- Home

- »

- Homecare & Decor

- »

-

Interior Design Market Size, Share & Growth Report, 2030GVR Report cover

![Interior Design Market Size, Share & Trends Report]()

Interior Design Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (New Construction, Remodeling), By End-use (Commercial, Residential), By Region (North America, Europe, Asia Pacific, Central & South America, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-4-68040-426-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Interior Design Market Summary

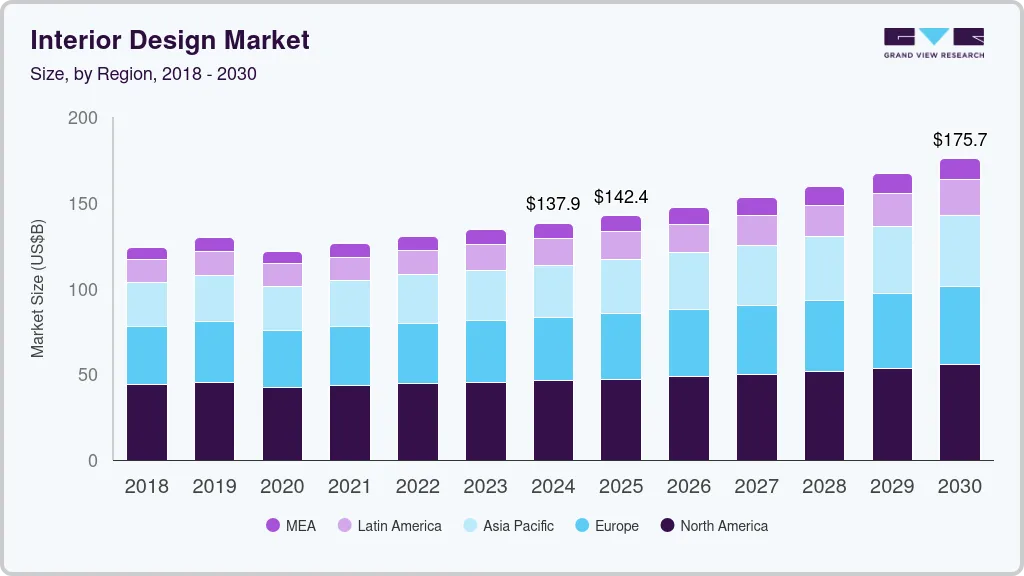

The global interior design market size was estimated at USD 137.93 billion in 2024 and is projected to reach USD 175.74 billion by 2030, growing at a CAGR of 4.3% from 2025 to 2030. The market has witnessed a substantial transformation over the past few years, driven by evolving consumer preferences, technological advancements, and the growing importance of wellness and sustainability.

Key Market Trends & Insights

- North America dominated the interior design market with a share of 33.79% in 2023.

- The U.S. interior design market accounted for a revenue share of around 83.21% in the year 2023.

- Based on type, the new construction segment accounted for a revenue share of 75.92% in 2023.

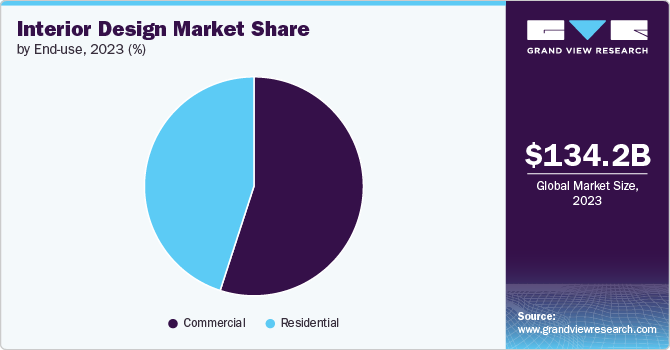

- Based on end use, the Commercial segment accounted for a share of 54.99% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 137.93 Billion

- 2030 Projected Market Size: USD 175.74 Billion

- CAGR (2025-2030): 4.3%

- North America: Largest market in 2023

As more people spend time indoors, whether due to remote work, urbanization, or lifestyle changes, the demand for thoughtfully designed spaces that cater to comfort, aesthetics, and functionality has increased. This shift has propelled the interior design services industry into a new era, where trends are continually evolving, and initiatives are being undertaken to meet these changing demands.

One of the most notable trends in the interior design services market is the growing preference for minimalist and functional designs. Minimalism, characterized by clean lines, uncluttered spaces, and a focus on essential elements, has become a dominant design philosophy. This trend is driven by a desire for simplicity and a need to create spaces that are both aesthetically pleasing and functional. Consumers are increasingly drawn to designs that emphasize quality over quantity, with a focus on materials that are durable, sustainable, and easy to maintain. The minimalist approach also aligns with the broader societal trend toward sustainability, as it often involves the use of fewer resources and promotes a more mindful consumption of goods.

In addition to minimalism, there is a rising demand for customizable and flexible furniture solutions. As living spaces become more compact, particularly in urban areas, the need for furniture that can adapt to different functions has grown. Modular furniture, which can be reconfigured to suit various needs, is becoming increasingly popular. For example, companies like IKEA have introduced lines of modular furniture that can be customized to fit different spaces and purposes, from small apartments to larger homes. This trend reflects a broader desire for personalization in interior design, where consumers are looking for solutions that cater to their unique needs and preferences.

The integration of technology into interior design is another significant trend shaping the market. Advanced software for 3D visualization and virtual reality (VR) previsualizations is revolutionizing the way designers work and how clients experience design concepts. These tools allow designers to create detailed digital models of spaces, enabling clients to see and interact with their designs before any physical work begins. This technology not only enhances the design process by providing a more accurate representation of the result but also helps in reducing costs and time associated with revisions. Companies like Houzz and Modsy are leading the charge in this area, offering platforms that use AR and VR to help consumers visualize and plan their spaces.

Another important trend in the market is the increasing focus on wellness spaces. With a growing awareness of the impact of the built environment on physical and mental health, there is a greater emphasis on creating spaces that promote well-being. This includes the incorporation of natural elements, such as indoor plants and natural light, as well as the use of materials that are non-toxic and environmentally friendly. The biophilic design, which seeks to connect occupants with nature, is gaining traction as a way to enhance the health and well-being of individuals in interior spaces. The WELL Building Standard, a performance-based system for measuring, certifying, and monitoring features of the built environment that impact human health, is becoming increasingly influential in guiding design practices.

Sustainability continues to be a key driver in the market, with both consumers and designers placing a greater emphasis on environmentally responsible choices. The use of recycled and upcycled materials, energy-efficient lighting, and sustainable sourcing of materials are becoming standard practices in the industry. This shift is not only driven by consumer demand but also by stricter regulations and guidelines aimed at reducing the environmental impact of building and design practices. Companies like Interface, a global flooring manufacturer, have been at the forefront of this movement, introducing products that are not only aesthetically appealing but also contribute to reducing carbon emissions and waste.

In recent years, there has been a surge in initiatives aimed at making interior design services more accessible to a broader audience. Online platforms and services have emerged that offer affordable design solutions, democratizing access to professional interior design services. For instance, e-design platforms like Havenly and Decorist allow consumers to work with professional designers entirely online, providing personalized design plans at a fraction of the cost of traditional interior design services. These platforms leverage technology to streamline the design process, making it easier for consumers to visualize and implement design changes in their homes.

The trend toward sustainable and wellness-oriented design and services is also reflected in the increasing popularity of wellness spaces in commercial environments. Companies are recognizing the importance of creating workspaces that support employee well-being, leading to a rise in the incorporation of wellness features in office design. This includes the use of ergonomic furniture, spaces for relaxation and mindfulness, and the integration of natural elements. The WELL Building Standard and LEED certification are becoming more common in commercial interior design, as businesses seek to create environments that not only enhance productivity but also contribute to the health and well-being of their employees.

The market has also seen a rise in collaborations between designers and technology companies to create innovative products and solutions. Smart home technology is becoming increasingly integrated into interior design, with products like smart lighting, thermostats, and security systems being seamlessly incorporated into the design of homes and offices. These technologies not only enhance the functionality and efficiency of spaces but also offer a new level of convenience and control for users. Designers are working closely with tech companies to ensure that these products are not only functional but also aesthetically pleasing and aligned with the overall design vision.

Type Insights

The new construction segment accounted for a revenue share of 75.92% in 2023. The market for new construction spaces is primarily driven by the demand for personalized and modern interiors that reflect the latest design trends. Consumers, especially younger generations, are increasingly seeking to create unique spaces that express their styles. This segment is characterized by the adoption of contemporary designs, with a focus on sleek, minimalist aesthetics and the incorporation of smart home technology.

The remodeling segment is projected to grow at a CAGR of 5.3% from 2024 to 2030. Remodeling projects are largely driven by the need to update outdated spaces, improve functionality, and increase property value. The remodeling segment is witnessing a growing trend toward sustainable and energy-efficient designs, as homeowners look to reduce their environmental impact and lower utility costs. This includes the use of eco-friendly materials, energy-efficient appliances, and the installation of insulation and solar panels.

End Use Insights

Commercial interior design accounted for a share of 54.99% in 2023. The commercial interior design segment is evolving rapidly, driven by the need for spaces that foster collaboration, innovation, and employee well-being. Companies are increasingly investing in the design of their workspaces to enhance productivity and attract top talent. This has led to the adoption of biophilic design principles, which incorporate natural elements like plants and natural light to create healthier work environments.

The demand for residential interior design services are estimated is projected to grow at a CAGR of 4.5% from 2024 to 2030. Residential interior design is increasingly influenced by the desire for comfortable, functional, and aesthetically pleasing living spaces. A major trend in this segment is the focus on wellness-oriented design, where the home is seen as a sanctuary for relaxation and well-being. This includes the incorporation of features like home gyms, spa-like bathrooms, and meditation spaces. The demand for multifunctional spaces is also driving the market, as homeowners look to make the most of their available space, especially in urban settings.

Regional Insights

The interior design market in North America held a share of 33.79% of the global revenue in 2023. In North America, the market is characterized by a strong emphasis on technology integration and innovation. The region has seen a rise in demand for smart homes, where interior designs incorporate the latest in automation and connectivity. Designers in North America are also leading in the adoption of wellness-oriented spaces, with a focus on biophilic design and the creation of environments that support mental and physical well-being.

U.S. Interior Design Market Trends

The U.S. interior design market accounted for a revenue share of around 83.21% in the year 2023. The market is driven by a diverse range of trends, including the growing popularity of sustainable and energy-efficient designs. There is a significant focus on creating homes that are not only stylish but also environmentally responsible, with an emphasis on materials that reduce carbon footprints.

Asia Pacific Interior Design Market Trends

The interior design market in Asia Pacific accounted for a share of 21.82% in the year 2023. The market in the Asia Pacific region is marked by a fusion of traditional and modern design elements. In countries like Japan and South Korea, there is a strong influence of minimalism and simplicity, reflecting cultural preferences for clean, uncluttered spaces. At the same time, there is a growing trend toward luxury and opulence in markets like China and India, where affluent consumers are seeking interior designs that showcase their wealth and status.

Europe Interior Design Market Trends

Europe interior design market is projected to grow at a CAGR of 3.6% from 2024 to 2030. Europe’s market is deeply rooted in a rich tradition of craftsmanship and innovation. There is a strong emphasis on sustainable design practices, with a focus on using locally sourced materials and energy-efficient solutions. The Scandinavian influence is particularly strong, with a preference for minimalist, functional designs that prioritize comfort and simplicity.

Key Interior Design Company Insights

The competitive landscape of the market is characterized by a mix of well-established firms, emerging players, and specialized boutiques, each vying for a share of a market driven by evolving consumer preferences, technological advancements, and economic factors. Major firms often leverage their brand reputation, comprehensive service offerings, and global reach to capture large-scale commercial and high-end residential projects.

These firms are increasingly focusing on sustainability, incorporating eco-friendly materials and practices to align with the growing demand for green design. Emerging players and smaller boutiques, on the other hand, are distinguishing themselves through niche expertise, innovative designs, and personalized services, catering to specific client needs. They often capitalize on local market knowledge and flexibility, offering bespoke solutions that appeal to a more targeted clientele.

Key Interior Design Companies:

The following are the leading companies in the interior design market. These companies collectively hold the largest market share and dictate industry trends.

- Aecom

- Gensler

- Jacobs Engineering Group Inc.

- Perkins and Will

- Stantec Inc.

- Areen Design Services Ltd

- IA Interior Architects

- Cannon Design

- Hirsch Bedner Associates

- NELSON & Associates Interior Design and Space Planning Inc.

Recent Developments

-

In May 2022, the interior design startup Havenly, known for its digital services, expanded into physical spaces with its new IRL services. This initiative allows Havenly's designers to visit clients' homes in person, conduct measurements, and ensure alignment with the client's vision before delivering a virtual design via digital layouts and 3D renderings.

-

In March 2022, Modsy, a prominent female-led online interior design company, introduced a groundbreaking virtual remodeling service. This innovative offering uses 3D technology to enable customers to visualize and virtually explore every aspect of their remodeling project.

Interior Design Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 142.40 billion

Revenue forecast in 2030

USD 175.74 billion

Growth rate

CAGR of 4.3% from 2025 to 2030

Actuals

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end use, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; and South Africa

Key companies profiled

Aecom; Gensler; Jacobs Engineering Group Inc.; Perkins and Will; Stantec Inc.; Areen Design Services Ltd; IA Interior Architects; Cannon Design; Hirsch Bedner Associates; and NELSON & Associates Interior Design & Space Planning Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Interior Design Market Report Segmentation

This report forecasts revenue growth at global, regional, & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global interior design market report based on type, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

New Construction

-

Remodeling

-

-

End Use Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Residential

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global interior design market was estimated at USD 134.22 billion in 2023 and is expected to reach USD 137.93 billion in 2024.

b. The global interior design market is expected to grow at a compound annual growth rate of 4.1% from 2024 to 2030 to reach USD 175.74 billion by 2030.

b. North America dominated the interior design market with a share of around 33% in 2023. The trend of using advanced software for 3D visualization and virtual reality previsualizations is particularly prevalent in this region, allowing for more precise and customized design solutions.

b. Some of the key players operating in the interior design market include Aecom; Gensler; Jacobs Engineering Group Inc.; Perkins and Will; Stantec Inc.; Areen Design Services Ltd; IA Interior Architects; Cannon Design; Hirsch Bedner Associates; NELSON & Associates Interior Design and Space Planning Inc.

b. Key factors that are driving the interior design market growth include the growing trend of incorporating sustainable and eco-friendly materials, the integration of technology into office and home designs, and a rise in demand for wellness-oriented spaces.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.