Intelligent Infrastructure Monitoring Market Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Deployment, By Industry Vertical, By Application, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-544-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

The global intelligent infrastructure monitoring market size was estimated at USD 4.29 billion in 2024 and is expected to grow at a CAGR of 15.3% from 2025 to 2030. The growth of this market is driven by the rising demand for real-time monitoring and predictive maintenance across industries such as transportation, energy, and smart cities. Increasing concerns over infrastructure safety, operational efficiency, and asset longevity are accelerating the adoption of smart monitoring solutions. Governments and enterprises are investing heavily in IoT-enabled sensors, AI-driven analytics, and cloud computing to enhance system reliability and minimize downtime. Furthermore, the integration of 5G networks with edge computing has improved data collection and processing capabilities, enabling faster and more accurate decision-making, thereby further propelling the adoption of smart monitoring solutions.

A key trend in the market is the rapid adoption of AI and machine learning in infrastructure monitoring. AI-powered predictive analytics enables organizations to detect potential failures in advance, optimizing maintenance schedules and reducing operational costs. Digital twins, which create virtual replicas of physical assets, are also gaining traction, facilitating real-time simulations to enhance infrastructure resilience. Additionally, the expansion of smart cities is driving demand for intelligent monitoring solutions across traffic management, energy distribution, and public safety, accelerating urban planning and sustainability initiatives worldwide.

The growing shift toward cloud-based solutions is further propelling the intelligent infrastructure monitoring industry. Cloud computing enables centralized data storage, remote monitoring, and seamless IoT integration, making it the preferred choice for industries seeking scalable and cost-effective solutions. Advancements in cybersecurity are also addressing data privacy and security concerns, encouraging greater adoption of cloud-based monitoring platforms. As industries embrace digitalization, the convergence of AI, IoT, and cloud technologies is reshaping infrastructure management practices.

Leading market players are expanding their product portfolios and forging strategic partnerships to strengthen their market presence. Companies such as Siemens, Hitachi, and Schneider Electric are investing in AI-driven monitoring solutions to enhance predictive maintenance capabilities. Cisco and IBM are integrating edge computing and cybersecurity features to improve real-time data processing and threat detection. Huawei and Microsoft are leveraging cloud platforms to deliver scalable, intelligent monitoring solutions. Mergers, acquisitions, and R&D investments continue to shape the competitive landscape, driving innovation and technological advancements in the intelligent infrastructure monitoring industry.

Application Insights

The predictive maintenance segment dominated the market with a revenue share of over 31% in 2024 and is expected to grow at a significant rate over the forecast period. The increasing usage of IoT sensors, analytics driven by AI, and machine learning algorithms has improved business capabilities to forecast failures and schedule optimal maintenance. Predictive maintenance solutions are applied extensively in transportation, energy, and manufacturing industries to reduce downtime, lower operational expenses, and enhance asset lifespan. As the focus on real-time data processing and automation gains momentum, the demand for AI-based predictive maintenance is expected to increase steadily over the forecast period.

On the other hand, the analytics & insights segment is expected to grow at a faster rate from 2025 to 2030. Growing demand for data-driven decisions and operational insights is driving interest in next-generation analytics platforms with rich insights on infrastructure performance. Enterprises and governments are adopting AI, big data analytics, and digital twin solutions to maximize asset management, improve resource utilization, and optimize system efficiency. Further, the increasing embracement of smart city projects and sustainability-focused initiatives is also fueling the incorporation of analytics solutions in different infrastructure sectors for ensuring long-term market growth.

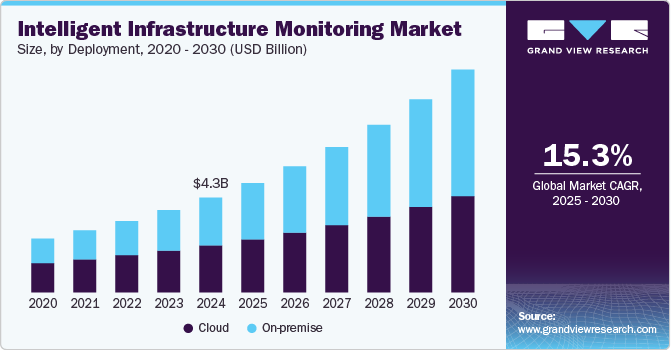

Deployment Insights

Based on deployment, the cloud segment dominated the market in 2024 with a revenue share of over 50% and is expected to grow at a fastest rate over the forecast period. Growing requirements for remote access, real-time analytics, and affordable solutions are fueling the use of cloud-based infrastructure monitoring. Cloud deployment facilitates effortless integration with IoT devices, AI-powered predictive maintenance, and improved data-driven decision-making. Transportation, energy, and smart city sectors are utilizing cloud solutions to enhance infrastructure performance, reduce downtime, and enhance operational efficiency. Moreover, developments in edge computing and cybersecurity are also driving cloud adoption further by overcoming security issues and improving data processing.

On the other hand, the On-premise segment accounts for significant share in the intelligent infrastructure monitoring market in 2024. Industries such as defense, government, and critical infrastructure opt for on-premise solutions to have full control over sensitive information and ensure continuity of operations. Although on-premise deployments ensure greater security and reliability, they tend to involve greater hardware maintenance, software upgrades, and IT infrastructure costs. Nevertheless, with the growing popularity of hybrid solutions merging on-premise security with cloud flexibility most organizations are increasingly moving towards cloud-based or hybrid intelligent infrastructure monitoring solutions.

Industry Vertical Insights

The IT & telecommunications segment dominated the market in 2024. The industry depends significantly on real-time network monitoring, AI-based analytics, and cybersecurity solutions to provide uninterrupted connectivity and avoid interruptions. With the growth of 5G, cloud computing, and edge computing, telecom operators are increasingly using automated fault detection and predictive maintenance to enhance service reliability. The increase in data traffic, working from home, and IoT-based communication networks further boost the requirement for sophisticated monitoring solutions, making this segment poised to grow steadily over the forecast period.

The healthcare & smart hospitals segment is anticipated to grow significantly from 2025 to 2030, fueled by the rising use of IoT-based medical devices, AI-based diagnostics, and real-time infrastructure monitoring. Smarten hospitals are tapping into AI-enabled systems to manage medical equipment efficiency, power management, and IT infrastructure so as to deliver maximum operational effectiveness with patient safety. The increase of telemedicine, robotic surgery, and digitalized health records further emphasizes the implementation of smart monitoring solutions within health facilities. As governments and private industries invest in smart cities and digital health, intelligent infrastructure monitoring solutions will be pivotal in improving operational resilience, reducing downtime, and maintaining regulatory compliance.

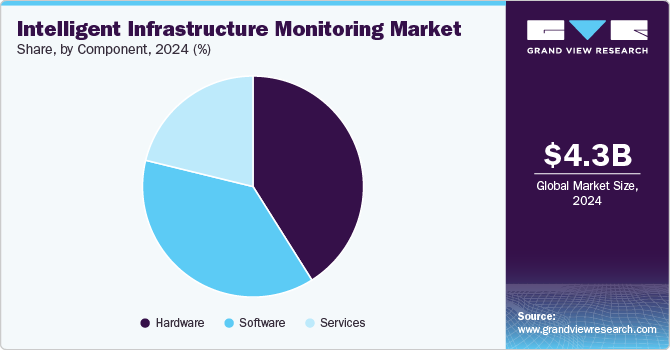

Component Insights

The hardware segment dominated the market in 2024. The use of smart infrastructure monitoring hardware, such as IoT sensors, edge devices, and data acquisition systems, has been booming across sectors, including transportation, energy, and smart cities. Such hardware plays a vital part in real-time data acquisition, predictive maintenance, and system optimization, enabling companies to reduce downtime and improve operational efficiency. Moreover, the shift towards high-performance computing, 5G networks, and edge AI is also compelling investments in monitoring hardware. As businesses continue to focus on automation and digitalization, the demand for sophisticated hardware solutions is expected to increase in the coming year.

On the other hand, the software segment is anticipated to experience significant growth from 2025 and 2030. The growing adoption of AI-driven analytics, cloud-based monitoring software, and machine learning algorithms is fueling the need for smart infrastructure monitoring software. Businesses are using sophisticated software platforms to process huge volumes of data gathered through sensors, making real-time anomaly detection, predictive analysis, and proactive decision-making possible. The increased focus on cybersecurity, remote management of infrastructure, and digital twins adds more shine to the software segment's appeal. As companies in all industries, such as healthcare, manufacturing, and government, strive to maximize their infrastructure operations, the use of monitoring software is growing significantly, making it a major growth driver for the market over the forecast period.

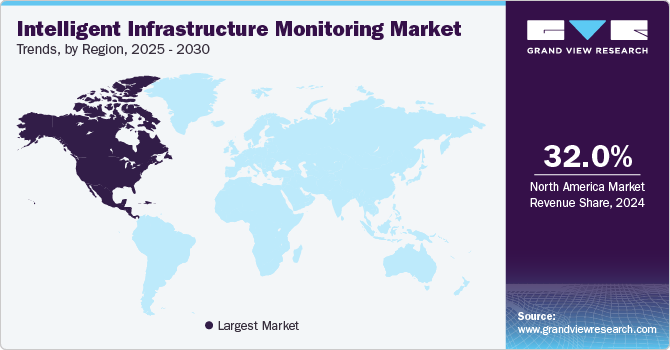

Regional Insights

North America intelligent infrastructure monitoring market accounted for the largest revenue share of over 32% in 2024. The region is supported by cutting-edge infrastructure, high adoption of AI-based monitoring technologies, and high investment in smart city initiatives. The U.S. dominates the market, with major players such as Cisco, IBM, and Honeywell that offer AI-based monitoring solutions for industrial, energy, and transportation industries. The growth in the adoption of predictive maintenance solutions in industries and government efforts to upgrade infrastructure are also fueling the growth of the market further. The use of cloud-based monitoring systems and IoT integration in infrastructure management is anticipated to continue leading growth in North America.

U.S. Intelligent Infrastructure Monitoring Market Trends

The U.S. intelligent infrastructure monitoring market is growing at a fast pace with rising investments in smart city initiatives, AI-based predictive maintenance, and IoT-enabled real-time monitoring solutions. Public sector initiatives like the Bipartisan Infrastructure Law are driving the use of high-tech monitoring systems in transportation, energy, and industrial sectors. The integration of AI, cloud, and cybersecurity is improving infrastructure efficiency and resilience. Also, the use of 5G and edge computing is facilitating quicker data processing and real-time analysis. With industries focusing on predictive maintenance and operation optimization, demand for smart monitoring solutions is expected to increase significantly during the forecasted period.

Europe Intelligent Infrastructure Monitoring Market Trends

The intelligent infrastructure monitoring industry in Europe is experiencing significant growth driven by the region's focus on smart city programs, sustainability initiatives, and digitalization throughout industries. IoT-based monitoring systems are being invested in by governments as well as private organizations to enhance the reliability of infrastructure, lower the cost of maintenance, and ensure public security. The EU's initiatives in green energy and intelligent grids are also influencing the uptake of intelligent monitoring solutions in energy and utility domains. With the growth of 5G networks and edge computing, infrastructure monitoring is becoming more efficient, allowing real-time data analysis and predictive maintenance for the transportation, manufacturing, and public infrastructure industries.

The UK intelligent infrastructure monitoring market is a driver of Europe's market, led by smart city initiatives, aging facilities, and the swift pickup of AI-based solutions. The government is investing in IoT-based monitoring and digital twins to enhance critical asset maintenance, including roads, railways, and bridges. Further, data privacy and cybersecurity regulations are impacting the manner in which intelligent monitoring solutions are being adopted by companies. The energy sector is also gaining from monitoring of power grids and renewable energy assets in real-time, aiding the UK’s transition towards a more resilient and sustainable energy infrastructure.

The intelligent infrastructure monitoring industry in Germany is a frontrunner in industrial automation and predictive maintenance, giving it the largest share of Europe's intelligent infrastructure monitoring market. Manufacturing and automotive industries in the country are investing heavily in IoT-based asset monitoring to improve operational efficiency and minimize downtime. Government policies that promote smart mobility, railway modernization, and urban infrastructure renewal further influence the uptake of monitoring solutions. Also, Germany's strong commitment to renewable energy has led to the large-scale adoption of smart grids and AI-powered power plant monitoring, guaranteeing smooth and efficient energy distribution and lowering carbon footprints.

Asia Pacific Intelligent Infrastructure Monitoring Market Trends

The intelligent infrastructure monitoring market in the Asia Pacific accounted for a significant revenue share in 2024. The market across the region is expected to witness growth at a CAGR of 18.2% from 2025 to 2030. The growth is driven by high urbanization, rising investment in smart city initiatives, and extensive adoption of IoT-based intelligent infrastructure monitoring solutions.

Regional leaders like China, India, and Japan are spearheading this effort, propelled by plans to modernize urban infrastructure, energy grids, and railways. The Chinese emphasis on AI-based infrastructure management, the Indian implementation of smart grid technology, and Japanese innovations in automated industrial monitoring are leading drivers. Furthermore, the growing 5G networks and low-cost IoT implementation in the region are accelerating demand for intelligent infrastructure monitoring solutions. The growing adoption of digital twins and real-time analytics continues to drive the market in Asia Pacific.

The Asia Pacific Intelligent Infrastructure Monitoring Market is witnessing aggressive growth due to urbanization, industrial growth, and government spending on smart infrastructure. Regionally, nations are embracing IoT, AI, and cloud-based monitoring solutions to increase the dependability of key infrastructure, such as transportation, energy, and utilities. The rapid adoption of 5G technology and edge computing is also fueling real-time data gathering and predictive maintenance. Moreover, surging fears regarding climate change and natural disasters have driven demand for structural health monitoring solutions that guarantee the safety and longevity of bridges, tunnels, and buildings in disaster-torn regions such as Japan, Indonesia, and the Philippines.

The intelligent infrastructure monitoring industry in China is at the forefront of adopting intelligent infrastructure monitoring as a result of its smart city programs, expansion of high-speed rail, and huge industrial sector. The government's Made in China 2025 strategy is driving increased automation and digitalization of infrastructure management. Through massive investments in AI, 5G, and IoT, China is realizing real-time monitoring in industries such as transportation, utilities, and public safety. Smart grids and energy monitoring solutions based on artificial intelligence are also instrumental in the nation's shift to renewable energy and carbon neutrality, helping build a more stable and efficient energy grid.

India intelligent infrastructure monitoring industry is becoming an important market due to the government's initiative for smart cities, digital transformation, and speeded-up urban infrastructure development. The growth of metro rail projects, roads, and energy infrastructure has heightened the demand for predictive maintenance and IoT-based monitoring solutions. The Digital India and Make in India initiatives are promoting the deployment of AI-based analytics, real-time monitoring, and remote asset management in manufacturing, utilities, and telecom sectors. In addition, India's renewable energy industry, especially solar and wind power, is increasingly depending on intelligent monitoring solutions to improve efficiency and minimize downtime.

Middle East & Africa Intelligent Infrastructure Monitoring Market Trends

The intelligent infrastructure monitoring market in the Middle East and Africa is growing enormously due to the adoption of smart city projects, mega infrastructure programs, and effective asset management demands. Regional governments are heavily investing in AI-enabled monitoring solutions, IoT predictive maintenance, and digital twin technology for optimizing the efficiency of key infrastructures such as transportation, utility, and oil & gas infrastructure. The surge in sustainability projects and renewable energy schemes, particularly in wind power and solar energy, is also driving the demand for real-time monitoring systems for enhanced energy efficiency and continuous operations.

United Arab Emirates (UAE) intelligent infrastructure monitoring industry is leading the adoption of intelligent infrastructure monitoring because of its ambitious smart city initiatives and high rate of urbanization. The Smart Dubai initiative of the country and the digital strategy of Abu Dhabi have propelled the adoption of AI-based asset monitoring solutions across transport, energy, and property sectors. The UAE's emphasis on sustainable infrastructure in the form of its green building regulations and renewable energy initiatives is fueling demand for structural health monitoring and smart grid monitoring solutions. The adoption of edge and cloud computing technologies is also increasing real-time decision-making for essential infrastructure projects.

The intelligent infrastructure monitoring industry in Saudi Arabia is becoming a pivotal market for smart infrastructure monitoring due to its Vision 2030 program and significant infrastructure spending. Neom, The Line, and Riyadh Metro projects are embracing AI-powered predictive maintenance, IoT-based monitoring, and digital twin technology to make operations more efficient and sustainable. The nation's renewable energy drive, specifically solar and wind power, is developing prospects for high-end energy monitoring solutions. Moreover, Saudi Arabia's emphasis on oil & gas infrastructure modernization is driving the demand for real-time asset monitoring systems, providing safety, efficiency, and cost-advantage in industrial processes.

Key Intelligent Infrastructure Monitoring Company Insights

Some key players in the AdTech market include Hitachi, Ltd., Siemens AG, Schneider Electric, and Dynatrace LLC.

-

Hitachi, Ltd. provides infrastructure monitoring solutions on its Lumada platform with the integration of AI, IoT, and big data analytics for predictive maintenance and asset management. Its technologies benefit transportation, energy, and smart city industries to optimize infrastructure efficiency, reliability, and sustainability. Hitachi is also interested in digital twin technology for simulating real-world situations for improved decision-making in infrastructure operations.

-

Siemens AG offers digital infrastructure solutions such as smart monitoring for industrial automation, energy grids, and smart buildings. Its MindSphere platform allows for real-time analytics of data, predictive maintenance, and optimization of operations across multiple industries. Siemens' solutions also integrate edge computing and AI-powered automation to increase the performance and reliability of mission-critical infrastructure assets.

-

Schneider Electric is an energy management and automation company that provides monitoring solutions for electrical grids, smart buildings, and industrial processes. Its EcoStruxure platform combines AI-based analytics, cloud computing, and IoT connectivity to enhance efficiency and sustainability in infrastructure management. Schneider Electric's solutions are extensively applied across industries such as data centers, utilities, and manufacturing to maximize energy consumption and operational processes.

-

Dynatrace LLC offers artificial intelligence-based observability solutions for monitoring of IT infrastructure, application performance monitoring, and cloud automation. Its platform applies machine learning to identify anomalies, and optimize cloud workloads and digital experience monitoring. Dynatrace also provides full-stack observability, such as infrastructure, applications, and security monitoring, to provide smooth IT operations for enterprises in various industries.

Cisco Systems, Inc., Honeywell International Inc., and IBM are some emerging market participants in the market.

-

Cisco Systems, Inc. provides network infrastructure monitoring solutions such as AI-driven security, cloud networking, and IoT analytics. Its solutions assist enterprises and service providers in monitoring network performance, cybersecurity attacks, and operational efficiency. Cisco's solutions are extensively used in data centers, smart cities, and industrial automation, enabling real-time insights for predictive maintenance and proactive problem-solving.

-

Honeywell International Inc. offers industrial automation and intelligent building solutions with combined infrastructure monitoring. Its Forge platform utilizes AI and predictive analytics to enhance building operations, energy management, and industrial processes. Honeywell's solutions serve industries such as aerospace, manufacturing, and commercial real estate, enabling organizations to enhance operational resilience and minimize downtime.

-

IBM provides AI-driven IT infrastructure monitoring and automation capabilities through its Instana and Watson AIOps offerings. These offerings enable organizations to identify problems, improve IT operation, and add resilience across hybrid cloud environments. IBM also incorporates quantum computing and blockchain technologies in its infrastructure offerings to increase security and operational efficiency.

Key Intelligent Infrastructure Monitoring Companies:

The following are the leading companies in the intelligent infrastructure monitoring market. These companies collectively hold the largest market share and dictate industry trends.

- Hitachi, Ltd.

- Siemens AG

- Schneider Electric

- Dynatrace LLC.

- Cisco Systems, Inc.

- Honeywell International Inc.

- IBM; Microsoft

- Huawei Technologies Co., Ltd.

- ABB

- Johnson Controls

- Alstom

Recent Developments

-

In 2024, Neilsoft introduced ConstructMonitor, a SaaS-based solution to remotely monitor construction quality and progress. Collaborated with Tokyo-based company Fujita Corporation, it helps identify deviations from BIM models on big projects such as high-rises, hospitals, and plants. ConstructMonitor employs LiDAR technology, and points cloud data to detect defects in real time, eliminating rework and delay. Its AI-based information and cloud processing guarantee construction accuracy, reduce material wastage and increase efficiency. With easy-to-use dashboards and remote monitoring, ConstructMonitor enables project teams to ensure quality, optimize workflows, and make informed decisions, enhancing overall project performance and cost savings.

-

In 2024, proteanTecs launched RTSM™ (Real-Time Safety Monitoring), a cutting-edge solution for fault detection and failure prevention of automotive electronics. With increasing software-defined and autonomous vehicles, RTSM offers real-time warnings, predictive maintenance, and failure prevention, ensuring ISO 26262 safety standard compliance. Through the processing of on-chip data and timing margin monitoring, RTSM supports quicker response, around-the-clock monitoring, and adaptive system tuning. This safety layer at the industrial grade boosts vehicle reliability, enabling manufacturers to deliver next-generation automotive requirements

-

In 2024, Dynatrace increased its infrastructure & operations app by adding powerful features to improve end-to-end infrastructure observability. The release features powerful filtering for enterprise-level search, a host view for powerful system health analysis, and higher level monitoring of network devices. These features take advantage of Dynatrace Grail™ data lakehouse and Davis® AI to give IT teams immediate insight into their environments so they can resolve performance issues ahead of time. With predictive monitoring and AI-powered analytics, Dynatrace is further optimizing infrastructure management to enable businesses to streamline system reliability and efficiency.

-

In 2024, New Relic introduced the first AI-powered, fully integrated Digital Experience Monitoring (DEM) solution for the industry, providing end-to-end visibility for mobile, web, and AI-driven applications. The solution allows companies to easily find and fix user friction points and deliver seamless digital experiences. It offers features such as mobile user journeys, enhanced session replay, and mobile log management, allowing organizations to identify and solve issues ahead of time. By combining real user monitoring (RUM) with APM 360 and AI monitoring, New Relic allows enterprises to optimize application performance, minimize downtime, and improve customer satisfaction.

Intelligent Infrastructure Monitoring Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 4.95 billion |

|

Revenue forecast in 2030 |

USD 10.08 billion |

|

Growth rate |

CAGR of 15.3% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, industry vertical, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; Saudi Arabia; UAE, South Africa |

|

Key companies profiled |

Hitachi, Ltd.; Siemens AG; Schneider Electric; Dynatrace LLC.; Cisco Systems, Inc.; Honeywell International Inc.; IBM; Microsoft; Huawei Technologies Co., Ltd.; ABB; Johnson Controls; Alstom |

|

Customization scope |

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Intelligent Infrastructure Monitoring Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global intelligent infrastructure monitoring market report based on the component, deployment, industry vertical, application, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premises

-

Cloud

-

-

Industry Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

IT & Telecommunications

-

Manufacturing & Industrial Automation

-

Healthcare & Smart Hospitals

-

Transportation & Logistics

-

Energy & Utilities

-

Government & Smart Cities

-

Aerospace & Defense

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Predictive Maintenance

-

Analytics & Insights

-

Smart Security & Surveillance

-

Automated Incident Detection & Response

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The key players in the Intelligent infrastructure monitoring market include Hitachi, Ltd., Siemens AG, Schneider Electric, Dynatrace LLC., Cisco Systems, Inc., Honeywell International Inc., IBM, Microsoft, Huawei Technologies Co., Ltd., ABB, Johnson Controls, and Alstom, among others.

b. Key factors that are driving market growth include increasing penetration of real-time monitoring, predictive maintenance, growing concern for infrastructure safety, operational performance, and asset longevity.

b. The global intelligent infrastructure monitoring market size was estimated at USD 4.29 billion in 2024 and is expected to reach USD 4.94 billion in 2025.

b. The global intelligent infrastructure monitoring market is expected to grow at a compound annual growth rate of 15.3% from 2025 to 2030 to reach USD 10.08 billion by 2030.

b. The North America intelligent infrastructure monitoring market accounted for more than 32% revenue share in 2024. North America’s leadership is supported with cutting-edge infrastructure, high adoption of AI-based monitoring technologies, and high investment in smart city initiatives. The U.S. dominates the market, with major players such as Cisco, IBM, and Honeywell that offer AI-based monitoring solutions for industrial, energy, and transportation industries.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."