- Home

- »

- Advanced Interior Materials

- »

-

Inverter Welding Equipment Market Size, Share Report, 2030GVR Report cover

![Inverter Welding Equipment Market Size, Share & Trends Report]()

Inverter Welding Equipment Market Size, Share & Trends Analysis Report By Type, (Manual Arc Welding, Mechanized Arc Welding), By Region (Asia Pacific, North America), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-481-8

- Number of Report Pages: 114

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Inverter Welding Equipment Market Trends

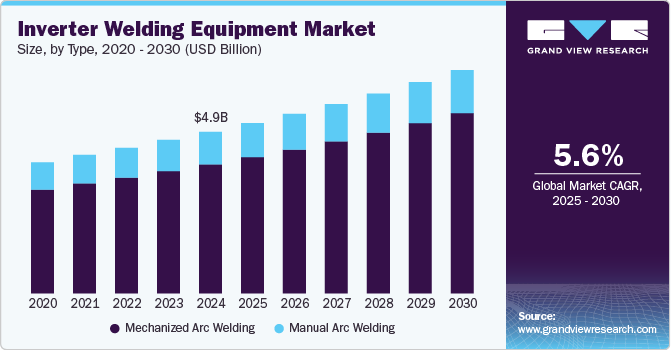

The global inverter welding equipment market size was estimated at USD 4.95 billion in 2024 and is anticipated to grow at a CAGR of 5.6% from 2025 to 2030. The global market is witnessing steady growth, driven by the widespread adoption of inverter welding equipment across the automotive, construction, shipbuilding, and aerospace industries. Additionally, the rising focus on sustainable manufacturing processes and reducing operational costs has contributed to the growth of this market.

The growing adoption of inverter welding equipment in the automotive industry is driving market growth. Inverter technology ensures precise control of spot-welding parameters with rapid response times, enhancing weld quality and efficiency. It also offers an improved power factor, reduced energy consumption, and superior weld appearance & strength owing to significantly shorter operation times.

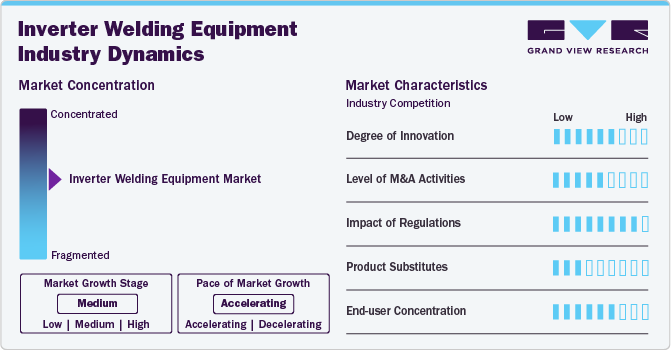

Market Concentration & Characteristics

The inverter welding equipment market exhibits a moderate level of concentration, characterized by a blend of established domestic manufacturers and prominent global players. Leading brands dominate the landscape by leveraging their strong brand reputation, extensive distribution networks, and comprehensive service offerings. The participation of international manufacturers has notably influenced market dynamics, introducing technological innovations and competitive pricing strategies that enhance the overall landscape.

This competitive environment compels companies to invest continuously in research and development, striving to deliver reliable, energy-efficient, and advanced inverter welding solutions that cater to the diverse needs of industrial and commercial clients. Notably, the demand for inverter welding equipment is on the rise, driven by economic growth, increased construction and manufacturing activities, and a heightened need for versatile and efficient welding solutions across various applications.

Market characteristics reveal a growing trend toward energy-efficient and environmentally friendly welding equipment, supported by regulatory frameworks aimed at promoting sustainability and minimizing operational costs. This shift not only improves operational efficiency but also aligns with broader goals of environmental responsibility within the industry. Overall, the North American inverter welding equipment market is evolving, emphasizing innovation, efficiency, and sustainability.

Drivers, Opportunities & Restraints

One of the primary drivers for the market is the growing demand for lightweight and portable welding solutions across various industries. As sectors such as construction, automotive, and manufacturing seek more efficient and flexible welding options, inverter equipment offers superior mobility and ease of use. Additionally, advancements in inverter technology have enhanced performance, making these tools suitable for a wide range of applications, thus fueling market growth.

A notable restraint in the inverter welding equipment market is the initial high cost of advanced inverter systems compared to traditional welding machines. Small and medium-sized enterprises may find it challenging to justify the investment required for these sophisticated tools, especially when cheaper alternatives are available. This financial barrier can limit the adoption of inverter technology, particularly in cost-sensitive industries.

The increasing emphasis on automation and smart manufacturing presents a significant opportunity for the inverter welding equipment market. With the integration of robotics and IoT technologies, there is potential for the development of intelligent welding systems that enhance precision and efficiency. Companies that innovate and adapt their inverter welding equipment to meet the demands of automation will likely find substantial growth prospects in this evolving landscape.

Type Insights

“The demand for the mechanized arc welding type segment is expected to grow at a notable CAGR of 5.8% from 2025 to 2030 in terms of revenue”

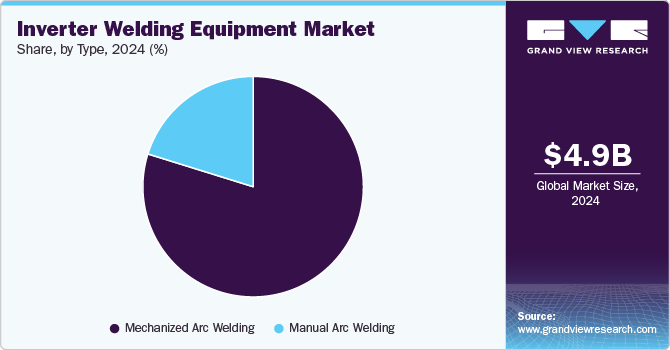

The mechanized arc welding segment dominated the market and accounted for 79.8% of the global revenue share in 2024. Mechanized arc welding brings automation to the welding process, improving efficiency, accuracy, and safety across various industries. By mechanizing aspects of welding such as angles, speed, and stick-out length, the process gains partial automation while still under the vigilant supervision of an operator. These adjustments can be made on the fly to ensure optimal performance.

Manual arc welding, also known as manual metal arc welding (MMAW) or shielded metal arc welding (SMAW), is a widely used fabrication process that creates an electric arc between a coated electrode and the workpiece to melt and fuse metals. Manual arc welding is favored in various industries owing to its flexibility, thereby allowing high-quality welds on thick materials. Moreover, it can used in various challenging environments, such as at heights or in confined spaces in shipyards or construction sites. The simplicity and minimal equipment requirements of this welding method also appeal to small- and medium-sized enterprises and hobbyists, as well as users in remote locations.

Regional Insights

“U.S. to witness market growth at 4.5% CAGR”

North America Inverter Welding Equipment Market Trends

North America inverter welding equipment market accounted for 25.2% of the global revenue share in 2024. The demand is projected to be driven by the growing usage of inverter welding equipment in key application industries, such as aerospace, automotive, oil & gas, and power generation. North America is witnessing rapid expansion owing to the industrial dynamism and easy availability of raw materials in its countries. In addition, the increasing number of oil & gas plants in the U.S. and Canada is anticipated to surge the demand and the requirement for inverter welding equipment in North America.

U.S. Inverter Welding Equipment Market Trends

The inverter welding equipment market in the U.S. is expected to grow at a CAGR of 4.5% from 2025 to 2030. As the U.S. is one of the prime automotive markets in North America, it witnesses high consumption of welding equipment by established players such as Ford, Toyota, GM, Nissan, and Chevrolet. Continuous improvements, development of innovative manufacturing methods, technological advancements, and application of standard and specific welding techniques are expected to help overcome the challenges and aid in the robust growth of the welding equipment market in the U.S.

Canada inverter welding equipment market is expected to grow at a CAGR of 4.9% from 2025 to 2030. Inverter welding equipment market in Canada is expected to grow at a significant rate during the forecast period owing to the rising demand for welding equipment from various end-use industries such as construction, automotive, and shipbuilding.

Europe Inverter Welding Equipment Market Trends

The inverter welding equipment market in Europe held a significant share in 2024. Europe is one of the largest producers of automobiles across the globe and attracts maximum foreign direct investment (FDI) in the automotive sector. Process innovation, improving R&D, and expansion of automobile production in countries such as Germany, the UK, and France are expected to fuel the growth of the automotive sector over the forecast period.

Germany's inverter welding equipment market held a 25.7% share in the European market. Germany is witnessing a rapidly expanding infrastructure as the government is increasingly investing in the development of transport and broadband infrastructure. In the 2030 Federal Transport Infrastructure Plan, the government has planned to invest USD 147.6 billion for the construction of roads till 2030 and allocate USD 74 billion for maintenance and replacement infrastructure. Welding is a key joining technology used for infrastructure development including rail tracks, bridges, and other steel structures.

The inverter welding equipment market in the UK held a substantial share of the Europe market. In the UK, an increase in the number of new industrial & commercial buildings and the output of the refurbishment market are boosting the growth of the inverter welding equipment market in the economy. Thus, the increasing utilization of metal panels in the roofing industry is propelling the demand for welding, which is majorly used for installation.

Asia Pacific Inverter Welding Equipment Market Trends

Asia Pacific dominated the market with a revenue share of 36.7% in 2024. According to the World Bank, Asia Pacific is the fastest-growing region in terms of both population and economic growth. Rapid urbanization, increased investments by governments, and rising consumer spending have boosted the Asian economy, thereby propelling infrastructure development in the construction industry. Economies such as China, India, and Japan are the key countries driving the development of the oil & gas, automotive, aviation, and building & construction industries in this region.

The inverter welding equipment market in China held a 48.5% share in the Asia Pacific market. Increased government spending on the One Belt, One Road (OBOR) project in China, wherein the Belt indicates a network of roadways and road implies sea routes, is projected to have a positive impact on infrastructural development in the country. This project involves the construction of a large network of maritime ports, roadways, railways, oil & gas pipelines, power grids, and associated infrastructure. Thus, increased government spending on such infrastructure development projects is expected to drive the demand for inverter welding equipment.

India inverter welding equipment market is expected to grow at a CAGR of 6.8% from 2025 to 2030. Expanding population and urbanization are likely to drive infrastructural development projects in India. Continuing economic development in the country is expected to trigger the growth of the construction market. The Indian construction industry is expected to exhibit significant growth owing to the high level of investments in energy projects under programs such as the National Skill Development Mission (NMSD), Atal Mission for Rejuvenation and Urban Transformation (AMRUT), 100 Smart Cities Mission, Make in India, and Power for all (PFA), which, in turn, are anticipated to have a positive impact on the product demand.

Middle East & Africa Inverter Welding Equipment Market Trends

The Middle East & Africa is projected to be emerging markets for inverter welding equipment over the forecast period on account of the rising number of civil engineering and commercial construction activities in the region, including the construction of stadiums and hotels. In December 2021, the UAE government launched a railways program worth USD 13.6 billion. The UAE railways initiative is expected to witness the construction of a 1200km rail network connecting the Saudi border to Fujairah. This investment in railroads is expected to open new market opportunities for inverter welding equipment manufacturers.

Saudi Arabia inverter welding equipment market does not have a substantial vehicle production base. The country's primary objective is to become the next automotive center in the Middle East. Despite being a significant importer of vehicles and auto parts, the government is currently striving to entice original equipment manufacturers (OEMs) to construct production units in the country to develop the domestic auto sector, which is anticipated to increase the demand for inverter welding equipment.

Latin America Inverter Welding Equipment Market Trends

The inverter welding equipment market in Latin America has been witnessing an inflow of new companies, particularly from North America in the region. Most of the manufacturing and construction companies based in North America are strategically orienting their investments in this region, specifically in Mexico and Brazil owing to the presence of excellent engineering, manufacturing, and servicing facilities in Latin America.

According to the National Agency for Petroleum, Natural Gas, and Biofuel, Brazil is expected to increase its oil production to over 5 million barrels of oil per day by 2027. In addition, the country requires multiple terminals and an extensive pipeline network to transport and store hydrocarbon-based products owing to their large size. These factors are expected to drive the demand for inverter welding equipment in Brazil as they are mainly used for joining oil-transporting pipelines.

Key Inverter Welding Equipment Company Insights

Some key players operating in the market include The Lincoln Electric Company, Miller Electric Mfg. LLC, and voestalpine Böhler Welding Group GmbH.

-

Lincoln Electric Holdings, Inc. offers development, design, and manufacturing of arc welding products, plasma, assembly & cutting systems, automated joining, and oxyfuel cutting equipment, and is one of the major players in the brazing and soldering alloys industry. It operates through three operating segments such as International Welding, Americas Welding, and The Harris Products GroupThe welding products manufactured by the company include stick electrodes, TIG wires, submerged arc consumables, ceramic backing materials, MIG wires, flux-cored wires, and autogenous wires.

-

Miller Electric Mfg. LLC provides innovative, solution-focused products and meets critical welding safety and health requirements. The company manufactures arc welding and cutting equipment. It offers a wide range of equipment such as welders, gas equipment, wire feeders, fume extraction, plasma cutters, automation, induction heating, integrated truck solutions, training equipment, and welding intelligence. The company supports a wide range of industries such as aerospace, construction & fabrication, heavy equipment, manufacturing, railcar, shipbuilding, transportation, and work trucks.

ESAB, Ador Welding Limited are some emerging players in the market.

-

ESAB offers welding & cutting equipment and consumables. It also offers personal protective equipment (PPE), specialty gas, digital solutions, arc accessories, gouging, & exothermic, manual plasma, welding automation, cutting automation arc equipment, gas control equipment, and filler metals. It caters to a wide range of end-use sectors such as aerospace, process industry, automotive, shipbuilding, pipelines, repair & maintenance, power generation, transport & mobile machinery.

-

Ador Welding Limited is engaged in the manufacturing and distribution of welding equipment, consumables, and automation solutions. It offers a wide range of welding consumables, including electrodes, wires, and fluxes, along with brazing products. In addition, the company also provides welding equipment based on different welding principles. The company operates through three business segments, namely Consumables, Equipment & Automation, and Flares & Process Equipment Division (FPED).

Key Inverter Welding Equipment Companies:

The following are the leading companies in the inverter welding equipment market. These companies collectively hold the largest market share and dictate industry trends.

- The Lincoln Electric Company

- Ador Welding Limited

- ESAB

- Fronius International GmbH

- voestalpine Böhler Welding Group GmbH

- Panasonic Industry Co., Ltd.

- Miller Electric Mfg. LLC

- Kemppi Oy

- GYS

- Migatronic A/S

Recent Developments

-

In April 2024, Miller Electric Mfg. LLC unveiled its latest innovation in the realm of collaborative robotic welding systems - the Copilot. This system boasts the newly introduced Auto Deltaweld as its core welding power source. Initially available with the air-cooled Copilot, plans are in place to incorporate the Auto Deltaweld into the water cooled variant later in the same year.

-

In April 2024, ESAB launched the Warrior Edge 500 DX, a versatile multi-process power source that integrates four sophisticated MIG/MAG WeldModes: ROOT, THIN, ROOT Pipe, and SPEED, along with an Advanced Pulse WeldMode. These WeldModes are designed to significantly enhance arc stability, offer superior control at increased travel speeds, and minimize spatter, thereby reducing the need for post-weld clean-up. The Warrior Edge DX aims to elevate the skill levels of welders, boost productivity, and enhance the quality and consistency of welding operations, while also streamlining the training process.

Inverter Welding Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.22 billion

Revenue forecast in 2030

USD 6.84 billion

Growth rate

CAGR of 5.6% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, units, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Type, region

Key companies profiled

Lincoln Electric Holdings, Inc.; Miller Electric Mfg. LLC; Ador Welding Limited; ESAB; Fronius International GmbH; voestalpine Böhler Welding Group GmbH;, Panasonic Industry Co., Ltd.;, Kemppi Oy; GYS; Migatronic A/S

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Inverter Welding Equipment Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global inverter welding equipment market report based on the type and region:

-

Type Outlook (Volume, Units; Revenue, USD Million; 2018 - 2030)

-

Manual Arc Welding

-

MIG

-

By End Use

-

Aerospace

-

Automotive

-

Building & Construction

-

Energy

-

Oil & Gas

-

Marine

-

Others

-

-

By Power Supply

-

1 Phase

-

3 Phase

-

-

-

TIG

-

By End Use

-

Aerospace

-

Automotive

-

Building & Construction

-

Energy

-

Oil & Gas

-

Marine

-

Others

-

-

By Power Supply

-

1 Phase

-

3 Phase

-

-

-

Plasma

-

-

Mechanized Arc Welding

-

MIG

-

By End Use

-

Aerospace

-

Automotive

-

Building & Construction

-

Energy

-

Oil & Gas

-

Marine

-

Others

-

-

By Power Supply

-

1 Phase

-

3 Phase

-

-

By Degree of Mechanism

-

Fully Mechanized Welding

-

Partially Mechanized Welding

-

-

-

TIG

-

By End Use

-

Aerospace

-

Automotive

-

Building & Construction

-

Energy

-

Oil & Gas

-

Marine

-

Others

-

-

By Power Supply

-

1 Phase

-

3 Phase

-

-

By Degree of Mechanism

-

Fully Mechanized Welding

-

Partially Mechanized Welding

-

-

-

Plasma

-

-

-

Regional Outlook (Volume, Units; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global inverter welding equipment market size was estimated at USD 4.95 billion in 2024 and is expected to be USD 5.22 billion in 2025.

b. The global inverter welding equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.6% from 2025 to 2030 to reach USD 6.84 billion by 2030.

b. The mechanized arc welding segment dominated the market and accounted for 79.8% of the global revenue share in 2024. Mechanized arc welding brings automation to the welding process, improving efficiency, accuracy, and safety across various industries.

b. Some of the key players operating in the inverter welding equipment market include Lincoln Electric Holdings, Inc., Miller Electric Mfg. LLC, Ador Welding Limited, ESAB, Fronius International GmbH, voestalpine Böhler Welding Group GmbH, Panasonic Industry Co., Ltd., Kemppi Oy, GYS, Migatronic A/S.

b. The global market is witnessing steady growth, driven by the widespread adoption of inverter welding equipment across the automotive, construction, shipbuilding, and aerospace industries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."