Internet Of Things In Retail Market Size, Share & Trends Analysis Report By Component (Hardware, Platform, Services), By Deployment (On-premise, Cloud), By Technology, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-752-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

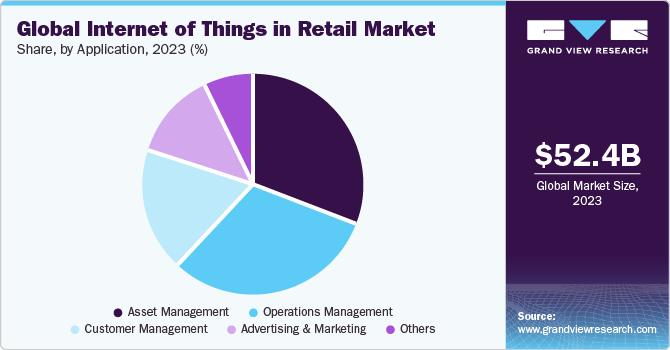

The global Internet of Things in retail market size was estimated at USD 52.42 billion in 2023 and is projected to grow at a CAGR of 29.3% from 2024 to 2030. The surge of omnichannel retailing, propelled by IoT technologies that seamlessly blend online and offline shopping channels, is driving the market growth. In addition, the increasing presence of IoT-enabled smart stores, wherein retailers leverage interconnected devices and sensors to create immersive and personalized shopping experiences, is further fueling the market expansion.

IoT in retail market is experiencing significant growth with the adoption of smart payment solutions. The significant benefits of smart payment options, such as contactless payments and mobile wallets, are their convenience and efficiency. It provides customers with a seamless and faster way to complete their purchases. They can tap their cards or mobile devices at the Point of Sale (POS) terminal to authorize payments, eliminating the need for traditional card swiping or PIN entry. This streamlined process significantly reduces checkout times, enhancing customer and retailer satisfaction while optimizing operational efficiency.

Furthermore, IoT-driven data analytics is a powerful tool for retailers to gain actionable insights into customer behavior, preferences, and purchasing patterns. By leveraging real-time data collected from IoT devices, retailers can personalize marketing campaigns, optimize component collections, and enhance operational efficiency. The adoption of predictive analytics powered by machine learning (ML) algorithms is emerging as a pivotal trend. This integration of IoT technologies enables retailers to predict customer needs and market trends, facilitating proactive decision-making. This, in turn, is likely to accelerate market expansion in the coming years.

Companies have engaged in component launches and strategic collaborations to drive growth and innovation. For instance, in January 2024, Softweb Solutions Inc. launched 360° programs focused on AI, generative AI, data, IoT, digital, and its new product called Needle. This new suite of technology provides an integrated approach to help enterprises realize their full potential of future-ready innovation. Such strategies by key companies are expected to fuel market growth in the coming years.

Moreover, the market growth is driven by the proliferation of IoT-enabled smart stores, where retailers leverage interconnected devices and sensors to create immersive and personalized shopping experiences. From smart shelves that automatically track inventory levels to interactive displays that deliver targeted promotions based on customer preferences, these innovations are enhancing customer engagement and loyalty while optimizing store operations.

Market Concentration & Characteristics

The degree of innovation in the market is high, and the market growth is accelerating owing to continuous technological advancements, including the integration of cutting-edge technologies such as artificial intelligence, machine learning, and blockchain. For instance, in January 2024, SAP SE announced new AI-powered tools to assist retailers in enhancing company operations, boosting consumer loyalty, and increasing profitability. From planning to personalization, the capabilities will give retailers holistic customer insights and data analysis to adapt to the rapidly changing market conditions.

The level of merger and acquisition (M&A) activities is significantly high as companies make strategic moves to enhance their component & service offerings and technological capabilities and gain a competitive advantage in the market. For instance, in June 2023, IBM Corporation acquired Agyla SAS to expand its hybrid multi-cloud services portfolio and further advance its hybrid cloud and AI strategy in the region.

The impact of regulations on the market is likely to be low to moderate. Regulations are enacted to address concerns related to data privacy, identity verification, and digital rights management. For instance, stricter data regulations such as General Data Protection Regulation (GDPR) in European Union and the California Consumer Privacy Act (CCPA) in the U.S. impose stringent requirements on how retailers collect, process, and store consumer data through IoT devices.

The end-user concentration in the market is expected to be high owing to retailers increasingly adopting IoT technologies to enhance customer experiences, optimize business processes, and drive growth. Retailers leverage IoT applications to address significant challenges and drive unprecedented benefits, such as business process optimization, cost reduction, and service automation. IoT devices, platforms, and applications are being used to track the location, condition, and movement of assets and inventory, providing 360-degree visibility and enabling retailers to make data-driven decisions.

Component Insights

The hardware segment dominated the market in 2023 with a share of 44.73%. This can be attributed to the growing adoption of IoT solutions in retail space to enhance operational efficiency, improve customer experiences, and gain competitive advantages in an evolving market landscape. In addition, the growing focus on data-driven decision-making and the need for real-time insights further drive the demand for IoT hardware to collect, process, and transmit data from physical environments, enabling retailers to make informed decisions and drive business growth.

The platforms segment is expected to record the fastest CAGR of 33.2% from 2024 to 2030. IoT platforms have become essential in implementing IoT technology in the retail industry. They provide the infrastructure for managing data, coordinating devices, and developing applications. The retail industry is increasingly adopting IoT to improve operations and enhance customer experiences. As a result, there is a growing demand for advanced IoT platforms.

Deployment Insights

The on-premise deployment segment recorded a significant market share in 2023. The segment’s growth can be attributed to the numerous advantages of this deployment mode such as the increased control over data security and privacy, reliability, cost savings, and customization choices. Furthermore, on-premise implementation is less expensive than cloud-based solutions for merchants with large-scale IoT deployments. Because data processing and storage are performed locally, on-premise deployment allows merchants to avoid costly data fees and other cloud-based charges. This approach provides more control over the data and allows for customization to meet specific business needs, thereby propelling market growth.

The cloud deployment segment is expected to register the fastest CAGR from 2024 to 2030. The increasing preference for cloud deployment mode among retailers can be attributed to the cloud’s ability to perform real-time analytics on data acquired by IoT devices, such as beacons, cameras, and sensors. Moreover, this data can also help retailers get insights about buying behavior, optimize store layouts and product placements, and identify peak shopping periods to adjust staffing in stores, thereby driving segmental growth.

Application Insights

The asset management segment accounted for the largest market share in 2023. This can be attributed to retailers' growing focus on optimizing asset utilization and operational efficiency. Moreover, retailers are leveraging IoT technology to remotely track assets across multiple locations, which enables them to safeguard functionality, monitor asset distribution, and make informed decisions based on real-time insights. Thus, the increasing demand for IoT solutions for asset tracking and loss prevention drives segmental growth.

Customer management segment is anticipated to grow at the fastest CAGR in the market from 2024 to 2030. The segment growth is attributed to the increased importance of customer management systems, which assist retailers in providing a tailored, personalized, and engaging customer experience. Furthermore, IoT devices and sensors give merchants a lot of information on consumer purchasing behavior and preferences, which can be utilized to improve customer engagement tactics in various ways, including customer segmentation, feedback, and personalization. The benefits of IoT for consumer engagement are projected to fuel segmental growth in the coming years.

Technology Insights

The near field communication (NFC) segment accounted for the largest market share in 2023. The rising demand for this technology, coupled with the increasing number of projects by mobile operators and device manufacturers to increase the coverage of NFC-based transactions, is driving segmental growth. In addition, the rise of mobile wallets has modernized payment methods, boosting NFC adoption in the retail sector. Moreover, supermarkets and medical stores implemented NFC technology to quicken the check-out processes and to manage the rush during the pandemic. The increasing application of this technology will contribute to segmental growth over the coming years.

Bluetooth low energy is estimated to witness the fastest CAGR from 2024 to 2030. This growth is attributed to this technology’s low-power, cost-effective, and versatile nature, making it a popular choice for connecting IoT devices. The factor contributing to Bluetooth’s prominence is its compatibility with smartphones and tablets. Most consumers already own these devices, which serve as convenient gateways to interact with IoT nodes. This inherent compatibility reduces the need for additional infrastructure, making Bluetooth a compelling choice for IoT deployments.

Regional Insights

North America accounted for the largest revenue market share of 29.27% in 2023. This can be attributed to the proliferation of e-commerce and the subsequent demand for IoT solutions for managing assets and inventories and tracking customer buying behavior among regional retailers. The presence of major players in the region, such as IBM Corporation, Google LLC, Microsoft Corporation, Intel Corporation, and PTC Inc., with strong R&D capabilities, is also contributing to the growth of the regional market.

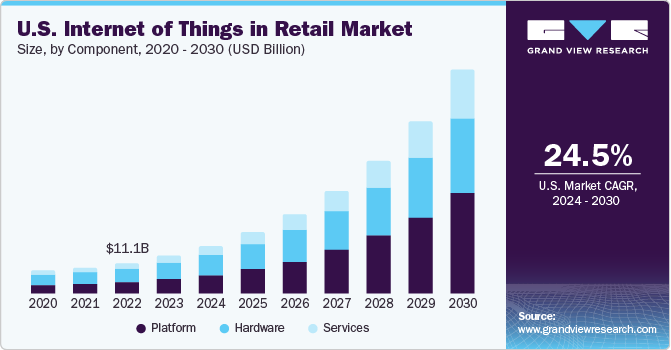

U.S. Internet Of Things In Retail Market Trends

Internet of Things in retail market in the U.S. is anticipated to grow at a CAGR of 24.5% from 2024 to 2030. This growth is attributed to the inclusion of in-store and digital operations in the retail sector, with technologies such as RFID tags and smart shelves helping retailers effectively manage inventory and provide an enhanced shopping experience.

Europe Internet Of Things In Retail Market Trends

Internet of Things in retail market in Europeis anticipated to grow at a CAGR of 27.9% from 2024 to 2030. The market is driven by the region’s increasing digitalization and technological advancements. The demand for personalized digital interactions is fueling the adoption of hardware avatars in industries such as gaming, entertainment, asset management, education, and retail.

UK Internet Of Things In retail market accounted for over 22% revenue share of the European market in 2023. In the UK, market is expanding rapidly, driven by increasing adoption of digital avatars for brand representation and the growing demand for personalized and immersive user experiences across various industries.

Internet Of Things In retail market in Germany is expected to grow at a CAGR of 26.6% from 2024 to 2030. Factors such as the increasing adoption of digital avatars for personalized userexperiences, customer engagement, and virtual interactions across various industries are propelling the market in Germany.

France Internet Of Things In retail market is projected to grow at a CAGR of 27.5% from 2024 to 2030. Companies in France are likely focusing on creating immersive and Hardware IoT in retail experiences to engage users effectively. The rising popularity of digital avatars in social media platforms and online communication tools drives the region’s demand for personalized avatar solutions.

Asia Pacific Internet Of Things In Retail Market Trends

Internet of Things in retail market in Asia Pacific is projected to be the fastest-growing market, anticipating a remarkable CAGR of 33.5% from 2024 to 2030. This surge is propelled by increasing internet penetration, smartphone usage, and e-commerce activities. This digital shift creates a conducive environment for adopting digital avatars in customer interactions, marketing strategies, and virtual experiences.

China Internet Of Things In retail market is projected to grow at a CAGR of 30.9% during the forecast period. The rise of retail sales in the country, driven by the expansion of major retail companies, and rising disposable incomes are expected to further fuel the market growth.

Internet Of Things In retail market in Japan is expected to grow lucratively during the forecast period. Factors such as a notable increase in retail sales and a growing urge among retailers to adapt to innovative technologies, revamp in-store strategies, create an omnichannel presence, and broaden supply chains are also expected to create lucrative growth prospects for market players in the near future.

India Internet Of Things In retail market is expected to grow at a CAGR of 35.8% from 2024 to 2030. Factors such as rapid urbanization and expansion of the retail sector in the country are creating massive growth opportunities for the market. The proliferation of various retail chains and the expansion of various foreign retailers in the country are stimulating the adoption of IoT solutions.

Middle East and Africa Internet Of Things In Retail Market Trends

Internet of things in retail market in the Middle East and Africa region is anticipated to grow at a CAGR of over 30% from 2024 to 2030. This growth can be attributed to the rising demand for IoT solutions driven by expansion of retail sector in the region. Retailers in the region are leveraging IoT technologies that can significantly enhance customer experiences by offering personalized services, optimizing store layouts, and providing real-time component recommendations.

South Africa Internet Of Things In retail market is projected to have lucrative growth during the forecast period. The increasing demand for enhanced customer round-the-clock customer support, advancements in AI and NLP technologies, integration with various communication channels, and the need for automation and cost-efficiency in customer service processes are propelling the market growth in the region.

Key Internet Of Things In Retail Company Insights

Some of the key players operating in the market are Cisco Systems Inc.; IBM Corporation; Intel Corporation; and Google LLC.

-

Cisco Systems Inc., offers industrial IoT solutions that help connect and monitor IoT devices, secure and automate OT operations, and simplify IT for industrial networks. Their solutions focus on driving innovation, security, simplicity, and scale for industrial networks, enabling businesses to securely connect assets, applications, and data in real time to drive transformative changes in both carpeted and non-carpeted spaces.

-

IBM Corporation offers a wide range of solutions and services to help retailers optimize their operations and enhance customer experiences. The company’s IoT retail solutions include AI-powered tools for inventory management, supply chain optimization, and customer engagement. These solutions leverage IoT devices, analytics, and machine learning to provide real-time insights and automate processes, enabling retailers to improve efficiency, reduce costs, and better serve their customers.

Softweb Solutions Inc.; Losant IoT; and RetailNext Inc. are some of the emerging market participants in the Internet of Things (IoT) in Retail market.

-

Softweb Solutions Inc. offers a comprehensive range of smart retail solutions that leverage disruptive technologies to transform both physical and digital retail spaces.The company develops end-to-end solutions that redefine core retail operations by integrating disruptive technologies like artificial intelligence and data intelligence

-

Losant IoT provides enterprise-level IoT software for application enablement. They offer an easy-to-use and powerful Enterprise IoT Platform designed to help teams quickly build real-time connected solutions. Losant's platform allows for easy connection, visualization, and automation of devices and data, leading to real-time insights and actionable intelligence. Their solutions focus on transforming operational strategies, turning Component s into intelligent assets, and offering a perfect balance between agility, flexibility, and affordability.

Key Internet Of Things In Retail Companies:

The following are the leading companies in the internet of things in retail market. These companies collectively hold the largest market share and dictate industry trends.

- Cisco Systems Inc.

- IBM Corporation

- Intel Corporation

- SAP SE

- Arm Limited

- Google LLC

- Microsoft Corporation

- NXP Semiconductors

- PTC Inc.

- Softweb Solutions Inc.

- Verizon Communications Inc.

- Losant IoT

- RetailNext, Inc.

- Zebra Technologies Corporation

Recent Developments

-

In January 2024, IBM Corporation collaborated with SAP SE to develop solutions to help clients in the consumer-packaged goods and retail industries optimize their supply chain, finance operations, sales, and services using generative AI.

-

In December 2023, Intel Corporation signed a memorandum of understanding with Siemens AG to drive the digitalization and sustainability of microelectronics manufacturing. The companies leveraged their respective portfolios of IoT solutions, along with the latter’s automation solutions, to enhance the efficiency and sustainability of semiconductor manufacturing.

Internet Of Things In Retail Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 66.39 billion |

|

Revenue forecast in 2030 |

USD 310.73 billion |

|

Growth rate |

CAGR of 29.3% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, technology, deployment, application, region |

|

Key companies profiled |

Cisco Systems Inc.; IBM Corporation; Intel Corporation; SAP SE; Arm Limited, Google LLC; Microsoft Corporation; Softweb Solutions Inc.; Verizon Communications Inc.; Zebra Technologies Corporation; NXP Semiconductors; PTC Inc.; Losant IoT; RetailNext, Inc. |

|

Customization scope |

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Internet Of Things In Retail Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the internet of things in retail market report based on component, technology, deployment, application, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Beacons

-

RFID Tags

-

Sensors

-

Wearables

-

-

Platform

-

Connectivity Management

-

Application Management

-

Device Management

-

-

Services

-

Professional Services

-

Managed Services

-

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Bluetooth Low Energy

-

Near Field Communication

-

Zigbee

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Operations Management

-

Inventory Management

-

Supply Chain Automation

-

Workforce Management

-

Security & Safety

-

-

Customer Management

-

Smart Vending Machine

-

Smart Shelves

-

Queue Management

-

Automated Checkout

-

-

Asset Management

-

Asset Tracking

-

Predictive Maintenance

-

-

Advertising and Marketing

-

Smart Digital Signage

-

Geomarketing

-

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

South Korea

-

Japan

-

-

Latin America

-

Mexico

-

Brazil

-

-

Middle East & Africa

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global internet of things in retail market size was estimated at USD 52.42 billion in 2023 and is expected to reach USD 66.39 billion in 2024.

b. The global internet of things in retail market is expected to grow at a compound annual growth rate of 29.3% from 2024 to 2030 to reach USD 310.73 billion by 2030.

b. North America accounted for a revenue share of over 29% in 2023 in the global IoT in retail market. This can be attributed to the region’s mature and technologically advanced retail market, robust infrastructure, favorable regulatory environment, strong consumer demand for personalized experiences.

b. Some of the key players in the global internet of things (IoT) in retail market include IBM Corporation; Impinj Inc.; Allerin Tech Pvt Ltd.; and RetailNext Inc.

b. Key factors that are driving the IoT in retail market growth include the need for enhanced customer experience and a decline in the component cost.

b. The hardware segment accounted for the highest revenue share of over 44% in 2023 in the IoT in retail market. This can be attributed to the growing adoption of IoT solutions in the retail space to enhance operational efficiency, improve customer experiences, and gain competitive advantages in an evolving market landscape.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."