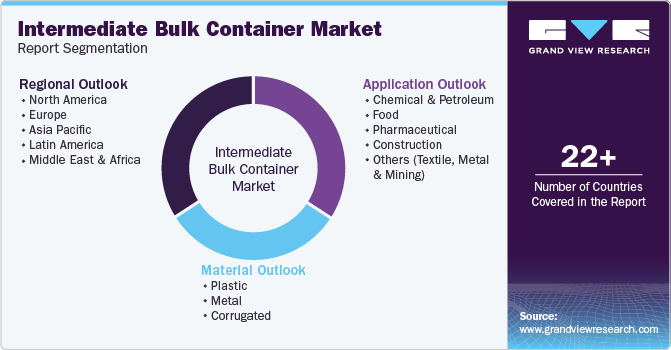

Intermediate Bulk Container Market Size, Share & Trends Analysis Report By Material (Plastic, Metal, Corrugated), By Application (Food, Chemicals & Petroleum, Pharmaceuticals), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-005-3

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Intermediate Bulk Container Market Trends

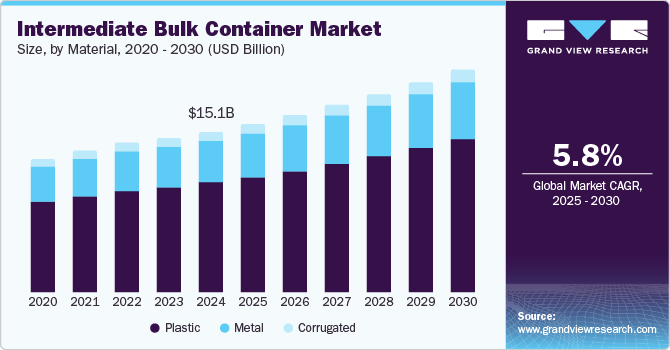

The global intermediate bulk container market size was valued at USD 15.1 billion in 2024 and is expected to grow at a CAGR of 5.8% from 2025 to 2030, driven by the growth in global trade and the wide adoption of intermediate bulk containers (IBCs) across various industries. As international commerce thrives, there is an increasing demand for efficient, durable, and cost-effective packaging solutions to transport goods, especially liquid and granular products.

IBCs are versatile and widely used in the chemicals, food & beverage, pharmaceuticals, and manufacturing sectors. Their ability to reduce shipping costs, minimize waste, and enhance product safety makes them a preferred choice, fueling market growth worldwide. The shift toward sustainable and reusable packaging, coupled with the growth in manufacturing and industrial activities, is expected to propel the market size.

As industries aim to reduce waste and carbon footprints, demand for eco-friendly, durable, and cost-efficient packaging solutions, such as IBCs, is expected to surge. These containers provide optimal storage and transport solutions and reduce the need for single-use packaging. The rising need for bulk storage across various sectors, including chemicals, food & beverages, and pharmaceuticals, is further expected to assist the growth of the intermediate bulk container industry.

Material Insights

The plastic segment recorded the largest revenue share of 67.9% in 2024, fueled by its affordability, versatility, and lightweight nature. Plastic IBCs are cost-effective, durable, and resistant to corrosion. These properties make them ideal for use in a wide range of industries. Their ease of handling, stackability, and compatibility with various products in both liquid & powder form have contributed to their widespread adoption. Advancements in plastic material technology, such as high-density polyethylene (HDPE), have enhanced the strength and performance of plastic IBCs, further escalating their demand.

The metal segment is expected to record the highest CAGR of 5.5% over the forecast period, attributed to its durability, strength, and versatility. Metal IBCs are increasingly favored for transporting hazardous chemicals, oils, and heavy industrial products due to their resistance to corrosion, robust construction, and ability to withstand extreme conditions. As industries prioritize safety and product integrity, the demand for metal IBCs is expected to surge. Benefits such as recyclability and long lifespan make them a sustainable choice, thereby contributing to their growing popularity in the market.

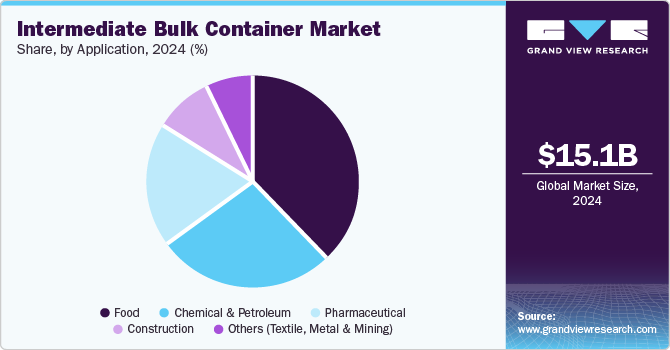

Application Insights

The food segment held the largest revenue share of 37.6% in 2024, owing to the rising demand for efficient, safe, and hygienic packaging solutions for bulk food storage and transport. IBCs, especially those made of food-grade plastic and stainless steel, provide optimal protection against contamination, ensuring the preservation of food quality. Their ease of handling, durability, and compliance with stringent food safety standards have made them a preferred choice. As global food production and distribution grow, the need for reliable and scalable IBC solutions in this segment continues to increase.

The chemical and petroleum segment is projected to record the highest CAGR of 5.3% during the forecast period due to the escalating demand for safe and efficient storage and transportation of hazardous liquids and chemicals. IBCs provide a secure solution for these industries, ensuring compliance with safety regulations and minimizing the risk of contamination. As the chemical and petroleum sectors expand globally, the need for durable, cost-effective, and eco-friendly packaging solutions is expected to rise. Their ability to handle large volumes and protect contents from environmental factors makes them increasingly essential in these industries.

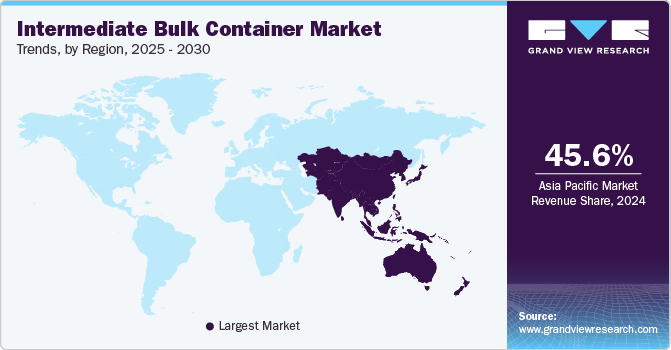

Regional Insights

North America intermediate bulk container market is set to emerge as the fastest-growing region with a CAGR of 4.9% from 2025 to 2030. The region is expected to record a rising demand for the IBCs from the chemical and petrochemical industries. IBCs are crucial for transporting bulk liquids, chemicals, and powders safely and efficiently. In addition, the increasing demand for hygienic and compliant packaging solutions in the pharmaceutical industry is contributing to further market growth. The evolving packaging requirements of these industries are driving innovation and growth, with both sectors expected to continue contributing to the upward trajectory of the market, increasing the overall market size in the coming years.

U.S. Intermediate Bulk Container Market Trends

The U.S. intermediate bulk container market growing emphasis on safety standards and the demand for cost-effective solutions are shaping the U.S. intermediate bulk container industry. With industries increasingly prioritizing secure and compliant packaging for hazardous materials, there is a rise in the adoption of IBCs that meet stringent regulatory requirements. Moreover, businesses are seeking more economical alternatives to traditional packaging, pushing the demand for durable and reusable IBCs. This focus on both safety and cost-efficiency is anticipated to accelerate market growth as companies look to streamline their supply chains and reduce operational expenses.

Canada intermediate bulk container market is projected to have a remarkable CAGR over the forecast period due to the escalating demand in the agriculture sector. As agricultural production increases, the need for efficient storage and transportation of fertilizers, pesticides, and plant oils becomes crucial. Furthermore, the rising demand for eco-friendly and reusable IBCs, driven by sustainability initiatives and environmental concerns, is further boosting the growth of intermediate bulk containers industry in the country. These containers offer cost-effective, sustainable, and reusable solutions, positioning them as a preferred choice in industries seeking to reduce their environmental footprint.

Europe Intermediate Bulk Container Market Trends

The Europe intermediate bulk container market demand for hygienic solutions and the integration of RFID technology are expected to propel the growth of the intermediate bulk container market in Europe. As industries including food, beverages, and pharmaceuticals prioritize product safety and hygiene, IBCs offering hygienic features, particularly spill prevention and contamination control, are in high demand. The integration of RFID technology in IBCs enhances logistics efficiency, combats counterfeiting, and ensures accurate tracking of containers. These advancements cater to evolving industry needs, boosting the market expansion and attracting investments in innovative IBC solutions.

The rising preference for customized intermediate bulk containers (IBCs) is expected to accelerate the growth of the market in Germany. Industries are increasingly seeking tailored solutions to enhance product protection and transportation efficiency. Besides, the rapid expansion of e-commerce and global trade is fueling demand for IBCs, as businesses require more flexible, durable, and cost-effective packaging solutions for bulk goods. These trends are projected to fuel the size of the IBC market in Germany, supporting both industry-specific requirements and international logistics needs, thereby expanding its market reach in the years ahead.

Increased emphasis on sustainability and regulatory adherence is projected to favor the growth of intermediate bulk container industry in France. As environmental concerns rise, industries are increasingly opting for eco-friendly, reusable, and recyclable IBCs to meet sustainability goals. Furthermore, stricter regulations in chemicals, pharmaceuticals, and food processing sectors require reliable and compliant storage solutions. IBCs are ideal for ensuring safe transportation and minimizing product contamination, which aligns with the environmental standards and regulatory frameworks of France, further propelling market growth and demand.

Asia Pacific Intermediate Bulk Container Market Trends

Asia Pacific held the largest market share of 45.6% in 2024, fueled by the expansion of the food & beverage sector in the region, coupled with the rising demand for sustainable packaging solutions. As consumer preferences shift toward eco-friendly packaging, companies in the food & beverage industry are increasingly adopting IBCs for efficient bulk transport and storage. These containers help minimize environmental impact, reduce waste, and improve logistics. This trend and the surging industrial activities in the region are driving the demand for IBCs in the market.

The rapid growth of the manufacturing industry, rising export activities, and incorporation of smart technologies are anticipated to accelerate the market growth across China. As the manufacturing sector of China grows, there is a positive impact on the demand for efficient, cost-effective packaging solutions for transporting bulk goods. In addition, the integration of smart technologies, particularly RFID tracking and temperature monitoring, enhances logistical efficiency, ensuring safer and more reliable transportation. These advancements in both production capabilities and technological innovations are leading to market expansion, meeting the growing needs of global trade and industries.

Customization for specific applications and a strong emphasis on high safety standards in transporting hazardous materials are projected to drive the intermediate bulk container industry in Japan. As industries demand specialized solutions for storing and transporting various substances, the need for tailored IBCs has risen. Moreover, strict regulations of Japan for the safe handling of hazardous materials ensure the adoption of IBCs that comply with safety standards. This focus on custom design and safety in logistics is expected to aid market expansion and meet the diverse needs of manufacturing and chemical sectors across Japan.

Key Intermediate Bulk Container Company Insights

Some of the key companies in the intermediate bulk container market include Greif; Mauser Packaging Solutions; Schuetz Container Systems Pvt. Ltd.; Snyder Industries; Hoover CS; Schafer Werke GmbH & Co KG; DS Smith PLC.; Mondi; Thielmann - The Container Company; Bulk Lift International LLC; and Schoeller Allibert.

-

Greif offers comprehensive industrial packaging solutions, including steel, plastic, fiber containers, bulk containers, and specialty products. Its offerings serve a variety of industries, such as food, chemicals, agriculture, and healthcare.

-

Mauser Packaging Solutions provides industrial packaging products, offering steel, plastic, and composite drums, IBCs, plastic containers, and intermediate bulk packaging. The company focuses on sustainability, reusable packaging, and customized solutions for various industries.

Key Intermediate Bulk Container Companies:

The following are the leading companies in the intermediate bulk container market. These companies collectively hold the largest market share and dictate industry trends.

- Greif

- Mauser Packaging Solutions

- Schuetz Container Systems Pvt. Ltd

- Snyder Industries

- Hoover CS

- Schafer Werke GmbH & Co KG

- DS Smith PLC

- Mondi

- Thielmann - The Container Company

- Bulk Lift International LLC

- Schoeller Allibert

Recent Developments

-

In September 2024, Greif opened a new facility in Pasir Gudang, Johor, Malaysia, marking a new chapter in its commitment to high-quality packaging solutions and contributing to the local economy. The facility manufactures intermediate bulk containers (IBCs) for various industries such as food, chemicals, lubricants, flavors, and fragrances.

-

In March 2024, Greif and CDF Corporation collaborated to introduce a redesigned GCUBE IBC Flex, specifically engineered for safely transporting sensitive liquids under sterile conditions. This innovative partnership offers a cutting-edge solution for secure and sterile transportation of delicate materials.

Intermediate Bulk Container Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 15.9 billion |

|

Revenue forecast in 2030 |

USD 21.1 billion |

|

Growth Rate |

CAGR of 5.8% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

February 2025 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Material, application, and region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; Saudi Arabia |

|

Key companies profiled |

Greif; Mauser Packaging Solutions; Schuetz Container Systems Pvt. Ltd.; Snyder Industries; Hoover CS; Schafer Werke GmbH & Co KG; DS Smith PLC.; Mondi; Thielmann - The Container Company; Bulk Lift International LLC; and Schoeller Allibert |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Intermediate Bulk Container Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global intermediate bulk container market report based on material, application, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Plastic

-

Metal

-

Corrugated

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemical & Petroleum

-

Food

-

Pharmaceutical

-

Construction

-

Others (Textile, Metal & Mining)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."