Internet Of Things (IoT) In Energy Market Size, Share & Trends Analysis Report By Component (Solution, Services), By Application (Oil & Gas, Coal Mine), By Deployment, By Connectivity, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-381-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Internet Of Things In Energy Market Trends

The global internet of things (IoT) in energy market size was estimated at USD 25.23 billion in 2023 and is expected to grow at a CAGR of 13.0% from 2024 to 2030. Advancements in sensor technology have significantly boosted the market. Modern sensors are more accurate, reliable, and affordable, enabling energy companies to gather detailed real-time data from various sources such as power grids, wind turbines, and solar panels. This data helps optimize energy production, distribution, and consumption, leading to more efficient operations. In addition, improved sensor technology supports predictive maintenance, reducing downtime and extending the life of energy infrastructure. As sensor technology continues to evolve, its integration into IoT solutions will further enhance the efficiency and sustainability of energy systems, thereby driving market growth.

Moreover, governments globally are rolling out initiatives and regulations to promote energy efficiency and reduce carbon footprints. These policies often include incentives for adopting IoT technologies in the energy sector through direct investments, subsidies, or mandates for smart utility meters in homes and businesses. Such governmental support accelerates the adoption of IoT solutions, driving growth by ensuring compliance, promoting sustainability, and encouraging innovation in energy management and distribution systems.

The global shift towards renewable energy sources such as solar, wind, and hydro is a major market growth. internet of things (IoT) technologies enable the efficient management of renewable energy systems by providing real-time monitoring and control. This ensures optimal energy production and distribution, reducing waste and improving reliability. Furthermore, IoT can facilitate the integration of renewable energy into existing grids, balancing supply and demand. As the world continues to prioritize sustainability and reduce dependence on fossil fuels, the role of IoT in supporting renewable energy initiatives will expand, contributing to market growth.

Moreover, IoT solutions offer significant cost savings and operational efficiencies for energy companies. By leveraging IoT, companies can automate processes, optimize resource utilization, and minimize energy wastage. Real-time data analytics provide insights into energy consumption patterns, enabling better demand forecasting and load balancing. Predictive maintenance powered by IoT sensors can identify potential issues before they lead to costly failures, reducing maintenance costs and downtime. As companies seek to remain competitive and improve profitability, the cost-saving potential of IoT will drive its adoption in the energy sector in the coming years.

Furthermore, consumers are increasingly interested in smart home devices like thermostats, lighting controls, and energy management systems that offer convenience, control, and cost savings. These devices rely on IoT technology to function and are often integrated with home energy systems and the broader power grid. This integration helps balance demand, reduce overall energy consumption, and enhance grid stability. Consumer demand for such technologies encourages energy providers to adopt and support IoT solutions, propelling the market forward.

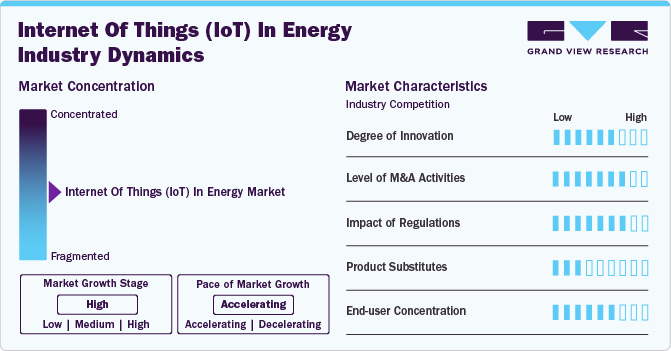

Industry Dynamics

The impact of innovation in the market significantly reduces operational costs and carbon footprints, fostering a more sustainable and efficient energy landscape. It enables smarter energy distribution and consumption, paving the way for a cleaner, more adaptable energy future.

Regulations on internet of things (IoT) in the energy market encourage the development of more secure and efficient systems but may slow innovation by imposing compliance costs and complexities. They aim to balance grid stability and consumer protection with the advancement of smart technologies.

The market is also being influenced by the rising number of mergers and acquisitions, which help companies increase market share, expand the customer base, and strengthen product portfolios.

The availability of product substitutes in the market can encourage innovation and reduce costs but might also fragment the market, leading to compatibility and standardization challenges. This competition encourages companies to enhance features and security to maintain a competitive edge.

High end-user concentration in the market drives the customization and scalability of solutions, focusing on specific consumer needs. However, it can also limit market diversification and increase dependency on major clients, potentially delaying broader innovation.

Application Insights

The smart grid segment held the highest revenue share in 2023 due to the increasing demand for efficient energy management and sustainability. Integration of IoT technologies enables real-time monitoring, predictive maintenance, and optimized energy distribution, reducing outages and enhancing grid reliability. Government initiatives and investments in smart infrastructure further drive this expansion. Moreover, advancements in communication technologies and data analytics foster the development and adoption of the smart grid segment.

The coal mine segment is estimated to register a significant growth rate from 2024 to 2030. The coal mine application segment is witnessing substantial growth due to the need for safety improvements and operational efficiency in mining operations. IoT technologies are being deployed for real-time monitoring of dangerous gases, structurally critical areas, and equipment status, significantly reducing the risk of accidents and downtime. In addition, IoT solutions are optimizing coal production processes, from extraction to delivery, by ensuring energy conservation and minimizing environmental impacts, thereby driving the segment growth.

Component Insights

The solution segment dominated the market in 2023 with a market share of 84.33%, driven by the increasing need for energy efficiency and sustainability. Advanced IoT solutions enable real-time monitoring, predictive maintenance, and optimized energy consumption, contributing to cost savings and enhanced operational efficiency. In addition, government regulations and incentives for smart grid technologies are fostering the adoption of IoT solutions. As a result, energy companies are investing heavily in IoT innovations to improve reliability and reduce environmental impact, thereby driving the segment growth.

The services segment is expected to record a significant CAGR of over 15% from 2024 to 2030. The segment growth is due to increased demand for efficient energy management and smart grid solutions. Service providers offer advanced analytics, predictive maintenance, and real-time monitoring, enabling utilities and consumers to optimize energy consumption and reduce costs. Integrating renewable energy sources and regulatory mandates for energy efficiency further propels the adoption of Internet of Things (IoT) services. Furthermore, advancements in AI and machine learning enhance the capabilities of IoT services, further driving the segment growth.

Connectivity Insights

The Wi-Fi segment held the highest revenue share in 2023, driven by its ability to offer high-speed, reliable connections essential for the real-time monitoring and management of energy systems. This increased adoption is leveraging the widespread availability of Wi-Fi infrastructure, making it easier and more cost-effective for energy providers to implement IoT solutions. Furthermore, Wi-Fi technology's ongoing advancements ensure its suitability for a broad range of IoT applications in the energy sector, from smart meters to grid management, enhancing operational efficiencies and promoting sustainable energy practices.

The Z-wave segment is estimated to register a significant growth rate from 2024 to 2030 due to its highly efficient, low-power, and reliable communication capabilities. This technology enables smart energy management systems to seamlessly connect and communicate, enhancing user control over energy consumption and reducing energy waste. Its mesh network capability ensures extensive coverage, making it an ideal choice for residential and commercial energy management, thereby driving the segment growth.

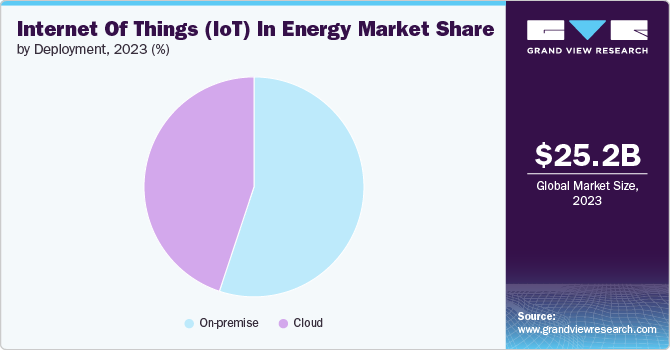

Deployment Insights

The on-premise segment held the highest revenue share in 2023. The segment growth is driven by the need for secure and reliable energy management solutions that comply with strict regulatory standards. On-premise solutions offer enhanced control over Internet of Things (IoT) devices and data, crucial for energy companies to optimize their operations and improve efficiency. Moreover, this growth is further fueled by the increasing demand for real-time data processing and analysis in energy systems to make immediate, informed decisions, thereby driving the segment growth.

The cloud segment is estimated to register the highest growth rate from 2024 to 2030. The cloud deployment segment is witnessing robust growth, propelled by its scalability, flexibility, and cost-effectiveness. Cloud-based solutions enable energy companies to easily manage vast amounts of data generated by IoT devices, facilitating improved operational efficiency and decision-making. This segment's expansion is further supported by the growing integration of advanced technologies like artificial intelligence and machine learning, which enhance predictive maintenance and energy optimization. As a result, the demand for cloud deployment in the energy sector is surging, driven by the pursuit of innovative, data-driven energy management strategies.

Regional Insights

The Internet of Things (IoT) in energy market in North America accounted for the highest revenue share of 37.04% in 2023, driven by a robust technological infrastructure and strong policy support for smart energy solutions, optimizing energy production and consumption. This integration of IoT technologies enables efficient management of renewable energy sources, enhances grid reliability, and offers consumers real-time energy usage data, fostering growth in the region's energy sector.

U.S. Internet Of Things (IoT) In Energy Market Trends

The Internet of Things (IoT) in energy market in the U.S. is anticipated to grow at a CAGR of around 10.0% from 2024 to 2030. Significant investment in smart grid technologies and expanding renewable energy sources are propelling the market growth. This, coupled with the government's support for energy efficiency and emission reduction initiatives, is driving the adoption of IoT solutions across the energy sector.

Asia Pacific Internet Of Things (IoT) In Energy Market Trends

The Internet of Things (IoT) in energy market in Asia Pacific is anticipated to grow at a considerable CAGR of 16.0% from 2024 to 2030. Rapid urbanization and the rising need for efficient energy management systems drive the Asia Pacific region's growth. Investments in smart grid technologies and the expansion of renewable energy sources are complemented by IoT innovations, allowing for enhanced energy distribution and monitoring, catering to the region's escalating energy demands.

India Internet of Things (IoT) in energy market is estimated to record a significant growth rate from 2024 to 2030. Rapid urbanization and the government's strong push for digital transformation in public utilities have created a productive ground for IoT in energy solutions, aiming to improve grid management and enhance renewable energy integration.

The Internet of Things (IoT) in energy market in China is expected to grow considerably from 2024 to 2030. China's focus on reducing its carbon footprint and its massive investments in smart city projects have made it a center for IoT in energy innovations, particularly in smart meters and grid automation, to handle the increasing energy demand efficiently.

Japan Internet of Things (IoT) in energy market is projected to witness a considerable growth rate from 2024 to 2030. With its commitment to sustainability and energy efficiency, Japan is seeing a surge in IoT applications in energy, especially in optimizing energy consumption in both residential and industrial sectors.

Europe Internet Of Things (IoT) In Energy Market Trends

The Internet of Things (IoT) in energy market in Europe accounted for a notable revenue share of 24% in 2023. Stringent environmental regulations and a commitment to reducing carbon emissions fuel the market growth. The region's focus on sustainable energy practices encourages the adoption of IoT for better energy efficiency, renewable energy integration, and consumer engagement in energy usage decisions, positioning Europe as a leader in green energy innovation.

The UK Internet of Things (IoT) in energy market is projected to grow considerably from 2024 to 2030. The UK's efforts to upgrade its old infrastructure and the shift towards a more decentralized energy system are key drivers for adopting IoT technologies in energy monitoring and management.

The Internet of Things (IoT) in energy market in Germany is expected to record significant growth from 2024 to 2030. Germany's Energiewende, or energy transition policy, which emphasizes heavily renewable energy and energy efficiency, significantly boosts the demand for IoT solutions in energy storage and grid optimization.

Middle East & Africa (MEA) Internet Of Things (IoT) In Energy Market Trends

The Internet of Things (IoT) in energy market in the Middle East and Africa (MEA) region is anticipated to grow at the highest CAGR of around 17% from 2024 to 2030. The MEA are witnessing a surge in the market as part of broader efforts to diversify energy sources and improve energy access. The deployment of IoT solutions in energy infrastructure projects enhances operational efficiencies and supports the transition towards renewable energy, driving economic growth and sustainability in the region's energy sector.

Saudi Arabia Internet of Things (IoT) in energy market accounted for a considerable revenue share in 2023. Saudi Arabia, in its journey to diversify its energy sources under the Saudi Vision 2030, is investing heavily in smart grid technologies and renewable energy projects, making it a growing market.

Key Internet Of Things (IoT) In Energy Company Insights

Some of the key players operating in the market are IBM Corporation, SAP SE, Intel Corporation, and Siemens AG.

-

IBM Corporation is a global technology leader known for its innovative solutions in hardware, software, and services. With a legacy spanning over a century, IBM has been at the forefront of technological advancements, driving transformative projects across various sectors including cloud computing, artificial intelligence, and quantum computing, among others.

-

SAP SE is renowned for innovative enterprise software solutions that facilitate efficient business operations and enhance customer relationship management. As an industry leader in enterprise resource planning (ERP), SAP’s product portfolio has broadened to include advanced cloud technologies, analytics, and machine learning, catering to a wide range of clients in over 180 countries.

GridPoint, Inc., Aeris Communications, Inc., and Davra Network Limited, among others, are some of the emerging market participants.

-

GridPoint, Inc. is a leading provider of smart energy solutions that enable businesses to optimize their energy consumption and enhance sustainability efforts. Their comprehensive platform leverages advanced technologies such as IoT, cloud-based analytics, and machine learning to drive energy efficiency, reduce operational costs, and lower carbon footprints.

-

Aeris Communications, Inc. specializes in Internet of Things (IoT) and Machine-to-Machine (M2M) communications, offering a robust platform that enables companies to connect and manage devices globally. With a focus on innovation and reliability, Aeris provides cutting-edge solutions for data analytics, connectivity, and security, catering to a diverse range of industries from automotive to healthcare.

Key Internet Of Things (IoT) In Energy Companies:

The following are the leading companies in the internet of things (IoT) in energy market. These companies collectively hold the largest market share and dictate industry trends.

- GridPoint, Inc.

- Aeris Communications, Inc.

- IBM Corporation

- Siemens AG

- Johnson Controls International PLC

- AGT International SpA

- Cisco Systems, Inc.

- Davra Networks Limited

- Intel Corporation

- SAP SE

Recent Developments

-

In August 2023, Siemens introduced the next-gen SIRIUS 3UG5 line monitoring relays, integrating IoT capabilities for efficient energy control. These relays are designed to boost the reliability and quality of power networks, catering to essential areas like healthcare facilities and manufacturing sectors. They provide important analytics and guarantee the peak functioning of components.

-

In August 2023, Zoho Corporation unveiled Zoho FSM, an all-inclusive platform for managing field services designed specifically for companies in the energy field. By integrating automation and enhancing visibility into operations, the platform aims to enable firms to seamlessly manage field activities and provide outstanding services in various sectors, including utilities and HVAC, among others.

-

In July 2023, Johnson Controls International PLC expanded its capabilities in the digital transformation sector by acquiring FM: Systems, known for its expertise in digital workplace management and IoT solutions. This strategic move supports the company's emphasis on creating autonomous and digitally integrated buildings. By merging FM: Systems' advanced predictive workplace management platform with Johnson Controls' current offerings in building automation and energy management solutions, the acquisition is set to enhance the company's service portfolio.

Internet Of Things (IoT) In Energy Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 30.18 billion |

|

Revenue forecast in 2030 |

USD 62.84 billion |

|

Growth rate |

CAGR of 13.0% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion/million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, application, deployment, connectivity, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

GridPoint, Inc.; Aeris Communications, Inc.; IBM Corporation; Siemens AG; Johnson Controls International PLC; AGT International SpA; Cisco Systems, Inc.; Davra Networks Limited; Intel Corporation; SAP SE |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Internet Of Things (IoT) In Energy Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global Internet of Things (IoT) in energy market report based on component, application, deployment, connectivity, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Asset Management

-

Energy Management

-

Safety Solution

-

Connected Logistics

-

Compliance & Risk Management

-

Data Management & Analytics

-

Others

-

-

Services

-

Professional Services

-

Managed Services

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Coal Mine

-

Smart Grid

-

-

Deployment Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Connectivity Outlook (Revenue, USD Million, 2018 - 2030)

-

Zigbee

-

Wi-Fi

-

Bluetooth

-

Z-Wave

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global internet of things (IoT) in energy market size was estimated at USD 25.23 billion in 2023 and is expected to reach USD 30.18 billion in 2024.

b. The global internet of things (IoT) in energy market is expected to grow at a compound annual growth rate of 13.0% from 2024 to 2030 to reach USD 62.84 billion by 2030.

b. The North America region accounted for the largest share of around 37% in the internet of things (IoT) in energy market in 2023 and is expected to continue its dominance in the coming years.

b. Some key players operating in the internet of things (IoT) in energy market include GridPoint, Inc., Aeris Communications, Inc., IBM Corporation, Siemens AG, Johnson Controls International PLC, AGT International SpA, Cisco Systems, Inc., Davra Networks Limited, Intel Corporation, SAP SE.

b. Key factors that are driving the internet of things (IoT) in energy market growth include the global shift towards renewable energy sources such as solar, wind, and hydro.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."