- Home

- »

- Pharmaceuticals

- »

-

Interleukin Inhibitors Market Size, Share, Growth Report 2030GVR Report cover

![Interleukin Inhibitors Market Size, Share & Trends Report]()

Interleukin Inhibitors Market (2025 - 2030) Size, Share & Trends Analysis Report By Type, By Route Of Administration (SC, IV), By Application (RA, Psoriasis, IBD, Asthma), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-172-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Interleukin Inhibitors Market Summary

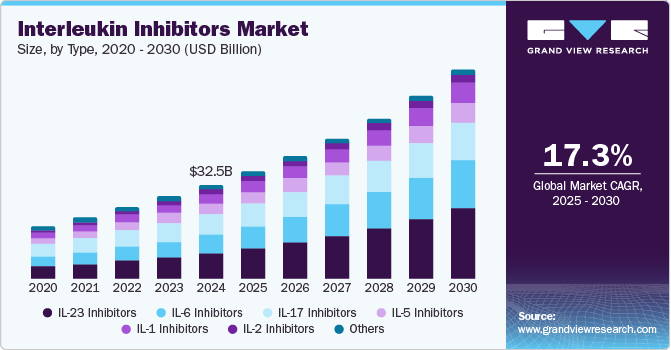

The global interleukin inhibitors market size was estimated at USD 32.5 billion in 2024 and is projected to reach USD 72.2 billion by 2030, growing at a CAGR of 17.3% from 2025 to 2030. Rheumatoid arthritis (RA), psoriasis, and inflammatory bowel disease (IBD) are increasingly prevalent, driving the demand for effective treatment options.

Key Market Trends & Insights

- The North America market held the largest revenue share of 37.5% in 2024.

- By type, IL-23 inhibitors segment led the market with a revenue share of 27.5% in 2024.

- By route of administration, the subcutaneous segment held the largest revenue share at 61.7% in 2024.

- By application, the psoriasis segment dominated the market and accounted for a share of 37.0% in 2024.

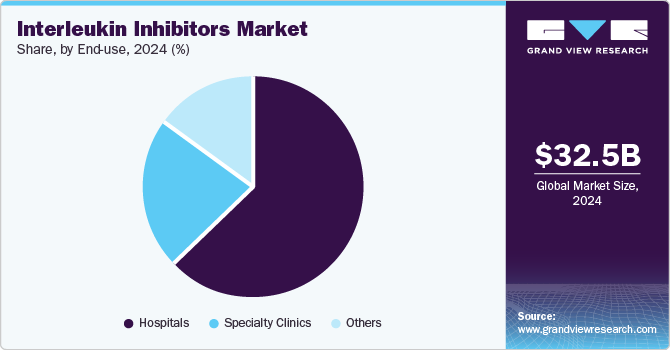

- By end-use, hospitals led the market, generating a revenue share of 62.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 32.5 Billion

- 2030 Projected Market Size: USD 72.2 Billion

- CAGR (2025-2030): 17.3%

- North America: Largest market in 2024

The rising incidence of these disorders significantly underscores the urgent need for IL inhibitors, which serve as a crucial catalyst for market expansion and the development of targeted therapeutic solutions.

Ongoing innovations in drug formulations and delivery methods have resulted in more accessible treatment options, allowing for improved patient outcomes. These advancements facilitate the development of novel IL inhibitors and refine existing therapies, aligning with the evolving healthcare landscape that prioritizes efficiency and patient-centric approaches.

As age-related chronic diseases become more prevalent, there is an escalating need for targeted therapies to address these conditions. The market’s shift towards personalized medicine complements this trend, as healthcare providers and patients alike are becoming more aware of the benefits offered by targeted therapies over traditional treatment protocols, thus enhancing the attractiveness of IL inhibitors.

Pharmaceutical companies are allocating significant resources to explore new therapeutic indications and combinations with immunotherapies, unlocking the vast potential for market expansion. Regulatory approvals for novel treatments, such as AbbVie’s SKYRIZI, underscore the momentum building within the sector. The acceptance of biosimilars promises to enhance competition and reduce costs, ultimately making these vital treatments more accessible to a broader patient population.

Type Insights

IL-23 inhibitors led the market with a revenue share of 27.5% in 2024 due to their efficacy in treating autoimmune diseases, such as psoriasis and IBD. Leading drugs such as Stelara (ustekinumab) and Tremfya (guselkumab) have demonstrated substantial therapeutic benefits. Moreover, the FDA’s approval of Eli Lily’s Mirikizumab in October 2024 has since expanded treatment options, stimulating market growth.

IL-17 inhibitors are expected to witness significant growth with a CAGR of 16.1% over the forecast period. Leading drugs such as Cosentyx (secukinumab) and Taltz (ixekizumab) have achieved blockbuster status. In September 2024, the FDA approved bimekizumab (Bimzelx) for four chronic immune-mediated inflammatory diseases, including psoriatic arthritis, nonradiographic axial spondyloarthritis, ankylosing spondylitis, and moderate to severe plaque psoriasis, further diversifying treatment options, driven by the rising prevalence of autoimmune diseases and a growing preference for targeted therapies.

Route of Administration Insights

The subcutaneous route of administration held the largest revenue share at 61.7% in 2024, driven by its convenience for self-administration and improved patient adherence. The segment growth is driven by the rising prevalence of autoimmune diseases, increased patient awareness, and advancements in formulations, with key products including Cosentyx (secukinumab) and Taltz (ixekizumab).

The intravenous segment is expected to grow rapidly over the forecast period due to its rapid onset and superior bioavailability. Key drivers include the increasing prevalence of autoimmune diseases, a preference for targeted therapies, and advancements in formulations. Notable IV drugs include Actemra (tocilizumab) and Ilumya (tildrakizumab).

Application Insights

The psoriasis segment dominated the market and accounted for a share of 37.0% in 2024. The demand for IL inhibitors in psoriasis is increasing due to their targeted action against inflammatory pathways, enhancing patient outcomes. Key drivers include the rising prevalence of psoriasis, increased awareness of treatment options, and a preference for biologics, highlighted by the FDA approval of BIMZELX (bimekizumab) in October 2023.

Applications of IL inhibitors in RA are expected to grow steadily over the forecast period. Factors driving this demand include rising RA prevalence, increased awareness of treatment options, and the approval of IL-6 inhibitors (such as Kevzara and Actemra) for patients unresponsive to conventional therapies.

End-use Insights

Hospitals led the market, generating a revenue share of 62.7% in 2024. The rising prevalence of autoimmune and inflammatory diseases demands advanced treatment options offered by IL inhibitors, specifically modulating immune responses. Improved hospital infrastructure for administering these therapies and advancements in biological drugs and personalized medicine underscores a broader shift toward targeted therapies for managing complex health conditions.

Specialty clinics are projected to grow significantly over the forecast period. These clinics are dedicated to complex and chronic conditions, particularly autoimmune diseases, and utilize IL inhibitors to provide targeted treatment. Their focus on personalized care improves patient outcomes and adherence. Increased FDA approvals for new biologics and the rising prevalence of chronic inflammatory diseases further enhance the demand for specialized therapies in these settings.

Regional Insights

The North America interleukin inhibitors market held the largest revenue share of 37.5% in 2024. The region benefits from a robust healthcare infrastructure, substantial healthcare expenditures, and significant investments in research and development. The rising prevalence of autoimmune diseases and demand for targeted therapies propel market growth. Key manufacturers and expedited regulatory approvals for new therapies bolster the availability and adoption of IL inhibitors in the region.

U.S. Interleukin Inhibitors Market Trends

The U.S. interleukin inhibitor market dominated North America, with a substantial revenue share in 2024. The country has an advanced healthcare infrastructure and substantial investments in research and development. High healthcare expenditures facilitate access to innovative therapies, while the rising prevalence of autoimmune diseases and a strong regulatory framework drive market growth and the adoption of IL inhibitors.

Europe Interleukin Inhibitors Market Trends

The interleukin inhibitor market in Europe held substantial market share in 2024, supported by advanced healthcare infrastructure and a strong regulatory framework. Countries such as Germany and the UK are at the forefront, driven by awareness of IL inhibitors’ benefits and the rising prevalence of autoimmune diseases.

The interleukin inhibitor market in Germany is expected to grow in the forecast period. Germany’s focus on research and development fosters the integration of innovative therapies, such as IL inhibitors. The rising incidence of chronic inflammatory diseases and a supportive regulatory framework for drug approvals stimulate demand. Specialized rheumatology centers are also improving treatment accessibility and expertise.

Asia Pacific Interleukin Inhibitors Market Trends

The interleukin inhibitor market in Asia Pacific is expected to register the fastest CAGR of 18.6% in the forecast period, fueled by enhanced healthcare infrastructure and growing disposable incomes. Increasing awareness of autoimmune diseases, a surge in clinical trials and drug approvals, and an aging population further propel market demand for targeted therapies.

The interleukin inhibitor market in China held a substantial share in the Asia Pacific market in 2024. Growing awareness of autoimmune diseases and their treatment options propels demand for targeted therapies such as IL inhibitors. Furthermore, the government’s commitment to enhancing access to advanced medical treatments and fostering pharmaceutical innovation supports market growth. With an aging population and increasing chronic disease prevalence, China anticipates significant demand for IL inhibitors and their distribution.

Key Interleukin Inhibitors Company Insights

Some key companies operating in the market include Novartis AG, AbbVie Inc., Eli Lilly and Company, Regeneron Pharmaceuticals Inc., and Johnson & Johnson Services, Inc., among others. Companies are broadening their product portfolios and improving therapeutic efficacy through strategic collaborations to seize emerging opportunities in autoimmune disease management and stimulate market growth.

-

AbbVie Inc. has developed and marketed IL inhibitors, including Skyrizi (risankizumab), targeting IL-23 for autoimmune conditions such as psoriasis and Crohn’s disease. The company has emphasized innovation through rigorous research and development to improve patient outcomes and address unmet medical needs in chronic inflammatory diseases.

-

Eli Lilly and Company has established a reputation for products such as Taltz (ixekizumab) and Mirikizumab, targeting IL-17 and IL-23, respectively. The company is focused on advancing therapeutic options for autoimmune diseases through strategic partnerships and clinical trials to improve treatment efficacy and safety profiles.

Key Interleukin Inhibitors Companies:

The following are the leading companies in the interleukin inhibitors market. These companies collectively hold the largest market share and dictate industry trends.

- Novartis AG

- AbbVie Inc.

- Eli Lilly and Company

- Regeneron Pharmaceuticals Inc.

- Johnson & Johnson Services, Inc.

- F. Hoffmann-La Roche Ltd

- AstraZeneca

- Bausch Health Companies Inc.

- GlaxoSmithKline plc

- Teva Pharmaceutical Industries Ltd

Recent Developments

-

In September 2024, Eli Lilly’s lebrikizumab-based drug, EBGLYSS, received FDA approval for adults and children aged 12 and older with moderate-to-severe atopic dermatitis inadequately controlled by topical treatments. This drug offers significant symptom relief.

-

In August 2024, Regeneron Pharmaceuticals Inc. presented 20 abstracts on Dupixent and itepekimab at the ERS Congress, highlighting significant advancements in treating respiratory diseases such as COPD, asthma, and chronic rhinosinusitis with nasal polyps.

-

In June 2024, Johnson & Johnson announced successful Phase 3 GRAVITI study results for TREMFYA (guselkumab), demonstrating its potential as the only IL-23 inhibitor offering subcutaneous and intravenous induction options.

-

In May 2024, AbbVie Inc. presented 15 abstracts at Digestive Disease Week, showcasing new data supporting its gastroenterology portfolio, particularly on risankizumab and upadacitinib for IBDs.

-

In May 2024, AstraZeneca presented data showcasing its innovations in respiratory diseases, emphasizing IL inhibitors such as tezepelumab and tozorakimab for COPD, asthma, and EGPA management at ATS 2024.

Interleukin Inhibitors Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 37.1 billion

Revenue forecast in 2030

USD 72.2 billion

Growth rate

CAGR of 17.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, route of administration, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Novartis AG; AbbVie Inc.; Eli Lilly and Company; Regeneron Pharmaceuticals Inc.; Johnson & Johnson Services, Inc.; F. Hoffmann-La Roche Ltd; AstraZeneca; Bausch Health Companies Inc.; GlaxoSmithKline plc; Teva Pharmaceutical Industries Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Interleukin Inhibitors Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global interleukin inhibitors market report based on type, route of administration, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

IL-1 Inhibitors

-

IL-2 Inhibitors

-

IL-5 Inhibitors

-

IL-6 Inhibitors

-

IL-17 Inhibitors

-

IL-23 Inhibitors

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Subcutaneous (SC)

-

Intravenous (IV)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Rheumatoid Arthritis

-

Psoriasis

-

Inflammatory Bowel Disease (IBD)

-

Asthma

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.