Intelligent Network Market Size, Share & Trends Analysis Report By Enterprise Size (Small & Medium Sized Enterprises, Large Enterprises), By Application (Telecom Service Provider, Cloud Service Provider), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-386-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Intelligent Network Market Size & Trends

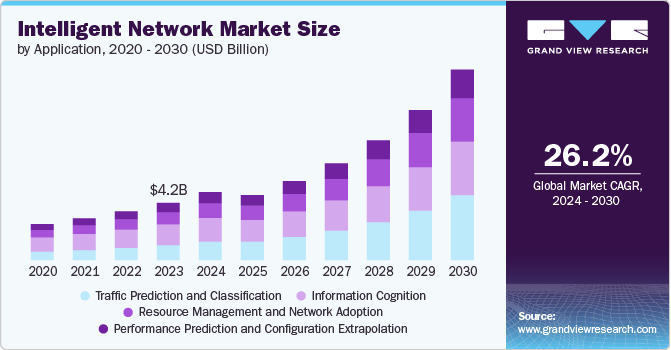

The global intelligent network market size was estimated at USD 4.24 billion in 2023 and is projected to grow at a CAGR of 26.2% from 2024 to 2030. The growth is driven by the telecom industry, which is experiencing significant increases in both interest and adoption of Artificial Intelligence (AI) and Machine Learning (ML) technologies. Although still in the early stages, the industry has moved beyond initial trials and lab testing, which were once considered cutting-edge. Intelligent networking is becoming mainstream as telecom companies increasingly utilize it for operational support, whether through deploying intelligence in next-generation networks or automating network management tasks like ticket correlation and predictive maintenance.

The adoption of intelligent networks in telecommunications is propelling the growth of the intelligent network market. These networks enable automation of numerous functions, such as call routing and management, allowing operators to swiftly introduce new services to customers. Additionally, intelligent networks offer real-time network information, aiding in the diagnosis and resolution of network issues, enhancing performance, and reducing downtime. Advances in artificial intelligence and machine learning, along with the rising demand for cloud-based services, are further boosting market growth. Despite these positive factors, high deployment costs, cybersecurity issues, and complex integration are hindering the market's expansion. Conversely, the widespread deployment of 5G networks is expected to create significant opportunities for the growth of the intelligent network industry.

Enterprise Size Insights

The large enterprises segment led the market, accounting for 56.0%% of the global revenue in 2023. Large enterprises are experiencing significant growth in the market due to the advancement of technologies like artificial intelligence and machine learning, as these innovations enable real-time network data analysis, improved problem identification and resolution, enhanced network performance, and reduced downtime. The large-scale implementation of 5G networks presents a major opportunity for intelligent network growth in large enterprises, as it offers faster speeds, lower latency, and support for advanced services and applications like IoT and virtual reality. Large enterprises are increasingly disseminating their data and applications across multiple data centers, clouds, and edge environments, necessitating new networking architectures that are cloud-ready, meet application connectivity requirements, and maintain technical and operational consistency across sites.

The Small and Medium-sized Enterprises (SMEs) segment is estimated to grow significantly over the forecast period. The growth is attributed to digitalization, as with digital maturity and the adoption of digital technologies positively impacting SMEs' development and competitiveness in the rapidly evolving business landscape. Digitalization has enabled the shift towards software-defined networking, which centralizes management and provides a comprehensive platform for uniform policy application and enforcement throughout the network. This allows for more flexible, scalable, and efficient network operations. Moreover, the development of human capital, particularly in terms of digital skills and training, is crucial for SMEs to fully leverage technological advancements and drive growth. Finally, supportive public institutions and policies that facilitate SME development, such as those promoting digital transformation and providing access to resources, contribute significantly to the growth potential of SMEs in intelligent networks.

Application Insights

The information cognition segment led the market and accounted for highest revenue of the global revenue in 2023. The market for information cognition within intelligent networking is showing strong growth potential. It is expected to have a larger market share during the forecast period compared to other applications in the intelligent network market. This growth is driven by the increasing need for information cognition in accumulating network operational data, including network characteristics, trace routes, traffic matrices, and other data functionalities. Moreover, As networks continue to evolve and become more complex, the importance of information cognition in intelligent networking is likely to grow further. It will play a crucial role in enabling self-optimizing and self-healing networks, improving network agility, and supporting the delivery of innovative services to customers

Traffic prediction and classification are accounted to hold highest revenue growth over forecast period. Traffic prediction in intelligent networks has become increasingly sophisticated, leveraging various AI techniques to improve accuracy and efficiency. Long Short-Term Memory (LSTM) networks, have shown promising results in predicting network traffic patterns. These models can capture the temporal dependencies in network traffic data, allowing for more accurate forecasts. The integration of prior knowledge into prediction models is enhancing their performance and interpretability. For instance, incorporating the self-similarity of network traffic as prior knowledge into LSTM networks has improved prediction accuracy and provided more interpretable results. This approach addresses the limitations of traditional statistical models in extracting traffic features from inadequate sample data.

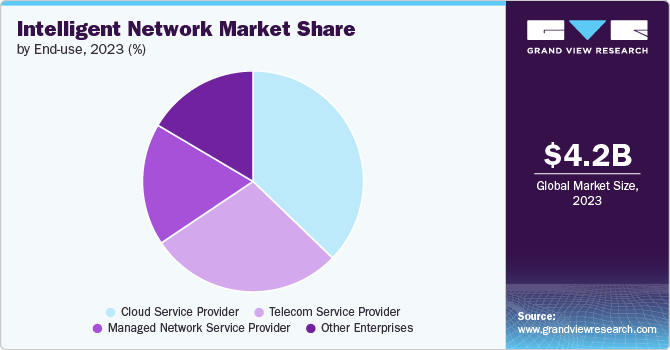

End-use Insights

The cloud service provider segment led the market and accounted for highest revenue of the global revenue in 2023. Cloud Service Providers (CSPs) play a crucial role in enabling intelligent networks by offering scalable, on-demand computing resources and advanced services over the internet. In the context of intelligent networks, cloud service provider offers the infrastructure and platforms necessary for implementing sophisticated networking solutions that leverage artificial intelligence, machine learning, and automation. Moreover, These providers offer a range of services, including Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS), which form the foundation for building and deploying intelligent network applications. By utilizing cloud-based resources, organizations can implement advanced network management tools, analytics platforms, and AI-driven services that enhance network performance, security, and efficiency.

Telecom Service Provider is accounted to hold highest revenue growth over forecast period. The advent of 5G networks is anticipated to transform various broadband services and enhance connectivity across multiple end use sectors. Key factors driving market growth include the rise in mobile subscriptions, increased enterprise usage, online video streaming, the development of 5G infrastructure, and diverse IoT applications leveraging 5G. moreover, Telecom providers leverage IN to deliver services like prepaid calling, virtual private networks, and universal personal telecommunications, enhancing the customer experience and operational efficiency. The use of protocols like Signaling System #7 (SS7) supports communication between network nodes, ensuring seamless service delivery across different network segments

Regional Insight

Theintelligent network market in North Americaheld a significant share of a 33.0% share in 2023. The North American region is anticipated to hold a substantial market share during the forecast period. This is largely due to the rising adoption of intelligent networking solutions, fueled by the advancement of technologies like analytics, deep learning, and network virtualization. Moreover, the demand for advanced technologies such as machine-to-machine communication, connected cars, and artificial intelligence is higher in this region compared to others. Consequently, it is expected to present significant opportunities for the 5G network, thereby driving market growth.

U.S. Intelligent Network Market Trends

The U.S. Intelligent Network market in North America accounting for a substantial portion of the market share. The U.S. market is driven by the growth of advanced technologies such as analytics, deep learning, and network virtualization. There's also increasing demand for machine-to-machine communication, connected cars, and artificial intelligence, which are fueling the need for intelligent networks.

Europe Intelligent Network Market Trends

Intelligent networking in Europe is poised for significant growth, driven by technological advancements, the rollout of 5G, and a strong focus on digital transformation and smart solutions. Europe leads in adopting AI, ML, and IoT, supported by proactive regulatory frameworks and substantial investments. The widespread deployment of 5G networks acts as a major catalyst, requiring sophisticated network management and optimization provided by intelligent networks. Key applications include smart cities, connected and autonomous vehicles, Industry 4.0, and healthcare, all of which benefit from the enhanced efficiency and reliability of intelligent networking.

Asia Pacific Intelligent Network Market Trends

Asia Pacific intelligent networkingis anticipated to witness the highest growth during the forecast period, Countries like China, South Korea, and Japan are leading the way in 5G implementation, necessitating sophisticated network management and optimization. The region's significant advancements in AI, ML, and IoT are being integrated into network systems to provide real-time monitoring and predictive maintenance. Key applications include telecommunications, manufacturing, healthcare, and retail, where intelligent networks enhance efficiency and customer experience.

Key Intelligent Network Companies Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, partnerships, and collaborations contracts, agreements, as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, In July 2024, Nokia Corporation announced new partnership with telecom Egypt to bring 5G technology to Egypt for the first time. This new agreement with Nokia further strengthens telecom Egypt’s strong partnership, reaffirms telecom Egypt commitment to providing cutting-edge digital services, and positions the company at the forefront of the 5G revolution.

Key Intelligent Network Companies:

The following are the leading companies in the intelligent network market. These companies collectively hold the largest market share and dictate industry trends.

- Cisco Systems

- Aruba Networks

- Huawei Technologies

- Nokia Corporation

- Juniper Networks

- Colt Technology Services

- Netcracker Inc.

- Snadvine

- Loom Systems

- Aricent Inc.

- Aria Networks

- APCON Inc.

Recent Developments

-

In June 2023, Nokia has globally introduced new products to strengthen its AirScale baseband portfolio, renowned for its exceptional performance, capacity, and energy efficiency. Among the innovations are two advanced 5G baseband capacity cards named Levante and Lodos. Additionally, Nokia has unveiled Ponente, a new high-performance baseband control card boasting unprecedented throughput capacity.

-

In November 2023, Huawei has introduced the 5.5G Intelligent Core Network Solution, designed to enable a broader range of new business opportunities. This solution leverages native intelligence, enhancing capabilities in service intelligence, network intelligence, and operational management (O&M) intelligence. These advancements aim to support a diverse array of new business ventures and contribute to creating a smarter, more interconnected world.

Intelligent Network Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 5.13 billion |

|

Revenue forecast in 2030 |

USD 20.69 billion |

|

Growth rate |

CAGR of 26.2% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Enterprise size, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

Cisco Systems; Aruba Networks; Huawei Technologies; Nokia Corporation; Juniper Networks; Colt Technology Services; Netcracker Inc.; Snadvine; Loom Systems; Aricent Inc.; Aria Networks; APCON Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Intelligent Network Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global intelligent network market report based on enterprise size, application, end-use and region:

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small and Medium-Sized Enterprises

-

Large Enterprises

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Information Cognition

-

Traffic Prediction and Classification

-

Resource Management and Network Adoption

-

Performance Prediction and Configuration Extrapolation

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Telecom Service Provider

-

Cloud Service Provider

-

Managed Network Service Provider

-

Other Enterprises

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global Intelligent Network market size was estimated at USD 4.24 billion in 2023 and is expected to reach USD 5.13 billion in 2024.

b. The global Intelligent Network market is expected to grow at a compound annual growth rate of 26.2% from 2024 to 2030 to reach USD 20.69 billion by 2030.

b. North America dominated the Intelligent Network market with a share of 33.0% in 2023. The North American region is anticipated to hold a substantial market share during the forecast period. This is largely due to the rising adoption of intelligent networking solutions, fueled by the advancement of technologies like analytics, deep learning, and network virtualization.

b. Some key players operating in the Intelligent Network market include Cisco Systems, Aruba Networks, Huawei Technologies, Nokia Corporation, Juniper Networks, Colt Technology Services, Netcracker Inc., Snadvine, Loom Systems, Aricent Inc., Aria Networks, APCON Inc.

b. Key factors that are driving the market growth include The adoption of intelligent networks in telecommunications is propelling the growth of the intelligent network market. These networks enable automation of numerous functions, such as call routing and management, allowing operators to swiftly introduce new services to customers.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."