- Home

- »

- Organic Chemicals

- »

-

Insoluble Sulfur Market Size & Share, Industry Report, 2030GVR Report cover

![Insoluble Sulfur Market Size, Share & Trends Report]()

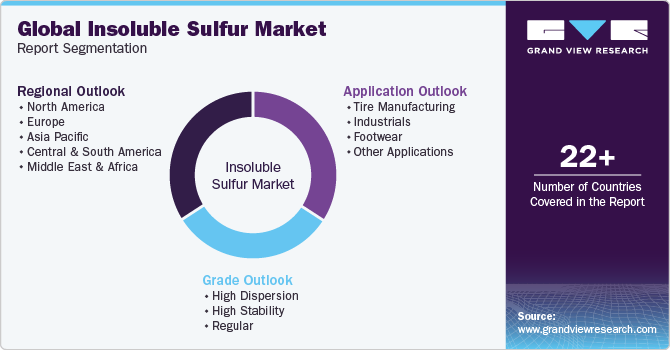

Insoluble Sulfur Market (2025 - 2030) Size, Share & Trends Analysis Report By Grade (High Dispersion, High Stability, Regular), By Application (Tire Manufacturing, Industrial, Footwear), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-862-6

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Insoluble Sulfur Market Size & Trends

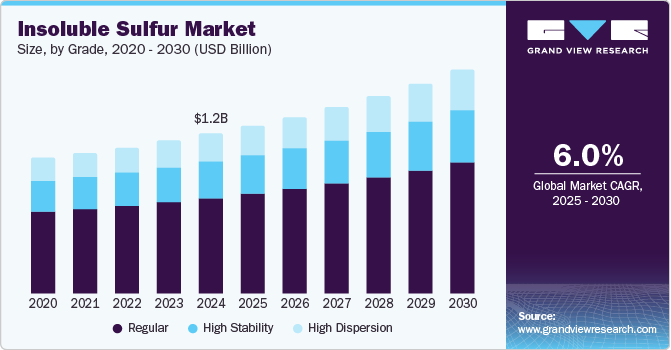

The global insoluble sulfur market size was estimated at USD 1.20 billion in 2024 and is projected to grow at a CAGR of 6.0% from 2025 to 2030. This growth is attributed to the increasing demand in the automotive and footwear industries, where it serves as a crucial vulcanization accelerator for rubber products. In addition, the rising production of tires, coupled with consumer preferences for durable and high-quality footwear, significantly boosts market demand. Furthermore, the expansion of the automotive sector in regions such as Asia-Pacific, characterized by robust rubber manufacturing, also drives market growth.

Insoluble sulfur is a crucial compound used primarily in the rubber industry, particularly as a vulcanizing agent that enhances the durability and mechanical properties of rubber products. The increasing demand for rubber products, especially in the automotive sector, significantly drives the growth of the insoluble sulfur market. In addition, as vehicle ownership rises globally, there is a heightened need for efficient and low-maintenance tire replacements. Tire manufacturers are under pressure to produce fuel-efficient tires, which has led to an increased application of insoluble sulfur in converting raw rubber into finished products at high temperatures, thereby improving their strength and flexibility.

Furthermore, insoluble sulfur enhances the resistance of various rubber products to wear and aging, making it ideal for a wide range of applications beyond tires, such as in rubber pipes, cables, and footwear. This versatility contributes to its growing demand across different segments of the rubber industry.

Moreover, the robust expansion of the automotive market further supports this trend, as manufacturers seek high-performance materials to meet consumer expectations. Consequently, the rising production of vehicles and the continuous innovation in rubber formulations are expected to sustain the momentum of the insoluble sulfur market over the forecast period.

Grade Insights

The regular grade segment dominated the market and accounted for the largest revenue share of 59.7% in 2024. This growth is attributed to its widespread use in the rubber industry, particularly as a vulcanizing agent. In addition, this grade enhances the strength of rubber products, durability, and heat resistance, making it essential for high-performance applications such as tires. Its low solubility allows for a controlled curing process, resulting in rubber with superior mechanical properties. Furthermore, the rising demand for quality rubber goods and tires continues to support the expansion of this segment.

The high dispersion grade segment is expected to grow at a CAGR of 6.6% over the forecast period, owing to its exceptional dispersibility, which enhances the uniformity and performance of rubber products. In addition, this grade is particularly favored in tire production, where consistent mixing is crucial for optimal vulcanization. Furthermore, the rising demand for high-performance tires, coupled with innovations in manufacturing processes that prioritize efficiency and product quality, has led to increased adoption of high-dispersion grades. Moreover, as manufacturers seek to improve the mechanical properties of rubber while reducing production costs, the high dispersion segment is expected to witness significant expansion in the market.

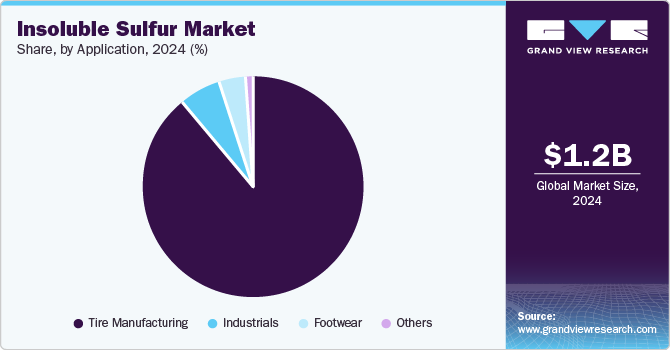

Application Insights

The tire manufacturing segment led the market with the largest revenue share of 89.4% in 2024, owing to the increasing demand for high-quality tires essential for vehicle safety and performance. As the automotive industry expands, manufacturers focus on producing durable and efficient tires that withstand various driving conditions. In addition, insoluble sulfur plays a vital role in this process by enhancing the vulcanization of rubber, improving its strength and longevity. Furthermore, advancements in tire technology and the rise of electric vehicles necessitate the use of high-performance materials, further boosting the demand for insoluble sulfur in tire production.

The industrial application segment is expected to grow at a CAGR of 7.6% from 2025 to 2030, primarily driven by its diverse use in manufacturing rubber products beyond tires. Industries such as construction, cables, and footwear rely on insoluble sulfur for its exceptional properties, including heat resistance and durability. Furthermore, the increasing industrialization and demand for high-quality rubber components drive manufacturers to adopt insoluble sulfur as a key ingredient in their formulations. Moreover, innovations in rubber processing technologies enhance the efficiency and effectiveness of insoluble sulfur, making it a preferred choice for various industrial applications, thus contributing to its market growth.

Regional Insights

The Asia Pacific insoluble sulfur market dominated the global market and accounted for the largest revenue share of 55.5% in 2024. This growth is attributed to its booming automotive and rubber manufacturing sectors. In addition, countries such as China and India are at the forefront of this growth, with increasing vehicle production and demand for high-quality tires. Furthermore, the region benefits from a well-established supply chain, skilled labor, and favorable government policies that encourage industrial growth. Moreover, ongoing investments in infrastructure and technological advancements enhance the production capabilities of insoluble sulfur, solidifying its market position.

China Insoluble Sulfur Market Trends

The insoluble sulfur market in China led the Asia Pacific market and accounted for the largest revenue share in 2024, driven by its status as a leading manufacturer of rubber products, particularly tires. In addition, the rapid expansion of the automotive industry, driven by rising consumer demand for vehicles, significantly boosts the need for high-performance tires that utilize insoluble sulfur. Furthermore, China's focus on improving production efficiency and sustainability in manufacturing processes further enhances the demand for insoluble sulfur, making it a crucial component in the rubber industry.

Europe Insoluble Sulfur Market Trends

Europe insoluble sulfur market is expected to grow at a CAGR of 6.2% over the forecast period, owing to stringent environmental regulations promoting sustainable materials in tire manufacturing. In addition, the region's emphasis on high-quality automotive products drives manufacturers to adopt advanced materials such as insoluble sulfur to enhance rubber durability and performance. Moreover, the increasing production of electric vehicles necessitates innovative tire solutions, further propelling the demand for insoluble sulfur as manufacturers strive to meet evolving consumer preferences and regulatory standards.

The insoluble sulfur market in Germany dominated the European market and accounted for the largest revenue share in 2024, primarily driven by its strong automotive industry, known for producing high-quality vehicles and components. In addition, as German manufacturers focus on developing advanced tire technologies that improve fuel efficiency and safety, the demand for insoluble sulfur as a vulcanizing agent grows. Furthermore, Germany's commitment to sustainability in manufacturing practices encourages using eco-friendly materials such as insoluble sulfur, aligning with regulatory requirements and consumer expectations for greener products.

North America Insoluble Sulfur Market Trends

The North America insoluble sulfur market is expected to grow significantly over the forecast period, driven by a resurgence in automotive manufacturing and an increasing emphasis on tire performance. In addition, the automotive sector in the region is adapting to consumer demands for longer-lasting and more efficient tires, leading to a higher utilization of insoluble sulfur in tire production. Furthermore, innovations in manufacturing technologies and supply chain improvements enhance the availability of high-quality rubber products, supporting the overall growth of the market in this region.

The insoluble sulfur market in the U.S. is expected to be driven by rising vehicle sales and a strong focus on tire quality and performance. In addition, as consumers prioritize safety and durability in tires, manufacturers are increasingly incorporating insoluble sulfur to enhance rubber properties. Furthermore, strategic partnerships between local manufacturers and global suppliers improve access to quality raw materials, further supporting market expansion as companies strive to meet regulatory standards while delivering high-performance products.

Key Insoluble Sulfur Company Insights

Key players in the insoluble sulfur industry include Lions Industries s.r.o, Nynas AB, Grupa Azoty, and others. These companies are adopting numerous strategies to gain a competitive edge. Merger and acquisition activities are being employed to expand market presence and integrate supply chains, enabling firms to leverage collaborations and increase production capacities. In addition, new product launches focus on developing innovative grades of insoluble sulfur that meet evolving industry standards, particularly in tire manufacturing. Moreover, strategic partnerships with rubber manufacturers enhance collaboration, facilitating the exchange of technology and expertise to improve product offerings and address market demands effectively.

-

Nynas AB produces high-quality naphthenic oils, essential for various industrial applications, including the formulation of insoluble sulfur. The company focuses on enhancing the dispersion and stability of insoluble sulfur in rubber compounds, particularly for tire manufacturing. Operating primarily in the process oils segment, the company provides tailored solutions that improve the performance of rubber products by ensuring the effective incorporation of curing agents.

-

LAXNESS operates within the rubber and tire segments, where it supplies high-performance materials that enhance the durability and efficiency of rubber products. LAXNESS focuses on developing innovative solutions that cater to the evolving needs of manufacturers, particularly in tire production. Through its commitment to quality and sustainability, LAXNESS aims to support the growth of industries reliant on advanced rubber formulations and applications.

Key Insoluble Sulfur Companies:

The following are the leading companies in the insoluble sulfur market. These companies collectively hold the largest market share and dictate industry trends.

- Lions Industries s.r.o

- Nynas AB

- Oriental Carbon & Chemical Ltd.

- LAXNESS

- SHIKOKU KASEI HOLDINGS CORPORATION

- China Sunsine Chemical Holdings

- Grupa Azoty

- Henan Kailun Chemical

- Schill+Seilacher Struktol GmbH

Insoluble Sulfur Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.25 billion

Revenue forecast in 2030

USD 1.68 billion

Growth rate

CAGR of 6.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Grade, application, region

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, China, India, Japan, Thailand, Germany, UK, France, Netherlands, Spain, Brazil, Argentina, and South Africa

Key companies profiled

Lions Industries s.r.o; Nynas AB; Oriental Carbon & Chemical Ltd.; LAXNESS; SHIKOKU KASEI HOLDINGS CORPORATION; China Sunsine Chemical Holdings; Grupa Azoty; Henan Kailun Chemical; Schill+Seilacher Struktol GmbH.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Insoluble Sulfur Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global insoluble sulfur market report based on grade, application, and region:

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

High Dispersion

-

High Stability

-

Regular

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Tire Manufacturing

-

Industrials

-

Footwear

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Netherlands

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.