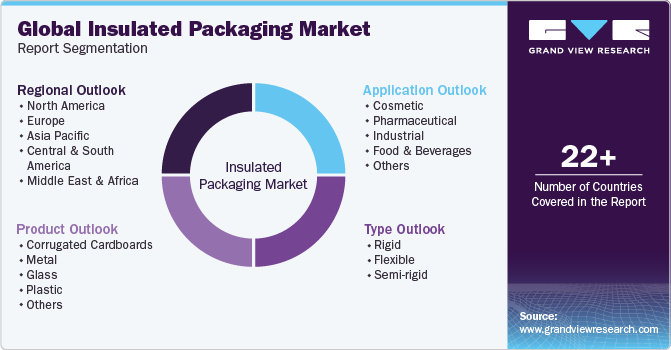

Insulated Packaging Market Size, Share & Trends Analysis Report By Type (Rigid, Flexible, Semi-rigid), By Product (Corrugated Cardboards, Metal, Glass) By Application (Cosmetic, Pharmaceutical), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-202-0

- Number of Report Pages: 87

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Insulated Packaging Market Size & Trends

The global insulated packaging market size was valued at USD 15.74 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.6% from 2023 to 2030. The increasing disposable income of people in developing economies is expected to be one of the key factors driving the market over the forecast period. Insulated packaging helps in preventing damage to products from variable temperatures & pressure and physical damage. The packaging is used in various sectors such as cosmetics, foods & beverages, pharmaceuticals, and electronics. Industrial chemicals are hazardous in nature and can easily catch fire. These bulk chemicals, which come in solid, liquid, and gaseous forms, are required to be handled with care.

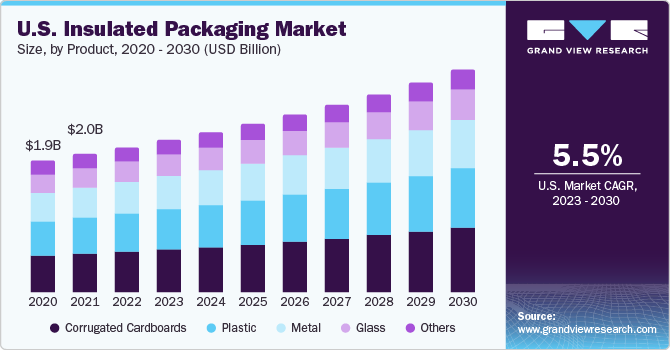

The U.S. is the largest producer of agricultural products, which has thus resulted in high demand for insulated packaging (IP). The large market size, high disposable income, ability to mass-produce, and high product variation have boosted the industry growth in the region. The presence of major industry players in the region and their manufacturing hubs across the globe have also contributed to the growth of the insulated packaging market.

The purpose of IP is to help manufacturers preserve their products from damage as well as transport them in a safe manner. The growing packaged food & beverage industry, rising urbanization, and rapidly increasing population are anticipated to drive the IP market over the forecast period. The rising demand for cosmetics, ready-to-eat food products, carbonated beverages, and medicines from emerging economies, such as China and India, is also expected to fuel the market growth over the forecast period.

Product Insights

The corrugated cardboards segment accounted for the largest revenue share of 27.7% in 2022. Corrugated cardboard comprises linerboard and fluted corrugated sheet. These components make corrugated cardboards stronger and help them withstand high amounts of pressure. Corrugated cardboards are usually manufactured by the means of flute lamination machines, which are also known as corrugators. The cardboards have high impact strength, bending resistance, tear resistance, and burst strength.

The plastic segment is expected to register the fastest CAGR of 6.2% over the forecast period. Plastic is used to package products that require storage under controlled temperature & pressure. The various products that are packaged by using plastic include red meat (bison, goat, lamb, and beef); pork, poultry (turkey and chicken); and seafood. Plastic is also used to pack meats and preserve & dry age them over a long duration spanning from few months to several years.

The other product types include wood and paper. Wood is used to manufacture barrels and boxes. The barrels made out of wood are used for aging and storing beer such as craft beer. The different types of wood used to impart distinct taste and aroma to the beer. Paper is used for manufacturing cardboards, cartons, and boxes that are used to store and transport various food & beverage, electronic, & pharmaceutical products.

Application Insights

The food & beverages segment held the largest revenue share of 26.1% in 2022. Insulated packaging (IP) for food & beverages provides tamper resistance, protection from physical damage, and preserves the nutritional aspects of the product. Food & beverage products need to be protected from temperature & pressure changes as they are perishable in nature and may become inconsumable by the time they reach their destination.

The pharmaceutical segment is expected to grow at the fastest CAGR of 6.1% over the forecast period. Pharmaceutical IP is subjected to stringent regulations across the globe on account of its use in the healthcare sector and the damage it may cause to patients due to discrepancies. The factors considered by regulatory authorities pertaining to this segment include patient safety, shelf life, and migration of packaging products into the medicines, sterility, heat, moisture, and degradation of drugs by oxygen content.

The others application segment consists of electronics, agriculture, textile, and printing. Packaging products for agricultural use are intended for protection against compression, vibration, shocks, temperature changes, and bacteria. Various electronic products are sensitive to sunlight & physical damage, and thus need to be stored and transported by wrapping them up in a UV resistant film inside a shock-proof container.

Type Insights

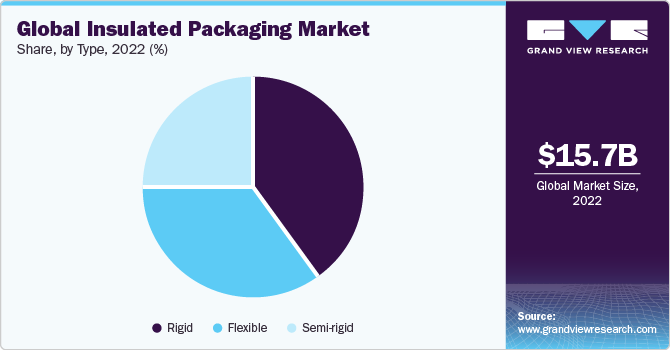

The rigid segment accounted for the largest revenue share of 39.7% in 2022. Rigid packing products are derived from paperboard, fiberboard, plastics, corrugated cardboard, and paper. The products are used to manufacture rigid products such as cases, trays, bottles, cans, cups, pots, and boxes. Rigid products are sealed by using adhesives, staples, and tapes. The products can be manufactured with Radio-frequency identification (RFID) and various color printing designs.

The flexible segment is expected to grow at a CAGR of 5.6% during the forecast period. Flexible products are made of plastic films and ply. Graphics are incorporated into the packaging to make them look attractive to the consumers. Flexible packing products are sealed by using pressure and heat. Plastic polymers used to manufacture flexible packaging products include polyester, nylon, polyethylene, and polypropylene.

Metalized plastics and aluminum foils are also used to manufacture end-use flexible products. Plastic films are used to manufacture end-use products such as bags, zippers, and pouches. The segment is relatively new as compared to rigid and semi-rigid segments but has garnered popularity in recent years owing to the increasing demand for convenience foods.

Semi-rigid products are neither flexible nor rigid in nature. The various end-use products include folding cartons, lined cartons, aseptic cartons, and thermoformed containers. Semi-rigid IP products are manufactured using polypropylene and polyethylene. The products are lightweight, have a high resistance to below-freezing point temperature, and are suitable for refrigeration.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 33.5% in 2022. Rapid urbanization, better government balance sheets resulting in increased infrastructure spending, and increasing disposable income are some of the major growth contributors for the IP industry in the Asia Pacific region. Governments have entered into Public-Private Partnerships (PPPs) to develop the electronics and automobile industries in the region. The concentrated efforts undertaken by various governments to provide efficient modern electronics are driving the IP industry.

The expanding population and urbanization in India are likely to continue generating the need for infrastructural development. The government is focusing on infrastructural development to improve trade competitiveness and cope with exponential population growth. Furthermore, the introduction of Goods and Service Tax (GST) to ease tax and the “Make in India” initiative to encourage domestic manufacturing activities are anticipated to be the key factors driving the IP market in India.

Central & South America is expected to grow at a CAGR of 6.1% during the forecast period. Government initiatives in Mexico are driving the growth of industrial sectors in the region. The region is witnessing rapid industrialization due to these efforts. Conducive environment, favorable conditions for investment, and the availability of labor are expected to be the key driving factors. The established smart packaging sector and the regional government’s efforts to provide technologically advanced packing solutions are expected to positively drive the market over the forecast period. Funding from organizations, such as the Organization for Economic Co-operation and Development (OECD) for manufacturing activities coupled with the increasing demand for smart packing products for food & beverages, is expected to positively drive the IP market in the region over the forecast period.

Key Companies & Market Share Insights

Insulated packaging product manufacturers have been adopting various strategies such as new product developments, partnerships, agreements, collaborations, and joint ventures in order to increase market penetration and cater to the changing technological requirements for different end-use applications. Some prominent players in the global insulated packaging market:

-

Sonoco Products Company

-

DuPont

-

Deutsche Post AG

-

Amcor plc

-

Huhtamaki Oyj

-

Innovative Energy Inc.

-

TP Solutions GMBH

-

Cold Ice Inc.

-

Ecovative LLC.

-

MARKO FOAM PRODUCTS

Recent Developments

-

In August 2023, Ranpak introduced a thermal liner designed to facilitate cold chain shipping within both the e-commerce and industrial sectors.The product named RecyCold climaliner constitutes a paper-based thermal liner that has been developed to assist products in maintaining their optimal temperature range for a duration of up to 48 hours.It has the capability to cater to three separate temperature ranges, encompassing ambient items situated around room temperature, chilled products usually stored within a refrigerator, or frozen items below 0°C/32°F.

-

In April 2023, Novolex introduced a novel packaging solution named Power Prep for fresh food. This packaging, created by Bagcraft, a paper-based brand under Novolex, includes an insulated and laminated wrap. The primary objective of this packaging is to maintain the freshness of food throughout the entire cycle of freezing, thawing, and reheating. To achieve this, the product employs non-fluorinated paper that is resistant to oil and grease, which is then laminated in a honeycomb pattern to establish an insulating layer.

Insulated Packaging Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 16.55 billion |

|

Revenue forecast in 2030 |

USD 24.29 billion |

|

Growth Rate |

CAGR of 5.6% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Report updated |

October 2023 |

|

Quantitative units |

Volume in Kilotons, Revenue in USD million, and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Thailand; Indonesia; Malaysia; Australia;Brazil; Argentina; Saudi Arabia; South Africa |

|

Key companies profiled |

Sonoco Products Company; DuPont; Deutsche Post AG; Amcor plc; Huhtamaki Oyj; Innovative Energy Inc.; TP Solutions GMBH; Cold Ice Inc.; Ecovative LLC.; MARKO FOAM PRODUCTS |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Insulated Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global insulated packaging market report based on type, product, application, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Rigid

-

Flexible

-

Semi-rigid

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Corrugated Cardboards

-

Metal

-

Glass

-

Plastic

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Cosmetic

-

Pharmaceutical

-

Industrial

-

Food & Beverages

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

Indonesia

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global insulated packaging market was estimated at around USD 15.74 Billion in the year 2022 and is expected to reach around USD 16.55 billion in 2023.

b. The global insulated packaging market is expected to grow at a compound annual growth rate of 5.6% from 2023 to 2030 to reach around USD 24.29 billion by 2030.

b. Corrugated Cardboard emerged as a dominating product segment with a value share of around 28% in the year 2022 owing to its high impact strength, bending resistance, tear resistance, and burst strength.

b. The key market player in the insulated packaging market includes Sonoco Products Company, Sonoco Products Company; Innovative Energy, Inc.; Huhtamaki Group; and Amcor Limited

b. The rising demand for cosmetics, ready-to-eat food products, carbonated beverages, and medicines from emerging economies, such as China and India is expected to fuel the market growth over the forecast period.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."