Insufflation Devices Market Size, Share & Trends Analysis Report By Application (Laparoscopic Surgery, Cardiac Surgery), By End-use (Hospitals, Ambulatory Surgical Centers), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-347-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Insufflation Devices Market Size & Trends

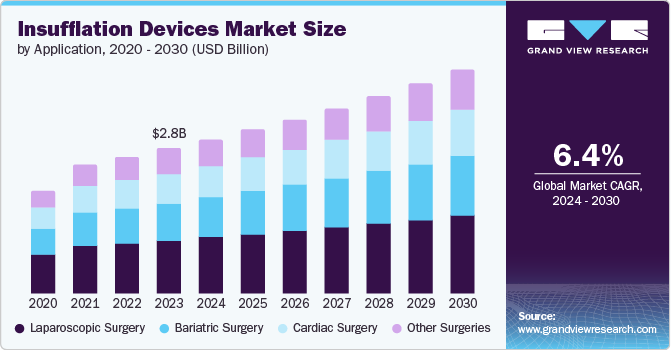

The global insufflation devices market size was valued at USD 2.76 billion in 2023 and is projected to grow at a CAGR of 6.4% from 2024 to 2030. The growing demand for insufflation devices is driven by advancements in surgical technology, an increase in surgical procedures, and the rising prevalence of uterine fibroids, obesity, and heart disorders globally. The surge in obesity, linked to sedentary lifestyles and higher consumption of high-fat, high-sugar foods, is a significant contributor to market growth.

According to the Trust for America's Health data published in September 2023, nationally, 41.9% of adults are obese. Obesity rates are also higher among residents of rural communities compared to those in urban and suburban areas.

Insufflation devices are essential in minimally invasive surgeries, facilitating the expansion of body cavities by introducing gases such as carbon dioxide. This process enhances visibility and access for surgeons, improving procedural accuracy and outcomes. Insufflation devices are crucial in bariatric surgery for maintaining pneumoperitoneum, reducing clinical risks and operating time, and optimizing abdominal pressure. Their use is preferred in various surgeries such as laparoscopic and cardiac procedures, expected to drive market growth due to rising global demand for laparoscopic and bariatric surgeries and their associated benefits. For instance, according to Nasdaq, Inc. data published in January 2023, approximately 250,000 bariatric surgeries were conducted annually in the U.S.

According to Bariatric Food Source data published in March 2023, the expanded guidelines for bariatric and metabolic surgery, particularly the recommendation for surgery for patients with lower BMIs and metabolic conditions, are likely to boost the demand for insufflation devices. The updated guidelines advise metabolic and bariatric surgery for individuals with a BMI of 35 or higher, regardless of the presence or severity of obesity-related conditions and propose considering it for those with a BMI of 30-34.9 who also have metabolic disease. This expansion in patient eligibility is anticipated to drive market expansion as healthcare providers seek to meet the rising demand for minimally invasive surgical options in addressing obesity and metabolic disorders.

The use of insufflation devices in cardiac surgery to reduce postoperative complications such as myocardial dysfunction, cerebral injury, and dysrhythmias is expected to drive the market during the forecast period. According to the American Heart Association in January 2024, in the U.S., a heart attack occurs roughly every 40 seconds. Each year, there are about 605,000 new heart attacks and 200,000 recurrent ones, with an estimated 170,000 being silent and symptomless. The average age for a first heart attack is 65.6 years for men and 72.0 years for women. Heart disease, including heart attacks, causes approximately 1,905 deaths daily in the U.S. The emphasis on reducing heart disease mortality rates indirectly contributes to increased demand for these devices.

The insufflation device market is significantly driven by the increasing prevalence of laparoscopic procedures. Laparoscopy, a minimally invasive surgical technique, requires the creation and maintenance of a pneumoperitoneum, an artificial cavity in the abdomen, for optimal visualization and instrument manipulation. Insufflation devices are essential in this process, as they insufflate carbon dioxide (CO2) into the abdominal cavity to create the necessary space for surgeons to operate effectively. About 15 million laparoscopic procedures are conducted annually in the U.S., making it one of the most frequently performed surgeries, according to the surgeons at North Kansas City Hospital & Meritas Health.

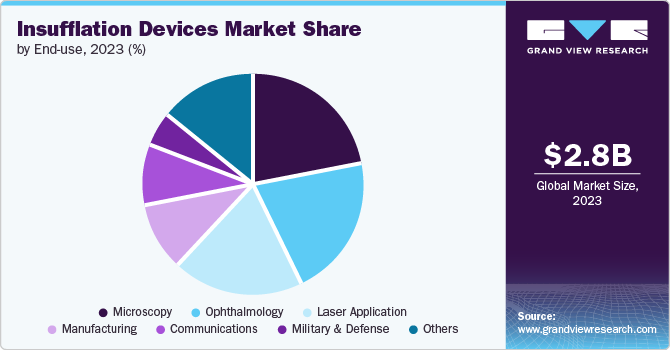

End-use Insights

The microscopy segment held the largest market share of 21.8% in 2023. This growth is driven by the increasing technological advancements in microscopy, which has led to the development of high-resolution imaging systems that provide detailed visualization during minimally invasive procedures. Moreover, the rising prevalence of chronic diseases and the subsequent increase in surgical procedures performed using endoscopic techniques have fueled the demand for insufflation devices with integrated microscopy capabilities to enhance procedural outcomes. For instance, the Arctis Cryo-PFIB, a microscope developed by Thermo Fisher Scientific in August 2023, has revolutionized cryo-electron tomography through advancements in sample preparation. These innovations have significantly improved the examination of cellular structures and molecular interactions, crucial for gaining insights into various diseases. While the primary impact is on cryo-electron microscopy, the technological enhancements in imaging and sample management could indirectly benefit a range of medical devices, potentially influencing the market for insufflation devices by enhancing diagnostic and research capabilities.

The communication segment is expected to grow at the fastest CAGR over the forecast period. The increasing adoption of advanced technologies, such as wireless connectivity and remote monitoring capabilities, primarily drives the segment's growth. These technologies enable healthcare providers to communicate more effectively with the devices, improving patient outcomes and operational efficiency. Additionally, the growing emphasis on interoperability and data integration within healthcare systems also contributes to market growth. Moreover, the market is further driven by the rising demand for telemedicine services which has fueled the need for enhanced communication features in insufflation devices, enabling real-time consultations and remote support.

Application Insights

The laparoscopic surgery segment accounted for the largest share of over 36.8% in 2023 and is expected to grow notably during the forecast period. The continuous improvement in the technology of insufflation devices has improved their safety, efficiency and user-friendliness. Advanced insufflators help in regulating the gas flow to optimal pressure levels and offers more accuracy during the procedure and practices. According to the study published by Springer Nature Limited in January 2024, the insufflation tube of the AirSeal system during laparoscopic surgery enhances performance by reducing fogging and maintaining clearer visibility, thereby improving surgical outcomes. Such advancements in insufflation technology drive market growth by addressing critical surgical challenges and improving efficiency and safety in minimally invasive procedures.

Integrated smoke extraction systems help in successfully removing surgical smoke, which improves the visibility for the surgeons, and it reduces possible health risks. Insufflation devices has better patient monitoring capacity, which helps in allowing real-time assessment of vital signs and patient parameters during surgery. For instance, the LAP-25 CO2 laparoscopic insufflator from Ecleris enhances laparoscopic surgery by precisely controlling CO2 flow and pressure to maintain a stable pneumoperitoneum. This improves surgical visibility and space management, reducing the risk of complications and enhancing the overall efficiency and safety of minimally invasive procedures. Surgeons are increasingly adopting these advanced devices which help in improving surgical outcomes, reducing complications and improving patient safety.

The bariatric surgery segment is expected to grow at a fastest CAGR during the forecast period. Bariatric surgery plays a significant role in driving the insufflation devices market due to the increasing prevalence of obesity and the rising number of weight-loss surgeries. According to The Hill data published in May 2023, weight loss surgeries are increasing among American teenagers and children. A research letter in JAMA Pediatrics reported a nearly 20% rise in metabolic and bariatric surgeries among adolescents aged 10-19 from 2020 to 2021, reflecting rising severe obesity rates. The study found more adults, children, and teenagers underwent these surgeries in 2021 compared to 2020. Specifically, 1,349 youths had the surgeries in 2021, up from 1,235 in 2020. Among adults, weight loss surgeries increased by about 24%, from 167,119 in 2020 to 207,834 in 2021. Therefore, this leads to an increase in the insufflation devices market due to the rising number of weight loss surgeries among both youths and adults.

Regional Insights

North America dominated the insufflation devices market, accounted for the largest share of revenue at 37.7% in 2023. Greater preference for laparoscopic treatment over open surgeries is one of the major reasons driving the market. In addition, the laparoscopic devices market would be affected by competition among leading manufacturers in terms of product innovation. Additionally, laparoscopy promotes rapid healing and effective results, surgeons are now choosing it over conventional treatments. Furthermore, rising healthcare costs in the U.S. may encourage new and existing competitors to enter the market.

U.S. Insufflation Devices Market Trends

The insufflation device market in the U.S. dominated the market with a share of 75.6% in 2023 due to the rising prevalence of minimally invasive surgeries, advancements in medical technology, and increasing demand for laparoscopic procedures. In addition, a growing senior population and the adoption of innovative surgical techniques further fuel market growth.

Asia Pacific Insufflation Devices Market Trends

The laparoscopic equipment market in Asia Pacific is expected to grow strongly during the forecast period due to more modern, well-equipped hospitals and more surgical procedures. In addition, the Asia Pacific market is heavily influenced by the growing popularity of global market players in terms of clinical trials and high R&D investments due to their favorable cost structure. Growing awareness of minimally invasive surgeries and patient acceptance of outpatient surgeries is expected to boost the market growth in this region.

The insufflation device market in China is primarily driven by the increasing prevalence of minimally invasive surgeries and advancements in medical technology. In addition, the rising healthcare expenditure and expanding medical infrastructure further contribute to market growth.

Key Insufflation Devices Company Insights

Some of the key players in the insufflation device market include Medtronic, B. Braun SE, STERIS, Olympus Corporation and among others. Major players are engaged in adopting strategies such as mergers and acquisitions, partnerships and launching new technologically advanced products and services to strengthen their foothold in the market.

Key Insufflation Devices Companies:

The following are the leading companies in the insufflation devices market. These companies collectively hold the largest market share and dictate industry trends.

- Fujifilm

- Medtronic

- Stryker

- BD

- Olympus

- B. Braun Melsungen

- Smith & Nephew

- Karl Storz

- Steris

- CONMED

- Richard Wolf

Recent Developments

-

In July 2023, Palliare's EU CE Mark approval under the new Medical Devices Regulation signifies compliance with updated safety and efficacy standards, enhancing market confidence in their product. It allows Palliare to market their medical devices across European Union countries, ensuring they meet stringent regulatory requirements for patient safety and performance.

-

In March 2023, Rotterdam startup Spatium Medical secures UNIIQ investment to advance its surgical insufflation technology, which personalizes gas pressure during procedures. This funding aims to enhance surgical outcomes by optimizing insufflation conditions tailored to individual patient needs, potentially revolutionizing surgical practice with more precise and effective procedures.

Insufflation Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.94 billion |

|

Revenue forecast in 2030 |

USD 4.26 billion |

|

Growth rate |

CAGR of 6.4% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA) |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; Denmark Sweden, Norway, China; India; Australia; South Korea; Thailand, Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

STERIS; Stryker; B.Braun SE; CONMED Corporation; Karl Storz; Olympus; Koninklijke Philip N.V.; Bracco; Baptist Health; Medtronic; Richard Wolf GmbH. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Insufflation Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global insufflation devices market report based on application, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Laparoscopic Surgery

-

Bariatric Surgery

-

Cardiac Surgery

-

Other Surgeries

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Ophthalmology

-

Microscopy

-

Laser Application

-

Manufacturing

-

Communications

-

Military & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."