Intravenous Immunoglobulin Market Size, Share & Trends Analysis Report By Application (Immunodeficiency Diseases), By Distribution Channel (Hospital Pharmacies), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-800-8

- Number of Report Pages: 153

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Intravenous Immunoglobulin Market Trends

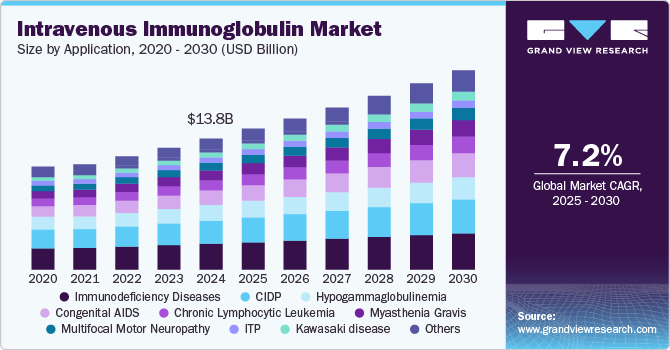

The global intravenous immunoglobulin market size was estimated at USD 13.85 billion in 2024 and is anticipated to grow at a CAGR of 7.2% over the forecast period. The market is driven by the rising prevalence of autoimmune disorders, immunodeficiencies, and neurological diseases, such as primary immunodeficiency (PID), chronic inflammatory demyelinating polyneuropathy (CIDP), and Guillain-Barré syndrome. Increasing awareness and advancements in immunotherapy, coupled with an aging population more susceptible to immune-related conditions, further fuel market growth.

The demand for Intravenous Immunoglobulin (IVIG) therapies is rising due to their effectiveness as the primary treatment for both acquired and primary immunodeficiency diseases. With no alternative treatment options available, IVIG remains a critical therapy for managing these conditions. In addition, sedentary lifestyles-characterized by high consumption of saturated fats, salt, sugar, excessive alcohol intake, and reduced physical activity-have contributed to a growing prevalence of lifestyle-related disorders such as antibody deficiency disorders, further driving demand for IVIG.

According to NCBI data, in 2020, around the world, over 6 million individuals were affected by primary immunodeficiencies (PIDs), with 70% to 90% remaining undiagnosed. More than 430 different types of PIDs have been identified, each caused by inherited defects in one or more components of the immune system. As a result, individuals with PIDs are not only more susceptible to infections but also face an increased risk of severe autoinflammation, autoimmunity, allergies, and malignancies. As awareness and diagnosis rates improve, along with advancements in plasma collection and manufacturing technologies, the IVIG market is poised for sustained growth.

Despite the growing demand for Intravenous Immunoglobulin (IVIG) therapies, the high cost of treatment remains a significant barrier to market expansion. IVIG infusions are typically administered every 3 to 4 weeks, requiring 12 to 16 sessions annually, making it a long-term and costly therapy. The estimated price of IVIG is USD 73.89 per gram, with total treatment costs reaching USD 10,000 or more, depending on the severity of the condition. Furthermore, immunoglobulin replacement therapy often extends for at least six months, further increasing the financial burden on patients and healthcare systems. According to the ABIM Foundation, the annual cost of IgG treatment therapy exceeds USD 30,000, posing affordability challenges that could hinder market growth.

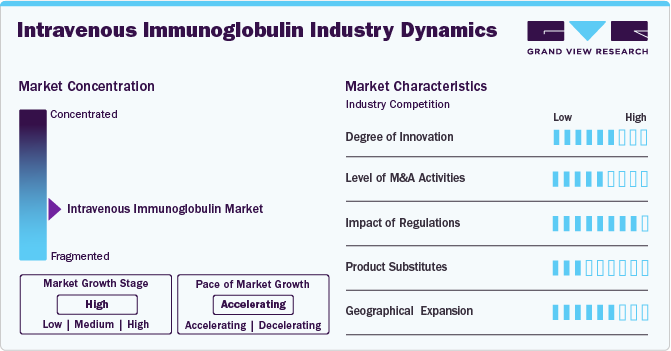

Market Concentration & Characteristics

The IVIG market continues to evolve with advancements in purification techniques, improved formulations, and innovative treatment protocols. Research is focused on enhancing the safety, efficacy, and tolerability of IVIG, particularly for immunodeficiency diseases, autoimmune disorders, and neurological conditions such as CIDP, Myasthenia Gravis, and Guillain-Barré Syndrome.

Mergers and acquisitions are a key trend in the IVIG market, with major pharmaceutical players acquiring specialized biotech firms to expand their immunoglobulin portfolios. Companies seek to strengthen their positions in treating conditions like Hypogammaglobulinemia, Kawasaki disease, and Chronic Lymphocytic Leukemia. The growing demand for IVIG therapies drives consolidation efforts to enhance production capacity and market reach.

Regulatory agencies such as the FDA and EMA enforce strict quality and safety guidelines for IVIG therapies. These regulations ensure patient safety but also contribute to lengthy approval processes. In addition, reimbursement policies influence market dynamics, as IVIG is a high-cost therapy primarily covered by healthcare payers in developed markets. Ensuring affordability and access remains a critical challenge, especially in emerging regions.

While IVIG is a standard treatment for multiple immune and neurological conditions, alternative therapies exist. These include plasma exchange, corticosteroids, and emerging monoclonal antibodies. However, IVIG remains a preferred option due to its broad applicability in conditions like Congenital AIDS, Multifocal Motor Neuropathy, and ITP.

Companies are expanding their presence in regions with growing demand for IVIG, particularly in Asia Pacific, Latin America, and the Middle East. Increased awareness, rising diagnosis rates, and improved healthcare infrastructure drive market growth. Access to IVIG remains challenging in some areas, leading manufacturers to focus on distribution networks and local partnerships.

Application Insights

Based on application, the Intravenous Immunoglobulin (IVIG) market has been categorized into immunodeficiency diseases, CIDP, hypogammaglobulinemia, congenital AIDS, chronic lymphocytic leukemia, myasthenia gravis, multifocal motor neuropathy, ITP, Kawasaki disease, Guillain-Barre syndrome, and others. The immunodeficiency diseases segment accounted for the largest revenue share of 19.78% in 2024. The growth of immunodeficiency diseases is driven by the rising incidence of primary and acquired immunodeficiency diseases (PID & AID); treatment with IV antibiotics is often necessary to manage infections. IVIG replacement therapy remains the most effective alternative for treating immunodeficiency diseases, driving steady market growth in the coming years.

The Kawasaki disease segment is expected to exhibit the fastest growth in the market over the forecast period. The rising incidence of Kawasaki disease in children and the growing demand for IVIG treatments are expected to drive market growth. While steroids serve as an alternative to IVIG therapy, they carry more side effects, making IVIG the preferred choice for treating Kawasaki disease. Furthermore, increasing patient awareness and the rising incidence of antibody deficiency diseases are expected to further boost the demand for IVIG therapies, fueling growth in this segment.

Distribution Channel Insights

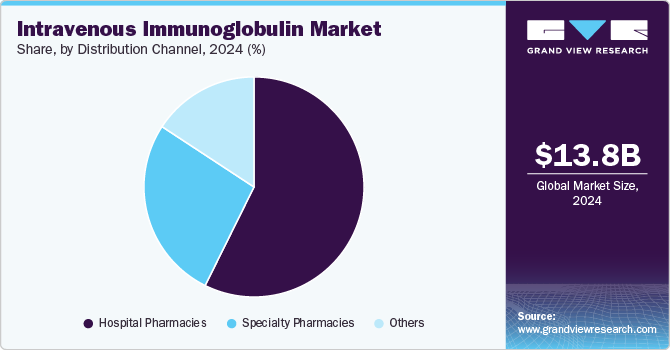

Based on distribution channel, the Intravenous Immunoglobulin (IVIG) market has been categorized into hospital pharmacies, specialty pharmacies, and others. The hospital pharmacies segment held the largest revenue share of 57.33% in 2024. The extensive network of hospitals and the wide range of products available through hospital pharmacies have made them a convenient option for patients. Moreover, the increasing incidence of primary immune deficiencies, hepatitis C, and other diseases has led to a rise in hospitalizations globally, driving greater patient preference for hospital pharmacies. Hospitals also offer quick reimbursement processes, effective treatment, and comprehensive care, further contributing to the growing trend of patients opting for hospital pharmacies.

Specialty pharmacy is expected to grow considerably over the forecast period. They offer the convenience of at-home treatment, making them an attractive option for many patients. As specialty drugs play a vital and growing role in the pharmacy industry, the number of licensed specialty drugs is increasing rapidly. This expansion is expected to drive significant growth in the specialty pharmacy segment during the forecast period.

Regional Insights

North America dominated the Intravenous Immunoglobulin (IVIG) market, with a global share of 46.11% in 2024. The North American Intravenous Immunoglobulin (IVIG) market is a leading region, capturing a global market share of 46.11% in 2024. This market is witnessing considerable growth, primarily driven by the increasing demand for IVIG therapies in treating a variety of immunodeficiency diseases and related conditions. The increasing usage of IVIG pharmacies also contributes to expanding access to medication across the region.

U.S. Intravenous Immunoglobulin Market Trends

The IVIG market in the U.S. continues to dominate the North American market, holding a share of 80.19% in 2024. The growth in the U.S. IVIG market is largely attributed to the increasing prevalence of immunodeficiency diseases and related health conditions. CIDP, Hypogammaglobulinemia, and autoimmune disorders such as Myasthenia Gravis and ITP are becoming more common, driving the demand for IVIG therapies. In addition, hospital and specialty pharmacies remain key distribution points for IVIG therapies in the U.S., where providers and patients benefit from advanced treatments offered by major suppliers such as Biotest AG, Baxter, and Octapharma AG.

Europe Intravenous Immunoglobulin Market Trends

The intravenous immunoglobulin market in Europe is also experiencing rapid growth, driven by increasing awareness of immunodeficiency diseases and the availability of effective IVIG therapies for conditions like CIDP, Guillain-Barre Syndrome, and Kawasaki disease. Countries like the UK, Germany, and France are witnessing a steady rise in the demand for IVIG products, particularly through hospital pharmacies and specialty pharmacies. The region’s growth is further supported by initiatives from key players like Grifols SA, CSL, and LFB, who are competing to expand their presence in the European market.

The UK intravenous immunoglobulin market is experiencing robust growth in the IVIG market, driven by the rising number of patients diagnosed with conditions such as Chronic Lymphocytic Leukemia, Hypogammaglobulinemia, and Myasthenia Gravis. The demand for IVIG is significantly increasing, with patients relying on hospital pharmacies and specialty pharmacies for treatment. Key players such as Biotest AG and Baxter are at the forefront of providing IVIG therapies, further accelerating market expansion in the UK.

The intravenous immunoglobulin market in Germany is witnessing steady growth in the IVIG market, primarily due to an increasing focus on treating immunodeficiency diseases and related conditions like ITP and Multifocal Motor Neuropathy. Hospital and specialty pharmacies are the primary points of distribution, with increasing partnerships between healthcare providers and major suppliers like Octapharma AG and Grifols SA. These companies are working to meet the growing demand for IVIG therapies and expand their reach in the German market.

France intravenous immunoglobulin market is growing rapidly, fueled by a rising awareness of the effectiveness of IVIG treatments for conditions like Guillain-Barre Syndrome and Kawasaki disease. The French market sees a high demand for IVIG therapies through hospital pharmacies, with significant competition between established international players and local suppliers such as LFB. This competitive landscape is helping to expand access to life-saving therapies for patients across France.

Asia Pacific Intravenous Immunoglobulin Market Trends

The IVIG market in Asia Pacific is expanding rapidly, driven by a significant increase in the incidence of immunodeficiency diseases, particularly in countries such as China, India, Japan, and Australia. The growing need for IVIG therapies to treat conditions such as CIDP, Myasthenia Gravis, and Guillain-Barre Syndrome is evident, with hospital pharmacies and specialty pharmacies being the main distributors. Companies like CSL, China Biologics Products Inc., and Kedrion are working to establish a stronger foothold in the region by increasing the availability of their therapies.

Japan intravenous immunoglobulin market is experiencing significant growth in the IVIG market, driven by an increasing number of patients suffering from Myasthenia Gravis, CIDP, and Multifocal Motor Neuropathy. Hospital pharmacies and specialty pharmacies are the leading distribution channels, ensuring that patients across the country have access to IVIG treatments. International and local companies, including BDI Pharma Inc. and Octapharma AG, are working to meet the growing demand for IVIG in Japan.

The IVIG market in China is witnessing rapid growth, primarily driven by the increasing incidence of immunodeficiency diseases such as Chronic Lymphocytic Leukemia, ITP, and Hypogammaglobulinemia. Urbanization and increased access to healthcare services contribute to the demand for advanced IVIG treatments, primarily distributed through hospitals and specialty pharmacies. Major players like China Biologics Products Inc. and Kedrion are expanding their market presence in China to capitalize on this growth opportunity.

Latin America Intravenous Immunoglobulin Market Trends

The intravenous immunoglobulin (IVIG) market in Latin America is experiencing notable growth, primarily due to rising demand for IVIG therapies to treat conditions such as Kawasaki disease and Myasthenia Gravis. Countries like Brazil are leading this trend, where an increasing number of hospitals and specialty pharmacies focus on delivering advanced treatments for immunodeficiency diseases. The presence of key players such as Grifols SA and Baxter is driving market expansion, helping to ensure wider access to IVIG therapies in the region.

Brazil IVIG market is growing rapidly, fueled by increasing public health concerns regarding diseases such as Chronic Lymphocytic Leukemia, ITP, and Guillain-Barre Syndrome. Hospitals and specialty pharmacies remain the country's key distribution channels for IVIG therapies. The proactive efforts of suppliers like LFB and Biotest AG, coupled with government initiatives, are driving the growth of the IVIG market in Brazil.

Middle East & Africa Intravenous Immunoglobulin Market Trends

The intravenous immunoglobulin market in MEA is experiencing growth, driven by increasing demand for treatments related to conditions such as CIDP, Myasthenia Gravis, and Kawasaki disease. Countries like Saudi Arabia, South Africa, UAE, and Kuwait are witnessing a rise in the prevalence of these conditions, leading to higher demand for IVIG therapies. Hospital pharmacies and specialty pharmacies play a pivotal role in ensuring that patients in the region have access to essential treatments. Major suppliers like BDI Pharma Inc. and Grifols SA are expanding their reach in the MEA region to address this growing demand.

Saudi Arabia intravenous immunoglobulin market is experiencing significant growth, driven by increasing awareness of immunodeficiency diseases and related conditions. With a focus on conditions such as Guillain-Barre Syndrome and Myasthenia Gravis, the demand for IVIG therapies through hospital and specialty pharmacies is on the rise. The Saudi government’s Vision 2030 Health Sector Transformation Program, which includes initiatives to address immunodeficiency diseases, is expected to further support the country's IVIG market growth.

Key Intravenous Immunoglobulin Company Insights

Leading companies in the IVIG market include Biotest AG, Baxter, Octapharma AG, LFB, Grifols SA, CSL, and BDI Pharma Inc. These players invest in research, manufacturing capacity, and global expansion to meet the increasing demand for IVIG therapies.

Product innovation and regulatory approvals are key strategies for leading companies in the IVIG market to maintain a competitive edge. Established players focus on developing advanced formulations and expanding therapeutic applications while securing regulatory approvals to enhance market reach. Meanwhile, emerging companies are exploring niche areas such as personalized IVIG therapies and novel delivery mechanisms to address unmet medical needs.

Key Intravenous Immunoglobulin Companies:

The following are the leading companies in the IVIG market. These companies collectively hold the largest market share and dictate industry trends.

- Biotest AG

- Baxter

- Octapharma AG

- LFB

- Grifols SA

- CSL

- China Biologics Products Inc.

- Kedrion

- BDI Pharma Inc.

Recent Developments

-

In March 2024, Argenx SE announced that Japan's Ministry of Health, Labour, and Welfare (MHLW) approved VYVGART (efgartigimod alfa) for intravenous (IV) use in adults with primary immune thrombocytopenia (ITP).

-

In January 2024, the FDA approved GAMMAGARD LIQUID for treating neuromuscular disability in adults with chronic inflammatory demyelinating polyneuropathy (CIDP). It is used as induction therapy, followed by maintenance doses. However, it has not been studied in immunoglobulin-naive patients or for use as maintenance therapy beyond six months.

-

in April 2022, Grifols S.A. completed its purchase of Biotest, a significant and transformative deal that will drive growth and innovation. Grifols' purchase of Biotest AG allows it to accelerate and extend its product range, boost patient access to plasma medicines, operate the biggest private European network of plasma facilities (87 sites), and drive revenue growth and margin development.

Intravenous Immunoglobulin Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 14.88 billion |

|

Revenue forecast in 2030 |

USD 21.05 billion |

|

Growth rate |

CAGR of 7.2% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia; Kuwait |

|

Key companies profiled |

Biotest AG; Baxter; Octapharma AG; LFB; Grifols SA; CSL; China Biologics Products Inc.; Kedrion; BDI Pharma Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Intravenous Immunoglobulin Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global intravenous immunoglobulin market report based on application, distribution channel, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Immunodeficiency diseases

-

CIDP

-

Hypogammaglobulinemia

-

Congenital AIDS

-

Chronic Lymphocytic Leukemia

-

Myasthenia Gravis

-

Multifocal motor neuropathy

-

ITP

-

Kawasaki disease

-

Guillain-Barre syndrome

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Specialty Pharmacies

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global intravenous immunoglobulin market size was estimated at USD 13.85 billion in 2024 and is expected to reach USD 14.88 billion in 2025.

b. Some key players operating in the intravenous immunoglobulin market include Biotest AG, Baxter, Octapharma AG, LFB, Grifols SA, CSL, China Biologics Products Inc., Kedrion, and BDI Pharma Inc.

b. The market opportunity for the U.S. intravenous immunoglobulin (IVIG) market includes the introduction of more efficient and cost-effective intravenous immunoglobulin therapies.

b. Key factors driving the market's growth include the rising prevalence of immunodeficiency diseases, increasing adoption of immunoglobulin replacement therapy, and rising geriatric populations.

b. The global intravenous immunoglobulin market is expected to grow at a compound annual growth rate of 7.18% from 2025 to 2030 to reach USD 21.05 billion by 2030.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."