- Home

- »

- Pharmaceuticals

- »

-

Invasive Ductal Carcinoma Treatment Market Report, 2030GVR Report cover

![Invasive Ductal Carcinoma Treatment Market Size, Share & Trends Report]()

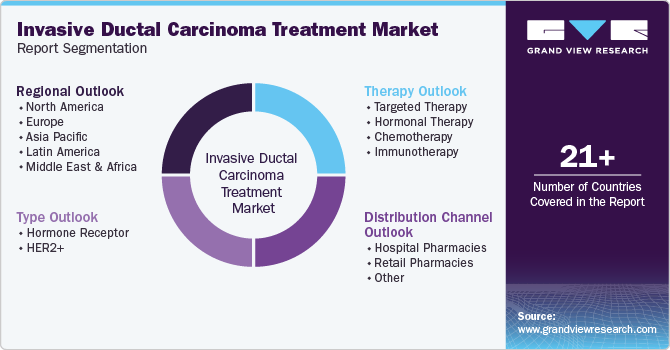

Invasive Ductal Carcinoma Treatment Market Size, Share & Trends Analysis Report By Therapy (Targeted, Hormonal), By Type, By Distribution Channel (Hospital Pharmacies, Retail Pharmacies), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-444-6

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

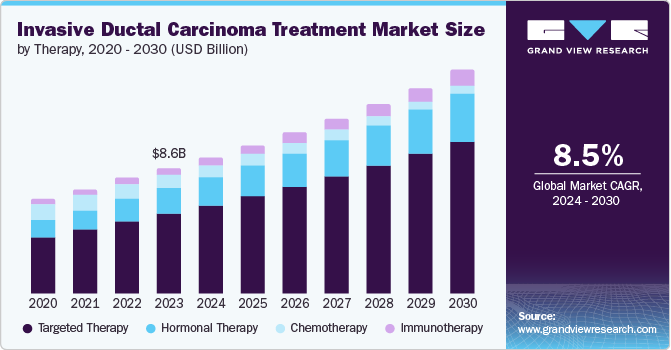

The global invasive ductal carcinoma treatment market size was valued at USD 8.59 billion in 2023 and is projected to grow at a CAGR of 8.50% from 2024 to 2030. The rising prevalence of breast cancer, technological advancements, an increasing preference for personalized medicine, government support, and higher healthcare spending are some of the growth factors. As research progresses, new medications and treatment alternatives are expected to continue to emerge, further propelling market growth. For instance, in April 2023, thousands of breast cancer patients in England were offered a cancer drug that specifically targets an inherited genetic mutation, marking a significant advancement in personalized oncology treatment.

Significant advancements in breast cancer research and development (R&D) drove the IDC treatment market growth. Ongoing research led to a better understanding of the molecular mechanisms underlying IDC, the identification of novel targets, and the development of innovative drugs. Additionally, the growing interest in immunotherapies, particularly checkpoint inhibitors, showed promise in improving outcomes for patients with triple-negative breast cancer, a subtype of IDC.

Increasing awareness about early detection of IDC is crucial for improving treatment outcomes and survival rates. Educational campaigns aimed at healthcare professionals and the public emphasize the importance of regular screenings, such as mammograms, which can identify IDC earlier when it is more treatable. As awareness grows, there is a corresponding increase in demand for innovative treatment options and diagnostic technologies within the IDC treatment market. This heightened focus on early detection drives market growth and fosters collaboration among stakeholders, including pharmaceutical companies, healthcare providers, and patient advocacy groups, to enhance research and development efforts in this area.

Government initiatives to improve and support cancer care such as implementing national breast cancer screening programs, investment in research and development, and providing subsidies for breast cancer drugs, create a conducive environment for market growth. The government launched initiatives in Japan to promote personalized medicine and improve access to advanced therapies, including targeted and immunotherapy options for IDC patients. These government-led efforts to enhance cancer care contributed to the growth of the IDC treatment market by ensuring that patients have access to the latest advancements in therapy.

Industry Characteristics

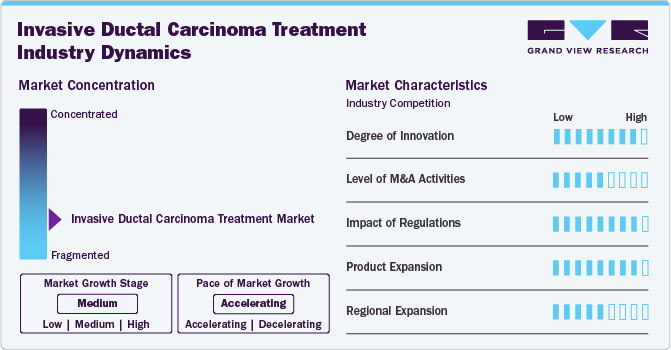

The degree of innovation in the IDC treatment market is high, characterized by the rapid development of targeted therapies and immunotherapies. The ongoing focus on precision medicine and integrating digital health technologies further enhances the innovative landscape, enabling more effective and tailored therapies for IDC patients. For instance, combining artificial intelligence in drug discovery and personalized medicine enhances innovation within this sector.

The level of merger and acquisition (M&A) activities is medium, with several strategic transactions to expand oncology portfolios. M&A activities are driven by the need to access innovative technologies and expand product offerings in a competitive market. As companies aim to strengthen their research and development efforts and bring new therapies to market, M&A activities are expected to shape the IDC treatment landscape significantly.

The impact of regulations is high, as regulatory bodies, including the FDA and EMA, are crucial in approving and monitoring new therapies. Recent initiatives such as the FDA’s Breakthrough Therapy Designation expedited the approval process for promising treatments, allowing patients to access innovative therapies more quickly. For instance, in April 2024, the FDA approved Enhertu to treat adult patients with unresectable or metastatic HER2-positive solid tumors receiving prior systemic treatment and lacking satisfactory alternatives.

Product expansion in the IDC treatment market is high, with numerous new therapies being launched to address patients' diverse needs. The approvals of targeted therapies, including hormone and immunotherapeutic, reflect a growing trend toward personalized treatment options. Ongoing clinical trials exploring new combinations and treatment modalities further expand the therapeutic landscape for IDC, ensuring patients access to the latest innovations.

Region expansion is medium, with increasing efforts to improve access to therapies in emerging markets. Countries in Asia-Pacific, the Middle East, and Africa are witnessing a rise in breast cancer awareness and healthcare investments, leading to new treatment facilities and the introduction of innovative therapies. For example, initiatives to enhance cancer care in low- and middle-income countries are being implemented to improve screening and treatment access.

Therapy Insights

The targeted therapy segment represented the largest share of 64.24% in 2023 and is expected to retain dominance during the forecasted period. The introduction of targeted therapies for HER2-positive and hormone receptor-positive breast cancers significantly changed treatment approaches. New drugs that focus on different cellular pathways related to breast cancer growth and survival also demonstrate potential in clinical trials. In January 2023, the U.S. FDA approved a targeted therapy for difficult-to-treat advanced breast cancers, thanks to the research and advocacy efforts from Duke University and Duke University Health System professionals.

The immunotherapy segment experienced the fastest CAGR in 2023. Immunotherapy agents, particularly checkpoint inhibitors, demonstrated considerable effectiveness in enhancing the outcomes for individuals with triple-negative breast cancer. Vaccines aimed at specific proteins that are overexpressed in breast cancer cells also show potential in clinical trials. As research progresses, immunotherapy is expected to play an increasingly vital role in treatment.

Type Insights

The hormone receptor segment accounted for the largest share of 65.37% in 2023. Hormone therapy, which encompasses SERMs, aromatase inhibitors, and LHRH agonists, is a commonly used treatment for breast cancer that tests positive for hormone receptors. Hormone receptors like Estrogen Receptors (ER) and Progesterone Receptors (PR) are proteins found on the surface of breast cancer cells that interact with hormones in the body, promoting the growth of these cells. As a result, hormone therapy is often utilized for hormone receptor-positive breast cancer, which represents a significant proportion of all diagnosed cases.

The HER2+ segment is estimated to exhibit significant growth during the forecast period. The growing number of strategic efforts by pharmaceutical companies to develop drugs for HER2-positive types is beneficial for market expansion. For instance, in February 2023, Gilead Sciences announced that Trodelvy received U.S. FDA approval for a third indication. This approval offers patients an additional treatment option for the most prevalent form of breast cancer. Trodelvy was first authorized for individuals with advanced breast cancer, specifically those with the HR-positive/HER2-negative type, who previously received at least two systemic treatments and were no longer responding to hormone therapies.

Distribution Channel Insights

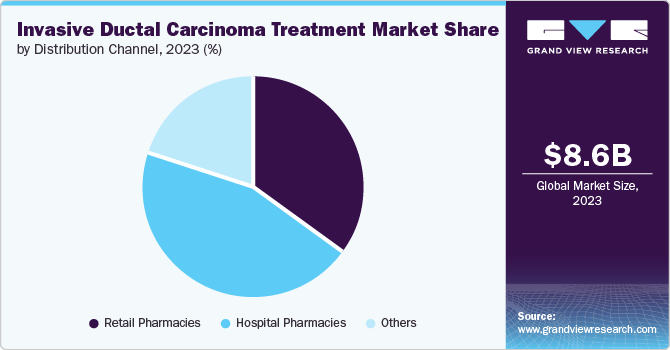

The hospital pharmacies segment held the largest revenue share of 45.45% in 2023, owing to the increasing prevalence of breast cancer, advancements in treatment protocols, and growing reliance on specialized medications that are often dispensed within hospital settings. Hospital pharmacies play a critical role by ensuring patients receive tailored therapies, including chemotherapy and targeted treatments, requiring careful management and monitoring. Instances such as integrating personalized medicine and enhanced patient care services further bolster this segment’s significance, as hospitals aim to improve treatment outcomes through specialized pharmaceutical support.

The other segment, categorized into online distribution channels and specialty stores, is expected to grow at the fastest CAGR over the forecast period. This growth is driven by increasing patient preference for online purchasing due to convenience and accessibility and the rise of specialty stores that offer tailored products and services for cancer patients. Telemedicine consultations and e-commerce platforms providing a wide range of treatment options contribute significantly to this trend, allowing patients to access innovative therapies and support systems more efficiently.

Regional Insights

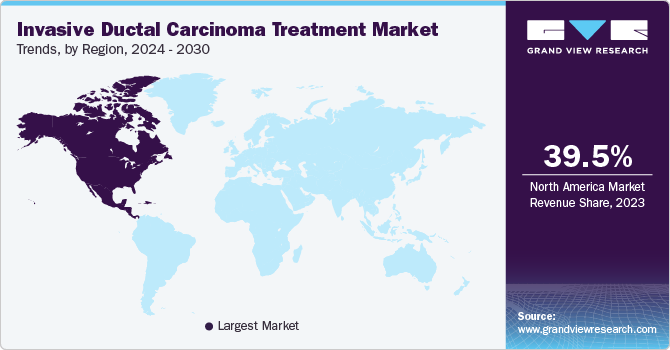

North America invasive ductal carcinoma treatment market is characterized by rapid innovation and the introduction of novel therapies, including targeted treatments and immunotherapies. Regulatory bodies such as the FDA streamlined approval processes for breakthrough therapies, leading to a surge in new drug launches. Additionally, government initiatives to increase cancer research funding bolstered the development of advanced treatment options. The prevalence of breast cancer remains high; according to the Canadian Cancer Statistics 2023, 1 in 8 women (13%) is projected to receive a breast cancer diagnosis at some point in their lives.

U.S. Invasive Ductal Carcinoma Treatment Market Trends

The invasive ductal carcinoma treatment market in the U.S. strongly focuses on personalized medicine and genetic testing to tailor treatments for patients. The competitive landscape is marked by significant mergers and acquisitions among pharmaceutical companies seeking to enhance their oncology portfolios. Furthermore, patient advocacy groups increasingly influence treatment guidelines and access to innovative therapies. According to the American Cancer Society, around 310,720 new cases of invasive breast cancer are diagnosed in women.

Europe Invasive Ductal Carcinoma Treatment Market Trends

The invasive ductal carcinoma treatment market in Europe is shaped by stringent regulatory frameworks and a growing emphasis on early detection and prevention strategies. Germany and Sweden are leading in implementing national screening programs that contribute to earlier diagnosis rates. Innovative therapies such as antibody-drug conjugates are gaining traction, supported by favorable reimbursement policies across various European nations. Collaboration between public health organizations and private sectors increased investment in breast cancer research initiatives.

UK invasive ductal carcinoma treatment market is witnessing growth driven by an increasing incidence of breast cancer and a greater adoption of advanced therapeutics. The National Health Service (NHS) is pivotal in regulating access to invasive ductal carcinoma treatments through its guidelines and funding decisions. The introduction of combination therapies that significantly improve patient outcomes. The UK government committed an extra £10 million to establish 29 additional breast cancer screening units and implement approximately 70 service upgrades to accelerate diagnosis and treatment, potentially saving lives. Additionally, there is an ongoing focus on addressing health disparities among different demographics within the population.

The invasive ductal carcinoma treatment market in France is characterized by a strong emphasis on research and innovation, supported by government funding and initiatives. The French healthcare system promotes access to advanced therapies, including targeted and immunotherapy options for breast cancer patients. Additionally, the focus on patient-centered care and comprehensive treatment approaches enhances the overall management of IDC.

Asia Pacific Invasive Ductal Carcinoma Treatment Market Trends

The invasive ductal carcinoma treatment market in Asia Pacific is witnessing significant growth, driven by a rising incidence of breast cancer and increasing awareness about early detection and treatment options. Countries are investing heavily in healthcare infrastructure and R&D to develop innovative therapies. Regulatory bodies are increasingly expediting the approval process for new treatments, leading to a rise in clinical trials and collaborations between pharmaceutical companies and research institutions.

Japan invasive ductal carcinoma treatment market is characterized by a strong emphasis on precision medicine. Novel therapies have been launched that target specific genetic mutations associated with breast cancer. The country's well-established healthcare system prioritizes cancer treatment, with the government providing universal health coverage. According to the NCBI, palbociclib and abemaciclib are approved as CDK4/6 inhibitors in Japan, while ribociclib is not. There is no pivotal study evidence for these drugs in premenopausal patients, but all have shown efficacy in improving PFS for HR-positive HER2-negative breast cancer.

The invasive ductal carcinoma treatment market in China is rapidly evolving due to significant investments in healthcare infrastructure and research. The Chinese government prioritized cancer treatment as part of its national health strategy, leading to increased funding for clinical trials and the introduction of new therapies. Moreover, there is a growing trend towards personalized medicine, with several local companies developing biosimilars that offer cost-effective alternatives to existing treatments.

Latin America Invasive Ductal Carcinoma Treatment Market Trends

The invasive ductal carcinoma treatment market in Latin America is marked by increasing awareness of breast cancer screening and prevention programs. Governments across the region are implementing initiatives to improve access to healthcare services, including better availability of IDC treatments. However, the market is expected to grow due to increasing awareness about breast cancer and the launch of new therapies. For instance, in June 2023, the Max Foundation launched a program to provide access to treatment for HR+/HER2- advanced breast cancer patients in low-income countries, collaborating with oncologists and partners to address the urgent unmet need in these regions.

Brazil invasive ductal carcinoma treatment market is facing challenges related to healthcare infrastructure and access to advanced therapies. However, the country saw some progress in recent years, with the approval of new drugs such as trastuzumab emtansine and pertuzumab for HER2-positive breast cancer. The Brazilian government also implemented initiatives to improve cancer care, such as the National Oncology Care Network, which aims to provide comprehensive cancer treatment services. Despite these efforts, the market faces ongoing challenges related to healthcare disparities and limited access to cutting-edge therapies in certain regions.

Middle East & Africa Invasive Ductal Carcinoma Treatment Market Trends

The invasive ductal carcinoma treatment market in the Middle East and Africa is evolving, driven by increasing breast cancer awareness and the implementation of government health initiatives. Countries in this region are witnessing a rise in the adoption of advanced diagnostic technologies and targeted therapies, which are crucial for improving treatment outcomes. The growing burden of chronic diseases prompted healthcare authorities to enhance cancer screening programs and invest in innovative treatment options.

Saudi Arabia invasive ductal carcinoma treatment market is experiencing significant growth due to strong government support and healthcare reforms to improve cancer care. The Saudi government has launched various initiatives to enhance early detection and treatment of breast cancer, including national awareness campaigns and screening programs. Furthermore, the approval of new therapies, such as CDK4/6 inhibitors, reflects the country's commitment to integrating innovative treatments into clinical practice.

Key Invasive Ductal Carcinoma Treatment Company Insights

The global market is intensely competitive due to the multitude of participants. These firms possess a significant market presence, diverse product ranges, extensive geographical coverage, and robust distribution systems. Furthermore, many companies invested substantially in research and development to maintain a competitive edge and provide their customers with the most advanced and innovative testing solutions.

Key Invasive Ductal Carcinoma Treatment Companies:

The following are the leading companies in the invasive ductal carcinoma treatment market. These companies collectively hold the largest market share and dictate industry trends.

- Novartis AG

- Pfizer Inc.

- Merck KGaA

- Janssen Pharmaceuticals, Inc.

- F. Hoffmann-La Roche Ltd.

- AstraZeneca

- AbbVie Inc.

- Bristol-Myers Squibb Company

- Macrogenics, Inc.

- Celldex Therapeutics

Recent Developments

-

In December 2023, Pfizer Inc. acquired Seagen Inc., a biotechnology firm focused on discovering, developing, and commercializing innovative cancer treatments.

-

In January 2023, the FDA approved elacestrant (Orserdu) for postmenopausal women and adult men with advanced ER-positive, HER2-negative breast cancer, particularly those with an ESR1 mutation who progressed after at least one endocrine therapy line.

Invasive Ductal Carcinoma Treatment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.32 billion

Revenue forecast in 2030

USD 15.21 billion

Growth Rate

CAGR of 8.50% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Therapy, type, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Sweden, Denmark, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, Saudi Arabia, South Africa, UAE, Kuwait

Key companies profiled

Novartis AG, Pfizer Inc., Merck KGaA, Janssen Pharmaceuticals, Inc., F. Hoffmann-La Roche Ltd., AstraZeneca, AbbVie Inc., Bristol-Myers Squibb Company, Macrogenics, Inc., Celldex Therapeutics

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Invasive Ductal Carcinoma Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global invasive ductal carcinoma treatment market report based on therapy, type, distribution channel and region.

-

Therapy Outlook (Revenue, USD Million, 2018 - 2030)

-

Targeted Therapy

-

Abemaciclib

-

Ado-Trastuzumab Emtansine

-

Everolimus

-

Trastuzumab

-

Ribociclib

-

Palbociclib

-

Pertuzumab

-

Olaparib

-

Others

-

-

Hormonal Therapy

-

Selective Estrogen Receptor Modulators (SERMs)

-

Aromatase Inhibitors

-

Estrogen Receptor Down regulators (ERDs)

-

-

Chemotherapy

-

Immunotherapy

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hormone Receptor

-

HER2+

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global invasive ductal carcinoma treatment market was valued at USD 8.59 billion in 2023 and is expected to reach USD 9.32 billion in 2024.

b. The global invasive ductal carcinoma treatment market is expected to grow at a CAGR of 8.5% from 2024 to 2030, reaching USD 15.21 billion by 2030.

b. The hormone receptor segment accounted for the largest share of 65.37% in 2023. Hormone therapy, which encompasses SERMs, aromatase inhibitors, and LHRH agonists, is a commonly used treatment for breast cancer that tests positive for hormone receptors.

b. Some of the prominent players in the global invasive ductal carcinoma treatment market are Novartis AG, Pfizer Inc., Merck KGaA, Janssen Pharmaceuticals, Inc., F. Hoffmann-La Roche Ltd., AstraZeneca, AbbVie Inc., Bristol-Myers Squibb Company, Macrogenics, Inc., Celldex Therapeutics

b. The rising prevalence of breast cancer, technological advancements, an increasing preference for personalized medicine, government support, and higher healthcare spending are some of the growth factors.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."