- Home

- »

- Electronic Devices

- »

-

Inverter Duty Motor Market Size And Share Report, 2030GVR Report cover

![Inverter Duty Motor Market Size, Share & Trends Report]()

Inverter Duty Motor Market Size, Share & Trends Analysis Report By Material (Laminated steel, Cast iron, Aluminum), By Application, By Industry Vertical (Chemicals, Metal & mining), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-401-7

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Inverter Duty Motor Market Size & Trends

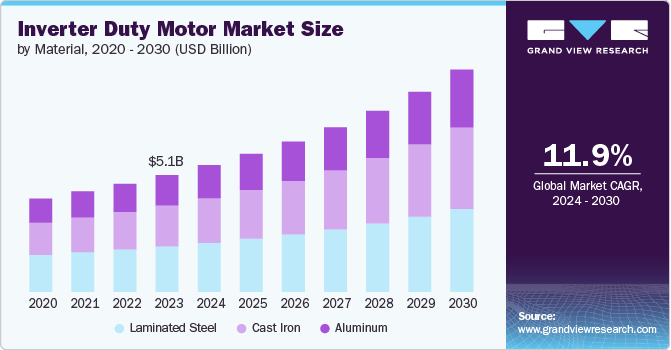

The global inverter duty motor market size was valued at USD 5.09 billion in 2023 and is expected to grow at a CAGR of 9.8% from 2024 to 2030. An inverter duty motor is an electric motor specifically designed to operate with variable frequency drives (VFDs). These motors are engineered with robust insulation and cooling systems to withstand the rapid voltage and frequency fluctuations inherent to VFD operation. They find applications across industries such as manufacturing, HVAC, and pumping. The market is experiencing substantial growth due to the increasing adoption of energy-efficient and precise motor control systems.

The inverter duty motor market is characterized by a strong inclination toward energy efficiency and precision. Advancements in motor design, materials, and cooling technologies are enabling the development of higher-efficiency and more durable motors. The integration of digital technologies, such as sensors and IoT connectivity, is transforming motor operations through predictive maintenance and performance optimization. Moreover, a growing emphasis on sustainability and reduced carbon emissions is driving the demand for inverter duty motors as they offer significant energy savings compared to traditional motors.

The market is subject to a range of regulations focused on energy efficiency, safety, and environmental protection. Governments worldwide are implementing stringent standards to promote the adoption of energy-efficient motors and reduce greenhouse gas emissions. Compliance with these regulations is crucial for motor manufacturers to gain market access. Additionally, safety standards, such as those related to insulation, mechanical integrity, and electromagnetic compatibility, must be adhered to for ensuring product reliability and user safety.

The primary drivers of the market include the increasing demand for energy efficiency, the growing adoption of automation and robotics, and the expansion of various end-user industries. Furthermore, advancements in VFD technology and the availability of cost-effective motor control solutions are propelling market growth. However, challenges such as the high initial cost of inverter duty motors compared to standard motors and the complexity of motor selection and application can hinder market penetration.

The market presents substantial opportunities for growth and innovation. The development of high-efficiency motors with extended service life can create new market segments. Integrating advanced features like condition monitoring and predictive maintenance can enhance motor reliability and reduce downtime. Expanding into emerging markets with growing industrialization offers significant potential for market expansion. Additionally, exploring niche applications, such as electric vehicles and renewable energy systems, can open up new avenues for growth.

Material Insights

The laminated steel segment dominated the market in 2023 and accounted for more than 39% of the global revenue share. The material’s superior magnetic properties, high efficiency, and lower weight compared to cast iron make it the preferred choice for a wide range of applications. The ability to produce thinner laminations results in reduced core losses, enhancing motor performance. While the manufacturing process is relatively complex, the overall cost-effectiveness and efficiency benefits have solidified laminated steel's position as the leading material in the inverter duty motor market.

The cast iron segment is projected to expand at the fastest CAGR during the forecast period 2024 to 2030. While currently smaller in market share, cast iron is experiencing the fastest growth in the inverter duty motor segment. Its inherent robustness and durability make it suitable for harsh operating environments, such as those found in the mining and construction industries. Additionally, advancements in casting technologies have improved the material's performance characteristics. As the demand for rugged and reliable motors increases, cast iron is expected to gain significant traction in specific market segments.

Application Insights

The pumps segment dominated the market in 2023. The ability to precisely control pump speed through VFDs enables energy savings, improved efficiency, and reduced wear and tear. Applications span across various industries, including water management, oil and gas, and chemical processing. The growing emphasis on water conservation and energy efficiency is driving the demand for inverter duty motors in pumping systems.

The fans segment is projected to expand at the fastest CAGR during the forecast period 2024 to 2030. The ability to modulate airflow through variable speed control offers significant energy savings and improved comfort in HVAC systems. Additionally, the increasing adoption of energy-efficient ventilation systems in commercial and residential buildings is driving the demand for inverter duty motors in fan applications.

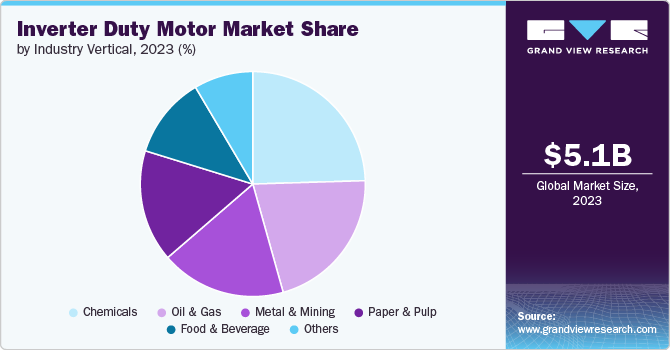

Industry Vertical Insights

The chemicals segment dominated the market in 2023. The demanding operating conditions in chemical plants, including corrosive environments and varying process loads, necessitate the use of robust and efficient motors. Inverter duty motors enable precise control of process parameters, improving product quality and reducing energy consumption. The growing focus on sustainable chemical production further drives the demand for these motors.

The paper & pulp segment is projected to grow at a faster CAGR during the forecast period 2024 to 2030. The energy-intensive nature of the industry makes energy efficiency a top priority. Inverter duty motors offer significant energy savings by optimizing pump and fan operations. Additionally, the ability to control motor speed precisely improves process consistency and product quality. As the industry seeks to reduce its environmental impact, the demand for inverter duty motors is expected to continue rising.

Regional Insights

North America inverter duty motor market dominated the global market in 2023 and accounted for a 35.0% share of the global revenue. The region boasts a mature industrial base with a strong emphasis on automation and energy efficiency. The presence of leading motor manufacturers and a well-established supply chain contributes to the region's dominance. Additionally, stringent energy efficiency regulations and a growing focus on sustainable operations are driving the adoption of inverter duty motors across various industries.

U.S. Inverter Duty Motor Market Trends

The inverter duty motor market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030. A robust manufacturing sector, coupled with advancements in motor technology, has positioned the U.S. as a global leader in inverter duty motors. The country's emphasis on research and development has led to the development of energy-efficient and high-performance motors. Moreover, government initiatives promoting industrial automation and energy conservation are driving the demand for inverter duty motors.

Europe Inverter Duty Motor Market Trends

The inverter duty motor market in Europe is expected to grow at a significant CAGR from 2024 to 2030. The region's mature industrial landscape, coupled with stringent environmental regulations, has fostered a conducive environment for inverter duty motor adoption. Germany, in particular, has been at the forefront of motor technology development, contributing to the overall growth of the European market.

Germany inverter duty motor market is expected to grow at a significant CAGR from 2024 to 2030. Renowned for its engineering expertise and focus on precision manufacturing, Germany boasts a strong presence of leading motor manufacturers. The country's emphasis on industrial automation and energy efficiency has driven the adoption of inverter duty motors across various sectors. Additionally, the automotive industry's shift toward electric vehicles is creating new opportunities for inverter duty motors in Germany.

Asia Pacific Inverter Duty Motor Market Trends

The inverter duty motor market in Asia Pacific is expected to grow with the fastest CAGR during the forecast period 2024 to 2030. The Asia Pacific region is experiencing the fastest growth in the inverter duty motor market, driven by rapid industrialization and urbanization. Countries like China and India are witnessing significant expansion in manufacturing, infrastructure, and consumer goods sectors, fueling the demand for energy-efficient motors. Moreover, the growing focus on automation and robotics is creating new opportunities for inverter duty motor applications.

India inverter duty motor market is expected to grow at a significant CAGR from 2024 to 2030. The country's rapid economic growth, coupled with government initiatives promoting industrial development and energy efficiency, has created a favorable environment for inverter duty motor adoption. The increasing penetration of air conditioning and refrigeration systems, along with the expansion of the automotive industry, is driving demand for these motors. Additionally, the government's focus on renewable energy and smart cities is expected to further boost the market.

Key Inverter Duty Motor Company Insights

Key players operating in the inverter duty motor market include ABB, Adlee Powertronic Co., Ltd., AES Electronic Services, Bodine Electric Company, Elmech Industries, FUKUTA ELEC. & MACH. CO, LTD., KEB Automation KG, Nidec Motor Corporation, Regal Rexnord Corporation, Veikong, Watertronics, and WEG.

-

In August 2023, Bosch commenced production of 800-volt powertrain components, including inverters and electric motors, enhancing electric vehicle charging speed and efficiency. Leveraging silicon carbide technology, these components deliver increased range and compact design, with a German automaker already adopting the new electric motor's core components.

-

In May 2021, ABB introduced the Baldor-Reliance Severe Duty XT motor as a mid-range option between its standard and premium models. This new motor offers robust construction, easy installation, and reliable performance for demanding industrial applications. Designed for durability and efficiency, the XT motor comes with a range of standard features that enhance its value proposition.

Key Inverter Duty Motor Companies:

The following are the leading companies in the inverter duty motor market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Adlee Powertronic Co., Ltd.

- AES Electronic Services

- Bodine Electric Company

- Elmech Industries

- FUKUTA ELEC. & MACH. CO, LTD.

- KEB Automation KG

- Nidec Motor Corporation

- Regal Rexnord Corporation

- Veikong

- Watertronics

- WEG

Inverter Duty Motor Market Report Scope

Attribute

Details

Market size value in 2024

USD 5.52 billion

Revenue forecast in 2030

USD 9.68 billion

Growth rate

CAGR of 9.8% from 2024 to 2030

Actual Data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Material, application, industry vertical, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

Country scope

U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, United Arab Emirates (UAE), Kingdom of Saudi Arabia (KSA), South Africa

Key companies profiled

ABB; Adlee Powertronic Co., Ltd.; AES Electronic Services; Bodine Electric Company; Elmech Industries; FUKUTA ELEC. & MACH. CO, LTD.; KEB Automation KG; Nidec Motor Corporation; Regal Rexnord Corporation; Veikong; Watertronics; WEG

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Inverter Duty Motor Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global inverter duty motor market report based on material, application, industry vertical, and region.

-

Material Outlook (Revenue, USD Billion, 2017 - 2030)

-

Laminated steel

-

Cast iron

-

Aluminum

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Pumps

-

Fans

-

Conveyors

-

Extruders

-

Others

-

-

Industry Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

Chemicals

-

Oil & gas

-

Metal & mining

-

Paper & pulp

-

Food & beverage

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

United Arab Emirates (UAE)

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global inverter duty motor market size was estimated at USD 5.09 billion in 2023 and is expected to reach USD 5.52 billion in 2024.

b. The global inverter duty motor market is expected to grow at a compound annual growth rate of 9.8% from 2024 to 2030, reaching USD 9.68 billion by 2030.

b. North America dominated the inverter duty motor market in 2023 and accounted for a 35.0% share of the global revenue. The region boasts a mature industrial base with a strong emphasis on automation and energy efficiency. The presence of leading motor manufacturers and a well-established supply chain contributes to the region's dominance.

b. Some key players operating in the inverter duty motor market include ABB, Adlee Powertronic Co., Ltd., AES Electronic Services, Bodine Electric Company, Elmech Industries, FUKUTA ELEC. & MACH. CO, LTD., KEB Automation KG, Nidec Motor Corporation, Regal Rexnord Corporation, Veikong, Watertronics, and WEG.

b. The primary drivers of the inverter duty motor market include the increasing demand for energy efficiency, the growing adoption of automation and robotics, and the expansion of various end-user industries. Furthermore, advancements in VFD technology and the availability of cost-effective motor control solutions are propelling market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."