Intelligent Process Automation Market Size, Share & Trends Analysis Report By Component, By Technology, By Deployment, By Organization Size, By Application, By End-Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-085-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

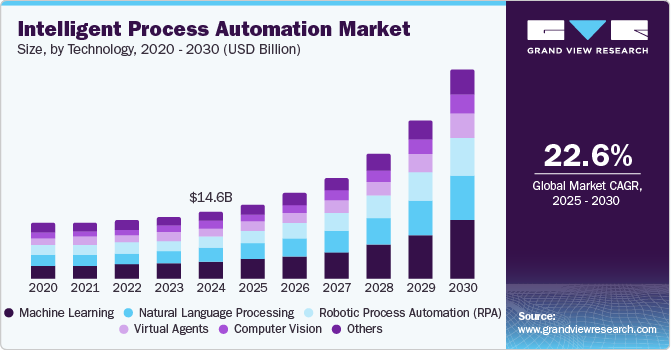

The global intelligent process automation market size was valued at USD 14.55 billion in 2024 and is projected to grow at a CAGR of 22.6% from 2025 to 2030. Multiple industries and businesses focus on reducing costs while enhancing efficiency by limiting the scope for human errors in the processes, primarily driving demand for this market. Integrating artificial intelligence (AI) technology with other advanced innovations such as robotics, machine learning, natural language processing, computer vision, analytics, Optical Character Recognition (OCR), and others assists organizations in accomplishing performance efficiencies and minimizing risks and wastages while gradually increasing productivity.

The emergence of technology-driven solutions, ease of availability related to innovative technologies, increasing adoption of automation, and expansion of multiple businesses on a global scale with the help of web-based technology advancements have resulted in an increasing need for effective performance enhancement solutions, automation technologies, and cost-reduction measures. This has led to a growing demand for intelligent process automation in recent years. Machine learning, Intelligent Character Recognition (ICR), and cognitive automation have helped industries develop complete process automation in warehousing, manufacturing, inventory management, and more.

For instance, Stellantis NV, one of the prominent companies in the automotive manufacturing industry, aims to deliver better products, reduce waste, and minimize size energy utility through its “Dare Forward 2030 strategic plan.” It plans to deploy automation, artificial intelligence, and other digital solutions for this. Currently, it uses Autodesk Construction Cloud, an AI-enabled robot guidance system, autonomous mobile robots (AMRs), and more.

Multiple new product developments and launches by key companies in the process automation or manufacturing intelligence industry are expected to drive the growth of this market. This includes innovations related to manufacturing assemblies, inspections, inventory management, workspace management, end-of-line testing, and more. For instance, MIRAI 2, software equipped with AI vision technology, assists manufacturers in effective robotic automation. The newly launched software empowers robots to navigate and engage with variances in shape, position, color, backgrounds, or lighting within their production environment with better abilities.

Component Insights

Based on components, the services segment dominated the global intelligent process automation (IPA) market with a revenue share of 56.5% in 2024. Services related to IPA are often characterized by support and expertise. The absence of in-house experts in innovation-based technologies, troubleshooting requirements while implementing newly adopted solutions, dependability of operational continuance on IPA tools, need for training, and ongoing support requirements are some of the key factors that have developed growth for this segment.

The solution segment is expected to experience significant CAGR during the forecast period. This segment is mainly influenced by the increasing focus of manufacturing organizations on implementing effective IPA solutions to achieve advantages such as energy efficiency, enhanced productivity, reduced wastage, effective assembly performances, and substantial reduction in manufacturing costs. Launching novel products and solutions backed by innovation and technologies linked to machine learning, artificial intelligence, robotics, and others also fuels the growth of this market. For instance, in May 2024, GE Vernova, a major market participant in the electrification, energy & power, and decarbonization technology industry launched cloud-based software equipped with computer vision abilities designed to assist multiple businesses in the automation of manual inspection process. The solution uses artificial intelligence/machine learning (AI/ML) algorithms and image capturing devices.

Technology Insights

The machine learning (ML) technology segment accounted for the largest revenue share in the global industry in 2024. This segment's growth is primarily driven by factors such as companies' significant expansion of automation capacities, their capacity to analyze vast data sets in real-time, and technology's assistance in continuously enhancing IPA systems. In addition, technology abilities such as adaptability, flexibility, scalability, predictive analytics, and others contribute to making ML a preferred choice for multiple businesses.

Natural Language Processing (NLP) segment is expected to experience significant CAGR from 2025 to 2030. The increasing dependency of businesses and industries on data has developed trends in data generation. This has resulted in vast amounts of unstructured data such as texts, documents, images, e-mails, and data generated from social media, which requires processing. NLP technology assists IPA in extracting actionable insights from the raw data. It also contributes to developing chatbots or virtual assistants that enable organizations to increase customer engagement through enhanced communication. Additional advancements in NLP, such as sentiment analysis, integration of AI, and others, are adding to the growth opportunities for this segment.

Deployment Insights

Based on deployment, the cloud-based segment accounted for the largest revenue share of the global industry in 2024. This is attributed to the increasing adoption of cloud computing technology owing to associated benefits such as scalability, cost efficiency, improved collaboration, faster deployment, minimized human error, accessibility to advanced technologies, and others. Cloud environments enable organizations to scale up or down according to business cycles and demands. This plays a vital role in IPA implementation as businesses can adjust the capability aspect of IPA based on workloads instead of making upfront investments that might pose challenges later. Cloud-based deployments also improve cross-functional team communications and ensure a smooth workflow.

The on-premise deployment segment is expected to experience significant growth during the forecast period. This segment is primarily influenced by the specific characteristics associated with the on-premise deployments, such as complete control over infrastructure, enhanced security, easier compliance adherence (especially in the healthcare or finance industry), lower latency, integration with critical legacy systems, cost-effective in the long term, and others. SMEs or small-scale manufacturing units that require automation solutions often rely on this sort of deployment.

Organization Size Insights

The large enterprise segment dominated the global industry for intelligent process automation in 2024. This segment's growth is mainly driven by large enterprises' ability to make necessary investments in developing or sourcing IPA solutions, higher adoption of advanced technologies that primarily rely on data, cloud adoption capacities, large-scale operations that require automation, and more. Large enterprises have the necessary technology competencies, skilled professionals, financial capacity, structural abilities, and resources to implement IPA systems and improve performance.

The SME segment is projected to experience the fastest CAGR from 2025 to 2030. This is attributed to the availability of cost-effective IPA solutions and services specially designed for SMEs and the easy accessibility and availability of data, which has increased the dependency of small or medium-scale businesses on data-driven technology solutions. In addition, SMEs are more focused on adopting effective IPA to attain cost reductions, improved productivity, enhanced customer experiences, and more.

Application Insights

Based on application, the business process automation segment accounted for the largest revenue share of the global market in 2024. This involves the automation of core or other business processes with the help of intelligent technologies and innovation. Processes that businesses automate can range from order processing, employee onboarding, and manufacturing to inventory management, endpoint testing, and more. Businesses often automate all three processes, including core, support, and long-tail processes. Growing collaboration between key players of the IPA market and the manufacturing industry is adding to the growth of this segment. For instance, Celonis, one of the prominent companies in process mining, applauded the automotive manufacturing brand BMW AG and announced that the two have expanded their partnership and strategic collaboration to continue applying process mining and process intelligence.

The security management segment is anticipated to experience lucrative growth during the forecast period. The dependency on data availability, data reliability, and data-driven strategic decision-making has increased businesses' data security and protection requirements. In addition, the rapid pace of digital transformations and adoption of advanced technologies such as Artificial Intelligence (AI), machine learning (ML), cloud computing, process automation, and others have resulted in growth in risks associated with cyber threats and data breaches. According to the U.S. Federal Bureau of Investigation Internet Crime Report 2023, businesses and governments collectively experienced nearly USD 12.50 billion losses in 2023. The Internet Crime Complaint Center (IC3) has received an average of 2,412 complaints daily. IPAs play a vital role in the automation of security management by offering solutions or services related to centralized authentication and authorization, monitoring and real-time analysis of user activities, enhanced threat detection and quick response, streamlined compliance processes, advanced analytics, and more.

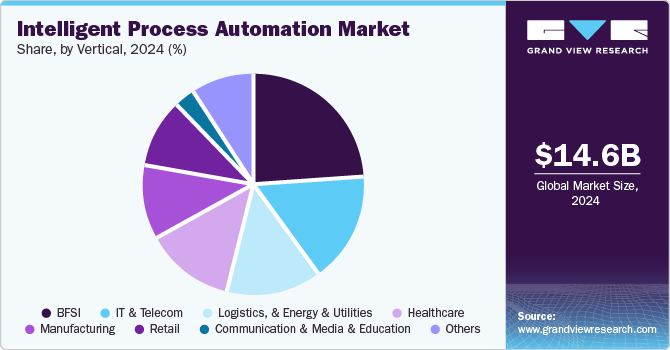

Vertical Insights

Based on vertical, the BFSI segment dominated the global market for intelligent process automation in 2024. This is attributed to factors such as increasing adoption of advanced technologies such as cloud computing, artificial intelligence, and others, growing use of data for decision-making and process implementations, growth in the digital footprint of the industry, and a vast amount of data generated through digital transactions worldwide. As the industry experiences unceasing growth in competition driven by the global nature of the business, companies are seeking solutions that help them achieve operational excellence, enhanced productivity, reduced costs, and improved customer experience.

The healthcare segment is projected to experience the fastest CAGR from 2025 to 2030. This is attributed to the increasing focus of healthcare businesses on reducing operational expenses and enhancing operational efficiency. The healthcare industry is now largely driven by technologies, patient data, and intelligent solutions that assist professionals and businesses in multiple aspects. IPA enables the healthcare industry to streamline administrative processes, improve focus on core patient care activities, manage data, analyze patients with chronic illnesses in real time, optimize resource allocations, enhance compliance adherence, and facilitate telehealth services.

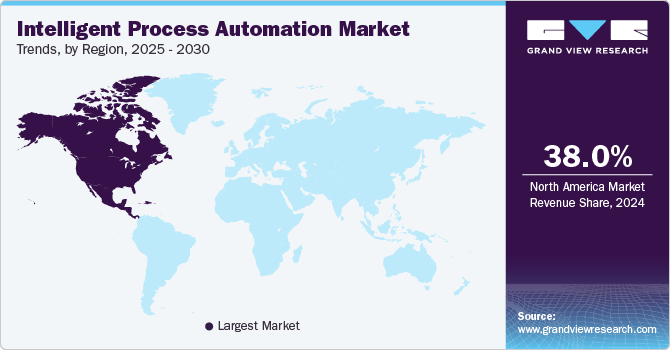

Regional Insights

North America intelligent process automation market held largest revenue share of 38.0% in 2024. This is attributed to regional trends such as early adoption, availability of multiple solutions launched by domestic companies from the U.S., increasing focus of businesses on transforming traditional operations into digitally advanced processes, and growing awareness regarding benefits associated with process automation such as cost reduction, reduced errors, limited wastages, improved productivity and more. The presence of multiple manufacturing industry participants in the region adds to this market's lucrative growth.

U.S. Intelligent Process Automation Market Trends

The U.S. intelligent process automation market dominated the regional industry due to the growing integration of modern technologies such as AI, ML, and others with processes in multiple industries. Numerous businesses in the U.S. seek effective automation solutions to ensure increased profitability generated from improved portfolios, enhanced operational workflows, improved customer experiences, growth in product or service quality, ease of internal process, and more. The U.S. is home to multiple key companies in the intelligent process automation market, such as Appian, Automation Anywhere, Inc., Celonis, and others. This also contributes to the growth of this market.

Europe Intelligent Process Automation Market Trends

The Europe IPA market was identified as a lucrative region in 2024. The rapid pace of digital transformation activities in the region primarily drives this market. European companies are focusing on adopting IPA systems that can assist in automating core business processes to reduce costs. In addition, companies that want to concentrate more on core business activities are choosing to automate the support or long-tail processes and deploy resources on core activities. The growing demand for intelligent process automation in the banking, financial services, and insurance industries also fuels this market.

Germany intelligent process automation market held the significant revenue share of the regional industry in 2024. This is attributed to factors such as the robust manufacturing industry operating in the country, government support, and rising demand for process automation to achieve cost reductions and increased productivity. Germany’s Federal Ministry for Economic Affairs and Climate Action and Federal Ministry of Education and Research collectively work with high-ranking individuals from applauded businesses to ensure the implementation of the Industrie 4.0 initiative. This is expected to assist the intelligent process automation market in terms of growth during the forecast period.

Asia Pacific Intelligent Process Automation Market Trends

Asia Pacific intelligent process automation market is expected to experience the fastest CAGR from 2025 to 2030. This is attributed to multiple factors, including the presence of numerous business process outsourcing companies in the region, growing adoption of automation systems by various industries, including automotive, BFSI, and healthcare, increased availability of effective intelligent process automation solutions, robust information and technology sector, and increased focus of multiple governments and businesses on digital transformations to ensure improved economic results and enhanced performances.

India intelligent process automation market is projected to experience a growth during forecast period. The development of this market is primarily driven by the growing penetration of modern technologies such as Artificial Intelligence (AI), machine learning, cloud computing, robotics, and others. Entry of process automation technologies that can be integrated with existing organizational structures, presence of multiple manufacturing businesses, increasing digital footprint of the BFSI industry, focus of healthcare businesses on process automation, and more.

Key Intelligent Process Automation Company Insights

Some of the key companies operating in the intelligent process automation market include Appian, Celonis, Automation Anywhere Inc., Microsoft, Pegasystems Inc., and others. To address growing competition and increasing demand, these companies are adopting new product developments, collaborations with other companies, service differentiations, enhanced product deliveries, and improved portfolios.

-

Celonis, one of the prominent companies in the data processing and technology industry, offers process excellence solutions through its platforms, which use process mining, process improvement techniques, and AI. The portfolio includes products and solutions related to process analysis, process improvements, process monitoring, process management, supply chain, IT, workforce productivity, artificial intelligence, and more.

-

Automation Anywhere Inc., a major participant in the intelligent process automation market, provides products and services such as AI systems, automation systems, process automation platforms, and more. Some of its automation systems offerings include Automation Workspace, CoE Manager, Citizen Developers, Bot Store, and others.

Key Intelligent Process Automation Companies:

The following are the leading companies in the intelligent process automation Market. These companies collectively hold the largest market share and dictate industry trends

- Appian

- AntWorks

- Automation Anywhere, Inc.

- Blue Prism Limited

- Celonis

- Fortra, LLC

- IBM

- Tungsten Automation Corporation (Kofax)

- Microsoft

- NICE

- Nintex UK Ltd

- Pegasystems Inc.

- UiPath

- WorkFusion, Inc.

- ThoughtSpot Inc.

Recent Developments

-

In July 2024, Celonis, a key business participant in the intelligent process automation industry, and Emporix, a prominent organization in commerce orchestration, partnered to develop and launch end-to-end process optimization and process orchestration solutions driven by AI technology.

-

In June 2024, Nintex UK Ltd, a process intelligence and automation industry participant, announced the launch of AI-powered improvements in the company's Nintex Process Platform. The new feature, which includes generative AI and native data storage, has significantly enhanced the platform's AI capabilities.

Intelligent Process Automation Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 16.16 billion |

|

Revenue forecast in 2030 |

USD 44.74 billion |

|

Growth Rate |

CAGR of 22.6% from 2024 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, technology, deployment, organization size, application, vertical, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, UAE, Saudi Arabia and South Africa |

|

Key companies profiled |

Appian; AntWorks; Automation Anywhere, Inc.; Blue Prism Limited; Celonis; Fortra, LLC; IBM; Tungsten Automation Corporation (Kofax); Microsoft; NICE; Nintex UK Ltd; Pegasystems Inc.; UiPath; WorkFusion, Inc.; ThoughtSpot Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Intelligent Process Automation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the intelligent process automation market report based on component, technology, deployment, organization size, application, vertical, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Services

-

Consulting

-

Design & Implementation

-

Training & Support

-

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Machine Learning

-

Natural Language Processing

-

Robotic Process Automation (RPA)

-

Virtual Agents

-

Computer vision

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud-based

-

On-premise

-

-

Organization Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprise

-

SME

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

IT Operations

-

Business Process Automation

-

Application Management

-

Content Management

-

Security Management

-

Other

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Healthcare

-

Retail

-

IT & Telecom

-

Communication and Media & Education

-

Manufacturing

-

Logistics, and Energy & Utilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."