Instant Coffee Market Size, Share & Trends Analysis Report By Packaging (Sachets, Jars, and Pouches), By Nature (Conventional, Organic), By Distribution Channel (B2C and B2B), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-542-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Instant Coffee Market Size & Trends

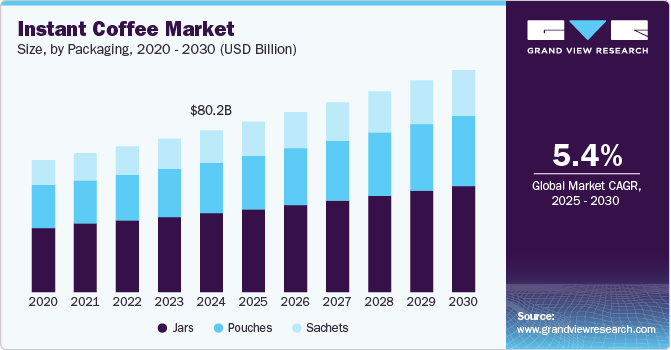

The global instant coffee market size was estimated at USD 80.20 billion in 2024 and is projected to grow at a CAGR of 5.4% from 2025 to 2030. The market is expected to grow owing to factors such as its ease of making, lifestyle changes, high adoption of coffee culture among millennials and Gen Z, and coffee being a rich source of antioxidants attracting health-conscious consumers. Additionally, companies are introducing new flavors to enhance the appeal of instant coffee, which, thus, is expected to augment the instant coffee market growth during the forecast period.

The user-friendly method of preparing coffee using instant coffee contributes to its popularity. Instant coffee gained attention during the Second World War due to its easy preparation and instant boost of energy for the soldiers. Instant coffee offers convenience for busy consumers seeking a dose of energy in their routines. Additionally, due to its antioxidant properties, it is a preferred choice by health-conscious consumers. Coffee, because it is instant, can be enjoyed anytime and anywhere, which appeals to consumers who enjoy outdoor activities such as traveling, hiking, or camping. Due to its easy preparation, instant coffee adoption is increasing, thus helping the market growth.

The increased adoption of foreign cultures is another significant factor in the increased popularity of instant coffee. The rise in migration for various reasons, such as career opportunities and travel enthusiasts, has introduced instant coffee among consumers and fueled the adoption of instant coffee. For instance, according to the Migration Policy Institute article published in March 2024, the growth of immigrants in the U.S. accounted for 65% between 2021 and 2022. Such instances are fueling the adoption of instant coffee and boosting the market growth.

The rise in health-conscious consumers and higher migration to foreign countries has stimulated product innovation. Various flavors of coffee are available in the market, such as vanilla instant coffee, hazelnut instant coffee, and Irish instant coffee, to name a few. Companies are innovating various coffee flavors to increase the appeal of instant coffee. For instance, Sleepy Owl Coffee launched premium instant coffee in 3 variants in January 2022. Such continued product innovations are expected to grow the instant coffee market during the forecast period.

Packaging Insights

The instant coffee jar packaging accounted for a revenue share of 48.70% of the global revenue in 2024. The segment growth is attributed to the product's preservation and longer shelf life. The instant coffee in jar packaging comes with screw caps which ensure the longer shelf-life of the product as the jars can offer high barrier properties against both moisture and oxygen. Furthermore, it allows companies to brand their product in attractive packaging, which appeals to consumers worldwide. In addition, the coffee jars are made of glass or plastic, which enables the consumer to reuse the packaging for other purposes. The convenience, ease of storage, and longer product life boost the segment's growth.

The instant coffee sachets market is expected to grow at a CAGR of 6.1% from 2025 to 2030. The segment growth can be attributed to the benefits offered by the packaging style, as it offers portability, convenience, and cost-effectiveness. Most importantly, it allows an opportunity for consumers to experiment with various options available without splurging huge amounts. Moreover, the sachets are perfect for storing and transport and are available in eco-friendly packaging materials. For instance, TIPA LTD and InstaBrew collaborated to produce 1 million sachets of instant beverage in compostable packaging in October 2023. Such instances, coupled with the benefits of the packaging solutions, boost the market growth of the segment.

Nature Insights

The conventional instant coffee market accounted for a revenue share of 95.87% of the global revenue in 2024. The growth of the segment can be attributed to the ease of availability, affordable options, attractive packaging, and variety of instant coffee flavors. The market growth can be significantly attributed to the rise of coffee culture, which is available in shops, cafes, and offices, and helps consumers get a gush of energy in their busy routines. The price-sensitive consumers prefer conventional coffee over organic labels as it is easily available and offers a similar taste. As a result, conventional coffee is expected to continue its growth in the market during the forecast period.

Organic instant coffee is expected to grow at a CAGR of 8.5% from 2025 to 2030. Organic coffee is made without synthetic raw materials and is free from chemicals such as pesticides and fertilizers. Organic instant coffee is environmentally sustainable and leaves a smaller carbon footprint. Health-conscious consumers are willing to pay a premium price for the quality of a product over its alternatives. Moreover, organic coffee packaging comes with various organic certifications that appeal to high-end consumers who are therefore inclined towards organic instant coffee. Several companies are involved in organic instant coffee, such as NESCAFÉ, which offers 100% organic instant coffee made with arabica beans in collaboration with the farmers producing organic coffee beans. Such instances and benefits are expected in the market to grow during the forecast period.

Distribution Channel Insights

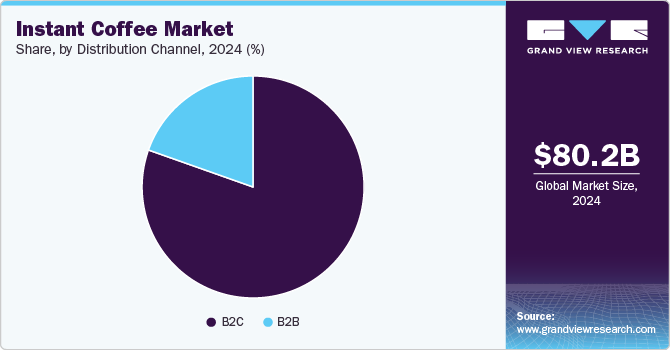

The sales of instant coffee through the B2C channel accounted for a revenue share of 80.41% of the global revenue in 2024. Supermarkets and hypermarkets such as Walmart offer a wide range of products in this category, allowing consumers to choose according to their preferences. These distribution channels perform well in terms of sales due to their array of products available in various brands, a variety of flavored instant coffee options, and product-size alternatives. This proves advantageous for consumers as they can compare different brands and make their final choice under one roof. Furthermore, these shopping spaces provide attractive offers and discounts, inclining consumers to impulse purchases. Moreover, their convenient location near the residential properties enables consumers to have an ease of accessibility. Such advantages and ease of accessibility contribute to the segment growth.

The sales of instant coffee through the B2B channel are expected to grow at a CAGR of 4.7% from 2025 to 2030. The offices and hotels & restaurants contribute to the growth of this segment. The commercial offices offer instant coffee for their employees for an instant boost of energy as they are required to work late at night during busy schedules. Additionally, with lifestyle changes and an increase in disposable income, hotels & restaurants are emerging with various beverage options. Instant coffee at such places is available in a variety of options, such as cappuccino, mocha, hazelnut coffee, and macchiato, to name a few. The B2B channel segment is, therefore, expected to grow during the forecast period.

Regional Insights

The instant coffee market in North America is expected to grow at a CAGR of 5.5% from 2025 to 2030, driven by the rising coffee culture, the high adoption of instant beverages, increasing consumer awareness, and the strong presence of the companies involved in the instant coffee category. The growing population of millennials and Gen Z is another factor driving the market growth. Premium coffee chain stores such as Starbucks Coffee Company and Tim Hortons are a preferred choice as they offer a wide array of products such as instant coffee, decaf instant coffee, instant light roast, and instant dark roast, which appeal to several consumers as per their personal preference.

U.S. Instant Coffee Market Trends

The instant coffee market in the U.S. is expected to grow at a CAGR of 5.3% from 2025 to 2030. A strong presence of coffee chains such as Starbucks Coffee Company offering a wide range of coffee products and a rising number of cafes offering coffee on the go for busy consumers contributes to the market growth. In addition, the rising population of millennials and Gen Z, coupled with the high adoption of coffee culture in the nation, boosts the market growth. For instance, according to the National Coffee Association of U.S.A., Inc. data published in April 2024, daily coffee consumption rose by 37% since 2004.

Europe Instant Coffee Market Trends

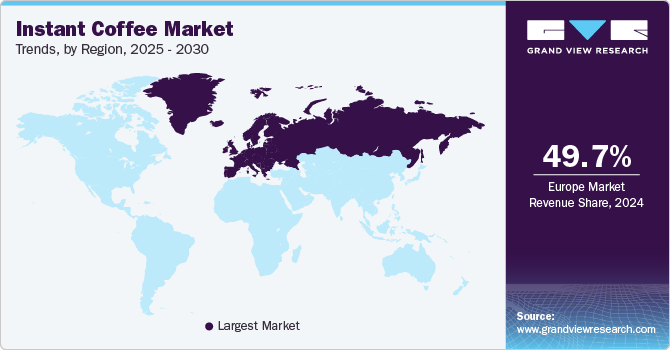

The instant coffee market in Europe accounted for a revenue share of 49.69% of the global revenue in 2024. The instant coffee market in the region is expected to grow owing to factors such as rising instant coffee companies, high adoption of coffee, variety of instant coffee beverages, and increased tourism in the region. For instance, according to the European Travel Commission data published in July 2024, tourists in Europe are expected to spend USD 891.80 billion. With the increased rate of tourism, several cafes offering instant coffee are growing across European countries.

Asia Pacific Instant Coffee Market Trends

The instant coffee market in the Asia Pacific is expected to grow at a CAGR of 6.5% from 2025 to 2030. The high influence of Western trends, the rising popularity of social media, and the high adoption of coffee culture in the region contribute to the market growth. Career opportunities and travel enthusiasm increased the adoption of coffee culture, coupled with the rising number of cafes offering instant coffee variations that are best suited to individuals. Moreover, various companies are involved in the category of collaborating and acquiring instant coffee brands. For instance, in August 2024, GRM Overseas Ltd. invested in Rage Coffee, an instant coffee maker, as its strategy to invest in consumer brands.

Key Instant Coffee Company Insights

The global instant coffee market is characterized by numerous well-established and emerging players. Manufacturers are continually introducing new products to capture consumer interest. This includes a variety of instant coffee beverages such as cappuccino, mocha, and instant Irish coffee options. For instance, brands such as Blue Tokai Coffee Roasters, an instant coffee company, are adopting eco-friendly practices by shifting towards sustainable packaging of the products. Furthermore, companies are embracing environment-friendly solutions by using recyclable paper pack solutions and making them available in supermarkets. In addition, various companies launch new products and acquire instant coffee brands to fuel market growth.

Key Instant Coffee Companies:

TThe following are the leading companies in the instant coffee market. These companies collectively hold the largest market share and dictate industry trends.

- Nestlé S.A.

- Starbucks Coffee Company

- Bevzilla

- Sleepy Owl Coffee

- The Good Life Company (TGL Co.)

- Tata Consumer Products Limited

- Rage Coffee

- Louis Dreyfus Company

- Little’s Coffee Ltd

- Tim Hortons

Recent Developments

-

In March 2024, Netherlands-based company Louis Dreyfus Company acquired Brazil-based Cacique Company Instant Coffee. The acquisition is a strategy by Louis Dreyfus Company to diversify revenue streams by acquiring value-added product lines.

-

In June 2023, instant coffee manufacturer Continental Coffee (CCL Products) acquired six coffee brands from Food Brands Group, a subsidiary of Sweden-based Löfbergs Group. The acquisition is the strategy of Continental Coffee to expand the manufacturing and distribution channels of FMCG products across the globe.

Instant Coffee Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 84.61 billion |

|

Revenue forecast in 2030 |

USD 110.28 billion |

|

Growth rate (Revenue) |

CAGR of 5.4% from 2025 to 2030 |

|

Historical data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD Million/Billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Packaging, nature, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; and Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; and South Africa |

|

Key companies profiled |

Nestlé; Starbucks Coffee Company; Bevzilla; Sleepy Owl Coffee; The Good Life Company (TGL Co.); Tata Consumer Products Limited; Rage Coffee; Louis Dreyfus Company; Little’s Coffee Ltd; and Tim Hortons |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Instant Coffee Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global instant coffee market report based on packaging, nature, distribution channel, and region.

-

Packaging Market Outlook (Revenue, USD Million, 2018 - 2030)

-

Sachets

-

Jars

-

Pouches

-

-

Nature Market Outlook (Revenue, USD Million, 2018 - 2030)

-

Conventional

-

Organic

-

-

Distribution Channel Market Outlook (Revenue, USD Million, 2018 - 2030)

-

B2C

-

Grocery Stores/Supermarkets

-

Hypermarkets

-

Convenience Stores

-

Online Retailers

-

Online Direct-to-Consumer (DTC)

-

Others

-

-

B2B

-

Cafes

-

Hotels & Restaurants

-

Offices

-

Bakeries and Coffee Shops

-

Others

-

-

-

Regional Market Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global instant coffee market was estimated at USD 80.20 billion in 2024 and is expected to reach USD 84.61 billion in 2025.

b. The global instant coffee market is expected to grow at a compound annual growth rate of 5.4% from 2025 to 2030 to reach USD 110.28 billion by 2030.

b. Europe dominated the instant coffee market with a share of 49.69% in 2024. The instant coffee market in the region is expected to grow owing to factors such as rising instant coffee companies, high adoption of coffee, variety of instant coffee beverages, and increased tourism in the region.

b. Some of the key market players in the instant coffee market are Nestlé, Starbucks Coffee Company, Bevzilla, Sleepy Owl Coffee, The Good Life Company (TGL Co.), Tata Consumer Products Limited, Rage Coffee, Louis Dreyfus Company, Little’s Coffee Ltd, and Tim Hortons.

b. The instant coffee market is expected to grow owing to factors such as its ease of making, lifestyle changes, high adoption of coffee culture among millennials and Gen Z, and coffee being a rich source of antioxidants attracting health-conscious consumers. Additionally, companies are introducing new flavors to enhance the appeal of instant coffee, which, thus, is expected to augment the instant coffee market growth during the forecast period.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."