- Home

- »

- Medical Devices

- »

-

Instrumentation Sterilization Containers Market Report, 2030GVR Report cover

![Instrumentation Sterilization Containers Market Size, Share & Trends Report]()

Instrumentation Sterilization Containers Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Sterilization Containers, Accessories), By Type (Perforated, Non Perforated), By Material, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-190-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

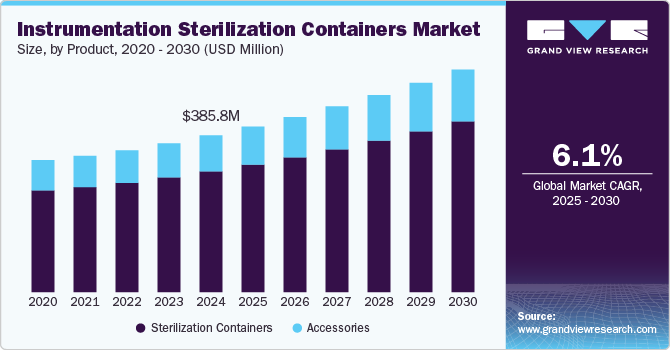

The global instrumentation sterilization containers market size was estimated at USD 385.77 million in 2024 and is projected to grow at a CAGR of 6.10% from 2025 to 2030. Growing emphasis on infection control & prevention, rising incidence of Hospital-Acquired Infections (HAIs), and an increase in the number of surgical procedures are the major factors contributing to the market growth. Moreover, technological advancements in sterilization container systems drive the market growth. For instance, in April 2024, Aesculap, Inc. (Aesculap) has introduced AESCULAP Aicon RTLS, integrating real-time location service (RTLS) technology with the AESCULAP Aicon Sterile Container System to enhance the efficiency of Sterile Processing Departments (SPD). These factors are expected to propel the market.

The rising incidence of HAIs is a key factor driving the industry growth. For instance, the Centers for Disease Control and Prevention (CDC) estimates that 1 in every 31 hospitalized patients has an HAI on any given day. Moreover, as per the NHSN Surgical Site Infection (SSI) Surveillance (January 2023) data reported in 2021, SSI accounted for 20% of all HAIs and is associated with a 2-to 11-fold increase in the risk of mortality, with SSI being directly responsible for 75% of SSI-associated deaths. SSI is the costliest HAI type, with an estimated annual cost of USD 3.3 billion, and extends hospital length of stay by 9.7 days, with the cost of hospitalization augmented by more than USD 20,000 per admission. Similarly, as per the data published by WHO in May 2022, of every 100 patients in acute-care hospitals, 7 in developed or high-income countries and 15 in low- and middle-income countries develop at least one HAI during their hospital stay. Moreover, on average, 1 in every 10 affected patients is likely to die due to HAI. These factors are expected to boost the industry growth over the forecast period.

The growing number of surgical procedures is projected to further drive market growth, as surgeries require the sterilization of medical instruments and equipment. Furthermore, the increasing number of hip and knee replacement surgeries that use surgical power drills is anticipated to propel market growth over the forecast period. According to the data published by the American College of Rheumatology in February 2024, about 544,000 hip and 790,000 total knee replacements are performed annually in the U.S.

Market Concentration & Characteristics

The market growth stage is moderate, and the pace is accelerating. The instrumentation sterilization containers market is characterized by a high degree of growth due to increasing prevalence of rising incidence of HAIs, hospital acquired infection.

The industry is experiencing high levels of innovation driven by continuous advancements in sterilization technologies. Rapid technological advancements in sterilization containers that have been focused on enhancing safety, efficiency, and usability. Improved materials offering better durability, heat resistance, and compatibility with various sterilization methods (such as steam, ethylene oxide, & hydrogen peroxide) have been developed. These materials ensure the integrity of the container and its contents during sterilization processes.

Regulatory bodies, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), play a significant role in shaping the industry. Compliance with stringent safety standards and sterilization guidelines is essential for product approvals, creating both challenges and opportunities for market participants to innovate and ensure regulatory compliance.

The industry is poised to experience robust mergers and acquisitions (M&A) activity as companies seek to expand their product portfolios and strengthen their market position. Consolidation strategies are also being employed to enhance operational capabilities, access new technologies, and broaden geographic presence. In January 2024, Medline announced the successful acquisition of United Medco, a national provider and partner in supplemental benefits and member engagement solutions. This strategic move represents a significant milestone in the growth of Medline's Health Plans business, enhancing the company’s distribution capabilities and expanding its supplemental benefit offerings.

There are a number of direct product substitutes for sterilization products. However, there are a number of alternative products that may be used to achieve similar outcomes to sterilization products, such as disposable sterile packaging wraps and pouches. These products may be used as substitutes for sterilization in certain applications.

End user concentration is a significant factor in the industry. Since there are a number of end-user industries that are driving demand for instrumentation sterilization containers. The concentration of demand in a small number of end-user industries creates opportunities for companies that focus on developing instrumentation sterilization containers for these industries.

Product Insights

Sterilization containers led the market and accounted for 77.04% of the global revenue in 2024. This high percentage might be attributed to the advantages, ease of use, protection against microorganisms, and financial benefits. Such advantages associated with these products are anticipated to propel the segment's growth. The demand for sterilization containers is increasing rapidly due to the rising demand for safe and sterilized medical equipment. Factors driving the segment include the increasing prevalence of Hospital-Acquired Infections (HAIs), a growing number of surgeries, and increased emphasis on infection prevention & control strategies.

Accessories are expected to register the fastest CAGR from 2025 to 2030. Accessories for surgical containers often complement their functionality and aid in the organization, sterilization, & transportation of medical instruments. Some common accessories include trays, identification tags, indicator cards, container lids, plates, locks, handles, etc. Continuous innovations and advancements in this segment are propelling the market.

Type Insights

Perforated accounted for the largest revenue share in 2024. This is attributable to the perforated sterilization containers are specially designed containers used in healthcare settings to hold and sterilize medical instruments. These containers are typically made of durable materials like stainless steel and feature perforations or holes that allow steam or gas to penetrate and sterilize the instruments inside. These containers offer several advantages, such as the requirement of relatively less time for sterilization and limited requirement of accessories, leading to high adoption. Moreover, these containers aid in rapid sterilization, around half as much time as nonperforated containers.

Non-perforated is expected to register a moderate CAGR from 2025 to 2030. Non perforated sterilization containers are specifically designed to hold and sterilize medical instruments without the presence of holes or perforations. Unlike perforated containers, non-perforated containers seal the instruments in an airtight or sealed environment during the sterilization process. These containers are often used when a completely sealed sterilization environment is required to prevent any potential contamination of the instruments after sterilization. They are commonly made of materials like stainless steel and feature secure locking mechanisms to maintain the sterility of the contents.

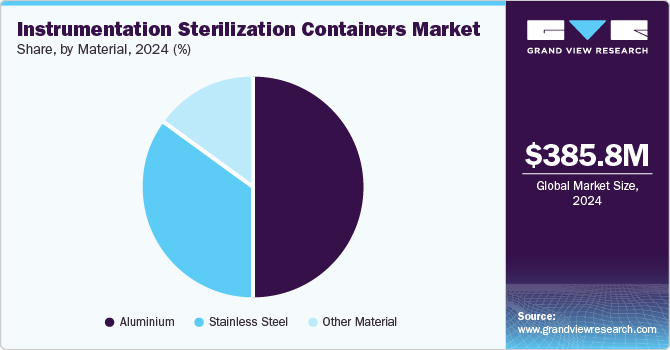

Material Insights

Aluminum accounted for the largest revenue share in 2024. This is attributable to the aluminum sterilization containers have a lifespan of more than 5 years, they are a suitable, long-term, affordable choice. Aluminum is softer, lighter than other metals, and rust-proof due to its chemical makeup, which makes it much easier to cut & shape.

In addition, aluminum is a more economical choice as its lifetime costs decline overall at a rate that is around 70% to 80% faster than those of single-use wraps. Anodizing print is the utmost choice for aluminum sterilization containers because the color is embedded in the anodized layer. It is also resistant to temperatures up to 650°C and mechanical & chemical stress, thereby increasing the value. Hence, the aforementioned factors are expected to lead to a high demand for aluminum sterilization container systems, thereby propelling the market growth.

The stainless steel segment is projected to witness the highest growth rate from 2025 to 2030. Stainless steel sterilization containers are purpose-built containers made from high-quality stainless steel, designed specifically for the sterilization and safe storage of medical instruments. They play a critical role in ensuring the cleanliness & sterility of surgical tools and devices in healthcare settings.

Regional Insights

North America instrumentation sterilization containers market dominated the global market with a share of 33.34% in 2024. This high share is attributable to the rising elderly population and the increasing prevalence of chronic disorders due to lifestyle changes, resulting in a higher volume of surgical procedures at hospitals. Consequently, there’s a growing need for sterilization containers to ensure safety and prevent hospital-acquired infections. Furthermore, the presence of key players in the region is one of the leading factors contributing to market growth.

U.S. Instrumentation Sterilization Containers Market Trends

The U.S. instrumentation sterilization containers market held a significant share in 2024. The increased utilization of surgical procedures, the high incidence of Hospital-acquired Infections (HAIs), and the benefits linked to sterilization containers are some of the major factors fueling market expansion. Moreover, WHO identifies HAIs as the most frequent adverse events in healthcare, estimating that at any given time, over 1.4 million patients worldwide are affected by them. In the U.S., there are over one million occurrences of HAIs within the healthcare system annually, leading to substantial morbidity and mortality.

The instrumentation sterilization containers market in Canada is experiencing significant growth, driven by increasing demand for infection control in healthcare facilities. These containers are widely used to store and sterilize surgical instruments, ensuring their safety and functionality. The rising prevalence of surgical procedures, advancements in sterilization technologies, and stringent regulations regarding healthcare hygiene standards are key factors propelling market growth.

Europe Instrumentation Sterilization Containers Market Trends

The Europe instrumentation sterilization containers market is experiencing significant growth. The market is driven by the increasing focus on infection control and prevention, rising incidence of Hospital-Acquired Infections (HAIs), and an increase in the number of surgical procedures. The market is driven by the advantages of sterilization containers, such as ease of use, protection against microorganisms, and financial benefits. The market is further propelled by the presence of major key players and the growing prevalence of chronic disorders leading to increased hospital admissions.

The instrumentation sterilization containers market in the UK is likely to show significant growth propelled by tangent infection control regulations implemented by the European Union to ensure high hygiene standards. Moreover, the rising prevalence of hospital-acquired infections (HAIs) has necessitated the adoption of advanced sterilization techniques and equipment, including sterilization containers. The market is further propelled by the increasing number of surgical procedures, particularly in the areas of orthopedics, general surgery, and minimally invasive surgeries.

Germany instrumentation sterilization containers market is experiencing significant growth. The prevalence of hospital-acquired infections in Germany significantly drives the market. Healthcare institutions, under economic and regulatory pressure, are investing in advanced sterilization solutions to improve patient outcomes and minimize infection risks. As the focus on patient safety intensifies, the demand for reliable instrumentation sterilization containers is expected to grow, establishing them as essential components of modern healthcare infrastructure.

Asia Pacific Instrumentation Sterilization Containers Market Trends

The instrumentation sterilization containers market in Asia Pacific is experiencing rapid growth due to the presence of major key players and the increasing prevalence of chronic disorders, surgical procedures & HAIs in the country. This is owing to the presence of major key players and the increasing prevalence of chronic disorders, surgical procedures & HAIs in the country. Investments in advanced medical technologies, including instrumentation sterilization containers equipment, are facilitating the modernization of healthcare facilities across the region.

China instrumentation sterilization containers market is growing with a lucrative growth rate. The increasing focus on infection control and prevention in healthcare settings. The expanding healthcare infrastructure, coupled with the rising number of surgical procedures, is driving the demand for efficient and reliable sterilization solutions. Additionally, the stringent regulatory standards imposed by the Chinese government on medical devices and sterilization processes are propelling the adoption of advanced sterilization containers.

Latin America Instrumentation Sterilization Containers Market Trends

The instrumentation sterilization containers market in Latin America is experiencing significant growth, driven by modernization efforts in healthcare facilities and the adoption of advanced medical technologies. To maintain rigorous infection control standards, there is a growing demand for sterilization container equipment. Brazil, with its extensive hospital infrastructure, is a key market within this region.

Middle East and Africa Instrumentation Sterilization Containers Market Trends

The MEA instrumentation sterilization containers market is experiencing growth driven by the increasing focus on healthcare infrastructure development and rising healthcare expenditure. The growing number of surgical procedures, coupled with the increasing prevalence of chronic diseases, necessitates the use of effective sterilization techniques to prevent infections. The market is further driven by the adoption of international sterilization standards and the increasing awareness of infection control practices among healthcare professionals in the region.

The instrumentation sterilization containers market in Saudi Arabia is driven by the Saudi government has significantly invested in healthcare infrastructure, including hospitals, clinics, and medical facilities. This expansion increases the need for sterilization processes to maintain safety and prevent infections

Key Instrumentation Sterilization Containers Company Insights

Key industry players are focusing on the launch of innovative types of sterilization container systems, growth strategies, and technological advancements. For instance, in April 2024, Aesculap, Inc. (Aesculap) has introduced AESCULAP Aicon RTLS, integrating real-time location service (RTLS) technology with the AESCULAP Aicon Sterile Container System to enhance the efficiency of Sterile Processing Departments (SPD). These advancements in instrumentation sterilization containers market are anticipated to boost the market growth over the forecast period.

Key Instrumentation Sterilization Containers Companies:

The following are the leading companies in the instrumentation sterilization containers market. These companies collectively hold the largest market share and dictate industry trends.

- Aesculap, Inc. - a B. Braun company

- Asel Tibbi Aletler A.Ş.

- Medline Industries, LP.

- DePuy Synthes (Johnson & Johnson)

- Bahadir Medical Devices

- Integra LifeSciences

- MELAG Medizintechnik GmbH & Co. KG

- Case Medical

- KLS Martin Group.

- STERIS

- Aspen Surgical Products, Inc.

Recent Developments

-

In January 2024, Medline announced the successful acquisition of United Medco, a national provider and partner in supplemental benefits and member engagement solutions. This strategic move represents a significant milestone in the growth of Medline's Health Plans business, enhancing the company’s distribution capabilities and expanding its supplemental benefit offerings.

-

In August 2023, Steris completed the acquisition of the surgical instrumentation platform of the company for a total of USD 540 million. This acquisition encompasses a comprehensive product portfolio, ranging from surgical instrumentation and laparoscopic tools to sterilization containers.

-

In November 2023, Medline entered into a vendor distribution agreement with University of Utah Health, a vital healthcare provider serving Utah, Idaho, Wyoming, Montana, parts of Nevada, and western Colorado. University of Utah Health stands as the sole academic medical center in the Mountain West region. In this agreement, Medline will serve as the exclusive provider, offering an extensive array of crucial medical supplies and solutions to University of Utah Health's inpatient acute care hospitals, as well as their network of physician offices and ambulatory surgery centers within the outpatient setting.

Instrumentation Sterilization Containers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 407.21 million

Revenue forecast in 2030

USD 547.57 million

Growth rate

CAGR of 6.10% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue, competitive landscape, growth factors, and trends

Segments covered

Product, type, material, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Aesculap, Inc. - a B. Braun company; Asel Tibbi Aletler A.Ş.; Medline Industries, LP.; DePuy Synthes (Johnson & Johnson); Bahadir Medical Devices; Integra LifeSciences; MELAG Medizintechnik GmbH & Co. KG; Case Medical; KLS Martin Group.; STERIS; Aspen Surgical Products, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Instrumentation Sterilization Containers Market Report SegmentationThis report forecasts revenue growth at global, regional and country levels, and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global instrumentation sterilization containers market report on the basis of product, type, material, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Sterilization Containers

-

Accessories

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Perforated

-

Non Perforated

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Stainless Steel

-

Aluminium

-

Other Material

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global instrumentation sterilization containers market size was estimated at USD 385.77 million in 2024 and is expected to reach USD 407.21 billion in 2025.

b. The global instrumentation sterilization containers market is expected to grow at a compound annual growth rate of 6.10% from 2025 to 2030 to reach USD 547.57 billion by 2030.

b. North America dominated the instrumentation sterilization containers market with a share of 33.34% in 2024. This is attributable to the rising elderly population and the increasing prevalence of chronic disorders due to lifestyle changes, resulting in a higher volume of surgical procedures at hospitals.

b. Some key players operating in the instrumentation sterilization containers market include Aesculap, Inc. – a B. Braun company; Asel Tibbi Aletler A.Ş.; Medline Industries, LP. ; DePuy Synthes (Johnson & Johnson); Bahadir Medical Devices; Integra LifeSciences; MELAG Medizintechnik GmbH & Co. KG; Case Medical; KLS Martin Group.; STERIS; Aspen Surgical Products, Inc.

b. Key factors that are driving the market growth include growing emphasis on infection control and prevention, rising incidence of Hospital-Acquired Infections (HAIs), increasing number of surgical procedures and hospitalization rate, and technological advancements in sterilization container systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.