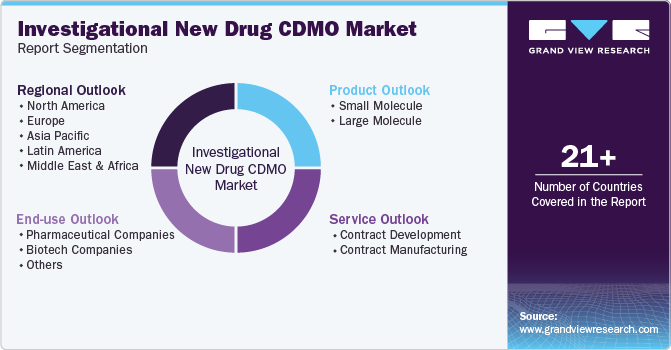

Investigational New Drug CDMO Market Size, Share & Trends Analysis Report By Product (Small Molecule, Large Molecule), By Service (Upstream, Downstream), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-537-3

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

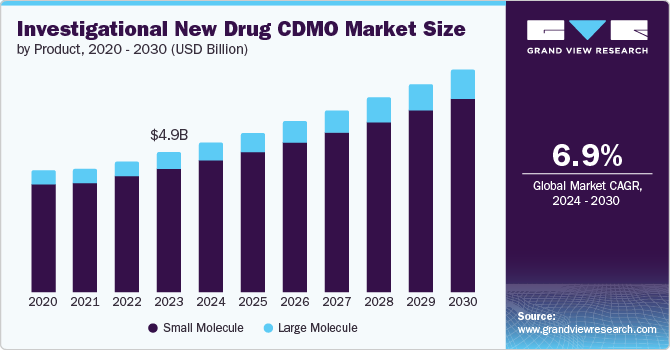

The global investigational new drug CDMO market size was valued at USD 4.88 billion in 2023 and is expected to grow at a CAGR of 6.9% from 2024 to 2030. Pharmaceutical companies' significant use of outsourcing services, increased spending on research and development, and stricter laws governing clinical study conduct can all be credited with the market's growth.

The globali sing world with health-care needs more new drugs and therapies. Among them the rise in incidences of chronic diseases, evolution of the population with extensive aging, the development of new diseases requires new treatment options. Consequently, the number of Investigational New Drugs (IND) has continued to increase and this is accompanied by the need to seek the services of CDMOs in managing the development process.

The industry is increasingly experiencing pressure to get treatments to the patients faster due to recent improvements in the technologies hence faster drug discovery and development. The capability to complete IND development efficiently and quickly is an advantage for CDMOs within this market.

Product Insights & Trends

Small molecule dominated the market and accounted for a share of 88.4% in 2023. This high percentage can be attributed to small molecules that constitutes more than 90% of the drugs currently in the market. Their simpler structure allows for easier development, potentially lower production complexities, and faster R&D, making them a cost-effective choice for pharmaceutical companies.

Large molecule is expected to register the fastest CAGR during the forecast period. This is mostly because large molecule therapeutic proteins are more specific than smaller molecules, making it possible to target previously hard-to-treat disease states such as oncology, neurology, and metabolic disease. As a result, pharmaceutical and biotech companies have been investing more in the discovery and development of large molecule therapeutic proteins.

Service Insights & Trends

Contract development accounted for the largest market revenue share in 2023. The segment is also projected to expand at the fastest CAGR during the forecast period. Compared to internal drug development, contract development has a number of advantages, including cost-effectiveness, faster time to market, access to industry expertise, and a stronger emphasis on key capabilities. Due to a lack of internal resources, the majority of small pharmaceutical and biopharmaceutical businesses chose to outsource their drug development operations.

The contract manufacturing segment is anticipated to witness lucrative growth over the forecast period. The sponsor companies that are creating the treatments are under tremendous pressure to reduce expenses and expedite the approval process for the market. The cost and duration of a drug development programme can be significantly impacted by various factors, such as manufacturing strategy and execution, even if safety and efficacy ultimately determine a new medicine's success. Therefore, it is crucial that a sponsor choose a CMO who is fully conversant with the IND submission procedure.

End-use Insights

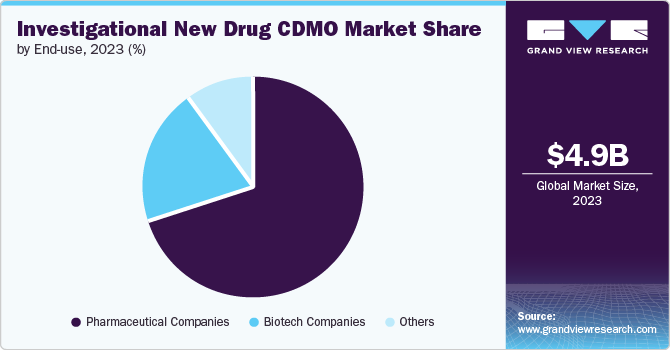

The Pharmaceuticals companies dominated the market in 2023. This can be attributed to the increasing investments in the pharmaceutical sector. There are roughly 7,000 different rare diseases that affect 350 million people worldwide, and more research is being done than ever before.

The biotic firms is projected to grow at the fastest CAGR over the forecast period. The basic research is done both alone and in conjunction with scientists and other members of the biomedical research ecosystem from different backgrounds, including venture capital, pre-competitive consortia, patient organisations, and illness foundations. It has a protracted development phase that is particular to the industry. The typical timeframe for a new medicine to go from IND submission to market entry after receiving regulatory approval is eight years.

Regional Insights

North America held the largest share of 43.3% in 2023. This can be attributed to money that pharmaceutical and life sciences firms are spending on research and development, which is anticipated to increase the need for contract manufacturing in the area.

U.S. Investigational New Drug CDMO Market Trends

The investigational new drug CDMO market in the U.S. dominated the market with a share of 80.6% in 2023 due to U.S. has a well-established pharmaceutical industry with a strong focus on innovation leading to high demand.

Asia Pacific Investigational New Drug CDMO Market Trends

Asia Pacific is anticipated to register the fastest growth rate of 7.8% throughout the forecast period. This surge is due to booming pharmaceutical industries, government support for R&D, cost-effective manufacturing, a massive patient pool for trials, and a rapidly growing scientific workforce. These factors position Asia Pacific as a prime location for developing the next generation of life-saving drugs.

China investigational new drug CDMO market held a substantial market share in 2023 owing to its lower operational cost as compared to established markets, offering cost-effective solutions for CDMO services.

Key Investigational New Drug CDMO Company Insights

A variety of strategic initiatives, including new partnership agreements, collaborations, and mergers & acquisitions, are being carried out by market participants in an effort to obtain a competitive edge by expanding their services and manufacturing services.

-

IQVIA Holdings Inc, is a contract research organization (CRO) providing outsourced services to the healthcare industry. They design and conduct clinical trials and studies to support the development and commercialization of drugs, biologics, and medical devices.

-

Thermo Fisher Scientific Inc. offers a wide range of instruments, consumables, and services for research, healthcare, and education. With a global presence, the company supports advancements across various scientific fields.

Key Investigational New Drug CDMO Companies:

The following are the leading companies in the investigational new drug CDMO market. These companies collectively hold the largest market share and dictate industry trends.

- Catalent, Inc.

- Lonza

- Recipharm AB

- Siegfried Holding AG

- Patheon Inc.

- Covance

- IQVIA Holdings Inc.

- Cambrex Corporation

- Charles River Laboratories International, Inc.

- Syneous Health

Recent Developments

-

In April 2024, Recipharm announced that they are selling seven of its manufacturing sites to private equity firm Blue Wolf Capital. This is likely to allow Recipharm to focus on its core business of developing and manufacturing drugs, especially new drugs and high potency drugs.

-

In March 2024, Cambrex, a drug development and manufacturing company announced that they are nearing completion of a USD 100 million investment plan a year ahead of schedule. This is anticipated to add 150,000 square feet of manufacturing space and new technologies across North America and Europe. The expansion is expected to allow them to better support the development of complex drugs and improve patient health.

-

In March, 2024 Lonza signed an agreement for the acquisition of the manufacturing facility of Genentech in Vacaville, U.S. from Roche for USD 1.2 billion. This is expected to significantly increase Lonza's capacity to produce biologic drugs and expand their presence in the U.S. Lonza plans to invest an additional USD 500 million to upgrade the facility and meet the demand for next-generation biologic therapies.

-

In February 2024, Novo Holdings, acquired Catalent for USD16.5 billion. This deal is expected to allow Novo Holdings to leverage Catalent's expertise in developing and supplying drugs while Novo Nordisk is set to acquire three of Catalent's manufacturing sites.

Investigational New Drug CDMO Market Report Scope

|

Report Attribute |

Details |

|

Market Size value in 2024 |

USD 5.21 billion |

|

Revenue forecast in 2030 |

USD 7.79 billion |

|

Growth rate |

CAGR of 6.9% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, service, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Lonza; Catalent,Inc; Recipharm AB; Siegfried Holding AG; Thermo Fisher Scientific Inc.; Charles River Laboratories; Cambrex Corporation;IQVIA Inc,; Syneous Health |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Investigational New Drug CDMO Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global investigational new drug CDMO market report on the basis of product, service, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Molecule

-

Large Molecule

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Contract Development

-

Small Molecule

-

Bioanalysis and DMPK Studies

-

Toxicology Testing

-

Pathology and Safety Pharmacology Studies

-

Drug Substance Synthetic Route Development

-

Drug Substance Process Development

-

Form Selection Crystallization Process Development

-

Scale-up of Drug Substance

-

Pre Formulation

-

Preclinical Formulation Selection

-

First In Man Formulation/ Process Development

-

Analytical Method Development / Validation

-

Release Testing of Drug Substance and Drug Product

-

Work Up Purification Steps

-

Telescoping & Process Refining

-

Initial Optimization

-

Formal Stability of Drug Substance and Drug Product

-

-

Large Molecule

-

Cell Line Development

-

Process Development

-

Upstream

-

Microbial

-

Mammalian

-

Others

-

-

Downstream

-

MABs

-

Recombinant Proteins

-

Others

-

-

-

-

-

Contract Manufacturing

-

Small Molecule

-

Oral Solids

-

Liquid and Semi-solids

-

Injectables

-

Others

-

-

Large Molecule

-

MABs

-

Recombinant Proteins

-

Others

-

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical Companies

-

Biotech Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."