Integration Platform As A Service Market Size, Share & Trends Analysis Report By Service, By Deployment (Public Cloud, Private Cloud, Hybrid Cloud), By Enterprise Size, By End-use By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-605-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

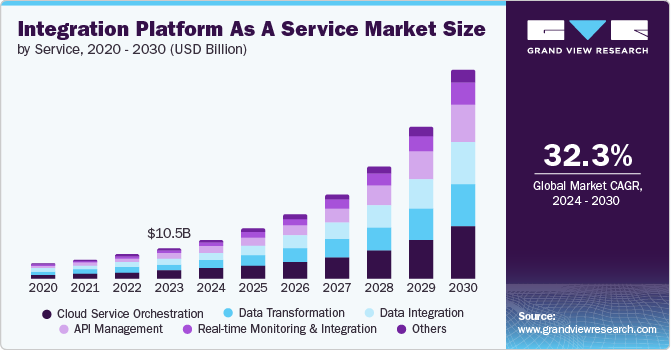

The global integration platform as a service market size was valued at USD 10.46 billion in 2023 and is projected to grow at a CAGR of 32.3% from 2024 to 2030. Integration Platform as a Service (iPaaS) is a comprehensive platform designed to streamline the management of integrations and data flows between various cloud and on-premises applications. iPaaS facilitates the entire lifecycle of APIs, automates business processes, and orchestrates workflows across multiple applications through a centralized integration platform.

IPaaS enables modern enterprises to seamlessly connect and utilize data in real-time across multi-cloud and hybrid environments by providing a single source of reliable data. However, the increasing complexity of IT ecosystems and the widespread use of diverse applications, both on-premises and in the cloud, have created a critical need for seamless connectivity. Integration Platform as a Service (iPaaS) can address this need by simplifying integration processes, enabling businesses to connect different systems and applications easily. This improves operational efficiency and speeds up the time-to-market for new projects.

Automation has become a key factor driving the adoption of iPaaS, transforming how businesses approach digital transformation efforts. As organizations strive to streamline processes and minimize manual tasks, iPaaS provides a robust automation framework. The global trend towards hybrid and multi-cloud environments has further fueled the adoption of iPaaS. Companies leverage various cloud services to enhance performance, reduce costs, and increase scalability. For instance, Microsoft built a cloud-based iPaaS solution that boosts the data transaction throughput and integration ability to improve their premises integration platform's capabilities, performance, and resilience. Moreover, iPaaS offers low-code/no-code technology, allowing both technical and non-technical users to create and manage integrations. This saves time, boosts productivity, and promotes collaboration across teams.

Service Insights

The cloud service orchestration segment held the largest market revenue share of 26.8% in 2023. As companies scale their operations, they require more agile and scalable solutions to manage complex integrations across diverse applications and data sources. Cloud service orchestration provides the flexibility to automate workflows, optimize resource utilization, and ensure consistency in data handling across the hybrid IT landscape. Moreover, the growing complexity of IT environments and the need for real-time data processing and analytics drive the demand for efficient orchestration tools that can streamline operations and enhance overall business agility.

Application Programming Interfaces (API) Management has poised to grow with lucrative CAGR of 34.3% in projected years. APIs are crucial connectors that enable seamless communication and integration between various applications, systems, and services. As businesses increasingly adopt cloud-based solutions and diverse software environments, efficient API management becomes crucial. Organizations seek to streamline their operations by securely exposing, managing, and monetizing APIs, enhancing agility and scalability while maintaining robust security measures. Additionally, the proliferation of microservices architecture further drives the demand for API management within iPaaS, as it facilitates modular development and accelerates time-to-market for new applications and services.

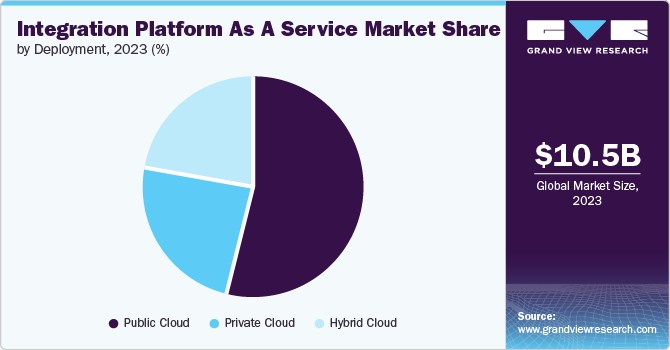

Deployment Insights

The public cloud segment held the largest market share in 2023. Public cloud offerings provide scalability and flexibility, allowing businesses to easily scale their integration needs according to demand without heavy upfront investments in infrastructure. This scalability is crucial in today's dynamic business environment. Public cloud platforms offer a wide array of integration tools and services, often including pre-built connectors and APIs that facilitate rapid integration across various applications and systems. This reduces time-to-market for new integrations and enhances operational efficiency. The cost-effectiveness of public cloud solutions appeals to businesses looking to optimize IT spending by paying only for the resources they use.

Hybrid cloud segment is poised to grow at the fastest CAGR over the forecast period. The demand for the hybrid cloud segment in the integration platform as a service (iPaaS) market is anticipated to rise primarily due to its ability to offer greater flexibility and scalability to businesses. Hybrid cloud environments allow companies to integrate and manage data and applications across both on-premises infrastructure and public or private cloud platforms. This flexibility is crucial for enterprises looking to optimize their IT infrastructure while maintaining control over sensitive data and applications that require on-premises hosting.

Enterprise Size Insights

Large enterprises segment held the largest market share in 2023. Large enterprises typically have complex IT environments with diverse applications, systems, and data sources across various departments and locations. iPaaS solutions offer these enterprises a centralized platform to seamlessly integrate and manage their disparate systems, improving operational efficiency and data visibility. Scalability is essential for large enterprises as they often experience rapid growth or need to accommodate fluctuating demand. iPaaS provides scalability by allowing enterprises to easily scale up or down their integration capabilities based on business needs without significant upfront investments in infrastructure.

SMEs segment is expected to witness grow at fastest CAGR over the forecast period. The highly competitive market environment has driven small and medium-sized enterprises (SMEs) to invest in iPaaS solutions to reach their target audience effectively. By incorporating cloud storage, SMEs can expect an increase in revenue, achieve their desired goals, and enhance overall business efficiency. SMEs often need help managing capital, hiring skilled employees, and ensuring scalability. To address these issues, SMEs opt for a pay-as-you-go model to effectively manage IT expenses, enhance business performance, make informed decisions, and streamline the integration process at a lower cost.

End-use Insights

BFSI dominated the market in 2023. The BFSI industry operates in a highly regulated environment with many data privacy and security standards. iPaaS solutions offer robust integration capabilities that help streamline operations across various systems and applications while ensuring compliance with stringent regulations. With increasing competition, BFSI firms seek to optimize costs and improve agility. iPaaS solutions provide scalable and cost-effective integration solutions that reduce time-to-market for new products and services, which is crucial in staying competitive in the dynamic financial services landscape.

The retail segment is projected to grow with the fastest CAGR over the forecast period. Retailers increasingly adopt digital transformation strategies to enhance operational efficiencies and improve customer experiences. iPaaS solutions are crucial in integrating disparate systems and applications within retail operations, including e-commerce platforms, inventory management systems, CRM software, and more. This integration helps streamline workflows, facilitate real-time data exchange, and improve decision-making processes. The shift towards omnichannel retailing requires seamless connectivity between online and offline channels, which iPaaS platforms can efficiently manage.

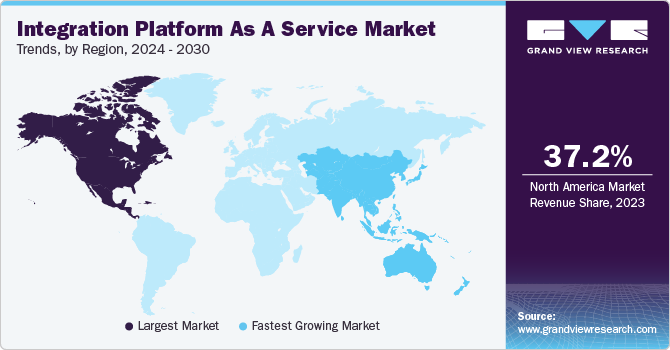

Regional Insights

The North America region dominated the integration platform as a service market with a revenue share of 37.2% in 2023. North American enterprises increasingly adopt cloud-based solutions to streamline operations and enhance scalability. iPaaS offers a centralized platform that facilitates seamless integration of diverse applications and data sources across cloud and on-premises environments. This is crucial in a market characterized by rapid digital transformation. Moreover, the region's robust regulatory environment and stringent data protection laws necessitate secure and compliant data integration solutions, further driving the adoption of iPaaS. Additionally, North American businesses focus on improving agility and time-to-market, leveraging iPaaS to integrate new technologies and applications quickly without extensive development cycles.

U. S. Integration Platform As A Service Market Trends

The U. S. held the largest regional market share of 73.3% in 2023. Businesses across various sectors are increasingly adopting cloud-based solutions to streamline operations and enhance agility. iPaaS offers a centralized platform that facilitates seamless integration of disparate applications and data sources, crucial for businesses aiming to achieve digital transformation goals. The rise of hybrid IT environments, where organizations use both on-premises and cloud-based systems, necessitates the robust integration capabilities that iPaaS provides.

Europe Integration Platform As A Service Market Trends

Europe market is experiencing a prominent growth in this industry. European enterprises increasingly prioritize digital transformation initiatives to enhance operational efficiency and customer engagement. iPaaS solutions offer streamlined integration capabilities across diverse applications and data sources, which is crucial for businesses aiming to modernize their IT infrastructures without extensive redevelopment costs. Stringent data protection regulations such as GDPR necessitate robust and compliant data integration solutions, driving the adoption of iPaaS platforms with built-in security and compliance features. The proliferation of cloud computing across Europe has spurred demand for iPaaS, as organizations seek scalable and agile integration solutions to seamlessly connect on-premises systems with cloud-based applications.

UK market is witnessing a significant growth. Businesses across various sectors, including finance, retail, and healthcare, increasingly adopt cloud-based solutions to streamline operations and improve efficiency. iPaaS provides a centralized platform that facilitates the integration of diverse applications and data sources, which is crucial in the UK's complex regulatory environment. The shift towards digital transformation initiatives has fueled the need for seamless connectivity between on-premises systems and cloud-based applications, enabling companies to enhance customer experiences and operational agility. Moreover, the scalability and cost-effectiveness of iPaaS solutions benefit organizations looking to modernize their IT infrastructure without significant upfront investments.

Germany market is witnessed as lucrative in this industry. The rise of digital transformation initiatives in manufacturing, automotive, and financial services is driving the need for iPaaS solutions that integrate legacy systems with newer technologies like IoT and AI. This integration enables real-time data sharing and analytics, facilitating better decision-making and customer service capabilities. Stringent data protection regulations in Germany, such as GDPR, require robust data management and security measures, which iPaaS platforms can provide through built-in compliance features.

Asia Pacific Integration Platform As A Service Market Trends

Asia Pacific market is expected to experience the fastest CAGR over the forecast period. Asia-Pacific countries are experiencing rapid digital transformation across various retail, manufacturing, healthcare, and finance sectors. These industries increasingly adopt cloud-based solutions to streamline operations, improve efficiency, and enhance customer experiences. Secondly, there is a rising trend towards hybrid IT environments, where businesses integrate on-premises systems with cloud applications to leverage both benefits. Lastly, the proliferation of mobile devices and internet connectivity across Asia-Pacific has fueled the demand for iPaaS solutions to support seamless integration across multiple platforms and devices, enabling real-time data access and analytics.

China market is witnessing a prominent growth. China digital transformation has resulted in a surge in the use of cloud services, highlighting the importance of iPaaS for smooth data integration. The growing industrial and manufacturing sectors depend on effective data workflows, creating a need for iPaaS solutions. In addition, the expanding Small and Medium-sized Enterprises (SMEs) sector in China views iPaaS as a versatile and scalable choice for optimizing workflows and linking applications. Moreover, China's digital innovation environment, combined with the adoption of cloud technology, establishes iPaaS as a crucial element of contemporary business infrastructure.

India's digital transformation drive across sectors such as banking, e-commerce, healthcare, and government services has propelled the need for seamless integration of diverse applications, data sources, and systems. This integration enhances operational efficiency, customer experience, and overall business agility. The rise of cloud adoption among Indian enterprises drives the need for iPaaS solutions that securely connect cloud-based and on-premises applications. This shift is driven by cost-effectiveness, scalability, and the flexibility of iPaaS platforms in managing hybrid IT environments.

Key Integration Platform As A Service Company Insights

Some of the key companies in the integration platform as a service market include Informatica Inc.; Boomi; SAP; Oracle; Salesforce, Inc.; Workato; SnapLogic Inc.; Software AG; IBM; Jitterbit in the market are focusing on development & to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives.

-

Informatica iPaaS delivers a productive data management environment powered by CLAIRE, an AI engine, their platform enables organizations to achieve end-to-end automation by efficiently managing vast amounts of data and events in real-time. This empowers businesses to create process automation workflows and integration patterns effortlessly.

-

Boomi offers an Integration Platform as a Service (iPaaS) that facilitates the seamless connection of applications and data sources. This platform is designed for low-code development, providing essential features such as API, lifecycle management, and event-driven architecture for cloud integration

Key Integration Platform As A Service Companies:

The following are the leading companies in the integration platform as a service market. These companies collectively hold the largest market share and dictate industry trends.

- Informatica Inc.

- Boomi

- SAP

- Oracle

- Salesforce, Inc.

- Workato

- SnapLogic Inc.

- Software AG

- IBM

- Jitterbit

Recent Developments

-

In May 2024, Boomi announced the acquisition of federated API management business from APIIDA AG. This acquisition aims to introduce the federates API management capabilities of APIIDA to the Boomi enterprise platform. Which will increase the scalability and security of the Boomi platform.

-

In June 2024, IBM announced the acquisition of StreamSets and webMethods, enhancing its automation, data integration, and AI capabilities. This acquisition strengthens IBM's portfolio by integrating StreamSets' data integration technology and webMethods' integration capabilities.

Integration Platform As A Service Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 13.29 billion |

|

Revenue forecast in 2030 |

USD 71.35 billion |

|

Growth Rate |

CAGR of 32.3% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Service, deployment, enterprise size, end-use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Japan, China, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE |

|

Key companies profiled |

Informatica Inc.; Boomi; SAP; Oracle; Salesforce, Inc.; Workato; SnapLogic Inc.; Software AG; IBM; Jitterbit |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Integration Platform As A Service Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global integration platform as a service market report based on service, deployment, enterprise size, end-use, and region.

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud Service Orchestration

-

Data Transformation

-

API Management

-

Data Integration

-

Real-time Monitoring and Integration

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Public Cloud

-

Private Cloud

-

Hybrid Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small & Medium Enterprises

-

Large Enterprises

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Energy and Utilities

-

IT and Telecom

-

Government and Public Sector

-

Healthcare

-

Manufacturing

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U. S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."