- Home

- »

- Next Generation Technologies

- »

-

Insurance Telematics Market Size And Share Report, 2030GVR Report cover

![Insurance Telematics Market Size, Share & Trends Report]()

Insurance Telematics Market (2025 - 2030) Size, Share & Trends Analysis Report By Offering (Hardware, Software), By Type (Pay-as-you-drive, Pay-how-you-drive), By Deployment, By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-840-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Insurance Telematics Market Summary

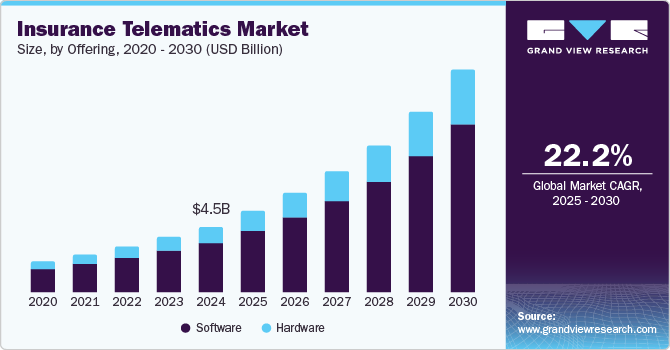

The global insurance telematics market size was valued at USD 4.45 billion in 2024 and is projected to reach USD 14.74 billion by 2030, growing at a CAGR of 22.2% from 2025 to 2030. Growing awareness regarding connected vehicles and the formulation of new laws and regulations concerning driver safety have driven the adoption of telematics solutions in recent years.

Key Market Trends & Insights

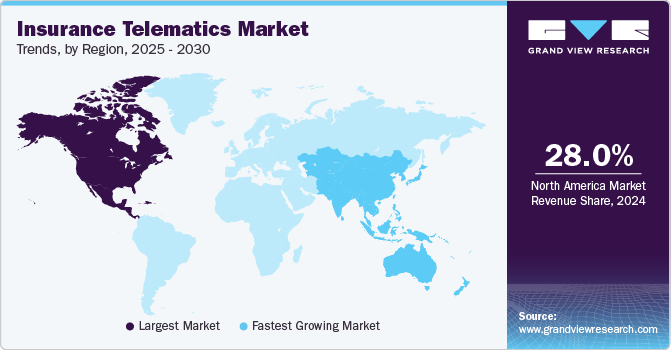

- North America led the market with 28.0% of the global revenue share in 2024.

- The U.S. accounted for a dominant revenue share of the regional market in 2024.

- By offering, the software segment accounted for a leading revenue share of 74.6% in 2024.

- By deployment, the cloud segment is anticipated to advance rapidly from 2025 to 2030.

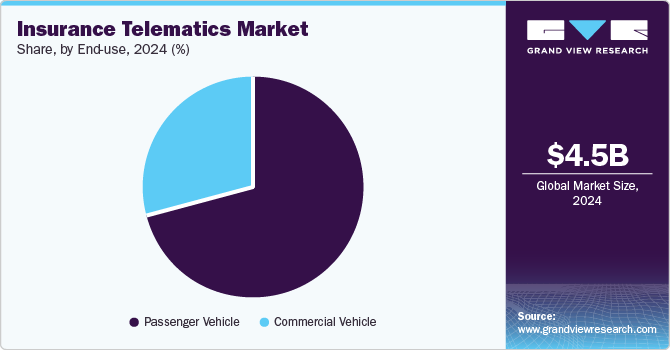

- By end use, the passenger vehicle segment accounted for a dominant revenue share in the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.45 Billion

- 2030 Projected Market Size: USD 14.74 Billion

- CAGR (2025-2030): 22.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Moreover, the emergence of advanced technologies such as artificial intelligence (AI), the Internet of Things (IoT), and 5G have accelerated innovations in the automotive sector, creating better opportunities to improve user experience and data monetization. A significant market driver is the increasing adoption of usage-based insurance policies across major global economies to provide highly personalized coverage alternatives and reduce accident risks by promoting safe driving practices.Insurers' preferences to directly access vehicle data from their onboard systems have led to integrating insurance telematics technologies with connected car systems. This enables insurers to offer a range of value-added services that can elevate customer experience by offering features such as vehicle tracking, emergency assistance, and remote diagnostics. Additionally, increasing incidences of road accidents have encouraged the integration of these technologies to mitigate risks. According to data from the U.S. National Highway Traffic Safety Administration (NHTSA), approximately 19,000 people faced mortality in vehicular crashes in the first half of 2024. Telematics has evolved as an important tool that organizations can leverage to lower accident risks to fleet drivers, thus promoting market growth.

With rising environmental concerns, there has been a constant appeal to incorporate systems that can monitor and help reduce the emission of harmful exhaust gases including carbon monoxide and nitrous oxide, into the atmosphere. By providing feedback regarding an individual’s driving habits, telematics encourages safer and more efficient driving practices. This includes suggestions to reduce aggressive braking and sudden acceleration that can lower fuel consumption and emissions. Moreover, the technology can also efficiently analyze upcoming traffic patterns and suggest optimal routes, enabling drivers to avoid traveling through congested areas and reduce idle time of vehicles. Insurers are also embracing this trend by promoting eco-driving techniques using telematics data and incentivizing drivers to adopt practices that minimize emissions. Insurance companies are offering lower premiums for EV or hybrid vehicle owners, promoting the use of environment-friendly alternatives. In China, a major market for EVs, new energy vehicle (NEV) companies such as Nio, Xpeng, and Xiaomi have integrated insurance offerings directly with the new vehicle purchases. Sensors can generate quality data that is expected to bring advancements such as automation of fraud prevention, claims management, and facilitate liability decisions. This is expected to optimize the efficiency of insurance carriers, enabling better pricing for responsible drivers.

Offering Insights

The software segment accounted for a leading revenue share of 74.6% in 2024 and is expected to maintain its position over the coming years. The demand for software solutions is expanding steadily due to the requirement of constant upgrades in network bandwidth and connectivity requirements. The combination of telecom and informatics allows in-vehicle electronics to communicate over a network with other devices, thus ensuring seamless data collection, analysis, and management. Telematics software provides live updates on vehicle location, speed, and status, enabling real-time monitoring of fleet or individual vehicles. It also tracks engine performance and alerts users to potential issues, enabling predictive maintenance and reducing downtime. In recent years, integrating this software with various IoT devices has allowed for more comprehensive data collection and analysis, improving real-time decision-making.

The hardware segment is anticipated to witness growth with the fastest CAGR during the forecast period. Telematics hardware is essential for collecting and transmitting data from vehicles to telematics software systems, enabling better communication and data exchange between hardware and software. This segment comprises several key components, including GPS trackers, OBD-II devices, telematics control units, sensors, and wireless communication modules. Continued technological advancements have resulted in the development of new hardware components that are more sophisticated and enable accurate data collection for various applications in the transportation and logistics industries. For instance, integrated sensors that may include accelerometers, gyroscopes, and GPS help provide comprehensive information regarding vehicle location, performance, and driver behavior, enabling better fleet management and ensuring improved safety.

Type Insights

The pay-as-you-drive (PAYD) segment accounted for the greater revenue share in the market in 2024. This model benefits policyholders and insurers, with continued technological advancements aiding positive developments in this segment. Insurers can leverage real-time driving data to optimize risk assessment and set premiums that accurately reflect individual driver behavior. By promoting safer driving habits through real-time monitoring, insurers may see a reduction in accident rates and claims, ultimately lowering the insurance costs. The customer base has rapidly expanded for the pay-as-you-drive model, particularly among younger drivers and those looking for more affordable options. Policyholders can pay premiums based on their driving frequency, which can lead to significant savings for safe drivers driving less frequently.

On the other hand, the pay-how-you-drive (PHYD) segment is anticipated to expand at the fastest CAGR during the forecast period. It links premiums to driving behavior, thus promoting safer driving, encouraging customer engagement, and creating a more equitable insurance marketplace. With the continuous evolution of telematics technology, the adoption of PHYD is likely to increase proportionally. This model encourages safer driving habits, which can lead to insurers experiencing a decline in accidents and claims, ultimately lowering costs. It incentivizes customers to adopt safer driving habits, as their premiums may decrease with improved behavior, creating a positive feedback loop. Moreover, providing consistent feedback on driving enhances interaction between insurers and policyholders, resulting in higher chances of retention. Insurers can use detailed telematics data to refine underwriting practices, developing more personalized and competitive offerings. Increasing technological integration through the use of mobile apps and telematics devices elevates user experience, providing actionable feedback and personalized insights.

Deployment Insights

The on-premise segment accounted for a larger revenue share in the global market in 2024. This deployment model offers several notable benefits, including enhanced data security, control over data management, and compliance with regulations, which enable providers to expand their client base. The substantial rise in the number of connected cars is expected to boost the deployment of on-premises systems in the coming years that can effectively meet connectivity requirements, including turnaround time and software updates. Increasing awareness and adoption of business intelligence systems, including smartphone applications, hardware devices, and smartphone-based telematics is the promoting the on-premise telematics. Additionally, the use of black box telemetry and GPS-powered asset tracking is another factor projected to ensure steady segment expansion.

The cloud segment is anticipated to advance rapidly from 2025 to 2030. The increasing focus on offering personalized solutions by insurers has driven the use of telematics, which considers individual driving behavior to offer customized premiums, resulting in fairer pricing and enhanced customer satisfaction. Moreover, this model allows for collecting and analyzing large volumes of data in real-time and enhances underwriting accuracy, risk assessment, and claim processing, making data-driven insights more appealing. Cloud-based platforms allow insurers to offer mobile apps and dashboards for customers to track their driving behavior and receive instant feedback, improving overall engagement and satisfaction.

Enterprise Size Insights

The large enterprise segment accounted for a leading revenue share in the global market in 2024. The need to reduce costs and enhance safety and operational efficiency has made insurance telematics a valuable tool in fleet management and risk mitigation strategies for large businesses. This trend is anticipated to maintain its momentum notably over the coming years, owing to technological advances and increased awareness regarding the benefits and features of such solutions. Moreover, these organizations are early adopters of innovative technologies that ensure better client services, such as AI, predictive modeling, and real-time monitoring using IoT (Internet of Things) devices.

Meanwhile, the small and medium enterprises segment is expected to witness the fastest CAGR from 2025 to 2030. These businesses constantly strive to retain clients, attract new ones, and offer cost-effective services concerning claims. Smaller businesses and start-ups leverage usage-based insurance models to drive better savings since premiums are based on actual driving behavior. Furthermore, telematics is also useful in asset tracking, as firms can monitor their vehicle’s location in real time, aiding in asset management and theft recovery. Maintaining compliance with various industry regulations is another factor driving the adoption of telematics, as they provide accurate records of driver behavior and vehicle use. SMEs can use these technologies to understand usage patterns that can enable them to offer tailored services to customers and improve their experience.

End Use Insights

The passenger vehicle segment accounted for a dominant revenue share in the market in 2024 and is expected to maintain its position during the forecast period. The increasing appeal of policies that offer premiums based on actual driving behavior and ensure substantial savings for safe drivers has driven the demand for insurance telematics in this segment. Moreover, the rising usage of smartphones has made it easier to implement telematics solutions via mobile applications, which lowers barriers for consumers and insurers. Consumers increasingly prefer personalized insurance plans that consider their individual driving habits rather than generalized policies. Integrating advanced analytics features allows insurers to understand the risks better and adjust their pricing models accordingly. The growing popularity of electric vehicles (EVs) among consumers and substantial developments in connected car technologies are further facilitating the use of telematics solutions in this segment.

Meanwhile, the commercial vehicle segment is anticipated to witness the fastest CAGR during the forecast period. The rapidly growing presence of commercial fleets across major global economies and increasing competition among leading players in the commercial telematics business are some of the notable drivers of this segment. Awareness regarding the importance of road safety and higher operational efficiency has led fleet service providers to adopt advanced technologies such as telematics to improve their business functioning. The availability of risk assessment data features enables owners to monitor their drivers and fleet, which helps optimize spending. Fleet owners require constant information regarding different vehicle usage parameters such as maintenance, fuel efficiency, and driving habits. This leads to commercial policyholders availing for driver safety training programs by insurance companies, resulting in the extensive use of telematics solutions.

Regional Insights

North America led the market with 28.0% of the global revenue share in 2024. The region witnesses significant demand for interconnected solutions and is a major technological hub, creating avenues for frequent developments in this industry. Moreover, increasing competition among insurance companies has resulted in the widespread deployment of cloud-based networks that offer better services to clients. Governments in the U.S. and Canada have emphasized on reducing the incidences of road accidents and promoting safer driving among citizens, leading to the utilization of telematics data extensively to enhance road safety initiatives.

U.S. Insurance Telematics Market Trends

The U.S. accounted for a dominant revenue share of the regional market in 2024, aided by increasing consumer awareness regarding the potential for savings and personalized insurance offerings through telematics. Additionally, supportive regulatory frameworks in several states have encouraged the development and implementation of telematics-based insurance models. Automakers are partnering with analytics solution providers in the insurance sector to improve their service offerings. For instance, in February 2024, Kia America announced its collaboration with LexisNexis Risk Solutions, which would make data from Kia-connected vehicles available to auto insurers in the country via LexisNexis Telematics Exchange. Such developments are expected to boost the adoption of telematics solutions and help improve driving standards.

Europe Insurance Telematics Market Trends

Europe accounted for a notable revenue share of the global market in 2024. The regional market is expanding at a substantial pace, aided by notable improvements in connectivity. Technologies such as GPS, and enhanced data analytics capabilities enabled the development of more efficient and accurate telematics solutions.

Asia Pacific Insurance Telematics Market Trends

Asia Pacific is anticipated to emerge as the fastest-growing market during the forecast period. Rapid urbanization in regional economies such as India and China led to a sharp increase in vehicle usage and increased demand for telematics solutions to improve driver safety and manage risks. Additionally, governments in the region are focusing on promoting smart transportation systems and road safety initiatives, which are expected to support telematics adoption in the coming years. The increasing adoption of telematics and IoT technologies that are reliant on third-party mobile devices is a major trend in the regional market. Emerging economies in Asia Pacific are also beginning to adopt telematics, driven by rising vehicle ownership and regulatory changes, aiding market expansion.

Key Insurance Telematics Company Insights

Some key companies involved in the insurance telematics market include Aplicom, Trak Global Solutions Holdings (Canada) Inc., and Octo Group S.p.A, among others.

-

Aplicom is a provider of telematics solutions specializing in vehicle tracking, fleet management, and data analytics. The company makes use of advanced technologies to enable businesses to optimize their operations, enhance safety, and reduce costs. Aplicom’s fleet management solutions include real-time tracking, vehicle diagnostics, and route optimization offerings. These offerings find several use cases, including predictive maintenance, waste management telematics, driving style analysis, and traffic safety, among other custom solutions.

Key Insurance Telematics Companies:

The following are the leading companies in the insurance telematics market. These companies collectively hold the largest market share and dictate industry trends.

- Agero, Inc.

- Aplicom

- Trak Global Solutions Holdings (Canada) Inc.

- Masternaut Limited

- META SYSTEM S.P.A.

- MiX by Powerfleet

- Octo Group S.p.A

- Bridgestone Mobility Solutions B.V.

- Trimble

- Sierra Wireless S.A.

Recent Developments

-

In June 2024, The National Insurance Crime Bureau (NICB) of the U.S. announced a partnership with Agero, which provides digital driver assistance software and services for major automotive insurance companies. This initiative has been undertaken to prevent insurance fraud activities from occurring due to availing services from questionable third-party vehicle service providers.

Insurance Telematics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.41 billion

Revenue Forecast in 2030

USD 14.74 billion

Growth Rate

CAGR of 22.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2017 - 2023

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Offering, type, deployment, enterprise size, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

Agero, Inc.; Aplicom; Trak Global Solutions Holdings (Canada) Inc.; Masternaut Limited; META SYSTEM S.P.A.; MiX by Powerfleet; Octo Group S.p.A; Bridgestone Mobility Solutions B.V.; Trimble; Sierra Wireless S.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Insurance Telematics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global insurance telematics market report based on offering, type, deployment, enterprise size, end use, and region.

-

Offering Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Pay-as-you-drive

-

Pay-how-you-drive

-

Pay-as-you-go

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

Passenger Vehicle

-

Commercial Vehicle

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.