- Home

- »

- IT Services & Applications

- »

-

Interior Design Software Market Size, Industry Report, 2030GVR Report cover

![Interior Design Software Market Size, Share & Trends Report]()

Interior Design Software Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Individual, Enterprise), By Deployment (Cloud, On-premises), By End-use (Residential, Non-residential), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-538-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Interior Design Software Market Summary

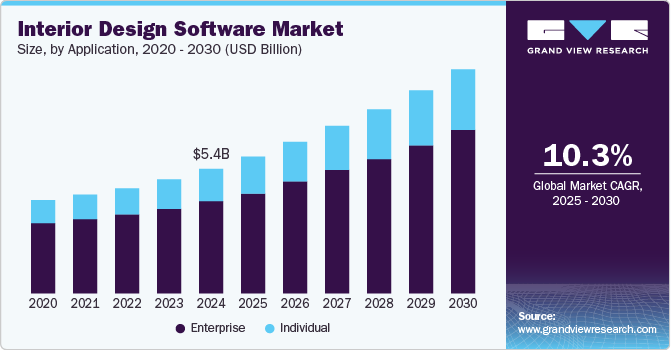

The global interior design software market size was estimated at USD 5,373.8 million in 2024 and is projected to reach USD 9,656.6 million by 2030, growing at a CAGR of 10.3% from 2025 to 2030. The rising demand for home renovation and remodeling projects is significantly fueling the growth of the interior design software market.

Key Market Trends & Insights

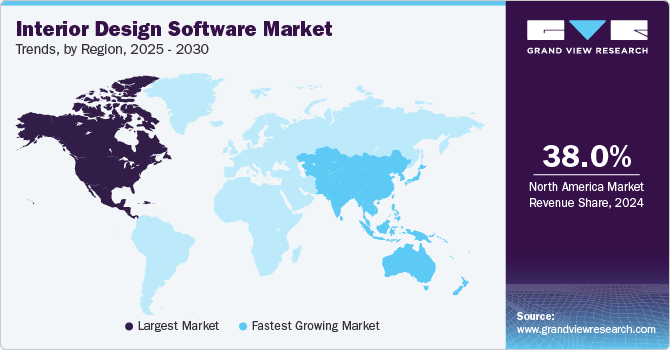

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, Australia is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, enterprise accounted for a revenue of USD 4,355.1 million in 2024.

- Individual is the most lucrative grade segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 5,373.8 million

- 2030 Projected Market Size: USD 9,656.6 million

- CAGR (2025-2030): 10.3%

- North America: Largest market in 2024

With a growing focus on personalized home aesthetics, smart home integrations, and sustainable design, homeowners and businesses are turning to interior design software to plan and execute their renovations. Additionally, the surge in home improvement projects has led to increased interest in DIY design software that enables individuals to create their layouts and styles with ease. Software solutions that offer virtual staging, augmented reality (AR) visualization, and AI-powered design suggestions are becoming increasingly popular among both professionals and homeowners. According to the article published by Leading Indicator of Remodeling Activity (LIRA), homeowners spent USD 463 billion on renovations in the first quarter of 2024. Additionally, 55% of American homeowners plan to renovate in 2024, an increase from 52% in 2023.

The expansion of cloud-based interior design software solutions is also playing a critical role in market growth. Cloud-based platforms allow designers, architects, and clients to collaborate in real-time, access project files from anywhere, and integrate with other digital tools such as BIM (Building Information Modeling) software, smart home applications, and material databases. Cloud-based solutions are particularly beneficial for large-scale commercial interior design projects, where multiple stakeholders need to coordinate efficiently. The shift toward subscription-based software-as-a-service (SaaS) models has also made high-end design software more accessible to freelancers, small businesses, and independent designers, further driving market adoption.

The rise of e-commerce and online furniture retailing is further boosting the need for interior design software. Online furniture and home décor retailers are increasingly offering AI-powered room visualization tools and AR-based furniture placement applications to enhance customer shopping experience. These tools enable consumers to visualize how furniture and décor items look in their homes before making a purchase. As e-commerce platforms continue to integrate advanced interior design features, the demand for interactive and user-friendly interior design software is expected to grow significantly.

The growth of the real estate industry and property staging solutions is another crucial factor driving demand for interior design software. Real estate developers, agents, and home staging professionals are utilizing virtual interior design software to digitally stage properties, enhance property listings, and attract potential buyers. Virtual staging reduces the cost and logistical challenges of traditional staging while also allowing clients to explore different design styles before making a purchase decision. With the increasing adoption of AI-driven real estate marketing tools, the need for interior design software that supports virtual property visualization and customization continues to rise.

Application Insights

The enterprise segment dominated the industry with a revenue share of over 73.0% in 2024. The rising demand for smart offices and hybrid workplace solutions is propelling the enterprise segment of the interior design software market. With the increasing adoption of hybrid work models, flexible office layouts, and intelligent workspace management systems, businesses require advanced design tools to optimize workspace utilization. Enterprise interior design software allows companies to create dynamic floor plans, integrate IoT-enabled smart furniture, and implement automated space management solutions. These technologies help organizations enhance employee productivity, optimize resource allocation, and improve workplace experience, making them an essential investment for modern enterprises. According to a Gensler survey, 70% of employees prefer working in a smart office equipped with technology-enabled features and services. A CBRE report highlights the most prevalent smart office features, including smart lighting (68%), smart temperature control (66%), smart security (64%), and smart desks and meeting rooms (62%).

The individual segment is expected to register significant growth over the forecast period. The rising popularity of do-it-yourself (DIY) home improvement projects drives the individual segment growth in the interior design software market. As more homeowners seek to personalize their living spaces without hiring professional interior designers, easy-to-use interior design software has become increasingly popular. Many software platforms offer drag-and-drop functionality, AI-powered design recommendations, and virtual staging features, allowing individuals to experiment with different layouts, colors, and furniture placements effortlessly. This democratization of design tools has made interior design more accessible, enabling users to create customized spaces that reflect their style.

Deployment Insights

The cloud segment dominated the market with a revenue share of over 75.0% in 2024. The integration of cloud-based design software with other business tools and enterprise systems is driving adoption among professional designers and organizations. Many cloud-based platforms offer seamless integration with project management tools, customer relationship management (CRM) software, enterprise resource planning (ERP) systems, and construction management applications. These integrations allow businesses to streamline their design processes, track project timelines, and manage budgets more efficiently.

The On-Premises segment is expected to register a CAGR of over 9.0% over the forecast period. The preference for one-time licensing fees over subscription-based models is also driving demand for On-Premises interior design software. Many companies prefer a one-time investment in software ownership rather than ongoing cloud subscription costs, which can add over time. While On-Premises solutions often require higher upfront costs for hardware, licensing, and IT maintenance, they provide long-term cost savings by eliminating recurring monthly or annual fees. This pricing structure is particularly attractive to established design firms, architectural agencies, and enterprises with predictable software usage patterns, as it allows them to maintain control over their software expenses.

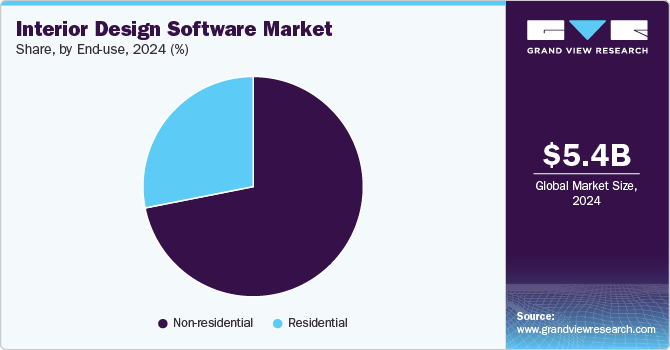

End-use Insights

The non-residential segment dominated the market and accounted for a revenue share of over 71.0% in 2024. The rise in hospitality and retail industries is another major factor fueling the growth of the non-residential interior design software market. Hotels, resorts, restaurants, and retail spaces must create immersive and attractive environments to enhance customer experiences and brand identity. The hospitality industry relies on interior design software to develop unique themes, optimize guest comfort, and incorporate luxury aesthetics. Similarly, retail businesses use 3D modeling, augmented reality (AR), and virtual reality (VR) tools to create engaging store layouts that maximize customer engagement and product visibility. Advanced interior design software enables retail brands to simulate different store configurations, lighting effects, and merchandising displays, helping them refine their concepts before making costly physical adjustments.

The residential segment is expected to grow significantly over the forecast period. The rise in online furniture and home decor shopping is further driving the adoption of interior design software in the residential sector. Many furniture retailers and home improvement brands now offer design software tools that allow customers to visualize products in their homes before purchasing. Augmented reality (AR) and virtual staging technologies enable users to place furniture digitally, test different paint colors, and experiment with décor arrangements in real-time. This enhances the customer shopping experience, reduces return rates, and helps homeowners make more informed design decisions. As e-commerce platforms continue to expand their home decor offerings, interior design software is becoming an essential tool for both consumers and businesses.

Regional Insights

North America interior design software market held a significant revenue share of around 38.0% in 2024. The widespread adoption of smart home technologies is a major factor driving the growth of interior design software in North America. With the rapid expansion of IoT-enabled home automation solutions, many homeowners are seeking to integrate smart lighting, climate control, and voice-activated devices into their interior designs. Interior design software solutions now come equipped with AI-driven recommendations, 3D visualization tools, and compatibility with smart home systems, enabling users to create connected, energy-efficient, and aesthetically pleasing living environments. The demand for seamless integration between design software and smart home technologies continues to rise, particularly in high-tech urban centers and affluent residential areas.

U.S. Interior Design Software Market Trends

The U.S. dominated the interior design software industry in 2024. The commercial real estate and hospitality sector’s emphasis on design innovation drives the interior design software market in the U.S. Businesses in industries such as hospitality, retail, and corporate offices are prioritizing space optimization and brand identity through customized interior designs. Hotels and resorts are leveraging advanced interior design software to create immersive, guest-friendly spaces, while retail brands are using these tools to optimize store layouts and enhance customer engagement. Similarly, corporate offices are focusing on ergonomic, wellness-oriented designs that foster productivity and employee satisfaction. The availability of cloud-based interior design platforms has made it easier for commercial clients to collaborate with designers remotely, streamlining the entire design and implementation process.

Europe Interior Design Software Market Trends

The interior design software market in Europe is anticipated to register considerable growth from 2025 to 2030. The rise of modular and space-efficient furniture solutions is a key driver boosting the adoption of interior design software across Europe. With increasing urbanization and the popularity of compact living spaces, there is a growing demand for modular furniture, foldable designs, and multi-functional interior layouts. Interior design software solutions help users visualize how modular furniture will fit into their spaces and optimize layouts for better functionality. This is particularly important in densely populated cities like London, Paris, and Berlin, where maximizing available space is a necessity. Software that offers real-time 3D modeling and virtual staging enables homeowners and interior designers to experiment with different configurations before making a final decision, leading to higher efficiency and reduced costs.

The Germany interior design software market held a substantial market share in 2024. The growing demand for secure cloud migration services drives market growth in Germany. The rise of smart homes and IoT integration in Germany is another key driver for the interior design software market. With the increasing adoption of smart lighting, automated climate control, and connected home appliances, interior design software is playing a critical role in helping homeowners and designers plan and integrate these technologies seamlessly. Advanced interior design tools now allow users to visualize smart home systems in 3D, simulate automation scenarios, and optimize space planning to accommodate IoT-enabled furniture and appliances.

Interior design softwaremarket in France is expected to grow rapidly during the forecast period. The increasing influence of digital design trends and social media platforms is further fueling the demand for interior design software in France. Platforms like Pinterest, Instagram, and Houzz have revolutionized the way people approach interior design, providing endless inspiration and encouraging users to experiment with different styles. Many interior design software solutions now integrate with these platforms, allowing users to seamlessly import design ideas and apply them to their own spaces. Additionally, the rise of online design communities and virtual collaboration tools has made it easier for professional designers and DIY enthusiasts to share ideas, get feedback, and co-create designs, further driving the market's expansion.

Asia Pacific Interior Design Software Market Trends

The Asia Pacific region is expected to register the fastest CAGR of over 19.0% during the forecast period in the market. The rapid urbanization and infrastructure development across Asia Pacific drives growth of the interior design software market. Countries such as China, India, Japan, South Korea, and Southeast Asian nations are witnessing a surge in urban construction projects, including residential complexes, commercial buildings, and smart cities. With the growing middle class and increasing disposable income, more people are investing in modern, aesthetically appealing, and functional home and office interiors. Interior design software plays a crucial role in this transformation by allowing designers, architects, and homeowners to visualize and plan spaces efficiently before making real-world changes. As cities become more densely populated, the need for space optimization and innovative layouts is further driving the demand for digital design tools.

The China interior design software market held a substantial market share in 2024. The growing middle class and increasing disposable income in China are also fueling the demand for customized and stylish home interiors. More consumers are looking for personalized home decoration solutions, and interior design software enables them to visualize and experiment with different styles before making real-world changes. With the rise of DIY culture, many homeowners are using user-friendly interior design applications that allow them to plan renovations without needing professional help. This trend is particularly strong in younger generations, who prefer digital and interactive platforms for home improvement projects.

Interior design softwaremarket in India is expected to grow rapidly during the forecast period.The growth in India’s e-commerce and online home decor market is also fueling the demand for interior design software. Major online platforms like Flipkart, Amazon, and Pepperfry have introduced virtual design tools that allow customers to visualize furniture in their space before making a purchase. Additionally, social media platforms like Instagram and Pinterest are influencing interior design trends, encouraging more consumers to explore and personalize their home interiors. Many Indian furniture brands and home improvement companies have also started offering integrated digital design solutions, bridging the gap between product discovery and final implementation.

Key Interior Design Software Company Insights

Some of the key players operating in the market include Autodesk Inc., Dassault Systèmes, and Trimble Inc., among others.

-

Autodesk Inc. is a multinational software corporation specializing in products and services for various industries, including architecture, engineering, construction, manufacturing, media, and entertainment. Autodesk offers a suite of software tools that cater to the needs of designers, architects, and builders. These tools facilitate the creation of detailed 2D and 3D designs, allowing professionals to visualize and plan interior spaces effectively. Autodesk's commitment to innovation is evident in its continuous development of software solutions that address the evolving needs of interior design professionals. By providing tools that enhance creativity, accuracy, and efficiency, Autodesk plays a pivotal role in shaping the future of interior design and architecture.

RoomSketcher AS and BeLight Software Ltd.are some of the emerging market participants in the target market.

-

RoomSketcher AS is an innovative technology company specializing in user-friendly floor plans and home design software. The company's flagship product, the RoomSketcher App, enables users to create detailed 2D and 3D floor plans, furnish and decorate interiors, and visualize designs with high-quality 3D renderings. This intuitive tool allows users to draw their plans or order floor plans directly from RoomSketcher's expert illustrators, making it accessible to both professionals and enthusiasts.

Key Interior Design Software Companies:

The following are the leading companies in the interior design software market. These companies collectively hold the largest market share and dictate industry trends.

- Autodesk Inc.

- Dassault Systèmes

- Trimble Inc.

- SmartDraw, LLC

- Foyr

- Chief Architect, Inc.

- ECDESIGN Sweden AB

- RoomSketcher AS

- Planner 5D

- BeLight Software Ltd.

- Infurnia Technologies Pvt Ltd

- Enscape

- Bentley Systems, Incorporated

- Vectorworks, Inc.

Recent Developments

-

In February 2025, Trimble Inc. launched visualization and interoperability features in the latest release of its SketchUp software. The 3D modeling tool offers photorealistic materials, advanced environment lighting options, and seamless transitions with other industry platforms. These enhancements improve visualization and streamline workflows, allowing designers to create, manage, and share complex projects more efficiently. The update helps users work faster with greater ease and reduced rework.

-

In October 2024, Bentley Systems Incorporated launched a generative AI capability for civil site design, featuring a design copilot and automated drawing production to enhance productivity and precision. OpenSite+, Bentley's latest offering, is the first engineering application to integrate generative AI into civil site design. This innovative tool enables engineers to efficiently design residential, commercial, and industrial sites using AI-driven solutions, significantly improving both speed and accuracy. Additionally, OpenSite+ ensures users retain control over their proprietary data during AI training, fostering responsible AI model development.

-

In February 2024, Autodesk, Inc. launched Autodesk Informed Design, a cloud-based solution that integrates design and manufacturing workflows. This platform enables architects to work with customized, pre-defined building products for precise results while enabling manufacturers to share their products with design stakeholders. By promoting industrialized construction and applying manufacturing principles to the built environment, Informed Design seeks to drive transformation in the architecture, engineering, construction, and operations (AECO) industry. The solution enhances building design and manufacturing workflows, boosting overall project efficiency.

Interior Design Software Market Report Scope

Report Attribute

Details

Market Size Value in 2025

USD 5.91 billion

Revenue Forecast in 2030

USD 9.66 billion

Growth rate

CAGR of 10.3% from 2025 to 2030

Actual data

2018 - 2024

Forecast Period

2025 - 2030

Quantitative Units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Application, deployment, end-use, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key Companies Profiled

Autodesk Inc.; Dassault Systèmes; Trimble Inc.; SmartDraw, LLC; Foyr; Chief Architect, Inc.; ECDESIGN Sweden AB; RoomSketcher AS; Planner 5D; BeLight Software Ltd.

Infurnia Technologies Pvt Ltd; Enscape; Bentley Systems; Incorporated; Vectorworks, Inc.

Customization Scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Interior Design Software Market Report Segmentation

This report forecasts revenue growths at global, regional, as well as at country levels and offers qualitative and quantitative analysis of the market trends for each of the segment and sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global interior design software market report based on application, deployment, end-use, and region.

-

Interior Design Software Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Individual

-

Enterprise

-

-

Interior Design Software Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-Premises

-

-

Interior Design Software End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Non-residential

-

-

Interior Design Software Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The cloud segment dominated the interior design software industry with the revenue share of 75.0% in 2024. The integration of cloud-based design software with other business tools and enterprise systems is driving adoption among professional designers and organizations

b. Some key players operating in the market include Autodesk Inc., Dassault Systèmes, Trimble Inc., SmartDraw, LLC, Foyr, Chief Architect, Inc., ECDESIGN Sweden AB, RoomSketcher AS, Planner 5D, BeLight Software Ltd.

b. The rising demand for home renovation and remodeling projects and the rise of e-commerce and online furniture retailing is significantly fueling the growth of the interior design software market.

b. The global interior design software market size was estimated at USD 5.37 billion in 2024 and is expected to reach USD 5.91 billion in 2025

b. The global interior design software market is expected to grow at a compound annual growth rate of 10.3% from 2025 to 2030 to reach USD 9.66 billion by 2030

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.