- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Inulin Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Inulin Market Size, Share & Trends Report]()

Inulin Market (2025 - 2030) Size, Share & Trends Analysis Report By Source (Chicory Inulin), By Form (Liquid, Powder), Application (Food & Beverage, Dietary Supplements), By Sales Channel, By Region, And Segment Forecasts

- Report ID: 978-1-68038-366-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Inulin Market Summary

The global inulin market size was valued at USD 1.84 billion in 2024 and is projected to reach USD 2.71 billion by 2030, growing at a CAGR of 6.7% from 2025 to 2030. This growth is attributed to increasing consumer awareness of health benefits associated with dietary fibers, particularly in promoting gut health.

Key Market Trends & Insights

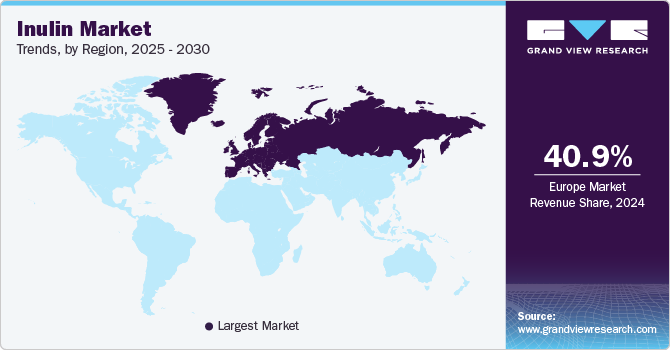

- Europe inulin market led the global market with the largest revenue share of 40.9% in 2024.

- By source, the chicory inulin segment held the largest revenue share of 73.8% in 2024.

- By form, the powder form segment accounted for the largest revenue share of 77.0% in 2024.

- By application, the food & beverages segment held the largest revenue share of 61.9% in 2024.

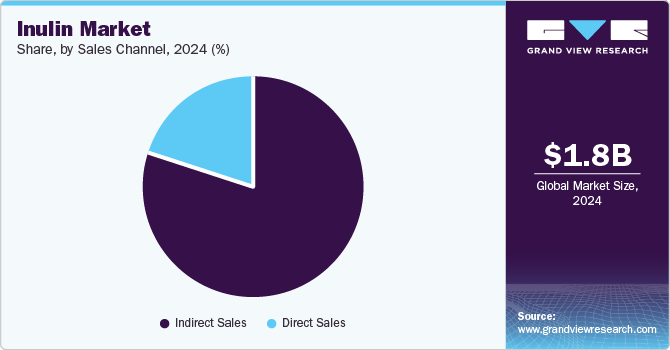

- By sales channel, the indirect sales channel segment held the largest revenue share of 79.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.84 Billion

- 2030 Projected Market Size: USD 2.71 Billion

- CAGR (2025-2030): 6.7%

- Europe: Largest market in 2024

In addition, the rising geriatric population seeking dietary solutions for health issues further fuels demand. Furthermore, the popularity of low-calorie and sugar-free products, alongside the growing use of inulin in the food and beverage industry, particularly dairy, contributes to market expansion. Moreover, the stable chicory root supply, a primary inulin source, also supports the market’s growth.

Inulin, a soluble fiber naturally produced by various plants, is gaining traction in the global market due to its numerous health benefits and increasing consumer awareness. This dietary fiber, found in foods such as chicory roots, onions, and garlic, is recognized for its potential to enhance digestive health and lower cholesterol levels.

The rising demand for high-fiber food products aligns with the growing interest in dietary and functional ingredients. Furthermore, the increasing prevalence of diabetes in developed nations has spurred interest in low-sugar and low-calorie alternatives, further driving the inulin market. Regulatory endorsements from authorities such as the FDA regarding the safety and benefits of inulin also support its adoption in food and pharmaceutical applications.

In addition, the market trends reflect a shift towards natural and clean-label ingredients as consumers prioritize healthier options. The popularity of fiber-rich products is on the rise as individuals become more conscious of their dietary choices. Inulin's versatility allows it to be utilized in functional foods and nutraceuticals experiencing significant growth. Moreover, its role in weight management and sugar reduction is becoming increasingly relevant as consumers seek healthier lifestyles. By leveraging these trends, industry players can effectively meet evolving consumer preferences while enhancing their competitive edge in the dynamic inulin market.

Source Insights

The chicory inulin segment dominated the market and accounted for the largest revenue share of 73.8% in 2024. This growth is attributed to its recognized health benefits and increasing consumer awareness. Chicory inulin acts as a prebiotic, promoting the growth of beneficial gut bacteria, which enhances digestive health and overall well-being. In addition, health-conscious consumers' rising demand for natural and clean-label ingredients further supports its adoption across various industries, including food, beverages, and dietary supplements. Furthermore, regulatory endorsements for its safety and efficacy bolster confidence among manufacturers and consumers alike, contributing to market expansion.

Jerusalem artichoke inulin is expected to grow at a CAGR of 6.6% over the forecast period, owing to its unique nutritional profile and health benefits. This type of inulin is rich in fructooligosaccharides, which support digestive health and may aid in blood sugar regulation, making it appealing to individuals with diabetes. In addition, the growing trend towards plant-based diets and functional foods has increased the demand for Jerusalem artichoke as a source of dietary fiber. Furthermore, its versatility allows it to be incorporated into various food products, including snacks and beverages, thus broadening its market appeal and driving growth in this segment.

Form Insights

The powder form led the market and accounted for the largest revenue share of 77.0% in 2024, owing to its versatility and convenience in various applications. Powdered inulin is favored for its ease of incorporation into a wide range of food products, from baked goods to dietary supplements, enhancing nutritional profiles without altering taste or texture. In addition, the rising consumer demand for high-fiber and functional foods further propels this segment, as powdered inulin is an effective ingredient for improving digestive health and promoting satiety. Furthermore, its stability and long shelf life make it an attractive option for manufacturers looking to create innovative, health-focused products.

The liquid form is expected to grow at a CAGR of 7.2% over the forecast period. This growth is attributed to its ease of use in beverages and ready-to-drink products. Liquid inulin offers a smooth texture and can be easily mixed into drinks, smoothies, and sauces, appealing to consumers seeking convenient health solutions. Furthermore, the increasing trend towards functional beverages that support gut health and overall wellness drives demand for liquid inulin as a prebiotic ingredient. Moreover, as consumers shift towards low-calorie and sugar-free options, liquid inulin enhances flavor and texture while maintaining health benefits. This adaptability positions liquid inulin favorably within the growing health-conscious market segment.

Application Insights

The food & beverages application led the market and accounted for the largest revenue share of 61.9% in 2024. This growth is attributed to a rising consumer demand for functional foods that promote health and wellness. As awareness of digestive health increases, inulin's prebiotic properties make it an attractive ingredient for enhancing gut health and overall well-being. Furthermore, inulin is a natural sugar and fat substitute, allowing manufacturers to create healthier, low-calorie products without compromising taste or texture. This aligns with the clean label movement, where consumers prefer natural ingredients, further boosting inulin's popularity in food and beverage formulations.

The animal feed additives are expected to grow at the fastest CAGR of 7.5% over the forecast period, owing to their nutritional benefits for livestock and pets. Inulin is recognized for its prebiotic effects, promoting gut health and improving animal digestion. As the demand for high-quality animal feed rises, particularly among health-conscious consumers seeking better nutrition for their pets, inulin's inclusion as a functional ingredient becomes increasingly relevant. Furthermore, the shift towards natural and organic feed options enhances inulin's appeal, aligning with trends favoring sustainable and healthy animal husbandry practices. This combination of factors is driving significant growth in the use of inulin within animal feed formulations.

Sales Channel Insights

The indirect sales channel led the market and held the largest revenue share of 79.9% in 2024. This growth is attributed to the increasing demand for health-focused products among consumers. In addition, retailers and distributors are expanding their offerings to include inulin-rich products, capitalizing on the rising awareness of its health benefits, such as digestive support and weight management. Furthermore, the convenience of online shopping has facilitated access to a wider range of inulin products, allowing consumers to easily find and purchase dietary supplements and functional foods that incorporate inulin, thus driving sales through indirect channels.

The direct sales channel is expected to grow at the fastest CAGR of 7.1% from 2025 to 2030, owing to personalized marketing strategies and direct consumer engagement. Companies increasingly utilize direct-to-consumer models to build relationships with health-conscious buyers, offering tailored products that meet specific dietary needs. In addition, this approach allows manufacturers to educate consumers about the benefits of inulin directly, fostering brand loyalty and trust. Furthermore, the rise of subscription services for health supplements has streamlined purchasing processes, encouraging repeat purchases and enhancing customer retention within the direct sales channel.

Regional Insights

The inulin market in Europe dominated the global market and accounted for the largest revenue share of 40.9% in 2024. This growth is attributed to increasing consumer demand for natural and healthy food products. As awareness of the health benefits of inulin rises, consumers gravitate towards products that incorporate this soluble fiber, particularly in bakery, dairy, and dietary supplements. In addition, the trend toward clean labeling and transparency in food production further drives demand as manufacturers seek to align their offerings with consumer preferences for natural ingredients. Moreover, the availability of raw materials such as chicory roots enhances production capabilities, supporting market expansion.

Germany inulin market dominated the European market and accounted for the largest revenue share in 2024. This growth is attributed to a substantial aging population seeking healthier dietary options. In addition, the country's robust healthcare system facilitates easy access to nutritional supplements, increasing demand for inulin-rich products. Furthermore, German consumers are willing to invest in their health, leading to a flourishing market for dietary supplements and functional foods containing inulin. Moreover, local manufacturers are innovating to meet this demand, further solidifying Germany's position as a leader in the European inulin market.

Asia Pacific Inulin Market Trends

The inulin market in the Asia Pacific is expected to grow at a CAGR of 7.4% over the forecast period, owing to rising health consciousness among consumers. There is an increasing demand for functional foods and beverages incorporating prebiotic ingredients such as inulin, particularly as urbanization and lifestyle changes increase awareness of nutrition's role in health. Furthermore, countries including India and Japan are witnessing a surge in dietary supplement consumption, which is anticipated to propel the overall demand for inulin across various applications.

China inulin market led the Asia Pacific market and accounted for the largest revenue share of 43.7% in 2024, driven by a growing focus on health and wellness among its population. The rising prevalence of lifestyle-related diseases has prompted consumers to seek healthier dietary alternatives, including low-sugar and high-fiber products. Furthermore, the Chinese government’s initiatives promoting nutritional education contribute to increased awareness of functional ingredients such as inulin. This shift towards healthier eating habits is expected to drive significant growth in the demand for inulin-based products.

North America Inulin Market Trends

The growth of the inulin market in North America is fueled by an increasing preference for functional foods that offer health benefits. In addition, the rising incidence of obesity and diabetes has led consumers to seek low-calorie and sugar-free alternatives, positioning inulin as an attractive ingredient. Moreover, the expanding e-commerce landscape allows greater accessibility to dietary supplements containing inulin, further driving its adoption among health-conscious consumers. This trend aligns with a broader movement towards clean-label products emphasizing natural ingredients.

U.S. Inulin Market Trends

The U.S. inulin market dominated the North American market and accounted for the largest revenue share in 2024. This growth is attributed to a notable increase in consumer awareness regarding gut health and its connection to overall well-being. This has resulted in heightened interest in prebiotic fibers such as inulin, which support digestive health. In addition, the growing popularity of plant-based diets also plays a crucial role, as consumers seek natural sources of fiber that can easily be integrated into their daily diets. Furthermore, as more manufacturers incorporate inulin into their product lines, this segment is expected to grow substantially over the coming years.

Key Inulin Company Insights

Some of the key companies in the market include S Cargill Incorporated, Dow DuPont, FMC Corporation, and others. These companies adopt various strategies, such as new product launches and strategic partnerships, to gain a competitive edge. Furthermore, mergers and acquisitions are also prevalent among the companies, further driving the overall growth in the sector.

-

Archer Daniels Midland Company (ADM) manufactures various products, including functional ingredients derived from chicory roots used in various food applications. The company’s inulin offerings cater to the growing demand for dietary fibers, serving sectors such as food and beverages, dietary supplements, and pharmaceuticals. By leveraging its extensive supply chain and innovation capabilities, ADM is well-positioned to meet the increasing consumer preference for healthier and more natural food options.

-

Cargill Incorporated focuses on producing high-quality chicory root inulin for various applications, particularly in the food and beverage sector. The company’s inulin products are designed to enhance nutritional profiles while providing functional benefits such as improved texture and taste. With a commitment to sustainability and innovation, Cargill aims to address the rising consumer demand for healthier alternatives, making it a key contributor to the expanding inulin market.

Key Inulin Companies:

The following are the leading companies in the inulin market. These companies collectively hold the largest market share and dictate industry trends.

- Archer Daniels Midland Co.

- S Cargill Incorporated

- Sudzucker Group

- Tate & Lyle PLC

- Dow DuPont

- FMC Corporation

- Koninklijke DSM N.V.

- PMV Nutrient Products PVT Ltd.

- Qingdao Oriental Tongxiang International Trading Co. Ltd.

- Sensus B.V.

- Steviva Brands, Inc.

- Tereos S.A.

- The IIDEA Company

- TrooFoods Ltd.

Inulin Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.96 billion

Revenue forecast in 2030

USD 2.71 billion

Growth Rate

CAGR of 6.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

October 2024

Quantitative units

Volume in Kilo Tons, Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, form, application, sales channel, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, and Middle East and Africa,

Country scope

U.S., Canada, Mexico, China, India, Japan, Australia, Germany, UK, Italy, Spain, France, Netherlands, and Brazil.

Key companies profiled

Archer Daniels Midland Co.; S Cargill Incorporated; Sudzucker Group; Tate & Lyle PLC; Dow DuPont; FMC Corporation; Koninklijke DSM N.V.; PMV Nutrient Products PVT Ltd.; Qingdao Oriental Tongxiang International Trading Co. Ltd.; Sensus B.V.; Steviva Brands, Inc.; Tereos S.A.; The IIDEA Company; TrooFoods Ltd.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Inulin Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global inulin market report based on source, form, application, sales channel, and region.

-

Source Outlook (Volume, Kilo Tons, Revenue, USD Million, 2018 - 2030)

-

Chicory Inulin

-

Jerusalem Artichoke Inulin

-

Agave Inulin

-

-

Form Outlook (Volume, Kilo Tons, Revenue, USD Million, 2018 - 2030)

-

Liquid

-

Powder

-

-

Application Outlook (Volume, Kilo Tons, Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Dietary Supplements

-

Animal Feed Additives

-

-

Sales Channel Outlook (Volume, Kilo Tons, Revenue, USD Million, 2018 - 2030)

-

Direct Sales

-

Indirect Sales

-

-

Regional Outlook (Volume, Kilo Tons, Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

-

Asia Pacific

-

India

-

Japan

-

China

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.