- Home

- »

- Next Generation Technologies

- »

-

Intelligent Apps Market Size, Share & Growth Report, 2030GVR Report cover

![Intelligent Apps Market Size, Share & Trends Report]()

Intelligent Apps Market (2024 - 2030) Size, Share & Trends Analysis Report By Type, By Providers, By Services, By Store Type, By Deployment Mode, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-314-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Intelligent Apps Market Size & Trends

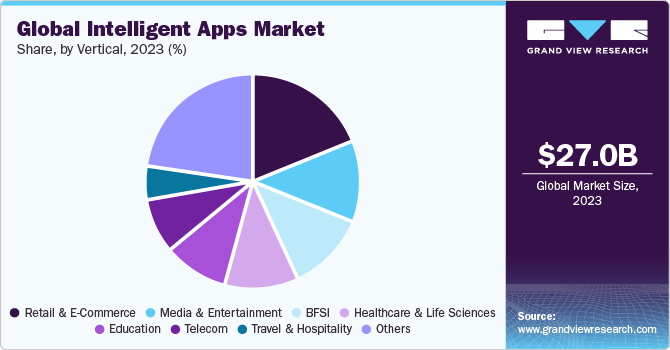

The global intelligent apps market size was estimated at USD 27.03 billion in 2023 and is expected to grow at a CAGR of 30.6% from 2024 to 2030. Businesses are increasingly looking to automate routine tasks to boost efficiency. Intelligent applications can automate various business processes, freeing up human resources for more strategic work. Moreover, intelligent apps can significantly enhance customer experience by offering features such as chatbots for 24/7 support, personalized recommendations, and proactive problem-solving. In addition, the widespread adoption of smartphones equipped with ever-improving computing capabilities is significantly driving the growth of the market.

Intelligent apps study patterns in consumer behavior, which can help predict upcoming market movements. By utilizing smart apps, companies can identify which content garners the most interaction and adjust their offerings as needed. Moreover, these applications are adept at creating predictive models for various outcomes, from forecasting future usage to anticipating potential mobile malware threats. In addition, leveraging predictive intelligence, smart apps deliver essential user insights to companies, enabling them to refine their marketing strategies. Through behavioral marketing, businesses can tailor their campaigns to individual users, thereby enhancing sales and boosting overall profit margins.

The future of customer interaction is set to be driven by Artificial intelligence (AI)-enhanced applications. As a result, market participants are concentrating on developing adaptable, omni-channel customer engagement platforms and AI-powered customer service representatives. For instance, in October 2023, Salesforce, Inc. acquired Airkit.ai, a developer of AI-powered customer service applications. Incorporating Airkit.ai into the Salesforce, Inc. would further enable service, sales, marketing, and commerce teams to rapidly advance into the future of customer engagement in the AI era.

Market Concentration & Characteristics

The intelligent apps industry is characterized by a high degree of innovation by advancements in technologies such as IoT, cloud computing, and Big Data. The ability to collect, store, and analyze big data is crucial for intelligent applications. This data analysis fuels their learning and improvement, making them more intelligent and responsive.

The intelligent apps industry is characterized by a high level of merger and acquisition (M&A) activities by the leading players. By acquiring smaller, innovative companies, larger firms can gain access to new technologies, talent pools, and customer bases, solidifying their position in the market. M&A allows companies to acquire teams with specialized skills in areas such as machine learning or natural language processing, accelerating their own AI development.

Intelligent apps rely heavily on user data. Therefore, data privacy regulations are a major concern. Regulations, such as the GDPR (General Data Protection Regulation) in Europe and CCPA (California Consumer Privacy Act) in the US, dictate how user data is collected, stored, and used. Companies developing intelligent applications need to ensure compliance with these regulations.

There is no direct substitute for the intelligent apps industry. Traditional apps with well-defined functionalities can handle basic tasks. Moreover, for tasks requiring human judgment or complex interactions, a human expert can be an alternative option.

End-user concentration is a significant factor in the intelligent apps industry. Social media platforms such as Facebook, Twitter, and YouTube leverage intelligent algorithms to personalize user fees and content recommendations, leading to high user concentration. Major e-commerce platforms such as, Amazon.com, Inc., and Alibaba Group Holding Limited use intelligent recommendation engines to personalize product suggestions, leading to a concentrated user base.

Type Insights

The consumer apps segment led the market in 2023, accounting for over 67% share of the global revenue. The uptake of consumer intelligent apps is driven by the offer of a more convenient, personalized, and interactive user experience that meets individual consumers' preferences. Intelligent features such as voice commands and text-to-speech can make apps more accessible for users with disabilities. These apps recommend content as per consumers' preference, keeping them engaged for longer periods.

The enterprise apps segment is predicted to foresee significant growth in the coming years. Enterprise intelligent applications are transforming businesses by automating tasks, optimizing processes, and generating valuable insights. These applications can analyze data to identify bottlenecks and inefficiencies in workflows, allowing businesses to streamline processes and boost overall productivity. By analyzing vast amounts of data, intelligent apps can provide data-driven insights that empower businesses to make better decisions in various areas such as, resource allocation, marketing strategies, and risk management.

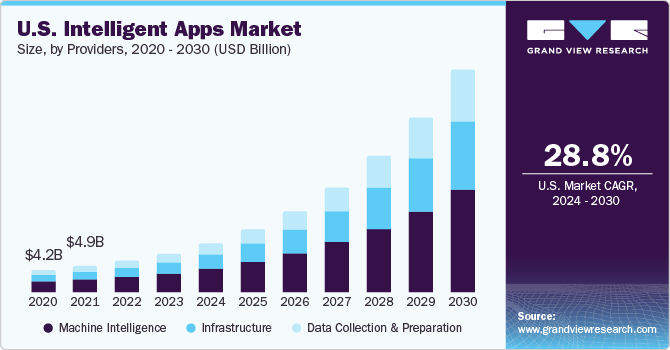

Providers Insights

The machine intelligence (MI) segment led the market in 2023. Machine learning, deep learning, and natural language processing are core AI techniques that enable machines to learn from data, recognize patterns, and make predictions. Advancements in these areas are crucial for developing more powerful and versatile MI applications. Moreover, the growing processing power of computers allows MI applications to handle complex tasks involving vast amounts of data. Cloud computing platforms further provide the necessary infrastructure for large-scale AI development and deployment.

The data collection & preparation segment is predicted to foresee significant growth in the coming years. Intelligent apps are data-driven. They require vast amounts of data to train machine learning models, personalize user experiences, and generate insights. The data collection & preparation segment provides the foundation for these applications to function effectively. The quality of data directly impacts the performance of intelligent applications. Inaccurate or incomplete data can lead to biased algorithms, unreliable insights, and poor user experience. This segment provides solutions for data cleansing, validation, and transformation to ensure high-quality data for intelligent applications.

Services Insights

The professional services segment led the market in 2023. Intelligent applications are incorporating advanced AI techniques and leveraging vast amounts of data. This complexity necessitates specialized expertise to design, develop, and integrate these applications effectively. Professional service providers offer experienced consultants and developers who understand the intricacies of AI, machine learning, and intelligent application development. They can guide organizations through the process and ensure a successful implementation.

The managed services segment is predicted to foresee significant growth in the coming years. Organizations are increasingly opting to outsource non-core functions such as IT infrastructure management. Managed services for intelligent applications allow them to focus their resources on core business activities and strategic innovation. By delegating the ongoing management of intelligent applications to MSPs, organizations can free up internal IT teams to focus on developing new applications, integrating with other technologies, and exploring emerging trends in the intelligent applications space.

Store Type Insights

The Google Play segment led the market in 2023. Google Play Store boasts a massive user base, having a significant portion of Android smartphone users globally. This large user base makes it a suitable platform for developers of intelligent applications, offering them access to a wide potential audience. Intelligent applications on Google Play benefit from seamless integration with the Android ecosystem. This includes features such as voice search integration with Google Assistant, push notifications, and in-app purchases, all of which can enhance the user experience.

The others segment is predicted to foresee significant growth in the coming years. The stores in others segment include Amazon Appstore, Samsung Galaxy Apps, and APKMirror among others. Amazon Appstore leverages its existing user base and shopping habits. They offer discounts or promotions on intelligent apps, especially those that complement Amazon services. These Appstore utilizes targeted recommendations based on user purchase history and browsing behavior, potentially leading to increased discoverability for relevant intelligent apps.

Deployment Insights

The on-premises segment held the largest revenue share in the market in 2023. Various end users, such as healthcare and finance dealing with sensitive data prioritize on-premises deployment for intelligent applications. This allows them to maintain greater control over data security and compliance with regulations such as HIPAA or GDPR. Moreover, cloud-based solutions raise concerns about data breaches, unauthorized access, and vendor lock-in. On-premises deployment offers a more secure environment for organizations handling sensitive information, thus driving the growth of the segment.

The cloud segment is predicted to foresee significant growth in the coming years. Cloud-based deployments offer scalability. Organizations can easily scale their computing resources up or down based on the needs of their intelligent applications. This eliminates the need for upfront investments in hardware infrastructure, leading to cost savings in the long run. Moreover, cloud providers offer pay-as-you-go pricing models, allowing organizations to only pay for the resources they use. This is particularly beneficial for organizations with fluctuating workloads or unpredictable resource requirements for intelligent applications.

Vertical Insights

The retail & e-commerce segment held the largest market revenue share in 2023. Intelligent applications use machine learning to analyze sales data, customer trends, and external factors to forecast demand for specific products. This allows retailers to optimize inventory levels, reduce stockouts and overstocking, and improve overall supply chain efficiency. Intelligent applications can automate repetitive tasks, such as order processing, fraud detection, and customer service interactions. This frees employees to focus on higher-value activities and improves overall operational efficiency.

The media & entertainment segment is predicted to foresee significant growth in the coming years. Intelligent applications are transforming content creation. AI-powered tools streamline scriptwriting, generate realistic special effects, and personalize content delivery based on audience demographics or viewing location. Intelligent applications leverage machine learning algorithms to personalize content recommendations for users based on their viewing history, preferences, and demographics. This enhances user engagement, increases content consumption, and keeps users engaged with the platform.

Regional Insights

North America intelligent apps market held the largest global market share of over 36.0% in 2023. North America boasts a well-developed technology infrastructure with high internet penetration, robust cloud computing services, and a skilled workforce comfortable with AI and machine learning technologies. This strong foundation makes it easier for businesses to adopt and integrate intelligent applications.

U.S. Intelligent Apps Market Trends

The intelligent apps market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030. The U.S. boasts a highly developed technology infrastructure with high internet penetration, robust cloud computing services, and a skilled workforce. It also has a more permissive approach to data collection and usage, facilitating the development and deployment of data-driven intelligent applications.

Canada intelligent apps market held a significant share in the North American region. Programs such as, Canadian Artificial Intelligence Strategy invest in research and development of AI technologies, fostering innovation in Canada. By leveraging its proximity to the U.S., government support, focus on specific industries, and strong educational system, end users across the country are adopting intelligent applications.

Europe Intelligent Apps Market Trends

The intelligent apps market in Europe is expected to witness significant growth over the forecast period. European companies are developing secure and privacy-preserving intelligent applications that comply with data regulations. This ensures responsible data practices and mitigates privacy concerns.

The UK intelligent apps market held a significant share in the European region. The UK government actively supports the intelligent apps sector through various programs, such as, the "AI Sector Deal" and the "Centre for AI and Data Science" invest in research and development, fostering a strong ecosystem for intelligent apps development. The UK government's "Open Data Initiative" promotes data sharing and accessibility. This fosters innovation in data-driven technologies such as intelligent applications.

The intelligent apps market in Germany is expected to grow at the fastest CAGR from 2024 to 2030. A cornerstone of Germany's economic strategy, Industry 4.0 emphasizes digital transformation in manufacturing. This creates a strong demand for intelligent applications that can automate processes, optimize production lines, and improve operational efficiency.

The France intelligent apps market is expected to grow at the fastest CAGR from 2024 to 2030 in the European region. The France government has placed increasing emphasis on digitalization across various sectors, with initiatives such as "France Numérique" promoting investments in digital infrastructure and technologies. This fosters the adoption of intelligent applications that drive efficiency and innovation.

Asia Pacific Intelligent Apps Market Trends

The Asia Pacific intelligent apps market is anticipated to register the fastest CAGR globally over the forecast period. Many APAC countries are experiencing rapid economic growth, leading to increased disposable income and rising demand for advanced technologies. This fuels the adoption of smartphones, a crucial platform for accessing and utilizing intelligent applications.

The intelligent apps market in Indiaheld a significant share in the Asia Pacific region. India boasts a significant youth population, many of whom are tech-savvy and early adopters of new technologies. This large user base creates a lucrative market for intelligent applications that cater to diverse needs and demographics.

The China intelligent apps market held a significant share in the Asia Pacific region. The Chinese government prioritizes AI development through initiatives such as the "Next Generation Artificial Intelligence Development Plan." This translates into significant funding for research and development, tax breaks for companies investing in AI, and the creation of AI research centers, fostering a robust ecosystem for intelligent application development.

The Japan intelligent apps market held a significant share in the Asia Pacific region. Japan is known for innovation in technology and robotics. This creates opportunities for the development and adoption of intelligent applications, particularly those that integrate with existing robotics infrastructure.

Middle East & Africa Intelligent Apps Market Trends

The intelligent apps market in the Middle East & Africa (MEA) region is anticipated to thrive over the forecast period. Smartphone adoption is rapidly increasing across the MEA region. This creates a larger user base for mobile-based intelligent applications. Expanding internet access through initiatives like fiber optic network deployments and affordable data plans further fuels the growth of intelligent applications.

Key Intelligent Apps Company Insights

Key intelligent apps companies include Advanced Micro Devices, Inc., Alibaba.com, and Amazon.com, Inc. These companies are active in the market and are focusing aggressively on expanding their customer base by gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development. For instance, in May 2024, Google LLC launched Performance Max, an AI-driven Search campaign tool aimed at enhancing conversion rates and return on investment across Google's platforms. Many retailers that advertise on Google have already adopted Performance Max. This tool employs generative AI technologies specifically designed for advertising purposes.

Key Intelligent Apps Companies:

The following are the leading companies in the intelligent apps market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services Inc

- Apple Inc

- Baidu Inc

- Google LLC

- International Business Machines Corporation

- Intel Corporation

- Oracle Corporation

- Salesforce.com, Inc

- SAP SE

- ServiceNow

Recent Developments

-

In May 2024, International Business Machines Corporation expanded collaboration with SAP SE, AI, to help clients improve business results using Generative AI. This partnership is set to boost clients' competitive edge and propel them into becoming next-gen enterprises with the help of generative AI. IBM Consulting and SAP are poised to fast-track transformations through RISE with SAP, aiding clients across various sectors in adopting next-generation AI business processes. Expanding collaboration with International Business Machines Corporation would enable more clients to fast-forward their cloud migration with RISE with SAP and unlock the transformative potential of generative AI for businesses in the cloud.

-

In March 2024, Oracle Corporation announced the incorporation of Generative AI functionalities into the Oracle Fusion Cloud Applications Suite, aiming to boost both customer and employee satisfaction, along with aiding in better decision-making by clients. These recent advancements in AI introduce generative AI features integrated within the current business processes spanning supply chain, finance, Human Resources, marketing, service, and sales. In addition, there is an enhancement of the Oracle Guided Journeys' extensibility framework, allowing customers and partners to add further generative AI features to meet their specific industry requirements and competitive demands.

-

In November 2023, Salesforce, Inc. expanded its partnership with Amazon Web Services to enable customers to develop reliable AI applications, provide intelligent, data-driven CRM experiences, and introduce Salesforce products to the AWS Marketplace. This partnership also facilitates the process for customers to handle their data efficiently and securely across both Salesforce and AWS and to incorporate generative AI technologies into their applications and workflows.

Intelligent Apps Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 34.76 billion

Revenue forecast in 2030

USD 172.21 billion

Growth rate

CAGR of 30.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, providers, services, store type, deployment mode, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Amazon Web Services Inc; Apple, Inc.; Baidu Inc; Google LLC; International Business Machines Corporation; Intel Corporation; Oracle Corporation; Salesforce.com, Inc; SAP SE; ServiceNow

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Intelligent Apps Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global intelligent apps market report based on type, providers, services, store type, deployment mode, vertical, and region:

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Consumer Apps

-

Enterprise Apps

-

-

Providers Outlook (Revenue, USD Billion, 2017 - 2030)

-

Infrastructure

-

Data Collection & Preparation

-

Machine Intelligence

-

-

Services Outlook (Revenue, USD Billion, 2017 - 2030)

-

Professional Services

-

Managed Services

-

Integration & Implementation

-

Training, Support & Maintenance

-

Consulting

-

-

-

Store Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Google Play

-

Apple App Store

-

Others

-

-

Deployment Mode Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cloud

-

On-premises

-

-

Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

BFSI

-

Telecom

-

Retail & E-Commerce

-

Healthcare & Life Sciences

-

Education

-

Media & Entertainment

-

Travel & Hospitality

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global intelligent apps market size was estimated at USD 27.03 billion in 2023 and is expected to reach USD 34.76 billion in 2024.

b. The global intelligent apps market is expected to grow at a compound annual growth rate of 30.6% from 2024 to 2030 to reach USD 172.21 billion by 2030.

b. North America dominated the market in 2023, accounting for over 36.0% of global revenue. It boasts a well-developed technology infrastructure with high internet penetration, robust cloud computing services, and a skilled workforce comfortable with AI and machine learning technologies.

b. Some key players operating in the intelligent apps market include Amazon Web Services Inc., Apple, Inc., Baidu Inc., Google LLC, International Business Machines Corporation, Intel Corporation, Oracle Corporation, Salesforce.com, Inc., SAP SE, and ServiceNow

b. Key factors driving the growth of the intelligent apps market include increasing consumer demand for personalized and contextual experiences, the growing adoption of smartphones, and the need for enhanced business mobility.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.