Integrated Passive Devices Market Size, Share & Trends Analysis Report By Application (EMS & EMI Protection, RF, LED Lighting, Digital & Mixed Signal), By End-use (Automotive), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-459-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Integrated Passive Devices Market Trends

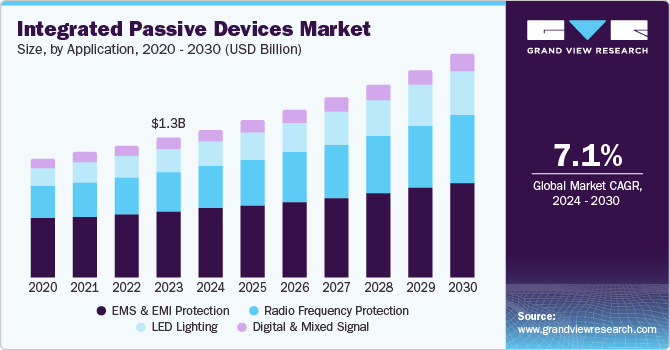

The global integrated passive devices market size was valued at USD 1.26 billion in 2023 and is projected to grow at a CAGR of 7.1% from 2024 to 2030. This market growth is driven by the rising adoption of filters and diplexers in wireless system applications. IoT (Internet of Things) applications of passive electronic components such as capacitors, resistors, and inductors are generating favorable opportunities for manufacturers, driving market growth. An upsurge in incorporating infotainment and navigation features, such as global positioning systems (GPS), in automobiles further boosts the demand for IPD devices.

The market is expanding with substantial opportunities led by rising development in integrated passive devices in wearable & hearable devices. Furthermore, they are also being utilized in manufacturing electronic durables such as set-top boxes, drones, wireless speakers, routers, and gaming systems. The need for high-speed mobile communication is rising significantly, and thus, the application of 5G networks is creating wider opportunities for prominent players in the integrated devices market. As a result of the integration of IPDs, which provide both performance and energy efficacy, the use of IPDs in numerous sectors such as IoT, healthcare, and LED (Light Emitting Diode) products has significantly improved the sales of integrated devices due to their low energy consumption.

Furthermore, advancements in IPDs made with thin glass films are becoming more popular than those made with silicon via (TSV) substrate due to their superior high resistivity, thermal steadiness, low dielectric loss, and adjustable coefficient of thermal expansion. Consequently, the integrated passive devices market is projected to grow due to the progress in IPDs utilizing Through-Glass-Via (TGV) substrate.

Application Insights

The EMS (Electro Magnetic Susceptibility) and EMI (Electro Magnetic Interference) segments dominated the market and accounted for a share of 47.0% in 2023 attributed to the integration of passive components in mobile devices. The offerings in EMS and EMI protection categories help reduce signal loss and improve signal strength, providing a tremendous growth opportunity for the market.

The LED lighting segment is expected to grow at a CAGR of 9.7% over the forecast years owing to the increasing importance of Silicon-based IPDs within the LED lighting industry due to their superior heat dissipation, which leads to decreased power usage and extended durability. In addition, the growing need for industrial production, the escalating requirement for storage facilities, and the expanding availability of office spaces are key drivers behind the increasing demand for the LED lighting segment.

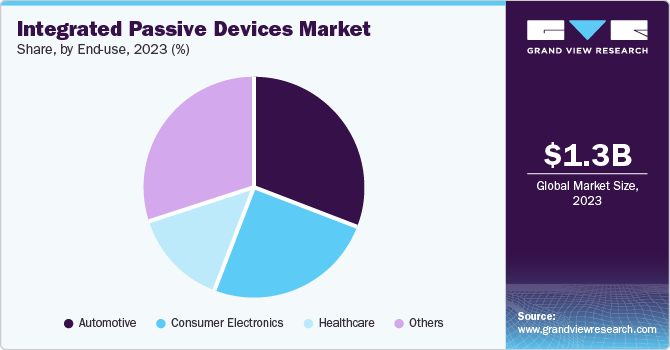

End-use Insights

The automotive segment dominated the market and accounted for a revenue share of 31.0% in 2023 pertaining to the widespread use of integrated passive devices in car electronics for wireless communication. IPDs, such as radar, lidar, and camera modules, are crucial components in ADAS applications, which need compressed and consistent passive devices. Furthermore, the growing popularity of electric vehicles (EVs) is contributing to the growth of the automotive segment, as IPDs are used in various EV components, such as battery management systems and power converters.

The consumer electronics segment is expected to grow at a CAGR of 8.7% over the forecast period. The growing market for integrated passive devices can be attributed to the rising adoption of smartphones and other IoT devices. In addition, the integrated passive devices market share is greatly influenced by the consumer electronics sector, as IPDs are widely used in smartphones and other smart devices to provide functions such as antenna tuning and filtering.

Regional Insights

The North America integrated passive devices market accounted for 29.0% of the market in 2023. This growth is attributed to the increasing utilization of IPDs in 5G technology. In addition, the expanding presence of IoT-based devices and the thriving consumer electronic industry offer favorable prospects for the market's expansion. Furthermore, North America is home to a thriving semiconductor industry, characterized by significant production facilities and a well-established manufacturing infrastructure. The continuous advancement of semiconductor technologies has led to the wider adoption of IPDs, resulting in a substantial boost to market growth.

U.S. Integrated Passive Devices Market Trends

The integrated passive devices market in the U.S. held a significant market share in 2023. This growth is attributed to emerging technologies, the widespread use of artificial intelligence, and 5G technology worldwide. In addition, the rapid expansion of the consumer electronics and automotive industries in the U.S. is driving the demand for miniaturized, high-performance IPDs. Furthermore, the country's strong R&D capabilities and the presence of major IPD manufacturers are propelling the market forward.

Europe Integrated Passive Devices Market Trends

The Europe integrated passive devices market dominated the global market and accounted for the largest revenue share of 39.5% in 2023 driven by the rise in the adoption of in-vehicle infotainment systems in the automotive sector in this region. In addition, the region's stringent regulatory standards and high investments in research and development by key players are propelling the market growth. Furthermore, the rising adoption of 5G technology and the increasing demand for miniaturized, high-performance electronic devices in consumer electronics and automotive sectors are further contributing to the growth of the IPD market in Europe.

The integrated passive devices market in Germany witnessed significant growth over the forecast years owing to the rising adoption of 5G technology and the increasing demand for miniaturized, high-performance electronic devices in the consumer electronics and automotive sectors. In addition, the market is influenced by increasing demand for glass-based IPDs, which are attributed to their superior resistivity, exceptional thermal stability, minimal dielectric loss, and cost-efficient characteristics.

Asia Pacific Integrated Passive Devices Market Trends

Asia Pacific integrated passive devices market is expected to grow at a CAGR of 9.3% over the forecast years. This growth is attributed to the increasing utilization of IPDs in portable medical devices, owing to their compact size and exceptional performance capabilities. In addition, the region's large manufacturing base and lower production costs are attracting major IPD manufacturers to establish facilities in the Asia Pacific.

The integrated passive devices market in China experienced substantial growth owing to the rapid expansion of the consumer electronics and automotive industries. This is driving the demand for miniaturized, high-performance IPDs. Furthermore, the country's large manufacturing base and lower production costs are attracting major IPD manufacturers to establish facilities in China.

Key Integrated Passive Devices Company Insights

The key players in the industry are focused on developing advanced and innovative products and are making substantial investments in research and development activities. The company's products include extremely consistent discrete components that improve operational efficiency and reduce energy losses. Some of the key companies in the integrated passive devices market include Broadcom, CTS Corporation; Global Communication Semiconductors, LLC.; Infineon Technologies AG; Johanson Technology, Inc.; MACOM; Murata Manufacturing Co., Ltd.; in the market is focusing on the development of treatments for integrated passive devices to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives.

-

MACOM is a semiconductor business that specializes in designing and manufacturing high-performance products for the industrial, data center sectors, telecommunications, and defense sectors. The company's varied product portfolio incorporates a range of technologies, including RF, microwave, analog, mixed-signal, and optical semiconductors.

-

CTS Corporation is an international provider of electronic components and sensors. The company operates in two business segments: Electronics Manufacturing Services and Components and Sensors. CTS designs, manufactures, assembles, and sells these products worldwide.

Key Integrated Passive Devices Companies:

The following are the leading companies in the integrated passive devices market. These companies collectively hold the largest market share and dictate industry trends.

- Broadcom

- CTS Corporation

- Global Communication Semiconductors, LLC.

- Infineon Technologies AG

- Johanson Technology, Inc.

- MACOM

- Murata Manufacturing Co., Ltd.

- NXP Semiconductors

- ON Semiconductors

- Qorvo, Inc.

- STMicroelectronics

- Texas Instruments Incorporated

Recent Developments

-

In June 2024, Johanson Technology unveiled a new 900MHz directional RF SMD coupler, designated as P/N 0898CP14C0035001T, designed for a variety of wireless applications. This compact coupler operates within the 865-928 MHz frequency range, making it well-suited for use in IoT, cellular, LoRa systems, and ISM. The small EIA 0603 form factor of the device and RoHS compliance enable seamless integration onto printed circuit boards.

-

In February 2023, STMicroelectronics launched nine RF-integrated passive devices (RF IPDs) that include antenna balun, harmonic-filter, and impedance-matching circuitry enhanced for STM32WL wireless microcontrollers (MCUs).

Integrated Passive Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.34 billion |

|

Revenue forecast in 2030 |

USD 2.03 billion |

|

Growth Rate |

CAGR of 7.1% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; ; France; Japan; China; India; Australia; South Korea; Brazil; ; South Africa; Saudi Arabia; UAE |

|

Key companies profiled |

Broadcom; CTS Corporation; Global Communication Semiconductors, LLC.; Infineon Technologies AG; Johanson Technology, Inc.; MACOM; Murata Manufacturing Co., Ltd.; NXP Semiconductors; ON Semiconductors; Qorvo, Inc.; STMicroelectronics; Texas Instruments Incorporated |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Integrated Passive Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global integrated passive devices market report based on application, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

EMS and EMI Protection

-

Radio Frequency Protection

-

LED Lighting

-

Digital and Mixed Signal

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Consumer Electronics

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."