- Home

- »

- Medical Devices

- »

-

Insulin Pump Market Size & Share, Industry Report, 2030GVR Report cover

![Insulin Pump Market Size, Share & Trends Report]()

Insulin Pump Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Patch Pumps, Tethered Pumps), By Product (Mini Med, Accu-Chek), By Accessories, By End-use (Hospitals & Clinics), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-876-3

- Number of Report Pages: 220

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Insulin Pump Market Summary

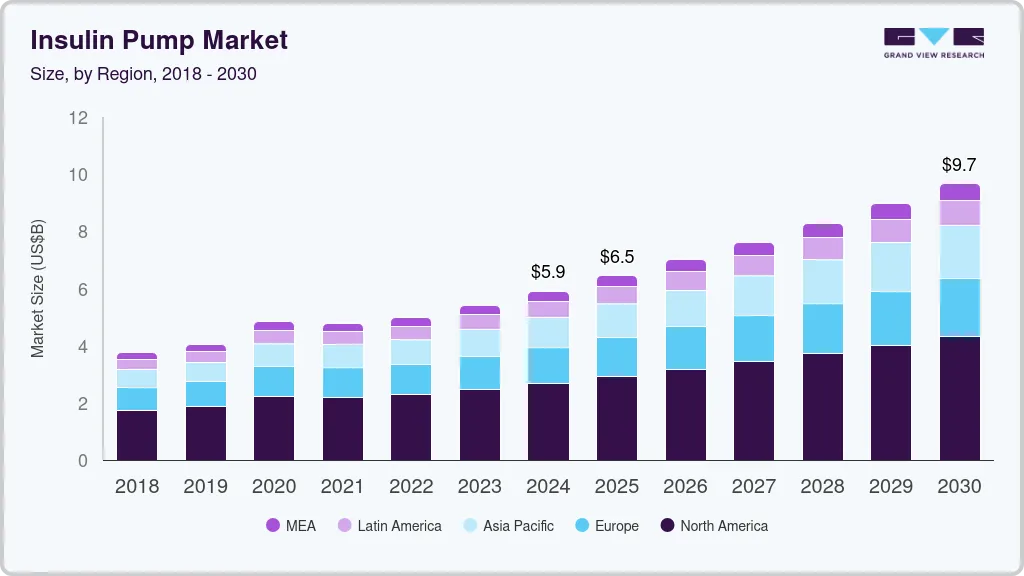

The global insulin pump market size was estimated at USD 5.90 billion in 2024 and is projected to reach USD 9.66 billion by 2030, growing at a CAGR of 8.42% from 2025 to 2030. The insulin pump industry growth is driven by technological advancements and the increasing adoption of insulin pumps over traditional methods.

Key Market Trends & Insights

- North America insulin pumps market held the largest share of 45.53% in 2024.

- The insulin pumps market in U.S. held the largest market share in 2024 in the North America region.

- By type, the tethered pumps segment dominated the market in 2024 and expected to lead during the forecast period.

- By product, the MiniMed segment dominated the market with a share of 52.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.90 Billion

- 2030 Projected Market Size: USD 9.66 Billion

- CAGR (2025-2030): 8.42%

- North America: Largest market in 2024

The market expansion is primarily due to the growing elderly population, increasing diabetes incidence, and rising obesity prevalence. Companies are developing next-generation insulin pumps with advanced technology to enhance compliance and integration with IT devices, further driving market growth. Innovations such as home infusion treatment and artificial pancreas technology are expected to create significant growth opportunities shortly. Additionally, as insulin pumps gain popularity, markets in both developed and developing countries are expanding.

An increase in the incidence of diabetes due to aging, obesity, and an unhealthy lifestyle is one of the factors contributing to the growth of the market. Obesity is a major factor causing diabetes, leading to increased incidences of diabetes-associated ophthalmic disorders. Risk factors, such as obesity, smoking, and high cholesterol, are expected to boost the prevalence of type II diabetes. According to the WHO, in 2022, it was estimated that around 2.5 billion were overweight. Of these, 43% of adults aged 18 years and over were overweight, and 16% were obese worldwide. In addition to obesity, diabetes is also becoming increasingly prevalent globally.

Diabetes is increasing globally and is one of the leading causes of death, with an increased chance of acquiring various other health issues. The number of people diagnosed with type 1 diabetes is also rising, boosting market growth. According to the International Diabetes Federation (IDF), in 2021, about 537 million adults were living with diabetes globally, a number projected to rise to 642 million by 2040. The global prevalence of diabetes is increasing, with the most significant growth observed in low- and middle-income countries. In 2021, the Western Pacific, South Asia, and Europe had the highest numbers of adults with diabetes, totaling 167 million, 88 million, and 59 million, respectively.

Furthermore, there is a notable increase in the number of elderly individuals prone to developing diabetic neuropathy. The geriatric demographic is particularly vulnerable due to factors such as longer diabetes duration, decreased nerve regeneration capacity, and comorbidities that can exacerbate neuropathic symptoms. As the global population ages, the World Health Organization (WHO) predicts that the number of people aged 60 years and older will increase to 1 in 6 by 2030, rising from 1 billion in 2020 to 1.4 billion recently. The global population of people aged 60 years and older is expected to double to 2.1 billion by 2050, with individuals aged 80 years or older set to triple to 426 million. This demographic shift will lead to a higher likelihood of chronic conditions like diabetes and peripheral neuropathy, increasing the risk of diabetic neuropathy among seniors.

The insulin pump industry growth is anticipated to be driven by the technological advancements and manufacturers competing for product approval in key application area drives the market forwards. More companies receive FDA approval, their adoption has notably increased. For instance, in April 2023, FDA approved the Medtronic MiniMed 780G System, an advanced automated insulin delivery system for individuals aged 7 and older with type 1 diabetes. It is world's first insulin pump with ‘Meal Detection Technology’. This system uses continuous glucose monitoring (CGM) to track glucose levels and automatically adjusts insulin delivery. It includes a glucose sensor, wireless data transmission, and a smart insulin pump. Clinical trials and real-world evidence confirm its safety and effectiveness in managing diabetes, enhancing users' glucose control and quality of life. With the anticipated expansion of the insulin pump market and supported benefits such as better blood sugar control and improved quality of life, insulin pumps are poised to significantly empower individuals with diabetes, leading to healthier and more satisfying lifestyles.

" Mealtimes prove to be one of the biggest challenges for people living with type 1 diabetes and now for the first time, the MiniMed 780G system addresses this unmet need with automatic, real-time insulin corrections”

-Que Dallara, EVP and President of Medtronic Diabetes

Increasing government initiatives for global awareness about medicare policies and the management of diabetes are also fueling market growth. Furthermore, there has been a rise in healthcare spending and an increase in the demand for improved tubeless insulin pumps that are both discreet and user pleasant. This is expected to drive market growth during the forecast period.

“We launched this unique contest in the community to better understand how patients describe diabetic nerve pain of their feet in their own terms.

By redefining the symptoms using their own words, our goal is to help diabetic peripheral neuropathy patients and their health care providers start using common language to talk about their symptoms, fostering more productive conversations around diagnosis, disease management and potential solutions.”

-Dr. Lizandra Marcondes, Head Medical Affairs Averitas Pharma.

Innovations in integrating advanced technology and improving patient outcomes is driving market growth. The latest developments include the creation of closed-loop systems, also known as artificial pancreas, which automate insulin delivery based on real-time glucose monitoring. With their seamless integration with continuous glucose monitoring (CGM) technology and demonstrated effectiveness in blood sugar management, insulin pumps are becoming essential tools in the fight against diabetes. Systems such as a pump connected to an automated insulin delivery (AID) system, paired with a connected insulin pen or smart pen cap, enhances diabetes management. When combined with a powerful continuous glucose monitor (CGM) sensor, this technology offers precise and efficient blood glucose control. Further, the incorporation of wireless connectivity and mobile app integration allows for seamless data tracking and remote monitoring, providing healthcare providers with valuable insights into patient management. Moreover, advancements in pump design, such as smaller, more discreet devices and pain-free insertion techniques, are increasing patient comfort and adherence.

‘’ An AID system is considerably more convenient since you don’t need to constantly check glucose levels and calculate basal insulin dosages.

Our FreeStyle Libre portfolio of products is at the center of this new era of diabetes management. We have a number of partners that will allow us to team up with leading insulin pump companies across the world, allowing for an integrated experience that streamlines and improves daily diabetes management for people on insulin therapy.

- Dr. Mahmood Kazemi, chief medical officer for Abbott’s diabetes care business.

With the increase in awareness regarding diabetes management and care, electronic insulin pumps are being favored by both doctors and consumers. This can be attributed to the fact that new-generation pumps are convenient, safe, and provide accurate results compared to traditional methods. The anytime-anywhere nature of digital technology enables patients to address their health issues by connecting with the healthcare team and sharing data. The aforementioned factors are expected to propel the growth of the market. Furthermore, the increasing number of initiatives undertaken by governments and nonprofit organizations to increase awareness about diabetes is expected to boost the adoption of insulin pumps used for the treatment.

Market Concentration & Characteristics

The insulin pump industry is accelerating at a high pace and has seen significant innovation driven by technological advancements that have significantly enhanced the accuracy and efficiency of devices. This surge in diabetic issues has emphasized the necessity for more advanced devices such as patch pumps, tethered pumps and nerve conduction testing devices.

Major players in the industry are continuously working to improve their product offerings in order to expand their customer base and gain a larger industry share. This involves expanding their products, gaining approvals, exploring collaborations, obtaining government approvals, and engaging in important cooperation activities. For instance, in April 2022, Ypsomed collaborated with Abbott and CamDiab to develop an integrated AID (automated insulin delivery) system. The new integrated AID system is being designed to link Abbott's FreeStyle Libre 3 with Ypsomed's MyLife YpsoPump to develop smart, and automatic procedure for delivering insulin with realistic glucose data.

Degree of Innovation: The insulin pump industry is witnessing significant innovation, driven by advancements in automated insulin delivery and personalized medicine. Recently, in May 2023, the FDA approved the iLet ACE Pump and iLet Dosing Decision Software from Beta Bionics for six years and older with type 1 diabetes. This innovative technology utilizes an adaptive closed-loop algorithm to automate insulin delivery, requiring only the user's body weight for setup. By streamlining insulin management and eliminating the need for manual adjustments and traditional carb counting, this breakthrough aims to enhance diabetes control and increase access to automated insulin delivery solution.

“As the first fully-automated insulin dosing system, the iLet changes the paradigm of diabetes management. By eliminating traditional setup, carb counting, and manual correction boluses, the iLet has removed many of the traditional tasks for both the user and healthcare provider. We hope that, for many people, the iLet helps to make diabetes a little bit easier.”

-Sean Saint, President and CEO of Beta Bionics

Level of Merger & Acquisition(M&A) Activities: Companies that manufacture insulin pumps are undertaking merger and acquisition activities. For instance, in September 2023, Abbott announced its plan to acquire Bigfoot Biomedical. This aim is to advance the digital innovation in the diabetes care. Such strategic approach seeks to improve technological capabilities, expand industry reach, and maintain competitiveness.

‘’The planned acquisition of longtime partner Bigfoot Biomedical further expands our presence in diabetes care and supports our efforts to develop connected solutions that help make living with diabetes easier. We’re bringing together two leaders in different areas of diabetes care - CGM and insulin dosing support - to make diabetes management even more personal and precise.’’

-Jared Watkin, senior vice president of Abbott’s diabetes care unit

Impact of Regulations: Regulations significantly impact on insulin pumps by ensuring safety and efficacy standards for treatments. They guide the development, testing, and approval processes of new therapies and devices, ensuring patient safety and fostering innovation in the field.

Product Approval: Manufacturers are pushing hard for product approval in the market, keeping degree of product approval high for the market. For instance, in April 25, 2023, Insulet announced it has received FDA approval for its Omnipod GO, a basal-only insulin pod designed for people with type 2 diabetes aged 18 and older. This tubeless and waterproof device provides a consistent dose of rapid-acting insulin for 72 hours and does not require a handheld controller. It supports various U-100 insulins and offers eight programmed daily rates from 10-40 units.

Regional Expansion: Regional expansion in insulin pumps involves extending the availability of treatments and therapies to new geographic areas. This can improve access to care, promote awareness, and address regional disparities in healthcare, ultimately enhancing patient outcomes globally. Recently in June 2022, Insulet Corporation, a world leader in tubeless insulin pump devices and technology, announced an investment of approximately USD 200 million in its upcoming manufacturing facility in Johor over the next five years. This would produce the company’s Omnipod Insulin Management System as part of its ambition to strengthen its worldwide manufacturing capabilities.

Type Insights

The tethered pumps segment dominated the market in 2024 and expected to lead during the forecast period. Tethered insulin pumps are connected to the body via a small tube linked to a cannula. The pump, containing all controls, can be conveniently worn on a belt, in a pocket, or under clothing for discretion. These pumps vary in color, screen size, and features, with some offering advanced options like Bluetooth remotes. As a practical and versatile option in the insulin pump market, tethered pumps cater to individual preferences and lifestyle needs, enhancing the user experience and improving diabetes management. Some of the notable tethered insulin pumps in market include MiniMed pumps from Medtronic, mylife YpsoPump from YpsoMed and Tandem t slim x2 insulin pump from Air Liquide Healthcare Ltd, which offer a variety of features, including continuous glucose monitoring (CGM) integration, automatic basal adjustments, and bolus calculators.

The patch pumps segment is expected to grow at the fastest growth rate of 9.47 % from 2025 to 2030. The market's high growth rate is mainly attributed to its benefits, such as no tubing in patch pumps and its remote control, which may also serve as a blood glucose meter. Moreover, pumps are integrated with calculators that help determine the exact insulin dosage required by patients. This helps reduce the overdose of insulin and its associated effects. Further manufacturers are advancing on taking strategies initiatives such as mergers and acquisition to offers the customers novel devices. For instance, in May 2023, Medtronic announced acquisition of EOFlow, a company that makes wearable insulin patches. This is likely to allow Medtronic to offer more ways for people to get insulin. EOFlow's EOPatch device is a tubeless, disposable patch pump. Medtronic wants to put EOPatch together with its other technology. Such factors are likely to boost the segments market's growth during the forecast period.

“Together, we'll work to advance innovation in wearable insulin patch technology to expand our reach to more individuals around the world living with diabetes. With a global footprint in over 100 countries, ability to scale up manufacturing quickly, and advanced software and sensor capabilities, Medtronic is the ideal strategic partner for EOFlow.”

-Jesse J. Kim, CEO and founder of EOFlow

Product Insights

The MiniMed segment dominated the market with a share of 52.9% in 2024. the high adoption rate and technological advancement. The growth of the MiniMed product line is primarily driven by a strong foothold and regional presence of Medtronic and the launch of its MiniMed 670G system, the world’s first hybrid closed-loop system. Some of the other feature hat MiniMed offers are Continuous glucose monitoring (CGM) integration, allowing users to see their blood sugar levels in real-time, which can help them make better decisions about insulin dosing, coupled with automatic basal adjustments as these pumps can automatically adjust the amount of basal insulin delivered based on a user's blood sugar levels. Recently, in January 2024, Medtronic Diabetes announced the world's first approval for the MiniMed 780G System with Simplera Sync disposable, all-in-one sensor. The system integrates advanced technology to enhance diabetes management, offering users a more streamlined experience. Such advancements in the product portfolio are poised to drive the segments market growth.

“We're incredibly proud that the MiniMed 780G system continues to be the most widely used automated insulin delivery system in Europe since we launched it in 2020. Real-world data on over 100,000 users on the system across many geographies and cultures shows that when using recommended settings, the system is delivering an average Time in Range of nearly 80%, raising the bar.

-Que Dallara, EVP and President, Medtronic Diabetes

The tandem segment is expected to grow at the fastest growth rate of 10.72% from 2025 to 2030. The growing adoption of most notable product is the t: slim X2 insulin pump, which is known for several features including touchscreen interface. The t: slim X2 has a large, color touchscreen that is easy to use, even for people with limited dexterity. Recently, in February 2024, Tandem Diabetes Care received FDA clearance for its Tandem Mobi insulin delivery system. The system featured an integrated mobile bolus and continuous glucose monitoring (CGM) control, marking a significant advancement in diabetes management technology.

This tiny, wearable pump exceeded the expectations of users from an early access program, and we are thrilled to begin offering this exciting new technology to more people in the diabetes community.

“With this launch, we are executing our strategy to offer a differentiated portfolio of durable insulin pumps, providing choice, along with new options in wearability’.

-president and CEO John Sheridan, Tandem Diabetic Care

Accessories Insights

The insulin set insertion devices segment dominated the market with a share of 41.4% in 2024. The insulin set insertion market high share is attributed to notable growth due to advancements in user-friendly designs and enhanced comfort. These devices are critical for ensuring accurate and pain-free delivery of insulin, which is essential for effective diabetes management. Innovations such as automatic insertion mechanisms and improved adhesive materials have contributed to increased adoption among users, thereby driving market expansion. Additionally, the growing prevalence of diabetes and the rising awareness of insulin pump therapy have further bolstered the demand for advanced insertion devices.

The insulin reservoir or cartridges segment is expected to grow at the fastest growth rate of 8.63% from 2025 to 2030. The growth is driven by driven by the need for efficient and convenient insulin storage solutions. Modern reservoirs and cartridges are designed to be more durable and easier to handle, reducing the risk of insulin wastage and enhancing overall user experience. The development of higher-capacity cartridges has allowed for less frequent replacements, providing added convenience for users. This typically involves loading a cartridge of insulin into the reservoir or drawing insulin from a vial into the reservoir. These reservoirs has capacity to hold 300 units of insulin and do not require a change for at least 2-3 days. As the market continues to evolve, the focus on innovation and user-centric designs in both the insulin set insertion devices and insulin reservoir or cartridges segments is expected to propel further growth in the insulin pump market.

End-use Insights

The hospital segment dominated the market with a share of over 44.4 % in 2024. Hospitals are increasingly adopting advanced diabetes management technologies, including insulin pumps, to improve patient outcomes. By integrating these devices into standard care protocols, hospitals enhance the precision and effectiveness of insulin therapy, leading to better glycemic control for patients with diabetes. Hospitals serve as crucial points of education and training for both healthcare providers and patients. Through comprehensive training programs, hospitals ensure that medical staff are well-versed in the latest insulin pump technologies and their proper usage. Additionally, hospitals are often involved in clinical trials and research studies focused on diabetes management. For instance, in June 2024, a study by Cincinnati Children's investigated the safety of home insulin pumps for children in hospitals. The study found that children with type 1 diabetes could safely use their home insulin pumps while hospitalized. The study monitored more than 2,700 children and concluded that pumps managed blood sugar as effectively as hospital injections. It's important to note that the study excluded children in intensive care and psychiatric units.

Homecare are expected to grow at the fastest growth rate of 8.79 % over the forecast period. The increasing acceptance and use of home insulin pumps are significantly driving the insulin pump market. Home insulin pumps offer patients the convenience and flexibility of managing their diabetes outside of clinical settings, leading to improved adherence and better glycemic control. This shift towards at-home management is propelled by advancements in pump technology, including user-friendly interfaces, remote monitoring capabilities, and integration with continuous glucose monitors. These features enhance patient autonomy and confidence in self-management. Additionally, the proven safety and efficacy of home insulin pumps, as evidenced by recent studies, bolster their adoption. As more healthcare providers and patients recognize the benefits of at-home insulin pump therapy, the demand for these devices continues to rise, stimulating market growth and encouraging further innovations in this segment.

Regional Insights

North America insulin pumps market held the largest share of 45.53% in 2024. Factors such as the increasing prevalence of diabetes in the region boost adoption of insulin pumps. Furthermore, the high treatment costs, technological advancement, and product launches are also expected to drive the market in the region.

U.S. Insulin Pumps Market Trends

The insulin pumps market in U.S. held the largest market share in 2024 in the North America region. The growth can be attributed to the presence of major market players in this country such as Medtronic, Hoffmann-La Roche AG, Tandem Diabetes Care, Inc., Insulet Corporation and others. Furthermore, the increasing prevalence of obesity, high treatment costs, technological advancement, and product launches are also expected to drive the market in the region. In March 2024, Abbott highlighted its partnership with Tander diabetic care. The combination of Abbott's FreeStyle Libre sensor and Tandem Diabetes Care's insulin pumps enabled real-time glucose monitoring and automatic insulin delivery adjustments. This advancement aimed to enhance patient outcomes by providing more accurate and responsive diabetes management. Abbott's collaboration with Tandem exemplified the growing trend of integrating innovative technologies to improve the lives of people with diabetes. Such strategic initiatives are poised to drive market growth in the country.

Europe Insulin Pumps Market Trends

The insulin pumps market in Europe held a significant market share in 2024. Advanced healthcare infrastructure and high healthcare spending, creating a favorable environment for the adoption of novel insulin pumps. Countries like Germany, France, and the U.K. are key contributors to this growth. Moreover, improvements in its healthcare sector and the implementation of advanced medical products and rise in the geriatric population, which is prone to diabetes are augmenting the demand for insulin pumps in the region. As per IDF estimates, Europe has a total of 1 million diabetics, with 7.3 million of them residing in the U.K. The region's emphasis on advanced healthcare technologies and significant investments in research and development are key factors driving market growth. Furthermore, the increasing geriatric population and supportive government initiatives aimed at managing diabetes complications are also contributing to this expansion.

The insulin pumps market in the UK is expected to grow owing to the increasing number of diabetic patients and advanced healthcare infrastructure. Government initiatives and funding campaigns for diabetes management are driving market growth. Insulin pumps are generally only available on the NHS to some children and adults with type 1 diabetes. It's important to consult with your healthcare team to see if you qualify for an NHS-funded pump.

The insulin pumps market in Germany is expected to grow over the forecast period. Germany has emerged as a key player in the insulin pumps industry, driven by its robust healthcare infrastructure and a strong emphasis on innovative medical technologies. The country has witnessed a growing adoption of insulin pumps due to increasing awareness of advanced diabetes management solutions and supportive government policies. The integration of insulin pumps with continuous glucose monitoring systems, such as Abbott's FreeStyle Libre, has enhanced patient outcomes and driving demand. In December 2022. Abbott integrated its FreeStyle Libre 3 with the mylife Loop automated insulin delivery system in Germany. This collaboration aimed to enhance diabetes management by combining continuous glucose monitoring with automated insulin delivery. The integration was designed to improve patient outcomes through real-time data and precise insulin dosing, reflecting Abbott's commitment to advancing diabetes care technology.

Asia Pacific Insulin Pumps Market Trends

The insulin pumps market in Asia Pacific is estimated to witness the fastest CAGR of 9.70 % during the forecast period. driven by countries such as China and Japan are at the forefront of this growth, with substantial investments in healthcare infrastructure and a strong focus on technological advancements. The market is also driven by the increasing adoption of insulin pumps among younger populations and the growing prevalence of type 1 diabetes. Additionally, supportive government initiatives and partnerships between local and international companies have bolstered market development. The region's emphasis on improving diabetes care and management continues to propel the insulin pumps industry forward.

Insulin pumps market in China is expected to grow at notable growth rate over the forecast period, this growth can be attributed to the large diabetic population and increasing awareness of advanced diabetes management technologies. The government's focus on healthcare reforms and significant investments in medical technology have played a crucial role in market expansion. Additionally, the rising prevalence of diabetes, particularly among the younger population, has led to increased adoption of insulin pumps. Collaborations between domestic and international companies have further enhanced the availability and affordability of these devices. The market's growth is also supported by improving healthcare infrastructure and favorable reimbursement policies.

Insulin pumps market in Japan is expected to grow, over the forecast period. This growth is mainly attributed to the country's focus on medical research and technological innovation, along with substantial healthcare investments, propels market growth.

Latin America Insulin Pumps Market Trends

The insulin pumps in the Latin America market is anticipated to undergo moderate growth throughout the forecast period. Latin America presents a promising growth opportunity for the insulin pumps industry, driven by the rising prevalence of diabetes and improving healthcare systems. This is due to a growing geriatric population more susceptible to diabetic complications and increasing healthcare expenditure, with prevalence of 62.3 million diabetics in recent years. However, limited access to advanced healthcare facilities and high treatment costs can act as restraints. Brazil is a key market within Latin America due to its large population and high diabetes burden.

The insulin pumps market in Brazil is anticipated to grow at a substantial rate over the forecast period. Brazil's insulin pumps market is experiencing significant growth, driven by a rising diabetic population and supportive government initiatives. The country's focus on improving healthcare infrastructure and increasing healthcare expenditure has bolstered the adoption of advanced diabetes management solutions.

MEA Insulin Pumps Market Trends

The insulin pumps market in MEA is anticipated to witness growth owing to several key factors. There is a rising prevalence of diabetes in the MEA region. Saudi Arabia and UAE respectively, have 4.2, 1.3 million adults, aged between 20 and 79, who have diabetes. Approximately, 17.1% of total adults were estimated to be affected by some sort of diabetes in 2022 in Saudi Arabia. Showing an increase in prevalence rate from 2.1% to 9% in recent years. The region's market growth is also fueled by increasing healthcare expenditure and the adoption of advanced medical technologies. Collaborations between local and international companies have enhanced the availability and affordability of insulin pumps.

Key Insulin Pump Company Insights

The major players in the insulin pump industry is actively enhancing their product portfolios through various strategies aimed at staying competitive and expanding their market share. This includes continuous product upgrades to incorporate the latest technological advancements, strategic collaborations, and exploring opportunities for acquisitions. Additionally, obtaining government approvals for their products is crucial to ensure compliance with regulatory standards.

Key Insulin Pump Companies:

The following are the leading companies in the insulin pump market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Hoffmann-La Roche AG

- Tandem Diabetes Care, Inc.

- Insulet Corporation

- Ypsomed

- Sanofi S.A.

- Sooil development

- Jiangsu Delfu Co., Ltd.

- Cellnovo Ltd

- Valeritas, Inc

Recent Developments

-

In March 2024, Sequel’s Twist Automated insulin delivery system received FDA Clearance. System features and benefits for people with type 1 diabetes. The twiist system is the first to directly measure insulin delivered with each dose. This allows for more precise insulin control. The system also integrates with Tidepool Loop technology, which uses CGM readings to adjust insulin delivery.

-

In February 2023, Roche Diabetes Care Inc. announced 510(k) approval for premarket for their Accu-Chek Solo micropump system with interoperable technology. Post this approval Roche can sell this micropump system without needing full FDA premarket approval because it's similar to already approved devices. The document specifies the regulatory class (Class II) and product code (QFG) for the device.

-

In February 2023, Insulet Corporation acquired a portfolio of patents related to insulin pump technology from Bigfoot Biomedical for USD 25 Million. This acquisition aimed to strengthen Insulet's intellectual property portfolio in the field of diabetes management devices, including insulin pumps.

-

In June 2022, Diabeloop, a world leader in therapeutic AI, and SOOIL Development Company, a leader in superior diabetes therapy announced an agreement for worldwide development at the American Diabetes Association Scientific Sessions. The collaboration is anticipated to establish clinical trials for expanding their cooperation and provide access to their goods to as many patients as possible through new innovative products.

-

In April 2022, Ypsomed announced a collaboration with Abbott and CamDiab to develop an integrated AID (automated insulin delivery) system. The new integrated AID system is being designed to link Abbott's FreeStyle Libre 3 with Ypsomed's MyLife YpsoPump to make a smart, and automatic procedure for delivering insulin with realistic glucose data.

Insulin Pump Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.45 billion

Revenue forecast in 2030

USD 9.66 billion

Growth Rate

CAGR of 8.42% from 2025 to 2030

Actual period

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, accessories, end-use

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; Mexico; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic; Hoffmann-La Roche AG; Tandem Diabetes Care, Inc.; Insulet Corporation; Ypsomed; Sanofi S.A.; Sooil development; Jiangsu Delfu Co., Ltd.; Cellnovo Ltd; Valeritas; Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Insulin Pumps Market Report Segementation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global insulin pump market report on the basis of type, product, accessories, end-use and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Patch pumps

-

Tethered pumps

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

MiniMed

-

Accu-Chek

-

Tandem

-

Omnipod

-

My life omnipod

-

Others

-

-

Accessories Outlook (Revenue, USD Million, 2018 - 2030)

-

Insulin reservoir or cartridges

-

Insulin set insertion devices

-

Battery

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & clinics

-

Homecare

-

Laboratories

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global insulin pump market size was estimated at USD 5.90 billion in 2024 and is expected to reach USD 6.45 billion in 2025.

b. The global insulin pump market is expected to grow at a compound annual growth rate of 8.42% from 2025 to 2030 to reach USD 9.66 billion by 2030.

b. North America insulin pumps market held the largest share of 45.53% in 2023. Factors such as the increasing prevalence of diabetes in the region boost adoption of insulin pumps. Furthermore, the high treatment costs, technological advancement, and product launches are also expected to drive the market in the region.

b. Some key players operating in the insulin pump market include Medtronic, Hoffmann-La Roche AG, Tandem Diabetes Care, Inc., Insulet Corporation, Ypsomed, Sanofi S.A., Sooil development, Jiangsu Delfu Co., Ltd., Cellnovo Ltd, and Valeritas, Inc.

b. Key factors that are driving the insulin pump market growth include growing elderly population, increasing diabetes incidence, and rising obesity prevalence.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.