- Home

- »

- Medical Devices

- »

-

Insulin Injection Aids Market Size And Share Report, 2030GVR Report cover

![Insulin Injection Aids Market Size, Share & Trends Report]()

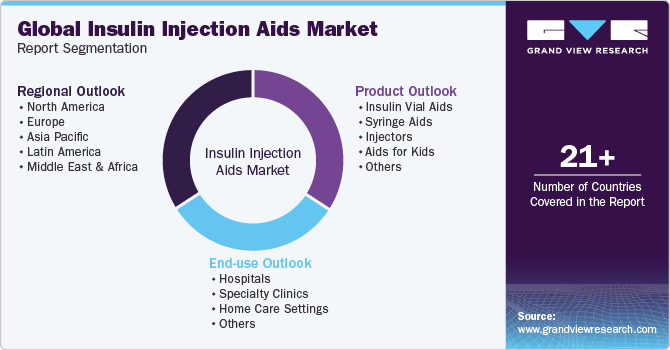

Insulin Injection Aids Market Size, Share & Trends Analysis Report By Product (Insulin Vial Aids, Syringe Aids, Injectors, Aids for Kids), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-302-0

- Number of Report Pages: 160

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Insulin Injection Aids Market Size & Trends

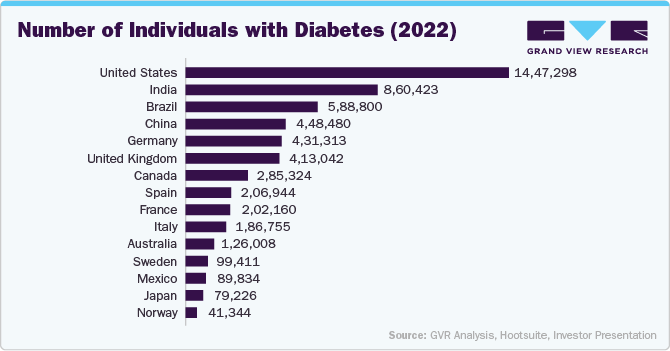

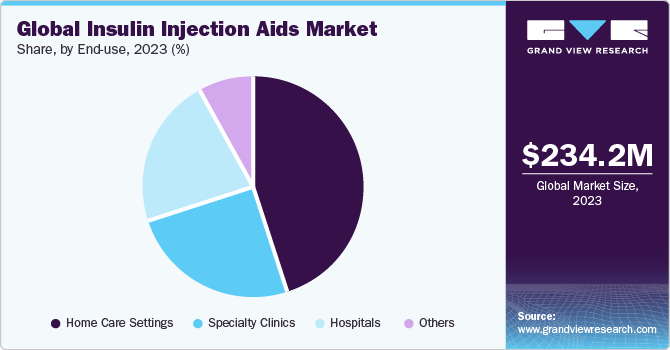

The global insulin injection aids market size was estimated at USD 234.2 million in 2023 and is expected to grow at a CAGR of 7.25% from 2024 to 2030. The rising worldwide prevalence of diabetes, technological advancements in insulin delivery devices, growing awareness and education about diabetes management, favorable government initiatives, rising geriatric population, and expansion of healthcare infrastructure are expected to drive the market in the near future. Moreover, the increasing adoption of advanced insulin delivery devices such as insulin pumps, injectors, and pens over conventional vials and syringes is anticipated to fuel the market growth.

Rising diabetes prevalence is one of the key factors driving the global insulin injection aids market. The number of people living with diabetes has been steadily increasing over the years. For instance, according to the report published by IDF Diabetes Atlas, in 2022, 537 Million adults had diabetes - 1 in 10. This number is expected to rise to 634 Million by 2030 and 783 Million by 2045. This rise in the prevalence of diabetes has led to a greater demand for convenient and effective methods of insulin delivery.

Furthermore, benefits associated with the insulin injection aids contribute to their widespread usage. These aids offer a simpler and more convenient way to administer insulin, broadening access for many individuals. Their ease of use is especially advantageous for those who need to inject insulin regularly. Insulin injection aids remove the necessity to draw insulin using a syringe, make adjusting doses easier, and provide more discreet ways to take insulin. This helps people living with diabetes to manage their condition more effectively in everyday life. Moreover, the insulin injection aids are portable and convenient for carrying and administering insulin on the go. These aids can reduce the risk of dosing errors. With clear dose memory features, dose calculations, and dose markings in some devices, people can ensure they are administering the correct amount of insulin. This reduces the possibility of mistakes caused by incorrect measurements or miscalculations when using vials and syringes.

Technological advancements have significantly influenced the development of insulin injection aids, aiming to improve the overall experience of individuals with diabetes. For instance, TickleFlex is used to attach to the end of the insulin pen and allows you to use it in a normal way. It makes self-injecting a safer, more comfortable, more consistent, and worry-free process. Increasing advanced insulin delivery devices such as insulin pumps, injectors, pens over conventional vials and syringes have been a significant factor driving the insulin injection aids market growth. Insulin injections such as pump and pens offer a greater convenience and ease to use compared to traditional vials and syringes. The devices such as TickleFlex, iPort Advance are the aids used more frequently with the advanced insulin delivery devices as they eliminate the need to draw insulin from vials.

Growing awareness and education about diabetes management play a crucial role in the expansion of the insulin injection aids market. As the public becomes more informed about the nuances of managing diabetes, including the importance of maintaining blood sugar levels within a healthy range, there is a natural increase in the demand for tools that facilitate this process. Insulin injection aids, which include devices such as automatic injectors, needle-aid devices, injection ports, syringe magnifiers, and insulin vial aids are designed to support insulin delivery devices such as insulin pens, pumps, and syringes to make the administration of insulin more accurate, less painful, and more convenient. The U.S. Centers for Medicare & Medicaid Services has launched the Medicare Diabetes Prevention Program is a structured program aimed at preventing type 2 diabetes in individuals with prediabetes. It includes 16 intensive "core" sessions over six months, based on the CDC's National DPP curriculum, focusing on dietary changes, increased physical activity, and weight control strategies. These sessions can be in-person or virtual. Participants attend six monthly follow-up meetings after the core sessions to maintain healthy behaviors. While more than 22 sessions can be offered, Medicare covers up to 22 sessions per eligible patient.

Additionally, in December 2022, the American Diabetes Association (ADA) released the 2023 Standards of Care in Diabetes, a set of comprehensive guidelines based on the latest research for preventing, diagnosing, and treating diabetes. These updated guidelines cover care for individuals with type 1, type 2, or gestational diabetes, as well as those with prediabetes. They include new strategies to prevent or delay type 2 diabetes, reduce complications, and improve health outcomes by addressing cardiovascular and renal risks.

“ADA’s mission is to prevent and cure diabetes, a chronic illness that requires continuous medical care, and the release of ADA’s Standards of Care is a critical part of that mission,”

-Chuck Henderson, chief executive officer for the ADA.

“Evidence-based recommendations drive better care for all people with diabetes, including vulnerable communities and those at high risk. ADA’s Standards of Care are the gold standard for diabetes care and prevention that allows clinicians around the world to remain abreast of the rapidly changing healthcare landscape,”

-Dr. Robert Gabbay, chief scientific and medical officer for the ADA.

Education and awareness campaigns highlight the benefits of using insulin injection aids, encouraging both patients and healthcare professionals to adopt them.

Market Concentration & Characteristics

The insulin injection aids industry is characterized by a moderate level of concentration, with a few major players dominating the industry. Key players such Medtronic Plc, Medicool, TickleTec Ltd, Pain Care Labs, Apothecary Products, BIONIX LLC, Convatec, and BD, among others, dominating the insulin injection aids industry. The industry is in a moderate growth stage, with rapid technological advancements and incremental innovation.

In the insulin injection aid industry, innovation plays a crucial role in meeting the diverse needs of diabetic patients and improving their quality of life. For instance, AmbiMedInc has developed the Insul-eze, a syringe magnifier that not only secures the syringe and medication vial for stability but also amplifies the calibration marks more than twofold for effortless visibility. This innovation in the Insul-eze syringe magnifier facilitates the syringe filling process, thereby boosting the medical self-sufficiency among the elderly.

Regulations impact the insulin injection aids market by setting standards for safety, efficacy, and quality. Regulatory bodies such as the FDA in the United States and the EMA in Europe enforce strict guidelines for the approval of new medical devices. The U.S. FDA suggests that individuals experiencing difficulties with fine motor skills or vision impairment might benefit from using insulin pens or other insulin injection aids. These devices are designed to help achieve precise insulin dosing, offering a supportive solution for those with challenges in administering insulin accurately. Additionally, various aids are available to assist in overcoming these specific difficulties.

Partnerships and collaborations activities can significantly shape the competitive landscape of the insulin injection aids industry. For example, In June 2023, Convatec Group Plc has declared its partnership with Tandem Diabetes Care, introducing a new five-inch infusion set for Tandem Mobi, which holds the title of the world's most compact durable automated insulin delivery system and has recently received FDA 510(k) clearance. These activities can lead to consolidation in the industry, allowing companies to expand their product portfolios and leverage synergies to improve innovation and reduce costs.

The availability of alternative diabetes treatments can influence the demand for insulin injection aids. For instance, the development of oral insulin and inhaled insulin offers patients alternatives to traditional injections, potentially impacting the industry for injection aids. However, the efficacy and convenience of these substitutes vary, and not all patients may find them suitable, thus still preserving a significant market share for injection aids.

Expanding into new geographical markets is a key strategy for companies in the insulin injection aids industry. Different regions may present varied market potentials due to differences in diabetes prevalence, healthcare infrastructure, and patient affordability. For example, emerging markets such as China and India are seeing rapid growth in diabetes cases, presenting opportunities for companies to introduce their products to a larger patient base. For instance, in June 2023, Convatec opened their new global headquarters in London, UK.

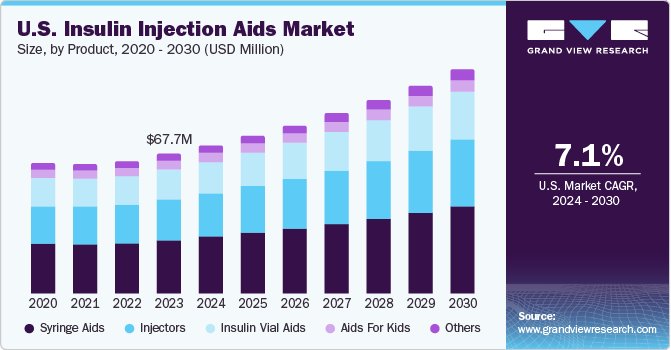

Product Insights

The syringe aids dominated the market and accounted for the largest revenue share of 38.77% in 2023 and is expected to continue its dominance over the forecast period. The commercially available syringe aids include Insul-eze developed by AmbiMedInc., MagniGuide by BD, and Count-a-dose by Prodigy Diabetes Care, LLC, iPort Advanced mini injection port developed by Medtronic to name a few. These devices offer several advantages such as syringe magnification for easy viewing, needle guidance, accurate dose measurement, and injection ports to be worn on the skin for every insulin dosage, without puncturing the skin. Additionally, these aids are normally disposable, lowering the risk of contamination or needle sticks injuries. The convenience and safety of using syringe aids are further enhanced by the availability of sharps containers for safe disposal. Some syringe aids may include other features such as ergonomic designs that enhance ease of use and comfort during administering injections and needle shields, which can help prevent accidental needle stick injuries. Due to their affordability, familiarity, and flexibility, syringe aids continue to be a popular choice.

"Adding i-port Advance to our diabetes solutions portfolio puts us in a stronger position to support a broader group of people with diabetes - including those currently on injection therapy - with tools to help simplify diabetes management routines,"

-Jeff Hubauer, vice president and general manager of insulin delivery for the Diabetes business of Medtronic.

The injectors segment is anticipated to witness fastest CAGR during the forecast period. The injectors segment includes auto injectors and pen injectors both. In contrast to conventional syringes, injectors provide a more practical and user-friendly method for administering insulin. Commercially available injectors are Inject-Ease, and a variety of products under the InsulCheck developed by AmbiMedInc. They typically have built-in dose selectors and clear dose indicators, which make it simpler for people to precisely measure and give their insulin doses.

End-use Insights

The home care settings segment captured the largest revenue share of over 45.36% in 2023. The penetration of insulin injection aids in home care settings is growing attributed to factors such as convenience, individualized diabetes treatment, and potential cost savings. Additionally, home care settings increase patient comfort, encourage self-diabetes management, and improve the overall quality of life for individuals with diabetes by lowering the need for frequent hospital visits. The need for home care services has increased as a result of the rising geriatric population and the rising prevalence of chronic disorders. Hence, the demand for insulin injection aids market in home care settings is projected to increase with the rising prevalence of diabetes.

The hospital segment is expected to grow at a significant CAGR from 2024 to 2030 attributed to the availability of skilled healthcare professionals, increasing government funding, and rising private sector investment in the healthcare sector. As hospitals are primary centers for the treatment of severe and complicated cases of diabetes, the need for efficient and effective insulin delivery systems in these settings has become more pronounced.

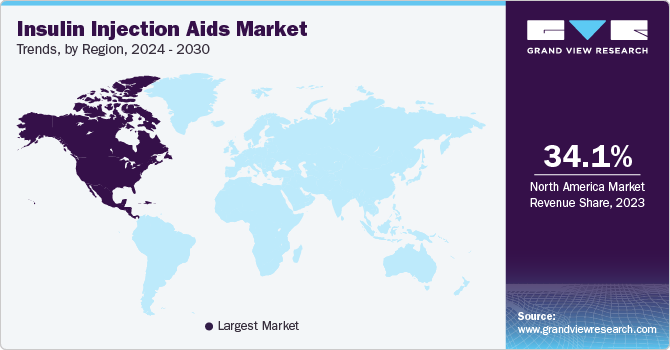

Regional Insights

The North America insulin injection aids market accounted for the largest revenue share of 34.11% in 2023. Some of the major factors contributing to the growth of the market include the rising diabetes prevalence, technological advancements and enhanced patient experience. For instance, according to the American Diabetes Association, 1.4 Million Americans are diagnosed with diabetes every year.

U.S. Insulin Injection Aids Market Trends

The insulin injection aids market the in U.S. is driven by advancements in healthcare infrastructure, increasing awareness about diabetes management, and the availability of innovative insulin delivery devices and presence of key players such as AmbiMedInc., and Convatec Inc. are propelling the market forward.

Europe Insulin Injection Aids Market Trends

The Europe insulin injection aids market is growing due to the rise in the diabetic population, technological advancements in insulin delivery device aids, and the introduction of innovations in the European market. For instance, according to the European Parliament, it is estimated that over 33 million people suffer from diabetes, as of 2023.

The insulin injection aids market in the UK has seen significant growth due to factors such as the rising burden of diabetes disorder and growing government initiatives to spread awareness of effective diabetes management. For instance, Between 2022 and 2023, more than 3.4 million individuals in England were recorded as having type 2 diabetes, and nearly 270,000 were registered with type 1 diabetes.

Asia Pacific Insulin Injection Aids Market Trends

The Asia Pacific insulin injection aids marketis anticipated to witness the fastest CAGR of 7.69% from 2024 to 2030, owing to the rising diabetes prevalence, increasing awareness and access to healthcare, and adoption of technological advancements. For instance, according to the data published by the World Bank, in Japan, 6.6% of the population ages 20 to 79 had diabetes in 2021.

The insulin injection aids market in China is expected to witness significant CAGR from 2024 to 2030. This is attributed to the rise in the diabetic population, technological advancements in insulin delivery devices, and the introduction of new innovations. For instance, recent developments in smart insulin pens and pumps have made insulin delivery more efficient and user-friendly, thereby improving patient adherence to treatment regimens.

The India insulin injection aids market is primarily driven by the increasing prevalence of diabetes in the country. According to a 2023 study by the Indian Council of Medical Research- India Diabetes (ICMR INDIAB), there are 101 million cases of diabetes in the country.

Latin America Insulin Injection Aids Market Trends

The insulin injection aids market in Latin America is experiencing significant growth, propelled by several factors such as increasing prevalence of diabetes in the region, heightened awareness about the disease, and the rising demand for more sophisticated and patient-friendly insulin delivery methods. Countries such as Brazil and Argentina, being major markets, play a pivotal role in this expansion.

In Brazil insulin injection aids market, the government's support for diabetes care through public healthcare programs and in Argentina insulin injection aids market, the growing middle-class population's access to healthcare services, are key contributors. Furthermore, technological advancements in insulin injection devices, such as smart insulin pens and pumps, enhance patient adherence to insulin therapy by offering convenience and precision. Additionally, initiatives by healthcare providers to educate patients about effective diabetes management and the importance of regular insulin intake fuel the market growth. Economic improvements and increased healthcare expenditure in these countries also support the expansion of the Latin America insulin injection aids market.

Middle East & Africa Insulin Injection Aids Market Trends

The insulin injection aids market in Middle East & Africa is witnessing significant growth, driven by several key factors. The increasing prevalence of diabetes in major countries such as Saudi Arabia, South Africa, the UAE, and Kuwait has fueled the demand for insulin injection aids. This surge is further supported by the rising awareness about diabetes management and the availability of advanced diabetes care products in these regions. However, the high cost of advanced insulin injection aids and a lack of awareness in certain rural areas of these regions could potentially hinder market expansion.

Key Insulin Injection Aids Company Insights

Some major players contributing to the global injection insulin aids market are Medtronic Plc, Convatec Inc., Becton, Dickinson and Co., AmbiMedInc., Medicool, TickleTec Ltd, Pain Care Labs, Apothecary Products, BIONIX LLC, and Prodigy Diabetes Care, LLC. To retain their relevance and build their position in the global insulin injection aids market, key market players are continuously working on innovation and improvement in current technologies.

Key Insulin Injection Aids Companies:

The following are the leading companies in the insulin injection aids market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic Plc

- Convatec Inc.

- Becton, Dickinson and Co.

- AmbiMedInc.

- Medicool

- TickleTec Ltd

- Pain Care Labs

- Apothecary Products

- BIONIX LLC

- Prodigy Diabetes Care, LLC

Recent Developments

-

In February 2023, Insulet Corporation has declared the acquisition of assets linked to pump-based automated insulin delivery (AID) technologies from Bigfoot Biomedical for a sum of USD 25 million. This purchase encompasses specific patents associated with pumps potentially applicable for AID treatment from Bigfoot.

-

In September 2021, Biocorp signed a deal with Novo Nordisk to create and market a Mallya smart attachment for Novo Nordisk's FlexTouch pen, which is utilized by patients with diabetes. Mallya, a smart device developed by Biocorp and equipped with Bluetooth, is intended to record the amount and timing of each injection made with insulin pen injectors and transmit this data in real time to a linked software.

Insulin Injection Aids Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 248.8 million

Revenue forecast in 2030

USD 378.7 million

Growth rate

CAGR of 7.25% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative Units

Revenue in USD & CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company share, competitive landscape, growth factors & trends

Segments Covered

Product, end-use, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country Scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

15% free customization scope (equivalent to 5 analysts working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Global Insulin Injection Aids Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the this study, Grand View Research has segmented the global insulin injection aids market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Insulin Vial Aids

-

Syringe Aids

-

Injectors

-

Aids for Kids

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Home Care Settings

-

Others

-

-

Regional Outlook (USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global insulin injection aids market size was estimated at USD 234.2 million in 2023 and is expected to reach USD 378.7 million in 2024.

b. The global insulin injection aids market is expected to grow at a compound annual growth rate of 7.25% from 2024 to 2030, reaching USD 378.7 million by 2030.

b. North America insulin injection aids market accounted for the largest revenue share of 34.11% in 2023.

b. Some key players operating in the insulin injection aids market include Medtronic Plc, Convatec Inc., Becton, Dickinson and Co., AmbiMedInc., Medicool, TickleTec Ltd, Pain Care Labs, Apothecary Products, BIONIX LLC, Prodigy Diabetes Care, LLC.

b. Key factors that are driving the market growth include the increasing prevalence of diabetes and technological advancements.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."