- Home

- »

- Plastics, Polymers & Resins

- »

-

Insulated Food Containers Market Size, Industry Report 2033GVR Report cover

![Insulated Food Containers Market Size, Share & Trends Report]()

Insulated Food Containers Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Stainless Steel, Plastics, Glass), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-173-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Insulated Food Containers Market Summary

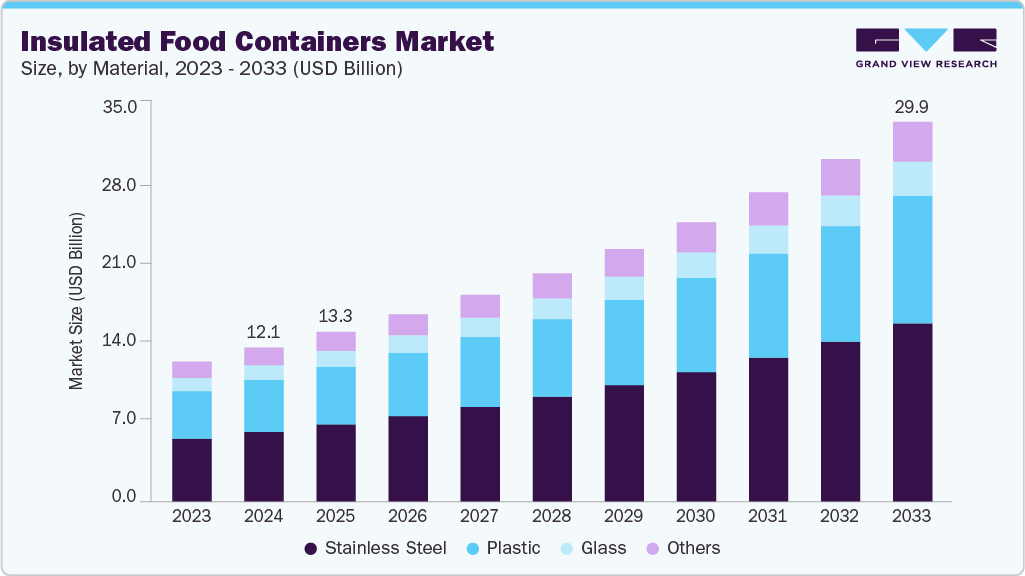

The global insulated food containers market size was estimated at USD 12.13 billion in 2024 and is projected to reach USD 29.94 billion by 2033, growing at a CAGR of 10.6% from 2025 to 2033. The market is driven by rising demand for convenient, temperature-retentive solutions fueled by the growth of on-the-go consumption and food delivery services.

Key Market Trends & Insights

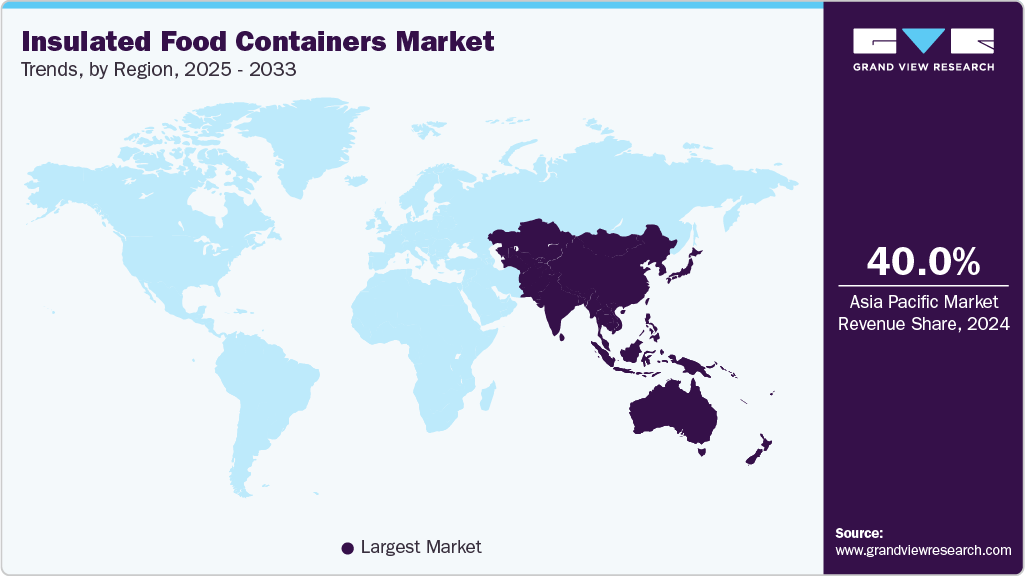

- Asia Pacific dominated the insulated food containers market with the largest revenue share of over 40.0% in 2024.

- The insulated food containers market in Germany is expected to grow at a substantial CAGR of 11.4% from 2025 to 2033.

- By material, the stainless steel segment is expected to grow at a considerable CAGR of 11.0% from 2025 to 2033 in terms of revenue.

- By distribution channel, the online segment is expected to grow at a considerable CAGR of 11.2% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 12.13 Billion

- 2033 Projected Market Size: USD 29.94 Billion

- CAGR (2025-2033): 10.6%

- Asia Pacific: Largest Market in 2024

Increasing consumer focus on food safety and freshness further supports market expansion. Rapid urbanization, busy work schedules, and lifestyle changes push consumers toward packaged meals and ready-to-eat food options that require durable and effective storage. Insulated food containers provide temperature control, ensuring meals remain warm or cold for extended periods, making them ideal for office workers, students, and travelers. For example, brands such as Thermos and Zojirushi are expanding their product lines with compact, leak-proof designs targeting urban professionals, highlighting how consumer convenience shapes market growth.The expansion of the food delivery and takeaway industry, which has surged globally due to the growth of online food delivery platforms such as Uber Eats, DoorDash, and Zomato, is also benefiting the market growth. Restaurants and cloud kitchens increasingly rely on insulated containers to maintain food quality during transit, improving customer satisfaction. The growing preference for safe, fresh food delivery options fuels demand for advanced insulated packaging solutions. For instance, QSR chains such as Domino’s and McDonald’s are adopting premium insulated delivery bags and reusable containers to ensure consistent food quality, reflecting the direct link between food delivery trends and container demand.

The rising health and wellness trend is also propelling the market, as consumers become more conscious of the nutritional value of freshly prepared home-cooked meals. Insulated food containers enable people to carry their meals while maintaining desired temperatures, reducing dependency on unhealthy fast food. This trend is particularly strong in North America and Asia-Pacific, where increasing adoption of meal-prepping habits and home-cooked lunch culture boosts sales of insulated lunch boxes, tiffin sets, and thermos flasks. For example, Stanley and Milton have launched innovative stainless-steel insulated containers to cater to health-conscious consumers who want durable, eco-friendly, and safe food storage options.

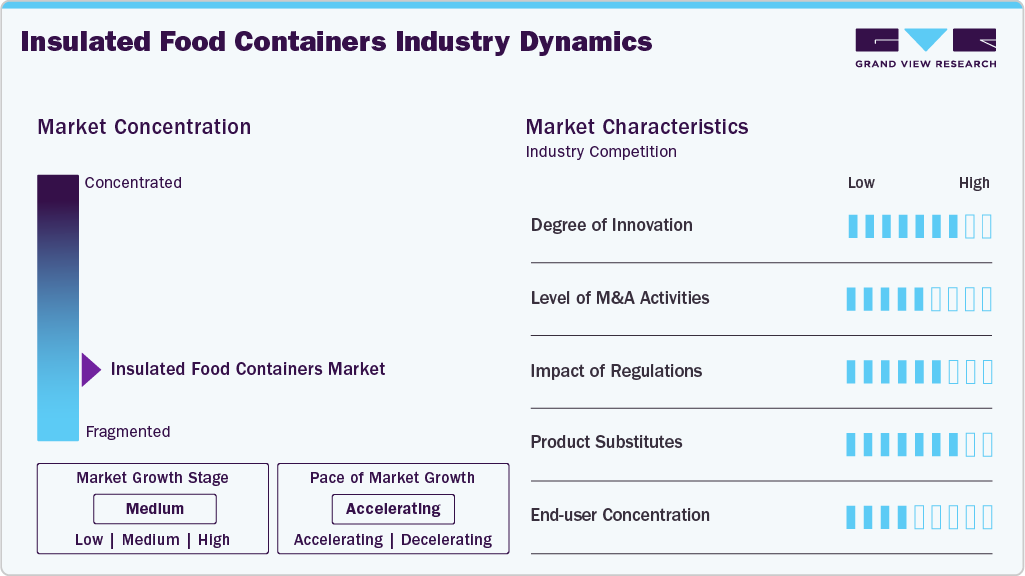

Market Concentration & Characteristics

The market is marked by a high degree of product innovation, as companies invest in advanced insulation technologies, lightweight materials, and eco-friendly alternatives to attract a diverse customer base. Features such as vacuum insulation, spill-proof locking mechanisms, and smart designs, such as dual-compartment containers, are becoming increasingly common. The rise in consumer preference for stylish, ergonomic, and portable solutions has also influenced product development and branding strategies.

Sustainability and regulations significantly impact the industry. Governments and environmental bodies are implementing stricter rules against single-use plastics, encouraging the adoption of reusable insulated containers. This regulatory push and growing consumer eco-consciousness have created opportunities for stainless steel, glass, and BPA-free polymer-based containers. Manufacturers that align with these sustainability trends gain a competitive edge.

Material Insights

The stainless steel segment recorded the largest market revenue share of over 43.0% in 2024 and is expected to grow at the fastest CAGR of 11.0% during the forecast period. Stainless steel insulated food containers are highly popular due to their superior durability, corrosion resistance, and ability to maintain food temperature for extended periods. These containers are often used in premium product categories, including lunch boxes, thermos bottles, and travel mugs, catering to health-conscious consumers prioritizing safety and reusability. The growth of stainless steel containers is driven by rising consumer awareness about food safety, the shift away from plastic due to environmental concerns, and demand for long-lasting, reusable products.

Plastic insulated containers dominate the mass-market segment due to their affordability, lightweight design, and wide availability. They are widely used in lunch boxes, storage containers, and portable food carriers, especially in price-sensitive markets like Asia-Pacific and Latin America. Modern innovations in BPA-free plastics and multi-layer insulation have improved the appeal of plastic-based products. Demand is largely driven by cost-effectiveness, versatility in design, and increasing urban lifestyles that require convenient, lightweight solutions for food storage and transport. Despite environmental challenges, growth in school-going populations and office-goers in emerging economies continues to fuel plastic container adoption.

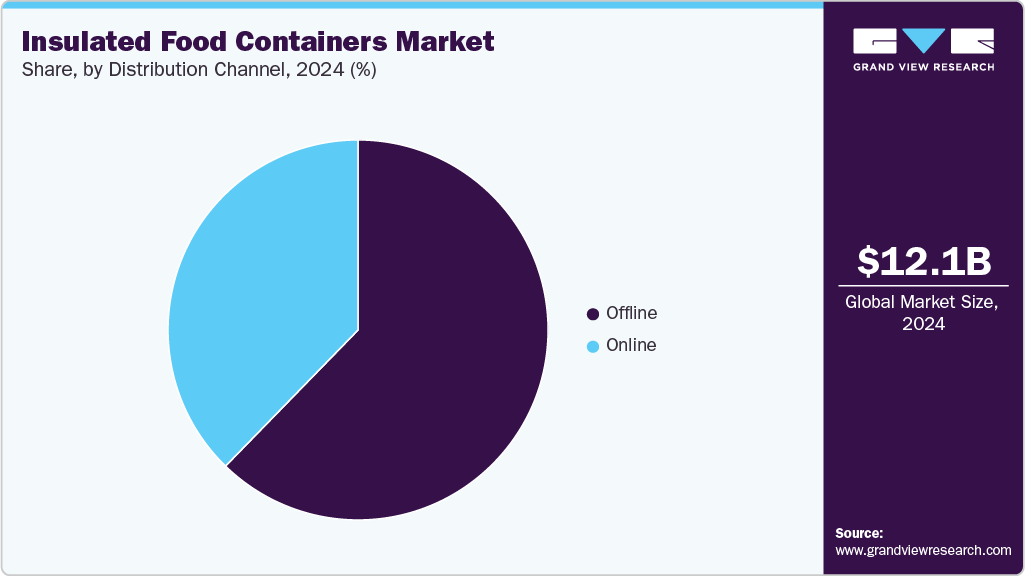

Distribution Channel Insights

The offline segment recorded the largest market revenue share of over 62.0% in 2024. The offline distribution channel includes supermarkets, hypermarkets, specialty stores, convenience stores, and physical retail outlets where consumers can directly assess insulated food containers' quality, size, and durability before purchasing. This channel remains dominant in regions where consumers prefer hands-on evaluation of products, particularly in markets such as Asia-Pacific and Latin America, where traditional retail networks are deeply entrenched. Offline outlets also benefit from bulk purchasing by institutional buyers such as restaurants, catering services, and corporate canteens.

Online is expected to grow at the fastest CAGR of 11.2% during the forecast period. The online distribution channel comprises e-commerce platforms, brand-owned websites, and third-party marketplaces, allowing consumers to purchase insulated food containers from their homes conveniently. The channel is rapidly growing due to the rise of digital shopping trends, supported by improved logistics networks and faster delivery services. Rising consumer preference for convenience, with attractive discounts, subscription services, and easy return policies offered by online platforms, is accelerating this trend.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of over 40.0% in 2024 and is expected to grow at the fastest CAGR of 11.0% during the forecast period. This positive outlook is due to rapid urbanization, rising disposable incomes, and the fast-paced adoption of convenience lifestyles. The growth of online food delivery platforms such as Swiggy, Zomato, Meituan, and GrabFood has significantly boosted the need for insulated food containers to maintain food quality and temperature during transportation. Moreover, the increasing consumption of ready-to-eat meals in urban centers such as Mumbai, Shanghai, and Singapore has driven demand for reusable and thermally efficient food storage solutions.

China Insulated Food Containers Market Trends

The insulated food containers market in China dominates the country-level segment due to its large urban population and booming online food delivery industry led by Meituan, Ele.me, and JD Daojia. Millions of daily food delivery orders necessitate insulated solutions to maintain meal quality and safety. Rising middle-class incomes and lifestyle changes fuel demand for lunch boxes and travel-friendly insulated products, especially among office workers and students.

North America Insulated Food Containers Market Trends

The insulated food containers market in North America is driving the market due to its highly developed food service and food delivery ecosystem. Companies such as Uber Eats, DoorDash, and Grubhub rely heavily on insulated containers for safe and temperature-controlled delivery. The growing demand for meal kits from companies such as HelloFresh and Blue Apron stimulates adoption, as consumers prioritize freshness and convenience. Furthermore, the region’s busy lifestyle and high work participation rates have made insulated lunch boxes and travel-friendly food containers increasingly popular among working professionals and students.

The U.S. insulated food containers market drives the North American market with its mature food delivery ecosystem and consumer inclination toward convenience products. With the rise of delivery apps such as DoorDash and Uber Eats, maintaining food temperature has become crucial, boosting demand for insulated packaging and containers. The U.S. workforce’s on-the-go lifestyle also fosters the adoption of lunch boxes and travel mugs that cater to busy professionals, students, and health-conscious consumers preferring home-cooked meals.

Europe Insulated Food Containers Market Trends

The insulated food containers market in Europe is primarily driven by its strong sustainability and environmental policies, which encourage consumers to shift away from disposable packaging toward reusable insulated solutions. The popularity of packed lunches, especially in Germany, the UK, and Nordic countries, has strengthened the demand for durable and eco-friendly lunch boxes. Moreover, Europe’s well-established café and takeaway culture, coupled with the rise of food delivery services like Deliveroo, Just Eat, and Delivery Hero, further increases the need for insulated food containers that ensure food quality during transport.

Germany insulated food containers market is one of the major European markets for insulated food containers, supported by its strong sustainability and environmental responsibility culture. German consumers prioritize eco-friendly, durable, and reusable food storage solutions, driving strong demand for insulated stainless steel and glass containers over plastic. Moreover, the German preference for home-cooked meals carried to workplaces and schools supports consistent usage of insulated lunch boxes.

Key Insulated Food Containers Company Insights

The competitive environment of the insulated food containers industry is characterized by a mix of established global players and emerging regional manufacturers competing on product innovation, material sustainability, and pricing strategies. Leading companies focus on advanced insulation technologies, lightweight yet durable designs, and eco-friendly materials such as BPA-free plastics, stainless steel, and biodegradable polymers to cater to rising consumer demand for convenience and sustainability.

In addition, private-label brands and low-cost manufacturers in Asia add pricing pressure, while e-commerce expansion increases accessibility and competition. Strategic partnerships, mergers, and acquisitions are common as companies aim to expand geographic reach and strengthen product portfolios in a fast-growing and innovation-driven market.

Key Insulated Food Containers Companies:

The following are the leading companies in the insulated food containers market. These companies collectively hold the largest market share and dictate industry trends.

- Sonoco ThermoSafe

- Huhtamaki

- Smurfit Westrock

- Anchor Packaging LLC

- Genpak

- Inline Plastics

- Evans Manufacturing

- Cambro

- Klean Kanteen

- YETI COOLERS, LLC

- KingStar Industries Co., Ltd

- BARTH GmbH

- MARKO FOAM PRODUCTS

Recent Developments

-

In August 2025, Sonoco ThermoSafe, a unit of Sonoco Products Company, launched a new reusable bulk insulated container designed for storing and distributing dry ice and perishable goods globally. This container features a 1,200 mm x 800 mm footprint and a storage capacity of 440 liters, optimizing truck cube utilization and maximizing storage for European and UK dry ice blocks.

-

In April 2025, Caraway launched its Glass Airtight Storage Containers, a stylish and non-toxic kitchen storage solution made from durable borosilicate glass. These containers feature a first-of-its-kind True Airtight Seal that locks in freshness, keeping food fresh longer while protecting from air, moisture, odors, and pests.

Insulated Food Containers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.37 billion

Revenue forecast in 2033

USD 29.94 billion

Growth rate

CAGR of 10.6% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, distribution channel, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Sonoco ThermoSafe; Huhtamaki; Smurfit Westrock; Anchor Packaging LLC; Genpak; Inline Plastics; Evans Manufacturing; Cambro; Klean Kanteen; YETI COOLERS, LLC; KingStar Industries Co., Ltd; BARTH GmbH; MARKO FOAM PRODUCTS

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Insulated Food Containers Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global insulated food containers market report based on material, distribution channel, and region:

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Plastic

-

Stainless Steel

-

Glass

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Online

-

-

Region Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global insulated food containers market was estimated at around USD 12.13 billion in the year 2024 and is expected to reach around USD 13.37 billion in 2025.

b. The global insulated food containers market is expected to grow at a compound annual growth rate of 10.6% from 2025 to 2033 to reach around USD 29.94 billion by 2033.

b. Offline segment emerged as the dominating distribution channel segment in the insulated food containers market due to strong availability through supermarkets, hypermarkets, and specialty retail stores.

b. The key players in the insulated food containers market include Sonoco ThermoSafe; Huhtamaki; Smurfit Westrock; Anchor Packaging LLC; Genpak; Inline Plastics; Evans Manufacturing; Cambro; Klean Kanteen; YETI COOLERS, LLC; KingStar Industries Co., Ltd; BARTH GmbH; and MARKO FOAM PRODUCTS.

b. The market is driven by rising demand for convenient, temperature-retentive solutions fueled by the growth of on-the-go consumption and food delivery services.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.