- Home

- »

- Next Generation Technologies

- »

-

Insurance Analytics Market Size, Industry Report, 2033GVR Report cover

![Insurance Analytics Market Size, Share & Trends Report]()

Insurance Analytics Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Tool, Service), By Application (Claim Management, Risk Management, Process Optimization), By Deployment, By Enterprise Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-522-9

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Insurance Analytics Market Summary

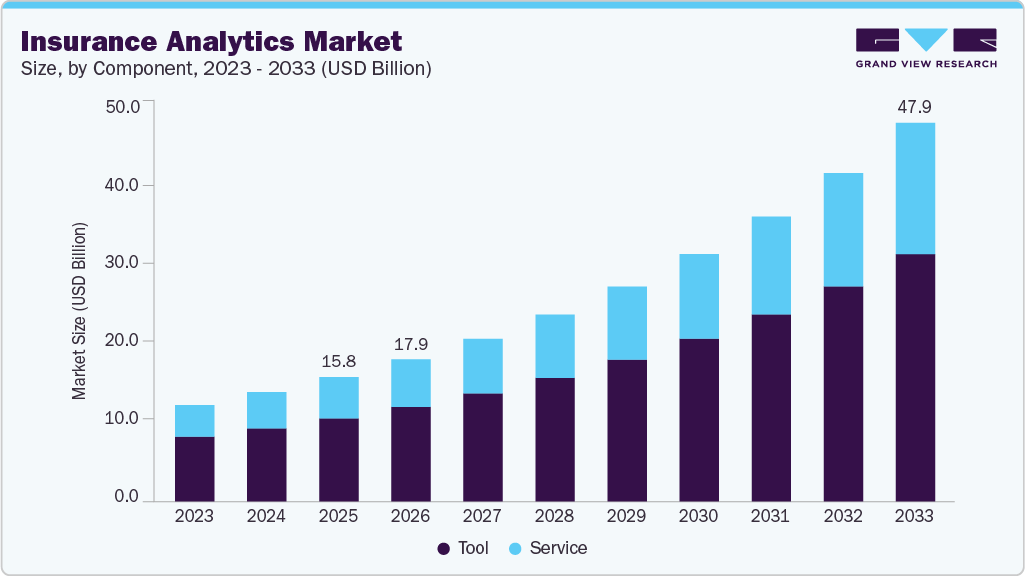

The global insurance analytics market size was estimated at USD 15.75 billion in 2025 and is projected to reach USD 47.97 billion by 2033, growing at a CAGR of 15.0% from 2026 to 2033. The growing use of advanced analytics and data-driven decision-making in the insurance industry is driving the market growth.

Key Market Trends & Insights

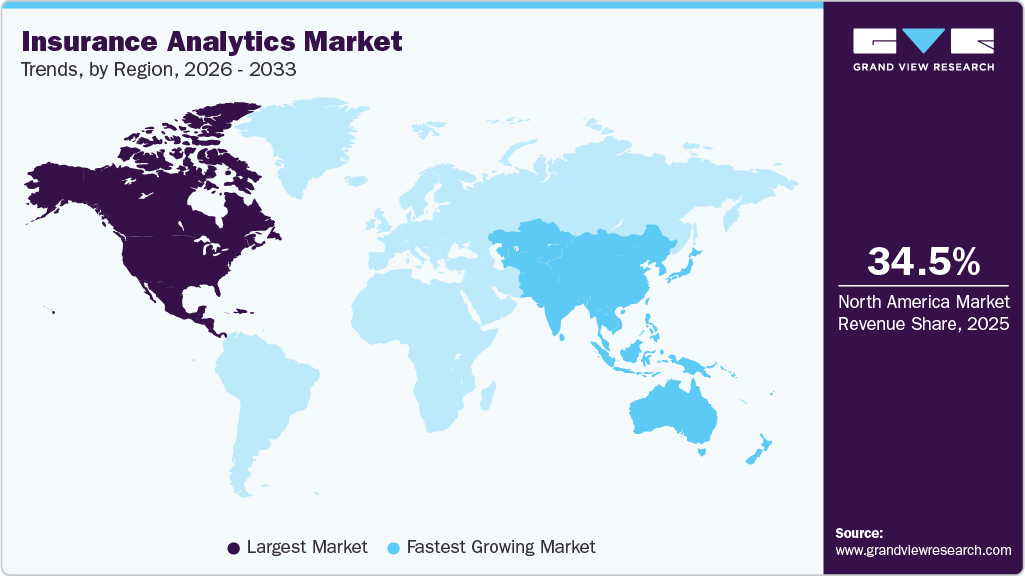

- The North America Insurance Analytics market accounted for a 34.5% share of the overall market in 2025.

- The insurance analytics industry in the U.S. held a dominant position in 2025.

- By component, the tool segment accounted for the largest share of 66.7% in 2025.

- By application, the risk management segment held the largest market share in 2025.

- By deployment, the cloud segment dominated the market in 2025.

Market Size & Forecast

- 2025 Market Size: USD 15.75 Billion

- 2033 Projected Market Size: USD 47.97 Billion

- CAGR (2026-2033): 15.0%

- North America: Largest market in 2025

- Asia Pacific: Fastest Growing market

In addition, the increasing adoption of insurance analytics tools and services by small- and medium-sized companies is likely to further drive demand in the coming years. IoT insurance is expected to grow at a significant pace as it enables insurers to offer new services and engage with customers, thereby driving market growth.The rising need for accurate risk management drives the insurance analytics industry as insurers leverage analytics to enhance underwriting processes and reduce potential losses. The growing adoption of AI and machine learning enables predictive insights that automate tasks such as claims processing and fraud detection, which improves operational efficiency. In addition, there is a growing demand for personalized, data-driven customer experiences, allowing insurers to tailor offerings, streamline interactions, and boost customer satisfaction. Analytics empower distributors and agents with tools to identify business opportunities and effectively serve existing customers. These solutions also help reduce overall customer handling costs, time, and instances of fraud, which is expected to drive market demand.

Compliance pressure also impels market adoption, as analytics tools support regulatory adherence through improved data transparency and reporting. Finally, as cybersecurity threats escalate in the digital landscape, insurers are investing in analytics to enhance cyber risk assessment and strengthen data protection strategies. For instance, in April 2024, Gore Street Energy Storage Fund began using ACCURE’s AI data analytics to manage risk and get improved insurance terms on projects in its portfolio.

Component Insights

On the basis of component, the industry is divided into tools and services, with services further segmented into professional and managed services. In 2025, the tools segment held the largest revenue share of 66.7%, which can be attributed to the growing demand for mobile-based insurance solutions, especially with rising smartphone usage. Increasing financial fraud also fuels the need for advanced analytics tools. Insurers are using analytics to gain insights into customer expectations, enabling them to design personalized products and enhance claims, risk management, and underwriting processes. The tool segment is growing due to its strong security features, ability to adapt to changing threats, and expanding applications.

The service segment is anticipated to grow at the fastest CAGR during the forecast period 2026 - 2033. It is driven by the increasing demand for analytical services that enhance operational efficiency and improve customer experience. This segment is further bifurcated into managed and professional services. As insurance companies seek to leverage data-driven insights for better decision-making and personalized service offerings, the service segment is projected to grow significantly.

Application Insights

On the basis of application, the market is segmented into claim management, risk management, process optimization, customer management & personalization, and others. In 2025, the risk management segment led the market and is projected to maintain its dominance, driven by the need for automated insights that enhance underwriters' decision-making. Analytics for risk management uncovers hidden data patterns, identifying potential risks and enabling insurers to take preventive measures. This rising demand for data-driven risk mitigation is fueling segment growth.

The customer management & personalization segment is anticipated to exhibit the highest CAGR over the forecast period. This growth is driven by insurers’ expanding use of analytics to enable proactive risk management, customize offerings, and deliver personalized policy discounts, all designed to align more closely with individual customer needs.

Deployment Insights

On the basis of deployment, the market is segmented into on-premise and cloud solutions, with the cloud solutions segment leading in 2025. The segment is projected to maintain its dominance over the forecast years. Cloud deployment enables seamless integration with third-party applications and enhances the security of online insurance services. Its pay-as-you-go model also reduces initial infrastructure costs. Organizations increasingly favor cloud-based applications due to their regulatory compliance, as seen with providers such as Snowflake Inc., which offers a cloud data warehouse certified for PCI, HIPAA, and FedRAMP. In addition, cloud deployment allows for real-time data sharing, minimizing redundant data exports in risk scoring processes. Cloud solutions also provide automatic updates, enabling users to access the latest software versions without disrupting operations.

The on-premise segment is anticipated to grow at a significant CAGR over the forecast period. Increased competition in the insurance sector is driving companies to adopt advanced analytics solutions to enhance decision-making and operational efficiency. These solutions allow companies to manage risks more effectively and meet regulatory demands. Data security concerns also drive this trend, as on-premise solutions provide insurers with greater control over sensitive information, ensuring that only authorized personnel can access it.

Enterprise Size Insights

On the basis of enterprise size, the market is segmented into large enterprises and Small & Medium Enterprises (SMEs). Large enterprises are increasingly adopting insurance analytics to enhance customer loyalty, reduce infrastructure costs, and comply with evolving regulations such as HIPAA, PCI-DSS, and federal standards. This adoption is expected to drive segment growth. These enterprises leverage analytics tools to process both structured data (e.g., policyholder information) and unstructured data (e.g., social media insights). Analytics enable large companies to create more transparent and simplified products, predict customer behavior, and design personalized policies, leading to improved customer satisfaction and retention.

The small and medium enterprises (SMEs) segment is anticipated to grow at the highest CAGR during the forecast period. This growth is primarily driven by the necessity for enhanced claims management through streamlined processes and data-driven decision making, which aids in the selection of suitable coverage. Furthermore, analytics contribute to cost efficiency by offering competitive pricing and enabling proactive risk management to mitigate potential losses. These tools empower SMEs to manage risks effectively while optimizing their insurance investments.

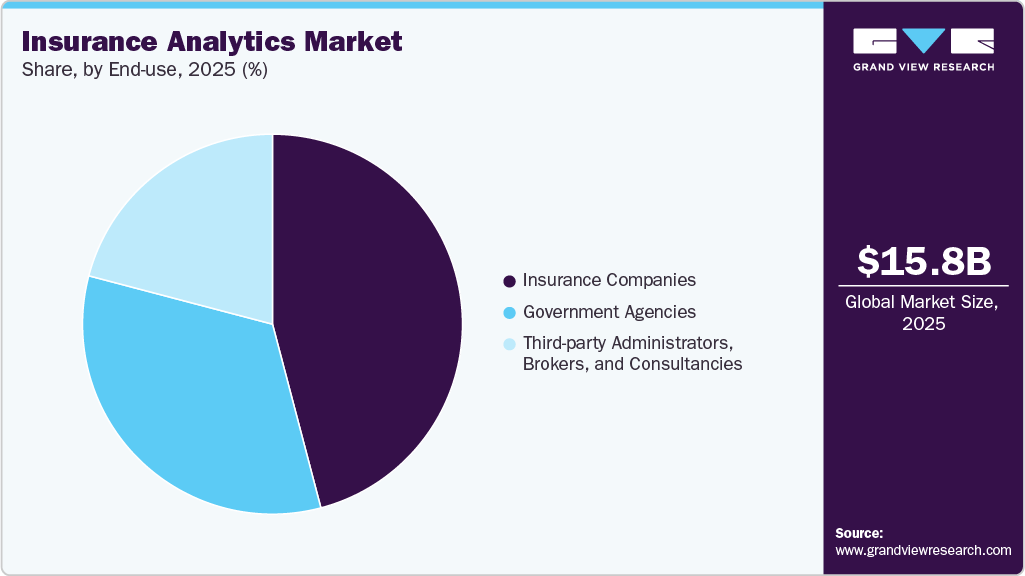

End-use Insights

On the basis of end use, the industry is segmented into insurance companies, government agencies, and third-party administrators, brokers, and consultancies. The insurance companies segment led the market in 2025 due to rising demand for insurance services and the need for advanced analytics in financial reporting. The expansion of third-party data sources has reduced insurers' reliance on internal data, as data from smartphones, social media, computers, and other devices now provides key behavioral insights for insurers.

Growing demand for online insurance solutions and enhanced digital offerings is expected to drive the segment growth. In addition, the need for tailored consultation services is pushing insurers to adopt analytics tools to deliver more customer-centric services. Analytics also enables companies to accelerate processes such as policy issuance and after-sales communication, boosting customer retention. Furthermore, these solutions provide actionable insights to identify potential fraud risks, allowing insurers to proactively address fraudulent activity.

The third-party administrators, brokers, and consultancies segment is anticipated to grow at the fastest CAGR over the forecast period. TPAs provide important services such as claims management, billing, and risk management. The use of advanced analytics improves efficiency, enhances customer service, and strengthens fraud detection. In addition to TPAs, brokers and consultancies are also crucial in this market. Brokers utilize analytics to better understand customer needs and customize insurance products, while consultancies provide expert advice on risk assessment and market trends. With the increasing demand for personalized insurance solutions, the roles of TPAs, brokers, and consultancies in the insurance sector are expected to rise in the upcoming years.

Regional Insights

The North America insurance analytics market dominated in 2025 with a revenue share of 34.5% and is expected to maintain this lead. This growth is driven by the adoption of analytics tools, a strong presence of major companies, and a focus on customer-centric solutions across sectors such as government, insurance, and third-party administrators. In addition, advancements in data analytics, cloud computing, and government initiatives to raise insurance awareness are set to further propel regional market growth.

U.S. Insurance Analytics Market Trends

The insurance analytics market in the U.S. dominated the regional market in 2025, which can be attributed to the high adoption of AI and cloud technology. The use of these technologies has enhanced underwriting, claims management, and fraud detection. Moreover, predictive analytics has evolved to prescriptive models, enabling insurers to proactively manage risks and improve customer experiences. Telematics and IoT usage in auto and property insurance have grown significantly, supporting usage-based policies. In addition, cloud-based analytics tools allowed more efficient data integration and scaling capabilities, aligning with trends such as embedded insurance and instant payments.

Europe Insurance Analytics Market Trends

The insurance analytics market in Europe is witnessing rapid advancements in digital transformation across industries, with strong adoption of insurance analytics tools by key sectors such as insurance, banking, and government agencies. The growing need for greater regulatory compliance, especially in financial services, and the increasing demand for data-driven customer insights are key growth drivers. In addition, government support and strategic initiatives focused on improving digital infrastructure and analytics capabilities are expected to accelerate adoption in the region.

Germany’s insurance analytics market is deeply aligned with its broader industrial and risk-engineering culture. German insurers deploy analytics primarily to strengthen fraud detection, capital adequacy modeling, and systemic risk assessment across motor, liability, and industrial insurance segments. Analytics investments are justified not only by efficiency gains but by their ability to support solvency stress testing and regulatory reporting. A notable trend in Germany is the use of cross-policy analytics, where claims and behavior patterns are analyzed across multiple insurance products to identify organized fraud and long-tail risk exposure.

The insurance analytics market in the UK is characterized by strong customer-centricity and rapid deployment cycles. Insurers extensively use analytics to personalize pricing, refine customer segmentation, and optimize retention strategies, particularly in motor and health insurance. Telematics-based insurance models are more commercially mature in the U.K. than in most European countries, supported by advanced behavioral analytics and usage-based pricing frameworks. The presence of analytics innovation labs and close collaboration with fintech ecosystems has positioned the U.K. as a testing ground for new insurance analytics use cases before wider European rollout.

Asia Pacific Insurance Analytics Market Trends

The insurance analytics market in the Asia-Pacific region is expected to grow at the fastest CAGR during the forecast period. The rapid expansion of the insurance sector and the growing demand for advanced analytics in risk management and fraud detection are driving market growth. The region’s early adoption of technology, government-backed innovations, and a large number of emerging insurance providers in countries such as China and India are key factors expected to drive the regional market. In addition, the increasing focus of governments on digital transformation across various industries, such as manufacturing and healthcare, is further promoting the adoption of insurance analytics solutions.

China insurance analytics market accounted for the highest revenue share in the region in 2025, which can be attributed to the Chinese government actively promoting digital infrastructure. Such initiatives allow insurers to enhance their support services. For example, the property and casualty insurance sector is rapidly modernizing to accommodate increasing consumer demand in areas such as health and auto insurance. With these advancements, insurers are meeting regulatory requirements and offering more personalized, data-driven insurance solutions that align with the digital lifestyles of Chinese consumers.

The insurance analytics market in India is transitioning rapidly from basic reporting tools to advanced predictive and automation-driven analytics. Growth is fueled by regulatory encouragement for digital insurance, expanding mobile distribution, and increasing penetration of health and life insurance products. Analytics is widely used to automate claims validation, reduce fraud leakage, and improve underwriting efficiency in high-volume, low-ticket policies. A distinct feature of the Indian market is the application of analytics to micro-insurance and rural risk modeling, supporting national objectives around financial inclusion while creating long-term data assets for insurers.

Key Insurance Analytics Companies Insights

Key players operating in the insurance analytics market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth. Some key companies in the insurance analytics industry are Hexaware Technologies Limited, LexisNexis Risk Solutions, Microsoft, MicroStrategy Incorporated., Open Text Corporation, and Oracle. These organizations are focusing on expanding their customer base and gaining a competitive edge in the industry. To achieve this, key players are actively pursuing several strategic initiatives, such as mergers and acquisitions, as well as forming partnerships with other leading companies. By leveraging these strategies, they aim to enhance their capabilities in providing data-driven insights, improving operational efficiency, and driving innovation in the insurance sector.

-

Oracle provides cloud-based data management and AI analytics solutions for the insurance industry. Oracle’s AI-driven platforms help insurers improve decision-making by enhancing capabilities in risk assessment, fraud detection, claims management, and customer segmentation. The company offers advanced tools that allow insurance organizations to analyze data at scale and drive more personalized services for policyholders.

-

MicroStrategy offers a business intelligence platform powered by AI and machine learning to help insurers make data-driven decisions. Their solutions enable insurers to analyze vast amounts of data in real time, improving processes such as claims management, underwriting, and customer engagement. MicroStrategy’s advanced analytics help organizations uncover actionable insights that drive growth and optimize operations.

Key Insurance Analytics Companies:

The following are the leading companies in the insurance analytics market. These companies collectively hold the largest Market share and dictate industry trends.

- Hexaware Technologies Limited

- LexisNexis Risk Solutions

- Microsoft

- MicroStrategy Incorporated

- Open Text Corporation

- Oracle

- Pegasystems Inc.

- Sapiens International

- Tableau Software, LLC

- Verisk Analytics, Inc.

Recent Developments

-

In October 2024, LexisNexis launched LexisNexis Life Smart Path, a new solution designed for U.S. life insurance companies. This tool provides insurers with valuable data and advanced analytics during the initial stages of life insurance applications and underwriting. By utilizing this solution, insurers can make quicker decisions and conduct more thorough risk assessments.

-

In September 2024, Sapiens International Corporation partnered with Addresscloud to enhance insurers' geographic risk assessment capabilities. This collaboration will provide accurate geocoding and property data for better underwriting decisions. The integration of Addresscloud's services with Sapiens' software aims to improve risk assessment accuracy and streamline claims management. Overall, this partnership seeks to provide insurers with a competitive advantage.

-

In March 2024, Verisk integrated Seek Now’s claims inspection technology into its property insurance solutions, streamlining damage assessments and eliminating the need for manual data transfer. This will accelerate claims resolution, improve outcomes, and reduce cycle times for customers of both companies.

Insurance Analytics Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 17.99 billion

Revenue forecast in 2033

USD 47.97 billion

Growth rate

CAGR of 15.0% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, application, deployment, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Hexaware Technologies Limited; LexisNexis Risk Solutions; Microsoft; MicroStrategy Incorporated; Open Text Corporation; Oracle; Pegasystems Inc.; Sapiens International; Tableau Software, LLC; Verisk Analytics, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Insurance Analytics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global insurance analytics market report based on component, application, deployment, enterprise size, end-use, and region.

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Tool

-

Service

-

Managed Services

-

Professional Services

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Claim Management

-

Risk Management

-

Process Optimization

-

Customer Management & Personalization

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

On-premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Insurance Companies

-

Government Agencies

-

Third-party Administrators, Brokers, & Consultancies

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global insurance analytics market size was estimated at USD 15.75 billion in 2025 and is expected to reach USD 17.99 billion in 2026.

b. The global insurance analytics market is expected to grow at a compound annual growth rate of 15.0% from 2026 to 2033 to reach USD 47.97 billion by 2023.

b. North America dominated the insurance analytics market with a share of 34.5% in 2025. This is attributable to the growing adoption of insurance analytics tools and a strong presence of insurance analytics vendors in the region.

b. Some key players operating in the insurance analytics market include Hexaware Technologies; LexisNexis Risk Solutions; Microsoft Corporation; MicroStrategy Incorporated; OpenText; Oracle Corporation; PEGASYSTEMS INC.; Sapiens International; Tableau Software, LLC; and Verisk Analytics, Inc.

b. Key factors driving the insurance analytics market growth include shifting consumer loyalties and rising competition in the market is encouraging competitors to upgrade their existing business model, streamline operations, and enhance the processes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.