility with Industrial Internet of Things (IIoT) applications, and advancements in real-time data monitoring and predictive maintenance are driving this high degree of innovation, positioning IO-Link as a key enabler of modern industrial automation.

The level of mergers and acquisitions in the market is high. This trend is driven by companies seeking to enhance their product portfolios, expand their market reach, and gain competitive advantages in the rapidly growing industrial automation sector. Large industry players are acquiring smaller, innovative firms specializing in IO-Link technologies to integrate advanced capabilities and improve their overall solutions. Additionally, strategic partnerships and collaborations are common as companies aim to leverage complementary strengths, accelerate innovation, and address the increasing demand for smart manufacturing solutions.

The impact of regulation on the market is moderate. While there are industry standards and compliance requirements that companies must adhere to, such as those related to safety, interoperability, and data security, these regulations are generally supportive of innovation rather than restrictive. Regulatory bodies often promote the adoption of standardized protocols like IO-Link to ensure compatibility and reliability across different systems and devices. This regulatory environment encourages the growth of the market by fostering a consistent and reliable framework for industrial automation, though it requires continuous updates and compliance efforts from market participants.

The level of product substitutes in the market is low. IO-Link offers unique advantages, such as seamless communication between sensors, actuators, and control systems, which are not easily replicated by alternative technologies. While other industrial communication protocols exist, IO-Link's standardization, ease of integration, and ability to enhance data exchange and diagnostics make it a preferred choice for modern industrial automation and smart manufacturing environments. The specialized nature and distinct benefits of IO-Link technology result in a lower threat from substitute products, solidifying its position in the market.

The end-user concentration in the market is low due to its broad applicability across various industries. IO-Link technology is utilized in a wide range of sectors, including manufacturing, automotive, pharmaceuticals, food and beverage, and consumer electronics, among others. This widespread adoption reduces the concentration of end-users, as no single industry or group of companies dominates the market.

Technology Insights

The IO-Link wired segment dominated the market in 2023 with a market share of over 76%, due to its reliability, stability, and widespread acceptance in industrial automation. Wired IO-Link systems offer consistent data transmission without interference, which is critical for maintaining the efficiency and accuracy of industrial processes. Additionally, the well-established infrastructure for wired connections and the ease of integration with existing systems have made it the preferred choice for many industries, contributing to its significant market share.

The IO-Link wireless segment is expected to record a significant CAGR of over 25% from 2024 to 2030, due to the increasing demand for flexible and scalable automation solutions. Wireless IO-Link technology offers numerous advantages, including reduced installation costs, enhanced mobility, and the ability to connect devices in hard-to-reach or hazardous areas. As industries continue to adopt smart manufacturing practices and the Industrial Internet of Things (IIoT), the need for wireless solutions that enable seamless and real-time communication between devices is driving the rapid growth of this segment.

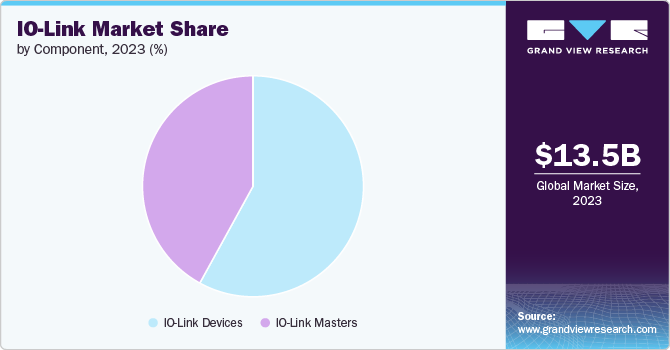

Component Insights

The IO-Link devices segment held the highest revenue share in 2023, owing to their widespread adoption in industrial automation and smart manufacturing. IO-Link devices, such as sensors and actuators, are integral to achieving efficient and intelligent production processes. Their ability to provide detailed data and diagnostics, improve machine performance, and reduce downtime makes them highly valuable to end-users. As industries increasingly prioritize operational efficiency and predictive maintenance, the demand for IO-Link devices continues to surge, solidifying their dominant market position.

The IO-Link masters segment is estimated to register the highest growth rate from 2024 to 2030, owing to its critical role in facilitating communication between IO-Link devices and the broader automation system. The increasing adoption of Industry 4.0 and the need for more sophisticated control and monitoring capabilities are driving the demand for IO-Link masters, leading to their significant growth prospects.

End-use Insights

The manufacturing segment held the highest revenue share in 2023, due to its extensive use of IO-Link technology for optimizing production processes and improving operational efficiency. In manufacturing, IO-Link systems enable precise control, real-time monitoring, and seamless communication between devices, which are crucial for maintaining high productivity and quality standards. The ability of IO-Link to provide detailed diagnostics and facilitate predictive maintenance has made it indispensable in modern manufacturing environments, leading to its dominant revenue share in this sector.

The oil & gas segment is estimated to register the highest growth rate from 2024 to 2030, owing to the sector's increasing need for advanced automation and real-time data monitoring to enhance safety and operational efficiency. IO-Link technology provides reliable, accurate data and diagnostics, which are crucial for managing complex and hazardous environments typical in oil and gas operations. As the industry focuses on optimizing processes, reducing downtime, and improving safety protocols, the adoption of IO-Link solutions is expected to rise, driving significant growth in this segment.

Application Insights

The monitoring segment accounted for the highest market share in 2023, driven by the growing emphasis on real-time data collection and analysis for operational efficiency and predictive maintenance. IO-Link technology excels in providing detailed, actionable insights from sensors and devices, which are crucial for the effective monitoring of machinery and processes. The ability to detect anomalies, prevent downtime, and ensure optimal performance has made monitoring applications highly valuable across various industries, contributing to their dominant market share.

The predictive maintenance segment is anticipated to expand at a significant CAGR from 2024 to 2030, due to the increasing need for minimizing unplanned downtime and reducing maintenance costs. IO-Link technology provides real-time data and analytics that allow for accurate prediction of equipment failures before they occur. This proactive approach enhances operational efficiency and extends equipment lifespan, aligning with the broader industry trend towards more intelligent and data-driven maintenance strategies. Therefore, the demand for predictive maintenance solutions driven by IO-Link is expected to grow rapidly.

Regional Insights

The IO-Link market in North America accounted for a significant revenue share of over 33% in 2023, due to the region's advanced industrial infrastructure and high adoption rates of automation technologies. The U.S. and Canada are leading in the implementation of Industry 4.0 practices, driven by their emphasis on enhancing manufacturing efficiency and integrating smart technologies. Investments in modernizing production processes and the increasing demand for real-time data and predictive maintenance solutions have further accelerated the growth of IO-Link systems.

U.S. IO-Link Market Trends

The U.S. IO-Link market is anticipated to grow at a CAGR of over 16% from 2024 to 2030. In the U.S., the adoption of IO-Link is fueled by significant investments in manufacturing automation and the increasing need for real-time data and predictive maintenance solutions.

Asia Pacific IO-Link Market Trends

The IO-Link market in Asia Pacific accounted for a significant revenue share of over 27% in 2023. The region's growing focus on automation, smart factories, and connected devices, combined with increasing government support for industrial modernization and digital transformation, has fueled the expansion of IO-Link systems. Additionally, the rising demand for predictive maintenance and real-time monitoring in key industries like automotive, electronics, and pharmaceuticals has further contributed to the market growth in Asia Pacific.

India IO-Link market is estimated to record the highest growth rate from 2024 to 2030, due to the growing focus on industrial automation and digital transformation across various industries, driving the adoption of IO-Link solutions.

The IO-Link market in China is projected to grow at a CAGR from 2024 to 2030. China’s market growth is fueled by its large-scale industrial sector, aggressive automation initiatives, and government policies supporting smart manufacturing technologies.

Japan IO-Link market is projected to grow at a CAGR from 2024 to 2030. Japan’s market growth is supported by its advanced technological infrastructure and the strong presence of automation and robotics in its manufacturing sector.

Europe IO-Link Market Trends

The IO-Link market in Europe is anticipated to register a CAGR of around 17% from 2024 to 2030, Europe’s market growth is supported by stringent regulations and standards promoting industrial efficiency and the widespread adoption of Industry 4.0 technologies.

U.K. IO-Link market is projected to grow at a CAGR from 2024 to 2030, driven by its push towards modernization in manufacturing and infrastructure sectors, embracing advanced automation and monitoring solutions.

The IO-Link market in Germany is estimated to record a CAGR from 2024 to 2030. Germany leads in IO-Link adoption due to its robust manufacturing sector and a strong focus on innovative automation technologies and smart factory solutions.

Middle East & Africa (MEA) IO-Link Market Trends

Middle East and Africa (MEA) IO-Link market is anticipated to grow at the highest CAGR of around 20% from 2024 to 2030, driven by increasing investments in infrastructure and industrial projects, along with a rising demand for advanced monitoring and maintenance technologies.

The IO-Link market in Saudi Arabia accounted for a considerable revenue share in 2023, fueled by significant investments in the modernization of its oil and gas sector, alongside other industrial sectors, aiming to enhance efficiency and operational performance.

Key IO-Link Company Insights

Some of the key players operating in the market are Siemens AG and Rockwell Automation Inc. and among others.

-

Siemens AG offers a comprehensive range of products and solutions, including advanced IO-Link technologies. With a strong emphasis on innovation and efficiency, the company leverages its extensive expertise in automation to provide integrated solutions for industries worldwide. The company’s cutting-edge technologies and global presence make it a key player in driving the evolution of industrial automation.

-

Rockwell Automation Inc. is renowned for its advanced technologies and solutions that enhance operational efficiency and productivity. Specializing in control systems, software, and IO-Link solutions, the company offers robust and scalable products that cater to diverse industrial needs. Its commitment to innovation and customer support has solidified its position as a leading force in the automation industry.

Datalogic S.p.A., and Belden Inc. are some of the emerging market participants in the market.

-

Datalogic S.p.A. provides automatic data capture and industrial automation solutions. Specializing in barcode readers, mobile computers, and vision systems, the company delivers innovative IO-Link technologies that enhance operational efficiency and accuracy. The company’s focus on high-quality products and technological advancements positions it as a key player in the automation and data capture markets.

-

Belden Inc. is in the industrial automation and networking solutions sector, known for its comprehensive portfolio of connectivity and networking products. The company’s IO-Link solutions, part of its broader industrial communication offerings, cater to the needs of modern automation systems. With a strong emphasis on reliability and performance, Belden supports various industries in achieving efficient and secure network connectivity.

Key IO-Link Companies:

The following are the leading companies in the IO-link market. These companies collectively hold the largest market share and dictate industry trends.

- Balluff Automation India Pvt. Ltd.

- Beckhoff Automation GmbH & Co. KG

- Belden Inc.

- Bosch Rexroth Corporation

- Datalogic S.p.A.

- Emerson Electric Co.

- OMRON Corporation

- Rockwell Automation Inc.

- SICK AG

- Siemens AG

Recent Developments

-

In May 2024, Balluff Automation India Pvt. Ltd. introduced a new line of wireless IO-Link communication products, including hubs, bridges, and network blocks, designed to streamline automation and field I/O device connectivity. This wireless system operates on the 2.4 GHz band, offering high-speed data transfer with minimal latency and reducing the need for extensive cabling, which simplifies installation and reconfiguration.

-

In February 2024, Belden Inc. unveiled a range of new solutions designed to improve connectivity, enhance speed, and boost power in critical environments. The latest releases include a new LioN-X IO-Link Hub from Lumberg Automation, advanced I/O Plenum Stadium Cables and Access Control Cables, and upgrades to Belden’s REVConnect Connectivity System. Additionally, the company has enhanced its Belden Horizon Console and Hirschmann Industrial HiVision software, alongside updates to its BXP Managed Switches.

-

In August 2023, Emerson Electric Co. launched a new Class A IO-Link master for its AVENTICS Series G3 Fieldbus platform, offering an affordable solution for connecting smart and analog sensors. The G3 IO-Link Master is designed for machine systems with numerous sensors and pneumatic valves, ensuring dependable digital data communication between field devices and machine controllers.

IO-Link Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 16.94 billion |

|

Revenue forecast in 2030 |

USD 48.57 billion |

|

Growth rate |

CAGR of 19.2% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Technology, component, end use, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Balluff Automation India Pvt. Ltd.; Beckhoff Automation GmbH & Co. KG; Belden Inc.; Bosch Rexroth Corporation; Datalogic S.p.A.; Emerson Electric Co.; OMRON Corporation; Rockwell Automation Inc.; SICK AG; Siemens AG |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global IO-Link Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global IO-Link market report based on technology, component, end-use, application, and region.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

IO-Link Wired

-

IO-Link Wireless

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

IO-Link Masters

-

PROFINET

-

EtherNet/IP

-

Modbus-TCP

-

EtherCAT

-

Multiprotocol

-

Others

-

-

IO-Link Devices

-

Sensor Nodes

-

Modules

-

Actuators

-

Others

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Aerospace & Defense

-

Automotive

-

Manufacturing

-

Electronics & Semiconductors

-

F&B (Food & Beverages)

-

Pharmaceuticals

-

Chemicals

-

Oil & Gas

-

Packaging

-

Utilities

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Monitoring

-

Predictive Maintenance

-

Process Automation

-

Quality Control

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global IO-Link market size was estimated at USD 13,517.8 million in 2023 and is expected to reach USD 16,948.8 million in 2024.

b. The global IO-Link market is expected to grow at a compound annual growth rate of 19.2% from 2024 to 2030 to reach USD 48,579.6 million by 2030.

b. The IO-Link market in North America accounted for a significant revenue share of over 33% in 2023, driven by the region's advanced industrial infrastructure and high adoption rates of automation technologies.

b. Some key players operating in the IO-Link market include Balluff Automation India Pvt. Ltd., Beckhoff Automation GmbH & Co. KG, Belden Inc., Bosch Rexroth Corporation, Datalogic S.p.A., Emerson Electric Co., OMRON Corporation, Rockwell Automation Inc., SICK AG, Siemens AG

b. Key factors that are driving IO-Link market growth include the growing need for enhanced communication between sensors and actuators, trend towards smart factories and Industry 4.0 as well as the integration of IO-Link technology into IIoT applications.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."