- Home

- »

- Automotive & Transportation

- »

-

Integrated Marine Automation System Market Report, 2030GVR Report cover

![Integrated Marine Automation System Market Size, Share & Trends Report]()

Integrated Marine Automation System Market (2024 - 2030) Size, Share & Trends Analysis Report By Offering (Hardware, Software), By Solution, By End Use (Commercial, Defense), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-381-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

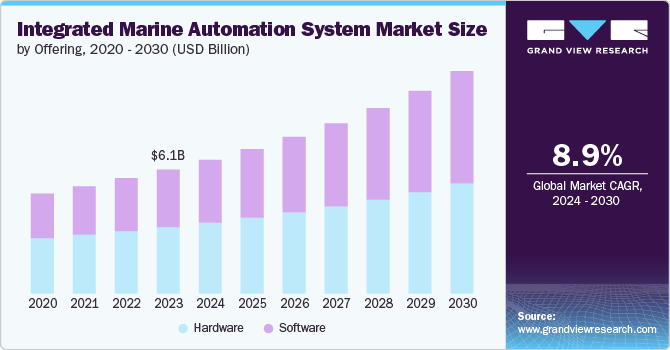

The global integrated marine automation system market size was estimated at USD 6.06 billion in 2023 and is expected to grow at a CAGR of 8.9% from 2024 to 2030. The maritime industry is experiencing a significant shift towards increased efficiency, safety, and environmental sustainability. At the forefront of this transformation lies integrated marine automation systems (IMAS). These complex networks act as the brain of a modern ship, integrating control and monitoring of all critical onboard functionalities.

An IMAS can be visualized as a central hub that gathers real-time data from various sensors located throughout the vessel. These sensors track engine performance, navigation systems, cargo conditions, and even environmental factors. The data is then processed by a central processing unit (CPU), which makes decisions based on pre-programmed algorithms. It then transmits instructions to control systems throughout the ship. Crews interact with the system through a user-friendly interface, allowing them to monitor performance, receive alerts, and intervene when needed.

Several key factors fuel the growth of IMAS. The global expansion of trade demands larger and more efficient vessels, and IMAS plays a crucial role in optimizing operations and fuel consumption. In addition, the need for enhanced situational awareness at sea necessitates real-time data and comprehensive system monitoring, which IMAS provides. Furthermore, the growing pressure to reduce emissions and improve fuel efficiency aligns perfectly with the capabilities of IMAS. Advancements in software and automation are making these systems ever more sophisticated and user-friendly.

However, implementing IMAS has its challenges. The initial investment and ongoing maintenance costs for these complex systems can be high. In addition, the increased reliance on digital technology introduces new vulnerabilities to cyberattacks. Robust security measures are essential to protect critical shipboard functions. The most significant challenge lies in the need for a skilled workforce. Operating and maintaining IMAS requires specialized technical knowledge, and training programs are crucial for successful adoption.

IMAS aligns perfectly with the industry's commitment to environmental sustainability. These systems facilitate data-driven decision-making, leading to improved fuel efficiency, optimized route planning, and reduced operating costs. Furthermore, IMAS contributes to a safer operational environment and environmental sustainability by providing automatic monitoring, reducing human error, and optimizing fuel consumption for reduced emissions. Looking ahead, IMAS serves as the foundation for integrating autonomous functionalities, paving the way for a more efficient and sustainable maritime landscape.

Offering Insights

The hardware segment dominated the market in 2023 and accounted for a more than 54% share of global revenue. This segment encompasses various physical components like sensors, data acquisition systems, CPUs, and network infrastructure. The dominance of hardware stems from the initial investment required to set up the core functionalities of an IMAS. As new vessels are built and existing ones are upgraded, the demand for hardware remains high.

The solution segment is projected to expand at a faster CAGR during the forecast period 2024 to 2030. This segment includes central processing algorithms, Human-Machine Interface (HMI) software, and additional specialized software for navigation, cargo management, and safety systems. The growth of this segment is driven by the increasing sophistication of IMAS features and the rising adoption of data-driven decision-making in ship operations.

Solution Insights

The vessel management segment dominated the market in 2023. It encompasses all functionalities related to managing the ship's overall operations, including navigation, propulsion, cargo handling, and communication. Vessel management solutions are crucial for ensuring safe and efficient voyages. In addition, this segment is poised for significant growth due to the integration of advanced features like route optimization and predictive maintenance.

The power management segment is projected to witness significant growth from 2024 to 2030. These solutions focus on optimizing fuel consumption and efficiently distributing power throughout the vessel. The growing need for operational cost reduction and compliance with stricter environmental regulations fuels this growth. As the focus on sustainability intensifies, power management solutions are expected to play an even more prominent role in IMAS.

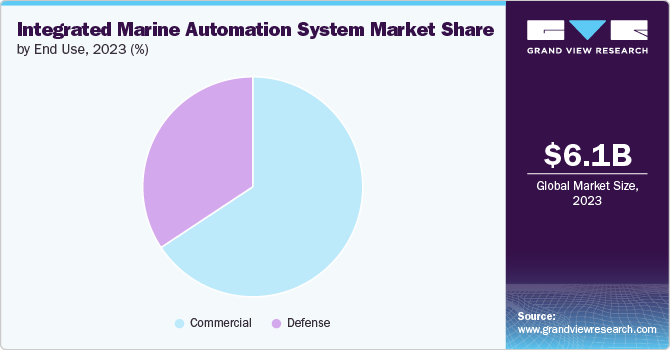

End Use Insights

The commercial segment dominated the market in 2023. The commercial shipping segment dominates the IMAS market due to the sheer volume of commercial vessels operating globally. The constant pressure to optimize costs and improve efficiency in commercial shipping drives the demand for IMAS solutions.

The defense segment is projected to grow at a faster CAGR during the forecast period 2024 to 2030. This is driven by the increasing complexity of naval vessels and the need for advanced automation capabilities. Additionally, growing defense budgets and the integration of new technologies like autonomous systems are further fueling the growth of IMAS in the defense sector.

Regional Insights

The integrated marine automation system market in North America is expected to witness steady growth from 2024 to 2030. A large commercial shipping fleet combined with growing defense budgets and investments in technological advancements contribute to this growth. However, the presence of established shipyards in Asia Pacific can pose some competitive challenges for North American manufacturers.

U.S. Integrated Marine Automation System Market Trends

The integrated marine automation system market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030. The U.S. IMAS market exhibits significant growth due to a large and diverse commercial shipping fleet. In addition, the U.S. Navy's focus on advanced technologies and autonomous capabilities creates robust demand for next-generation IMAS solutions.

Europe Integrated Marine Automation System Market Trends

The integrated marine automation system market in Europe is expected to grow at a significant CAGR from 2024 to 2030. The European region boasts a well-established maritime industry and significant growth potential in the IMAS market. Strict environmental regulations and a focus on fuel efficiency necessitate the adoption of advanced automation solutions. In addition, several leading IMAS manufacturers are headquartered in Europe, further contributing to the regional growth.

The integrated marine automation system market in France is expected to grow at a significant CAGR from 2024 to 2030. France, a major European maritime player, demonstrates significant growth in the IMAS market. Government investments in modernizing the French navy and a focus on advanced automation capabilities for both commercial and defense vessels drive this growth.

Asia Pacific Integrated Marine Automation System Market Trends

The Asia Pacific region dominated the integrated marine automation system market in 2023 and accounted for a 40.4% share of the global revenue. This is primarily driven by the booming shipbuilding industry in countries such as China, South Korea, and India. In addition, growing economies and increasing trade volumes necessitate efficient and well-equipped vessels, further propelling the IMAS market. Government initiatives focused on modernization and technological advancements in these countries also play a significant role in the region's dominance.

The integrated marine automation system market in Japan is expected to grow at a significant CAGR from 2024 to 2030. Japan holds a significant position in the IMAS market due to its long-standing maritime heritage and strong focus on technological innovation. Japanese companies are renowned for developing cutting-edge IMAS solutions, and their domestic demand for advanced ship automation systems further fuels market growth.

Key Integrated Marine Automation System Company Insights

Key players operating in the integrated marine automation system market include ABB, Blue Ctrl AS, Emerson Electric Co., Høglund AS, Honeywell International Inc., INGETEAM, S.A., Jason Marine Group, Kongsberg Gruppen ASA, L3Harris Technologies, Inc., Moxa Inc., SEAM AS, Siemens AG, Thales Group, Ulstein Group ASA, and Wärtsilä. To stay ahead of the curve, companies are implementing a range of strategic initiatives, including developing new IMAS solutions, forging partnerships, and entering strategic agreements. These initiatives foster innovation and create synergies that ultimately benefit the industry.

-

In June 2023, Wärtsilä Automation, Navigation, and Control Systems (ANCS) launched a new solution to upgrade existing marine engine governor systems. This upgrade extends the lifespan of the system while improving fuel efficiency and reducing emissions. The system uses AI and digital controls to optimize engine performance for various ship types.

-

In December 2020, Rolls-Royce acquired Servowatch Systems, a British company that provides ship automation systems. This acquisition strengthens Rolls-Royce's Power Systems division, particularly its ship automation product line. By integrating Servowatch's technology, Rolls-Royce aims to offer a complete "bridge-to-propeller" solution for its customers in the maritime industry.

Key Integrated Marine Automation System Companies:

The following are the leading companies in the integrated marine automation system market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Blue Ctrl AS

- Emerson Electric Co.

- Høglund AS

- Honeywell International Inc.

- INGETEAM, S.A.

- Jason Marine Group

- Kongsberg Gruppen ASA

- L3Harris Technologies, Inc.

- Moxa Inc.

- SEAM AS

- Siemens AG

- Thales Group

- Ulstein Group ASA

- Wärtsilä

Integrated Marine Automation System Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.53 billion

Revenue forecast in 2030

USD 10.86 billion

Growth rate

CAGR of 8.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Offering, solution, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; United Arab Emirates (UAE); Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

ABB; Blue Ctrl AS; Emerson Electric Co.; Høglund AS; Honeywell International Inc.; INGETEAM, S.A.; Jason Marine Group; Kongsberg Gruppen ASA; L3Harris Technologies, Inc.; Moxa Inc.; SEAM AS; Siemens AG; Thales Group; Ulstein Group ASA; Wärtsilä

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Integrated Marine Automation System Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the integrated marine automation system market based on offering, solution, end use, and region.

-

Offering Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Vessel Management

-

Power Management

-

Safety System

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Commerce

-

Defense

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

United Arab Emirates (UAE)

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global integrated marine automation system market size was estimated at USD 6.06 billion in 2023 and is expected to reach USD 6.53 billion in 2024.

b. The global integrated marine automation system market is expected to grow at a compound annual growth rate of 8.9% from 2024 to 2030, reaching USD 10.86 billion by 2030.

b. The Asia Pacific region dominated the integrated marine automation system market in 2023 and accounted for a 40.4% share of the global revenue. This is primarily driven by the booming shipbuilding industry in countries like China, South Korea, and India. Additionally, growing economies and increasing trade volumes necessitate efficient and well-equipped vessels, further propelling the IMAS market.

b. Some key players operating in the integrated marine automation system market include ABB, Blue Ctrl AS, Emerson Electric Co., Høglund AS, Honeywell International Inc., INGETEAM, S.A., Jason Marine Group, Kongsberg Gruppen ASA, L3Harris Technologies, Inc., Moxa Inc., SEAM AS, Siemens AG, Thales Group, Ulstein Group ASA, and Wärtsilä.

b. The global expansion of trade demands larger and more efficient vessels, and IMAS plays a crucial role in optimizing operations and fuel consumption. Additionally, the need for enhanced situational awareness at sea necessitates real-time data and comprehensive system monitoring, which IMAS provides. Furthermore, the growing pressure to reduce emissions and improve fuel efficiency aligns perfectly with the capabilities of IMAS. Advancements in software and automation are making these systems ever more sophisticated and user-friendly.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.