- Home

- »

- Medical Devices

- »

-

Interventional Oncology Market Size, Industry Report, 2033GVR Report cover

![Interventional Oncology Market Size, Share & Trends Report]()

Interventional Oncology Market (2026 - 2033) Size, Share & Trends Analysis Report By Technique (Ablation Therapies, Embolization Therapies), By Procedures (Tumor Biopsy, Vascular Interventions), By Application (Lung Cancer, Kidney Cancer), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-363-1

- Number of Report Pages: 210

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Interventional Oncology Market Summary

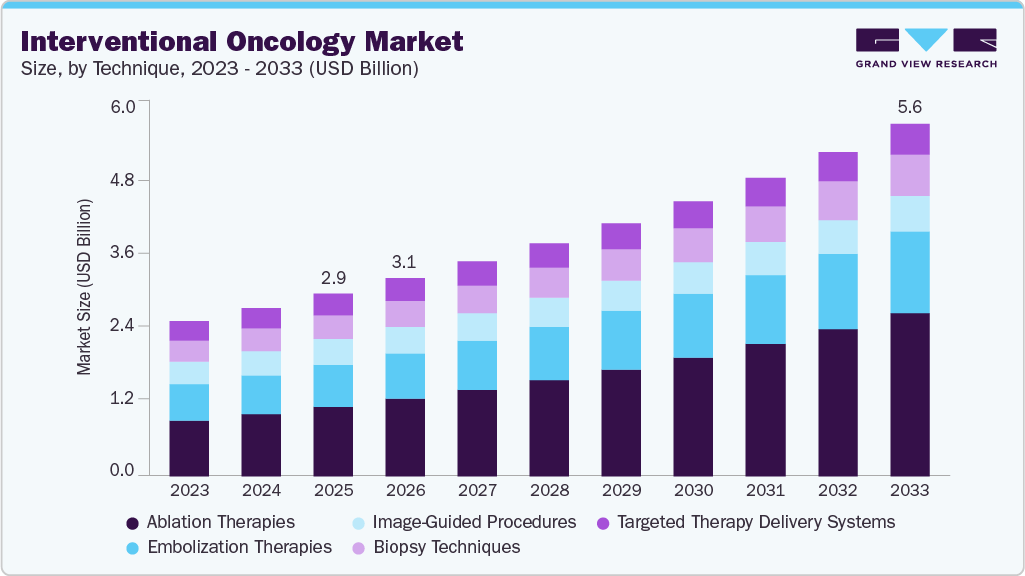

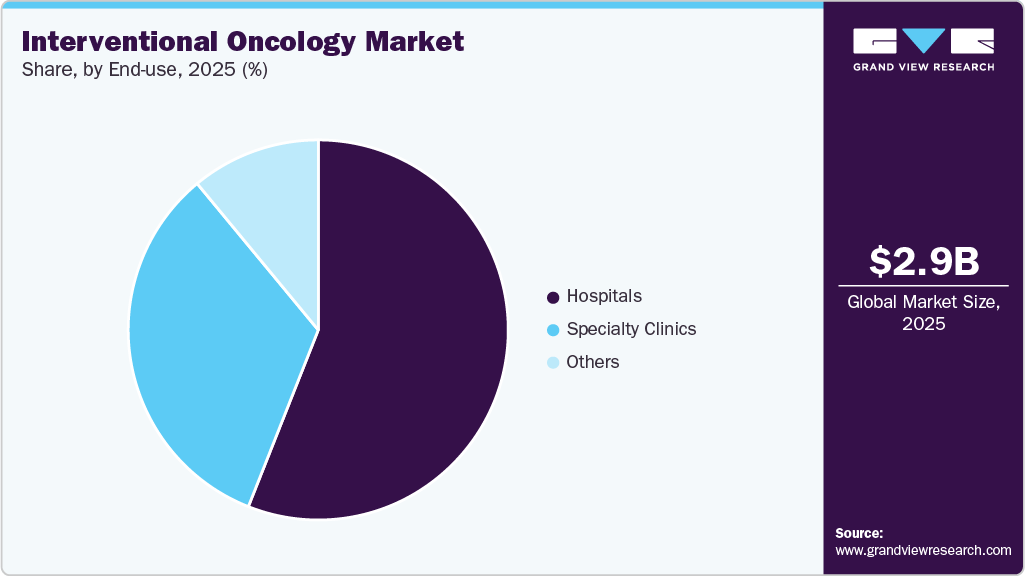

The global interventional oncology market size was estimated at USD 2.90 billion in 2025 and is projected to reach USD 5.61 billion by 2033, growing at a CAGR of 8.59% from 2026 to 2033. This growth can be attributed to the increasing prevalence of cancer, increasing technological advancements in minimally invasive procedures, growing geriatric population, rising focus on early cancer detection, and increasing public and private investments in the field of interventional oncology.

Key Market Trends & Insights

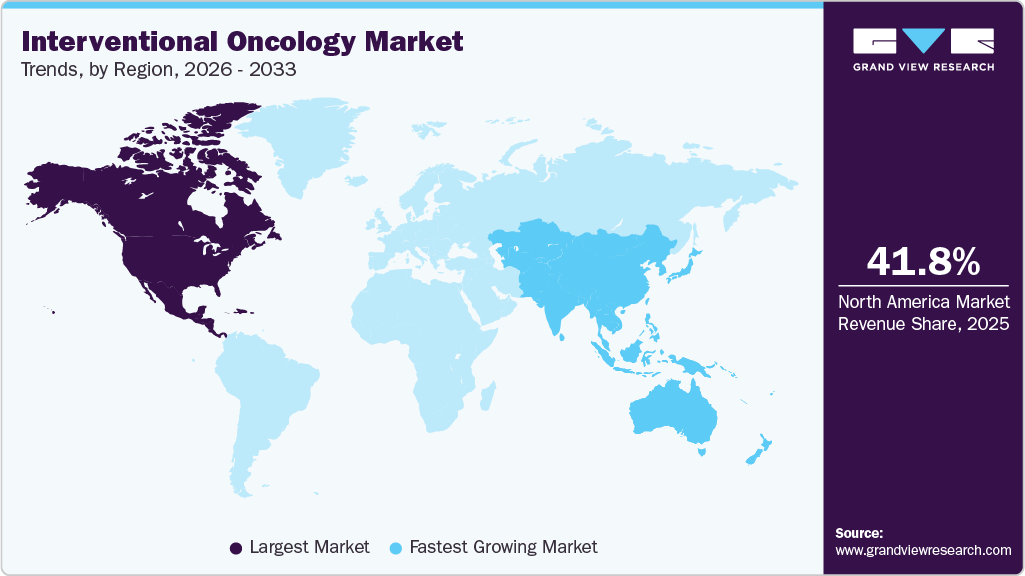

- North America’s Interventional oncology devices market held the largest share of 41.80% of the global market in 2025.

- The U.S. interventional oncology market is anticipated to witness lucrative growth over the forecast period.

- By technique, the ablation therapies segment dominated the market in 2025 with the largest revenue share.

- By procedures, the vascular intervention segment held leading market share of 38.1% in 2025.

- By application, the liver cancer segment accounted for the largest revenue share of 27.8% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 2.90 Billion

- 2033 Projected Market Size: USD 5.61 Billion

- CAGR (2026-2033): 8.59%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

There is a significant rise in the number of cancer cases globally, increasing the need for advanced solutions facilitating better cancer care according to WHO, in 2022, approximately 20 million new cancer cases and 9.7 million deaths occurred. By 2050, cases are projected to rise to over 35 million, marking a 77% increase in the global cancer burden.Interventional oncology, with its array of minimally invasive techniques such as radiofrequency ablation (RFA), transarterial chemoembolization (TACE), and cryoablation, offers significant advantages over traditional surgery, including reduced recovery times and lower complication rates. As the global cancer burden continues to rise, the adoption of these advanced interventional techniques is expected to accelerate, driven by their ability to improve patient outcomes and quality of life.The rising global incidence of cancer is largely attributed to increasing tobacco use, unhealthy diets, alcohol consumption, air pollution, and physical inactivity. This surge in cancer cases poses a significant challenge for healthcare systems, spurring the development of advanced solutions that offer better results and outcomes. Interventional oncology, which provides a minimally invasive alternative to traditional cancer treatments such as surgery, radiation, and chemotherapy, has become increasingly popular. Its advantages in terms of reduced patient trauma and quicker recovery times are key factors driving market growth.

These staggering statistics highlight the urgent need for effective cancer treatments. Interventional oncology, with its array of minimally invasive techniques such as radiofrequency ablation (RFA), transarterial chemoembolization (TACE), and cryoablation, offers significant advantages over traditional surgery, including reduced recovery times and lower complication rates. As the global cancer burden continues to rise, the adoption of these advanced interventional techniques is expected to accelerate, driven by their ability to improve patient outcomes and quality of life.

Companies in the interventional oncology market are actively pursuing various strategies to develop advanced solutions aimed at improving patient treatment and care. For example, in April 2021, Terumo launched its global therapeutic interventional oncology team to achieve excellence in interventional oncology solutions, with the goal of enhancing patient quality of life and survival rates. Such initiatives are expected to spur the development of innovative solutions, increasing the adoption of interventional oncology and driving market growth.

Moreover, increased efforts to develop advanced solutions have led to significant investments from both government and private organizations. In June 2023, Royal Philips announced that the Philips-coordinated IMAGIO consortium of clinical partners received a grant of approximately USD 25.97 million. This funding is intended to support research on minimally invasive cancer treatments, with a focus on liver cancer, lung cancer, and soft tissue sarcomas. Such investments are crucial for advancing interventional oncology technologies and improving patient outcomes.

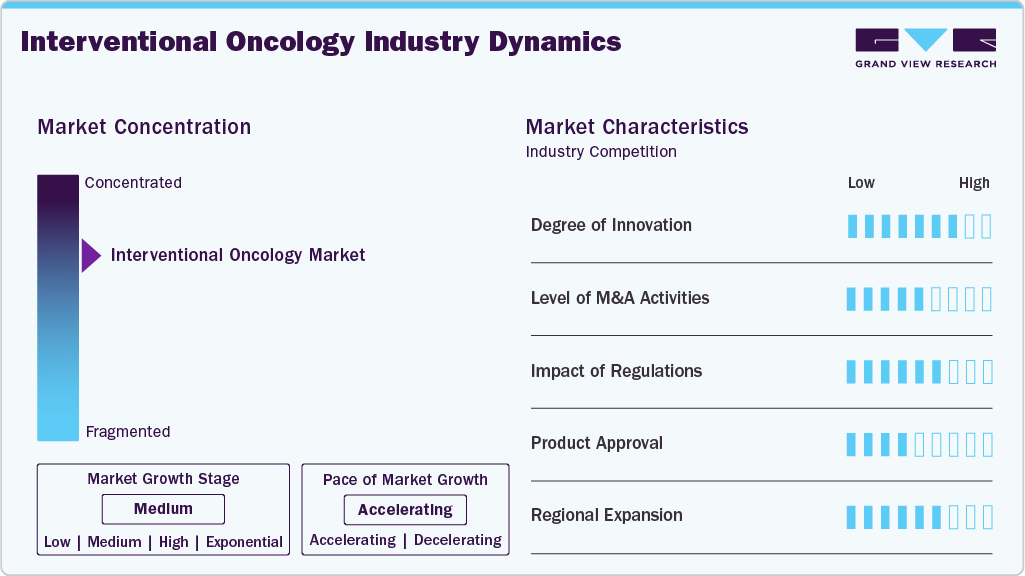

Market Concentration & Characteristics

The industry growth stage is high, and the pace of the market growth is accelerating. The market for interventional oncology devices has seen significant innovation, characterized by product innovations and technological advancements and enabling more precise and targeted therapies. These advancements help in reducing patient recovery and offer an alternative to systemic treatments which often have significant side effects.

In order to expand their customer base and gain a larger market share, major players in the industry are continuously working to improve their product offerings. This involves upgrading their products, exploring acquisitions, obtaining government clearances and engaging in important cooperation activities. For instance, in December 2024, AngioDynamics received FDA 510(k) clearance for its NanoKnife System to ablate prostate tissue. This non-thermal, radiation-free technology offers a minimally invasive treatment option for prostate cancer patients.

The interventional oncology devices market has achieved a high degree of innovation, owing to remarkable technological advancements that have positioned them at the forefront of medical diagnostics. For instance, in September 2022, Stryker's OptaBlate bone tumor ablation system received FDA clearance. This interventional oncology technology features patented micro-infusion technology, enabling quicker, more consistent ablations and the simultaneous treatment of two vertebral body levels. OptaBlate offers a reliable solution for patients with painful metastatic tumors.

Companies that provide interventional oncology techniques and procedures are undertaking merger and acquisition activities. This strategic approach seeks to improve technological capabilities, expand market reach, and maintain competitiveness. In September 2024, Stryker completed its acquisition of care.ai, a company specializing in AI-assisted virtual care workflows, smart room technology, and ambient intelligence solutions. This acquisition aims to enhance Stryker's healthcare IT offerings and wirelessly connected medical device portfolio, providing real-time, smart, and connected decision-making tools to improve patient care.

Regulatory bodies, including the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA), play a pivotal role in shaping the development and deployment of interventional oncology techniques and procedures. The regulations and their expanding approvals of newer technologies support the adoption of these techniques beyond traditional indications and in clinical environments.

New product/procedure launches and approvals by manufacturers to stay competitive in the market and the growing demand and adoption of interventional oncology is an important factor driving market growth. For instance, in September 2024, Sirtex Medical announced that its SIR-Spheres Y-90 resin microspheres was certified under the European Union's Medical Device Regulation (MDR EU 2017/745). The company also launched its SIROS delivery system in Europe, which was designed to improve the precision and safety of administering SIR-Spheres, thereby enhancing targeted cancer treatment in oncology.

The interventional oncology industry is witnessing growth across various regions, propelled by a range of factors unique to each geographical area. This growth is being fueled by increasing awareness of cancer screening initiatives, increasing preference for minimally invasive procedures, advancements in image-guided technologies, and the expansion of healthcare infrastructure within developing economies.

Technique Insights

The ablation therapies segment dominated the market in 2025 with the largest revenue share. Ablation therapies, including radiofrequency, microwave, cryoablation, and laser ablation, are gaining popularity due to their minimally invasive nature and their effectiveness in targeting tumours with minimal damage to surrounding tissues. These therapies offer a promising alternative to traditional cancer treatments such as surgery and radiation, providing patients with shorter recovery times, reduced pain, and fewer complications. With an increasing number of cancer cases each year, there is a growing demand for effective and less invasive treatment options. According to the World Health Organization, cancer is one of the leading causes of death worldwide, and the number of new cases is expected to rise significantly in the coming decades. This escalating burden of cancer is propelling the adoption of innovative treatment modalities like ablation therapies, hence driving the interventional oncology ablation market.

The embolization therapies segment is anticipated to witness significant growth rate (CAGR) over the forecast period. Embolization in interventional oncology market, which involve the selective occlusion of blood vessels to cut off the blood supply to tumors, are increasingly recognized for their efficacy in treating various types of cancer, particularly liver cancer. These minimally invasive procedures offer significant advantages over traditional surgical approaches, including reduced recovery times, decreased complications, and the ability to target tumors that are otherwise inoperable. The growing preference for minimally invasive procedures among patients and healthcare providers is also contributing to the market's expansion. Embolization therapies are typically performed on an outpatient basis, resulting in shorter hospital stays, lower healthcare costs, and quicker recovery times compared to traditional surgery. This preference aligns with the broader trend towards cost-effective and patient-centric healthcare solutions, making embolization an attractive option for cancer treatment.

Procedures Insights

The vascular interventions segment captured the largest revenue share of 38.1% in 2025. Vascular interventions encompass variety of procedures, such as transarterial chemoembolization (TACE), transarterial radioembolization (TARE), and percutaneous transhepatic biliary drainage (PTBD). This segment is experiencing significant growth, driven by advancements in minimally invasive techniques and the increasing prevalence of liver cancer. The preference for these procedures is growing due to their ability to target tumours more precisely, reduce systemic toxicity, and improve patient outcomes. Key drivers for this market include the rising incidence of cancer, particularly hepatocellular carcinoma, the aging population, and the continuous technological advancements in imaging and catheter-based delivery systems. Trends indicate a shift towards more personalized treatment approaches, with ongoing research focusing on combining vascular interventions with immunotherapies and other systemic treatments to enhance efficacy. In addition, the development of drug-eluting beads and the integration of artificial intelligence in procedure planning are expected to further propel market growth.

The tumour ablation segment is expected to grow at a fastest CAGR of 9.10% during the forecast period. Tumour ablation techniques, including radiofrequency ablation (RFA), microwave ablation (MWA), cryoablation, and laser ablation, represent a rapidly expanding segment within the interventional oncology market. These procedures offer minimally invasive alternatives to traditional surgical approaches for treating solid tumours, with RFA and MWA being particularly prominent due to their effectiveness in targeting and destroying cancer cells with precision. Moreover, the increasing adoption of advanced tumour ablation therapies by various cancer care providers is further contributing to segment growth. For instance, in April 2022, the University of Alabama at Birmingham’s Department of Radiology announced the adoption of new tumour ablation therapy. This new therapy allows physicians to target tumours in the liver, kidney, breast, lung, or soft tissues without harming other normal structures and provides an extra layer of safety to patients.

Application Insights

The liver cancer segment accounted for the largest revenue share of 27.8% in 2025. The liver cancer segment represents the largest portion of the interventional oncology market, driven by several key factors. Liver cancer, particularly hepatocellular carcinoma (HCC), is one of the most common and deadly cancers worldwide, with the American Cancer Society estimating approximately 42,230 new cases and 30,230 deaths in the U.S. alone in 2023. Furthermore, according to the World Cancer Research Fund International data, around 866,136 people were diagnosed with liver cancer in 2022, making it the 6th most common cancer globally. The high prevalence and mortality rates necessitate advanced treatment options. Interventional oncology offers minimally invasive techniques such as radiofrequency ablation (RFA), transarterial chemoembolization (TACE), and microwave ablation, which are highly effective for treating liver tumors. For example, studies have shown that TACE can significantly improve survival rates in patients with intermediate-stage HCC. In addition, the rising adoption of image-guided procedures, which enhance the precision and efficacy of these treatments, further boosts the market's growth. Companies like Boston Scientific and Medtronic are investing heavily in developing innovative interventional oncology devices tailored for liver cancer, illustrating the segment's market potential.

The lung cancer segment is emerging as the fastest-growing area within the interventional oncology market, driven by advancements in minimally invasive procedures and the high global incidence of lung cancer. According to the World Health Organization (WHO), lung cancer remains the leading cause of cancer-related deaths worldwide, with an estimated 2.21 million new cases and 1.8 million deaths in 2020. This urgent healthcare challenge propels the demand for innovative treatment solutions. Interventional oncology offers promising options such as microwave ablation (MWA), cryoablation, and image-guided biopsy, which are particularly beneficial for patients who are ineligible for surgery. For instance, several patients with non-small-cell lung cancer (NSCLC) are not healthy enough for surgery. While several patients might develop lung tumors at a place that creates difficulties in surgeries. In such scenarios, ablative treatments can serve as a treatment alternative. Furthermore, major industry players such as AngioDynamics and BTG (now part of Boston Scientific) are investing in the development of novel interventional oncology devices and expanding their product portfolios to address the specific needs of lung cancer treatment. The combination of a high disease burden, technological advancements, and strategic investments fuels the rapid growth of the lung cancer segment within the interventional oncology market.

End-use Insights

The hospitals segment accounted for the largest revenue share of 55.3% in 2025. Hospitals offer the capacity to perform interventional oncology procedures, such as tumor embolization and ablation. Moreover, the reimbursement policies in several regions are becoming more favorable for interventional oncology procedures performed in hospital settings compared to other healthcare facilities. For instance, in December 2021, Singapore General Hospital (SGH) became first hospital in Asia with global gold standard by International Accreditation System for Interventional Oncology Services (IASIOS) for interventional oncology care.

The specialty clinic segment is expected to witness fastest growth over the forecast period. The number of specialty clinics focused on providing interventional oncology services is increasing. Similarly, Specialty clinics also tend to provide more personalized care, with dedicated staff who specialize in interventional oncology. These factors make specialty clinics an attractive option for patients seeking timely, high-quality cancer care.

Regional Insights

Interventional oncology market in North America dominated the global market and accounted for a revenue share of 41.80% in 2025 owing to several factors such as the presence of key market players in the region, high healthcare expenditure, awareness about minimally invasive procedures, favorable regulatory scenario, and high prevalence of cancer. According to the Canadian Cancer Statistics report released by the Canadian Cancer Society in November 2023, cancer was the leading cause of death in the country, and 239,100 people were expected to be diagnosed with cancer in 2023. Such a high prevalence of cancer increases the demand for advanced solutions, such as interventional oncology solutions, which drive market growth in the region.

U.S. Interventional Oncology Market Trends

The U.S. interventional oncology market is anticipated to witness lucrative growth over the forecast period. This can be attributed to the presence of key market players, supportive regulatory framework, increasing R&D efforts, and increasing government efforts to spread cancer awareness. In December 2022, the Society of Interventional Radiology (SIR) Foundation announced 1.5 million USD funding for 4 projects focusing on embolization & interventional oncology research. This funding is aimed at supporting high-impact interventional radiology research, which is expected to lead to breakthrough IR therapies, enabling improved patient outcomes.

Europe Interventional Oncology Market Trends

The interventional oncology market in Europe is projected to witness significant growth driven by factors such as rising cancer prevalence, focus on adopting minimally invasive procedures in cancer care, growing geriatric population, and rising government initiatives. According to a report published by the European Commission in September 2023, around 2.7 million people were diagnosed with cancer in the EU in 2022, which is an increase of 2.3% from 2020. Similarly, the number of cancer deaths were approximately 1.3 million, which is an increase of 2.4% from 2020. This increasing prevalence of cancer in the Europe is expected to drive the market growth in the region.

Asia Pacific Interventional Oncology Market Trends

The interventional oncology market in Asia Pacific is anticipated to witness the fastest growth at a CAGR of 9.60% from 2026 to 2033. This can be attributed to the high prevalence of cancer in the region, developing healthcare infrastructure and rising initiatives to increase the adoption of interventional oncological procedures in the region. For instance, in June 2023, FDA Oncology Center of Excellence (OCE) Project Asha was accordance to strengthen the relationship between the U.S. and India and to identify the regulatory landscape and potential barriers for increasing India’s access to interventional oncology trials. Such increasing initiatives for adoption of interventional oncology solutions are expected to drive the market growth in the region.

Key Interventional Oncology Company Insights

Key players operating in the interventional oncology market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are playing a key role in propelling market growth.

Key Interventional Oncology Companies:

The following are the leading companies in the interventional oncology market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic plc

- Boston Scientific Corporation

- Johnson & Johnson (Ethicon)

- Teleflex Incorporated

- Cook Medical

- AngioDynamics Inc.

- Stryker Corporation

- Profound Medical

- Terumo Corporation

- Siemens Healthineers

Recent Developments

-

In December 2024, AngioDynamics received FDA 510(k) clearance for its NanoKnife System to ablate prostate tissue. This non-thermal, radiation-free technology offers a minimally invasive treatment option for prostate cancer patients.

-

In February 2024, Profound Medical and Siemens Healthineers partnered to integrate Profound's TULSA-PRO system with Siemens' MAGNETOM Free.Max MRI scanner. This collaboration aims to provide a comprehensive solution for MRI-guided prostate therapy, enhancing precision in treating prostate conditions.

-

In September 2024, Stryker Corporation completed its acquisition of care.ai, a company specializing in AI-assisted virtual care workflows, smart room technology, and ambient intelligence solutions. This acquisition aims to enhance Stryker's healthcare IT offerings and wirelessly connected medical device portfolio, providing real-time, smart, and connected decision-making tools to improve patient care.

-

In November 2023, Terumo Corporation India launched Occlusafe and LifePearl, enhancing liver cancer treatment in India. Occlusafe is designed for embolization procedures, while LifePearl offers drug-eluting beads for targeted chemotherapy delivery. These innovations aim to improve patient outcomes and expand therapeutic options in interventional oncology.

-

In August 2022, Boston Scientific Corporation acquired Obsidio, Inc. This acquisition strengthens the company’s interventional oncology & embolization portfolio with the addition of Gel Embolic Material (GEM) technology, offering a differentiated solution to patients and physicians.

Interventional Oncology Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 3.15 billion

Revenue forecast in 2033

USD 5.61 billion

Growth rate

CAGR of 8.59% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technique, procedure, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic plc; Boston Scientific Corporation; Johnson & Johnson (Ethicon); Cook Medical; AngioDynamics Inc.; Stryker Corporation; Terumo Corporation; Siemens Healthineers; GE Healthcare, Teleflex Incorporated, Profound Medical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Interventional Oncology Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 - 2033. For this study, Grand View Research has segmented the global interventional oncology market report based on technique, procedures, application, end-use, and region:

-

Techniques Outlook (Revenue, USD Million, 2021 - 2033)

-

Ablation Therapies

-

Radiofrequency Ablation (RFA)

-

Microwave Ablation (MWA)

-

Cryoablation

-

Laser Ablation

-

Irreversible Electroporation (IRE)

-

-

Embolization Therapies

-

Transarterial Chemoembolization (TACE)

-

Transarterial Radioembolization (TARE)

-

-

Biopsy Techniques

-

Core Needle Biopsy

-

Fine Needle Aspiration (FNA)

-

-

Targeted Therapy Delivery Systems

-

Drug-Eluting Beads

-

Radioembolization

-

Drug-Eluting Stents

-

Injectable Hydrogels and Nanoparticles

-

Other Targeted Therapy Systems

-

-

Image-Guided Procedures

-

Ultrasound Guidance

-

CT Scan Guidance

-

MRI Guidance

-

Fluoroscopy Guidance

-

-

-

Procedure Outlook (Revenue, USD Million, 2021 - 2033)

-

Tumor Ablation

-

Tumor Biopsy

-

Vascular Interventions

-

Palliative Care

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Liver Cancer

-

Lung Cancer

-

Kidney Cancer

-

Prostate Cancer

-

Breast Cancer

-

Other Cancer

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Specialty Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global interventional oncology market size was estimated at USD 2.9 billion in 2025 and is expected to reach USD 3.1 billion in 2026.

b. The global interventional oncology market is expected to grow at a compound annual growth rate of 8.59% from 2026 to 2033 to reach USD 5.61 billion by 2033.

b. North America dominated the interventional oncology market with a share of 41.73% in 2025 owing to several factors such as the presence of key market players in the region, high healthcare expenditure, awareness about minimally invasive procedures, favorable regulatory scenario, and high prevalence of cancer.

b. Some key players operating in the interventional oncology market include Medtronic plc; Boston Scientific Corporation; Johnson & Johnson (Ethicon); Baxter International Inc.; Cook Medical; C.R. Bard Inc. (Acquired by BD); AngioDynamics Inc.; Stryker Corporation; B. Braun Melsungen AG; Terumo Corporation; Siemens Healthineers; GE Healthcare.

b. Key factors that are driving the market growth include prevalence of cancer, increasing technological advancements in minimally invasive procedures, growing geriatric population, rising focus on early cancer detection, and increasing public and private investments in the field of interventional oncology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.