Intellectual Property Management Software Market Size, Share & Trends Analysis Report By Component (Service, Software), By Deployment, By Application, By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-550-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

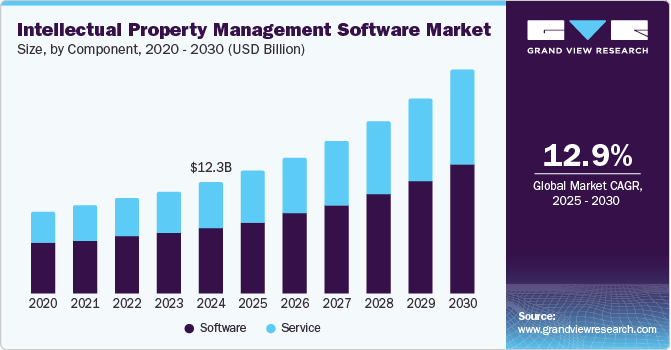

The global intellectual property management software market size was valued at USD 12.30 billion in 2024 and is projected to grow at a CAGR of 12.9% from 2025 to 2030. The increasing awareness and application of Intellectual Property (IP) rights among individual and commercial end-users are expected to drive the demand for intellectual property management software. Furthermore, the increasing demand for a well-documented and secure system to manage intellectual properties within an organization is also expected to contribute to market growth. Intellectual property is a lawful approach to protecting inventions and ideas by offering the owners exclusive rights and enabling them to reap commercial benefits from their work.

Moreover, the increasing global emphasis on innovation and business expansion into new markets drives demand for advanced IP management solutions. As organizations seek to safeguard their innovations while adhering to various legal frameworks, sophisticated software that provides features such as predictive analytics and automated document management becomes increasingly essential. Furthermore, integrating artificial intelligence and machine learning technologies into these software solutions enhances their capabilities, making them more appealing to enterprises focused on optimizing their IP portfolios.

In addition to technological advancements, the growing awareness of intellectual property rights among businesses and individuals is likely to contribute to market expansion. As more companies recognize the value of their intellectual assets, there is a heightened demand for comprehensive management solutions that facilitate effective tracking and enforcement of IP rights. These factors position the intellectual property management software industry for sustained growth in the coming years.

Component Insights

The software segment dominated the market with a share of 59.7% in 2024. The segment growth can be attributed to the increasing adoption of intellectual property management software in various industries, such as BFSI, IT and telecom, technology, automotive, healthcare, and jewelry. These sectors widely use the software to apply for and keep track of their intellectual property rights. This can be attributed to the increasing reliance on software solutions for managing complex IP portfolios efficiently. Businesses are adopting these tools to streamline their processes, enhance compliance, and reduce the risk of IP infringement. As organizations continue to recognize the importance of protecting their intellectual assets, the demand for robust software solutions is expected to maintain its upward trajectory.

The service segment is projected to grow at the fastest CAGR during the forecast period. IP services play a vital role in the deployment process of intellectual property management software. Vendors offering this software also provide services such as software upgrades, maintenance, and fixing bugs and errors in the software. They also provide training & consultation services to assist end-users in operating the software with ease. The growth is driven by the rising need for specialized services that accompany software solutions, such as consulting, training, and support. As companies navigate the complexities of intellectual property management, they are increasingly seeking expert guidance and tailored services to optimize their IP strategies. The combination of software and services is essential for businesses looking to maximize their investment in the intellectual property management software industry.

Deployment Insights

The cloud segment dominated the market with the largest revenue share in 2024. The segment growth can be attributed to the increasing adoption of cloud deployment services owing to factors such as on-demand availability of solutions and services and no setup cost. Furthermore, cloud services allow individuals and organizations to track applications conveniently by allowing them to carry out their tasks as per their convenience compared to on-premise, thus propelling the segment growth.

The on-premise segment is expected to grow at a significant CAGR over the forecast period, driven by organizations prioritizing data control and security. Many businesses prefer on-premise solutions, allowing for greater customization and compliance with internal policies. This deployment model is particularly appealing to industries with stringent regulatory requirements, where maintaining data within an organization’s infrastructure is crucial. As awareness of data privacy issues increases, the demand for on-premise intellectual property management software is anticipated to rise. This software is installed and operated from an organization’s internal infrastructure. Furthermore, individuals who file a patent can use the software on their PC to track and manage their applications. The on-premise deployment allows internal teams to fix bugs and detect errors in the systems.

Application Insights

The licensing segment dominated the market with the largest revenue share in 2024 due to the increasing complexity of licensing agreements and the need for effective management solutions. As businesses seek to monetize their intellectual property assets, they often engage in licensing arrangements that require meticulous tracking and compliance management. Licensing software enables organizations to streamline these processes, ensuring that all terms are adhered to while maximizing revenue opportunities. This trend is further supported by the globalization of markets, where companies leverage licensing to expand their reach and enter new territories efficiently.

The patent management segment is expected to grow at the fastest CAGR over the forecast period,driven by a surge in patent applications worldwide. As innovation accelerates across various industries, organizations are filing more patents to protect their inventions and maintain competitive advantages. According to the World Intellectual Property Organization (WIPO), in 2023, 3.55 million patent applications were filed globally, reflecting a 2.7% rise compared to the previous year. Patent management software provides essential tools for tracking applications, managing deadlines, and ensuring compliance with legal requirements, which are crucial as the number of patents continues to rise. This growth reflects a broader recognition of the importance of intellectual property in fostering innovation and driving economic growth, making it a key focus area within the intellectual property management software industry.

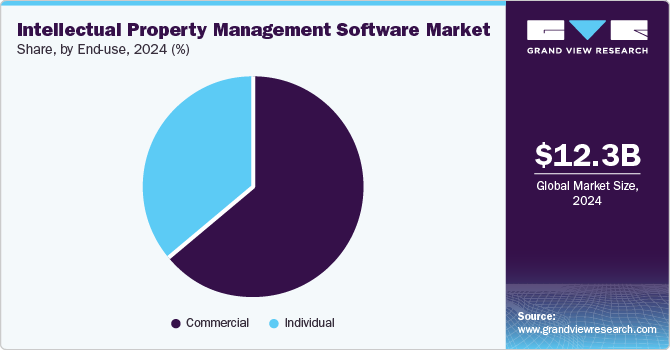

End-use Insights

The commercial segment dominated the market with the largest revenue share in 2024, reflecting its critical role in various industries, including technology, pharmaceuticals, and automotive. Companies in these sectors increasingly recognize the value of their intellectual assets and invest in software solutions to manage them effectively. The commercial segment benefits from robust investments in Research and Development (R&D), leading to more patents and trademarks requiring diligent management. As businesses strive for innovation and market differentiation, the demand for comprehensive IP management solutions remains strong.

The individual segment is expected to grow at the fastest CAGR over the forecast period as more inventors and entrepreneurs seek accessible tools for managing their IP rights. This growth is fueled by an increasing awareness of IP rights among individuals who recognize the need to protect their innovations. Intellectual property management software designed for individual streamlines processes such as patent filing and application tracking, facilitating easier navigation through the complexities of IP management. As educational initiatives around intellectual property continue to expand, more individuals are likely to engage with these tools, driving further growth in this intellectual property management software industry segment.

Regional Insights

The North American intellectual property management software market is experiencing significant growth, driven by a combination of factors that enhance its competitive landscape. Businesses and individuals are highly aware of intellectual property rights, creating an environment that encourages the adoption of IP management solutions in this region. In addition, numerous established companies, such as Anaqua, Clarivate, and Questel, contribute to the market's robustness by offering innovative software solutions tailored to various industries.

U.S. Intellectual Property Management Software Market Trends

The U.S. intellectual property management software market is thriving. The demand for intellectual property management software is increasing significantly due to the country's position in driving innovation. The United States Patent and Trademark Office (USPTO) has reported a steady increase in patent filings, reflecting the ongoing technological advancements across sectors such as biotechnology, pharmaceuticals, and information technology. According to USPTO, approximately 457,500 serialized patent applications were filed in fiscal year 2022, reflecting a 1.6% increase from the previous fiscal year, 2021. This surge in patent activity necessitates sophisticated management tools to track applications, ensure compliance, and protect intellectual property rights effectively.

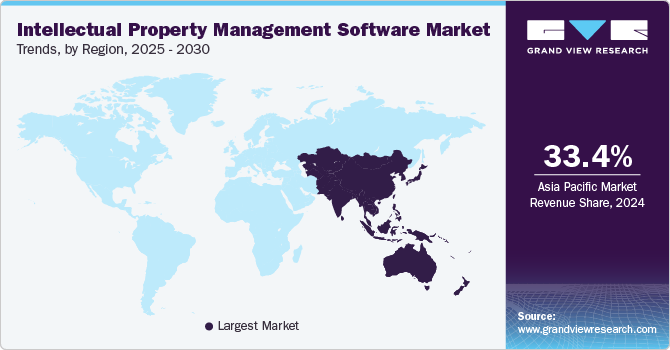

Asia Pacific Intellectual Property Management Software Market Trends

Asia Pacific intellectual property management software market dominated the global market with a revenue share of 33.4% in 2024. reflecting its critical role in the growth of IP management solutions. This dominance is driven by rapid technological advancements and an increasing volume of patent filings across various industries. Countries such as China, India and Japan are heavily investing in research and development, leading to a surge in innovations that require effective management of intellectual property rights. The growing awareness of the importance of IP protection among businesses and supportive government policies promoting innovation further fuels the demand for specialized software solutions.

China intellectual property management software market dominated the regional market in 2024. China’s rapid economic growth and its position as a global leader in technology and manufacturing have resulted in a significant increase in patent applications. Major companies such as Huawei and Alibaba are actively filing patents to protect their innovations, driving the demand for robust IP management solutions. Furthermore, the Chinese government has implemented various initiatives to enhance IP protection and encourage innovation, including streamlined patent application processes and increasing enforcement against infringement.

Latin America Intellectual Property Management Software Market Trends

Latin America intellectual property management software market is expected to grow at the fastest CAGR from 2025 to 2030. driven by a growing recognition of the importance of intellectual property rights among businesses and individuals in the region. As economies in Latin America continue to develop, there is an increasing emphasis on innovation and protecting intellectual assets. This shift is prompting companies to adopt advanced software solutions that facilitate the management of patents, trademarks, and copyrights.

Brazil intellectual property management software market dominated the regional market in 2024, reflecting the country's significant investments in technology and innovation. Brazil has seen a surge in patent filings driven by its vibrant technology and manufacturing sectors. Companies increasingly recognize the need for robust IP management solutions to navigate complex legal frameworks and effectively protect their innovations. Furthermore, Brazil's commitment to improving its IP laws and enforcement mechanisms has created a more favorable environment for businesses to invest in intellectual property management software.

Key Intellectual Property Management Software Company Insights

The intellectual property management software market includes several companies offering diverse IP asset management solutions. Questel provides a comprehensive suite of tools for patent lifecycle management, while Anaqua Inc. focuses on integrating IP management with innovation strategies. Thales emphasizes security in its IP management solutions, catering to industries with stringent data protection needs. Clarivate offers analytics-driven tools that help organizations gain insights into their IP portfolios, enabling informed decision-making. Together, these companies play a vital role in shaping the market landscape.

-

PatSnap is a provider of innovation intelligence and R&D analytics that helps organizations navigate the complexities of intellectual property management. The company offers a comprehensive platform that aggregates and analyzes data from patents, scientific literature, and market reports, enabling clients to make informed decisions about their innovation strategies.

-

Anaqua Inc. specializes in integrated solutions for managing intellectual property and innovation. Its platform combines various aspects of IP management, including patent prosecution, trademark management, and licensing, allowing organizations to effectively align their intellectual assets with business objectives.

Key Intellectual Property Management Software Companies:

The following are the leading companies in the intellectual property management software market. These companies collectively hold the largest market share and dictate industry trends.

- Anaqua Inc.

- Questel

- Thales

- Clarivate

- Innovation Asset Group Inc.

- Dennemeyer & Associates S.A.

- LexisNexis

- PatSeer Technologies Pvt. Ltd

- Patsnap

- Cardinal Intellectual Property, Inc.

Recent Development

-

In September 2024, Questel announced a strategic partnership with the SaaS platform Patently. This partnership integrates Questel's meticulously curated Standard Essential Patent (SEP) data into Patently's database. This collaboration aims to enhance the delivery of high-quality patent information and services to a broader audience of IP professionals.

-

In June 2024, Clarivate launched the IP Collaboration Hub at the Clarivate Ignite conference. This new solution integrates with Clarivate's IP Management Systems (IPMS) to create a centralized platform for collaboration with local agents globally. The IP Collaboration Hub streamlines the prosecution process and IP filing by providing a portal for users to exchange information, thereby reducing reliance on email and minimizing associated risks.

-

In December 2022, Questel acquired Equinox, an Intellectual Property Management System(IPMS) provider. This acquisition added a dedicated solution for law firm clients in Questel’s portfolio, strengthening its well-established IPMS business.

-

In March 2022, Questel acquired Markify, one of the leading trademark-watching and search service providers. This acquisition gave Questel access to one of the largest trademark databases of Markify, enabling Questel to offer global end-to-end Intellectual Property services.

Intellectual Property Management Software Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 13.52 billion |

|

Revenue forecast in 2030 |

USD 24.82 billion |

|

Growth rate |

CAGR of 12.9% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, application, end-use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, UAE, Saudi Arabia, South Africa |

|

Key companies profiled |

Anaqua Inc.; Questel; Thales; Clarivate; Innovation Asset Group Inc.; Dennemeyer & Associates S.A.; LexisNexis; PatSeer Technologies Pvt. Ltd; Patsnap ; Cardinal Intellectual Property, Inc.. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Intellectual Property Management Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global intellectual property management software market report based on component, deployment, application, end-use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Service

-

Software

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Premise

-

Cloud

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Patent Management

-

Trade Management

-

Licensing

-

Buses and Coaches

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Individual

-

Commercial

-

BFSI

-

IT & Telecom

-

Automotive

-

Technology

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."