- Home

- »

- Next Generation Technologies

- »

-

Insurance Brokerage Market Size And Share Report, 2030GVR Report cover

![Insurance Brokerage Market Size, Share & Trends Report]()

Insurance Brokerage Market (2024 - 2030 ) Size, Share & Trends Analysis Report By Insurance (Life Insurance, Property & Casualty Insurance), By Brokerage, By End Use (Individual, Corporate), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-442-2

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Insurance Brokerage Market Summary

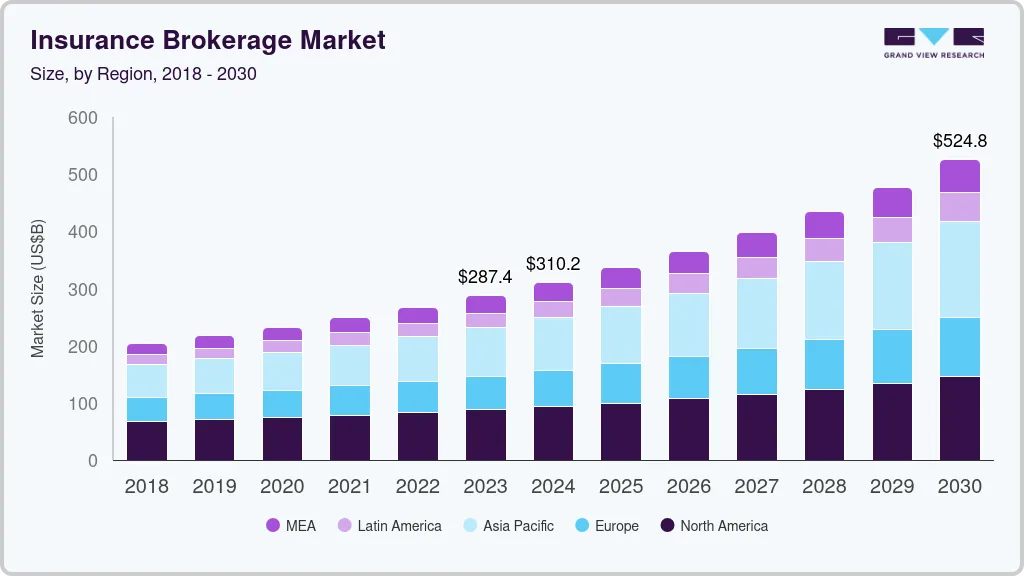

The global insurance brokerage market size was valued at USD 287.40 billion in 2023 and is projected to reach USD 524.80 billion by 2030, growing at a CAGR of 9.2% from 2024 to 2030. The rising demand for insurance products drives the growth of the market.

Key Market Trends & Insights

- North American insurance brokerage market dominated the global industry in 2023 and accounted for 30.50% share of the global revenue.

- The insurance brokerage market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030.

- Based on insurance, the property & casualty insurance segment dominated the market in 2023 and accounted for a 69.54% share of the global revenue.

- Based on brokerage, the retail segment dominated the market in 2023.

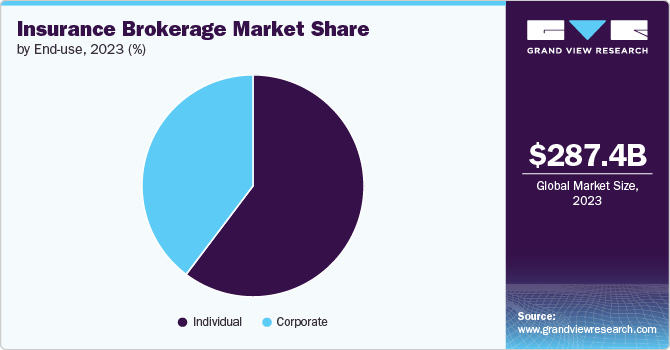

- Based on end-use, the individual segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 287.40 Billion

- 2030 Projected Market Size: USD 524.80 Billion

- CAGR (2024-2030): 9.2%

- North America: Largest market in 2023

As economies expand, more individuals and businesses seek to protect their assets, income, and health through insurance. Economic growth often correlates with a rising disposable income, enabling more people to afford insurance coverage. Additionally, as the population grows, potential insurance customers increase, driving demand for a wide range of insurance products, from life and health insurance to property and casualty insurance. Insurance brokers help customers navigate the often complex and varied insurance offerings available. They assist in selecting the right coverage customized to individual or business needs, making the process more accessible and understandable. As a result, the rising demand for insurance products translates directly into increased demand for brokerage services, thus driving the market growth.

Moreover, there is a growing awareness of the importance of having adequate insurance coverage. It is partially due to educational efforts by governments, financial institutions, and insurers emphasizing the need for protection against various risks. The law often mandates insurance, such as auto insurance or workers' compensation for businesses. These legal requirements ensure a baseline level of demand, further boosting the need for insurance services.

The ongoing digital transformation in the insurance industry is reshaping the role of insurance brokers. Digital tools and platforms enable brokers to offer more personalized and efficient services, including real-time quotes, data-driven insights, and streamlined claims processes. This technological advancement enhances customer experience and attracts a broader client base, including younger generations who prefer digital interactions.

The increasing complexity of insurance regulations across different regions and sectors necessitates the expertise of insurance brokers. Brokers assist clients in navigating regulatory requirements and ensuring compliance, which is particularly important for businesses operating in multiple jurisdictions. The need for specialized knowledge and the ability to manage regulatory risks contribute to the growing reliance on brokerage services.

The need for customized and specialized services fuels the market's growth. Clients increasingly seek customized insurance solutions tailored to their specific needs, whether for commercial or personal use. With their ability to offer specialized products and services, insurance brokers are well-positioned to meet this demand. The trend toward customization drives the growth of brokerage firms that can provide expertise in particular areas, such as cyber insurance and environmental liability.

Insurance Insights

The property & casualty insurance segment dominated the market in 2023 and accounted for a 69.54% share of the global revenue. As urbanization accelerates and more people acquire properties, the demand for property insurance rises correspondingly. Homeowners, real estate investors, and businesses increasingly seek comprehensive coverage to protect against potential property damage, theft, and other risks. This surge in property ownership and urban development boosts the demand for property insurance products, with insurance brokers playing a critical role in providing tailored coverage options and advising clients on appropriate policies.

The life insurance segment is projected to grow significantly from 2024 to 2030. There is a growing recognition of the importance of comprehensive financial planning, which includes life insurance as a key component. As individuals become more financially savvy, they seek to protect their assets and provide for their dependents in the event of unforeseen circumstances. Insurance brokers play a vital role in educating clients about life insurance benefits and helping them select appropriate policies to meet their financial goals and protection needs.

Brokerage Insights

The retail segment dominated the market in 2023. The retail segment is experiencing significant growth due to technological advancements and the rise of digital platforms. Online tools and mobile apps enable brokers to offer seamless customer experiences, including policy comparisons, quote generation, and easy access to information. Technology facilitates efficient policies and claims management, enhancing customer satisfaction and engagement.

The wholesale segment is projected to grow significantly from 2024 to 2030. Companies are emphasizing robust risk management and mitigation strategies more due to the rising frequency and severity of claims related to natural disasters, regulatory changes, and technological disruptions. Wholesale brokers provide valuable risk assessment and management services, helping clients identify potential vulnerabilities and implement appropriate insurance solutions.

End Use Insights

The individual segment dominated the market in 2023. There is a growing demand for insurance products tailored to individual needs and preferences. Insurance brokers are adept at providing personalized advice and customized solutions that address their client's specific requirements. Whether customizing coverage for unique health conditions, lifestyle choices, or family situations, brokers offer value by ensuring that insurance policies align closely with individual needs. This focus on personalization helps attract and retain clients, contributing to the growth of the insurance brokerage market among individuals.

The corporate segment is projected to grow significantly from 2024 to 2030. Corporate clients are subject to a growing array of regulatory and compliance requirements, both locally and internationally. These regulations often mandate specific types of insurance coverage or impose stringent reporting and documentation standards. Insurance brokers help corporations navigate these regulatory landscapes, ensuring they meet compliance requirements while optimizing their insurance portfolios.

Regional Insights

North American insurance brokerage market dominated the global industry in 2023 and accounted for 30.50% share of the global revenue. The regulatory changes and increasing compliance requirements in North America drive the market's growth. Brokers are critical in helping clients navigate the complex regulatory environment, ensuring they comply with relevant laws and regulations. The need for compliance expertise has driven demand for brokerage services as businesses seek to mitigate risks associated with non-compliance.

U.S. Insurance Brokerage Market Trends

The insurance brokerage market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030. The U.S. insurance market is heavily regulated, with ongoing changes at both federal and state levels. These regulatory shifts can affect everything from coverage requirements to pricing structures. Insurance brokers provide valuable expertise in interpreting these regulations and advising clients to remain compliant.

Europe Insurance Brokerage Market Trends

The insurance brokerage market in Europe is expected to witness notable growth from 2024 to 2030. As businesses across Europe face increasingly complex risks, there is a growing demand for specialized risk management services provided by insurance brokers. From cyber threats to climate-related risks, companies are turning to brokers to help them identify, assess, and mitigate these challenges. Brokers' expertise in tailoring insurance solutions to meet specific risk profiles has made them indispensable partners for businesses, driving market expansion.

Asia Pacific Insurance Brokerage Market Trends

The insurance brokerage market in Asia Pacific is expected to witness significant growth from 2024 to 2030. As economies in the Asia Pacific region continue to develop, individuals and businesses are increasingly aware of the importance of insurance products. This growing awareness is accompanied by higher penetration rates of both life and non-life insurance products. Insurance brokers play a crucial role in educating potential customers and guiding them through complex insurance options, driving the growth of the brokerage market.

Key Insurance Brokerage Company Insights

Key players operating in the insurance brokerage market include Marsh & McLennan Companies, Inc.; Willis Towers Watson; Aon plc; Arthur J. Gallagher & Co.; Brown & Brown, Inc.; Lockton Companies; Alliant Insurance Services; HUB International Limited; Edgewood Partners Insurance Center (EPIC); USI Insurance Services. The companies are focusing on numerous strategic initiatives, including partnerships & collaborations, new product development, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In August 2024, Contact Insurance Brokerage launched a new mobile application designed to enhance insurance policy management and streamline customer interactions. This innovative app provides users with a range of features that facilitate the management of both active and expired insurance policies, allowing customers to access their information using their national ID numbers.

-

In May 2024, Riskbirbal Insurance Brokers launched the Wellconnect platform, a transformative solution designed to streamline healthcare and insurance management for users. This innovative platform integrates advanced technology and data-driven insights to simplify the complexities associated with navigating health insurance services.

Key Insurance Brokerage Companies:

The following are the leading companies in the insurance brokerage market. These companies collectively hold the largest market share and dictate industry trends.

- Marsh & McLennan Companies, Inc.

- Aon plc

- Willis Towers Watson

- Arthur J. Gallagher & Co.

- Brown & Brown, Inc.

- Lockton Companies

- Alliant Insurance Services

- HUB International Limited

- Edgewood Partners Insurance Center (EPIC)

- USI Insurance Services

Insurance Brokerage Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 310.23 billion

Revenue forecast in 2030

USD 524.80 billion

Growth rate

CAGR of 9.2% from 2024 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Insurance, brokerage, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

Country scope

U.S., Canada, Mexico, U.K., Germany, France, China, India, Japan, South Korea, Australia, Brazil, Kingdom of Saudi Arabia (KSA), UAE, South Africa

Key companies profiled

Marsh & McLennan Companies, Inc.; Aon plc; Willis Towers Watson; Arthur J. Gallagher & Co.; Brown & Brown, Inc.; Lockton Companies; Alliant Insurance Services; HUB International Limited; Edgewood Partners Insurance Center (EPIC); USI Insurance Services

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Insurance Brokerage Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global insurance brokerage market report based on insurance, brokerage, end use, application and region.

-

Insurance Outlook (Revenue, USD Billion, 2018 - 2030)

-

Life Insurance

-

Property & Casualty Insurance

-

-

Brokerage Outlook (Revenue, USD Billion, 2018 - 2030)

-

Retail

-

Wholesale

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Individual

-

Corporate

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global insurance brokerage market size was estimated at USD 287.40 billion in 2023 and is expected to reach USD 310.23 billion in 2024.

b. The global insurance brokerage market is expected to grow at a compound annual growth rate of 9.2% from 2024 to 2030 to reach USD 524.80 billion by 2030.

b. North America dominated the insurance brokerage market with a share of 30.50% in 2023. The regulatory changes and increasing compliance requirements in North America drive the regional market's growth.

b. Some key players operating in the insurance brokerage market include Marsh & McLennan Companies, Inc.; Aon plc; Willis Towers Watson; Arthur J. Gallagher & Co.; Brown & Brown, Inc.; Lockton Companies; Alliant Insurance Services; HUB International Limited; Edgewood Partners Insurance Center (EPIC); and USI Insurance Services.

b. Key factors that are driving the market growth include the growing awareness of the importance of having adequate insurance coverage and the rising demand for insurance products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.